Rhode Island Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - with Financial Statements

Description

How to fill out Rhode Island Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - With Financial Statements?

Creating papers isn't the most simple task, especially for those who rarely work with legal papers. That's why we advise making use of correct Rhode Island Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - with Financial Statements samples made by professional lawyers. It gives you the ability to stay away from troubles when in court or dealing with official institutions. Find the samples you want on our website for top-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will immediately appear on the template page. Soon after accessing the sample, it will be stored in the My Forms menu.

Customers without an active subscription can quickly create an account. Look at this simple step-by-step help guide to get the Rhode Island Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - with Financial Statements:

- Be sure that the form you found is eligible for use in the state it’s required in.

- Confirm the file. Utilize the Preview option or read its description (if readily available).

- Buy Now if this file is the thing you need or go back to the Search field to get another one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these easy steps, you are able to complete the sample in your favorite editor. Double-check completed information and consider requesting a legal representative to examine your Rhode Island Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - with Financial Statements for correctness. With US Legal Forms, everything becomes much easier. Test it now!

Form popularity

FAQ

Despite the fact that a prenup is arranged before a marriage, you can still sign one after exchanging "I do's." This contract, known as a post-nuptial agreement, is drafted after marriage by those who are still married and either are contemplating separation or divorce or simply want to protect themselves from the

Just as a future asset can be protected by a prenup if adequately described, future income can also be treated as belonging to one partner but not both.

In the event of divorce, a prenup can protect a spouse from being liable for any debt the other spouse brought into the marriage.A prenup can also protect any income or assets you earn during the marriage, as well as unearned income from a bequest or a trust distribution.

In common law states, debt taken on after marriage is usually treated as being separate and belonging only to the spouse that incurred them. The exception is those debts that are in the spouse's name only but benefit both partners.

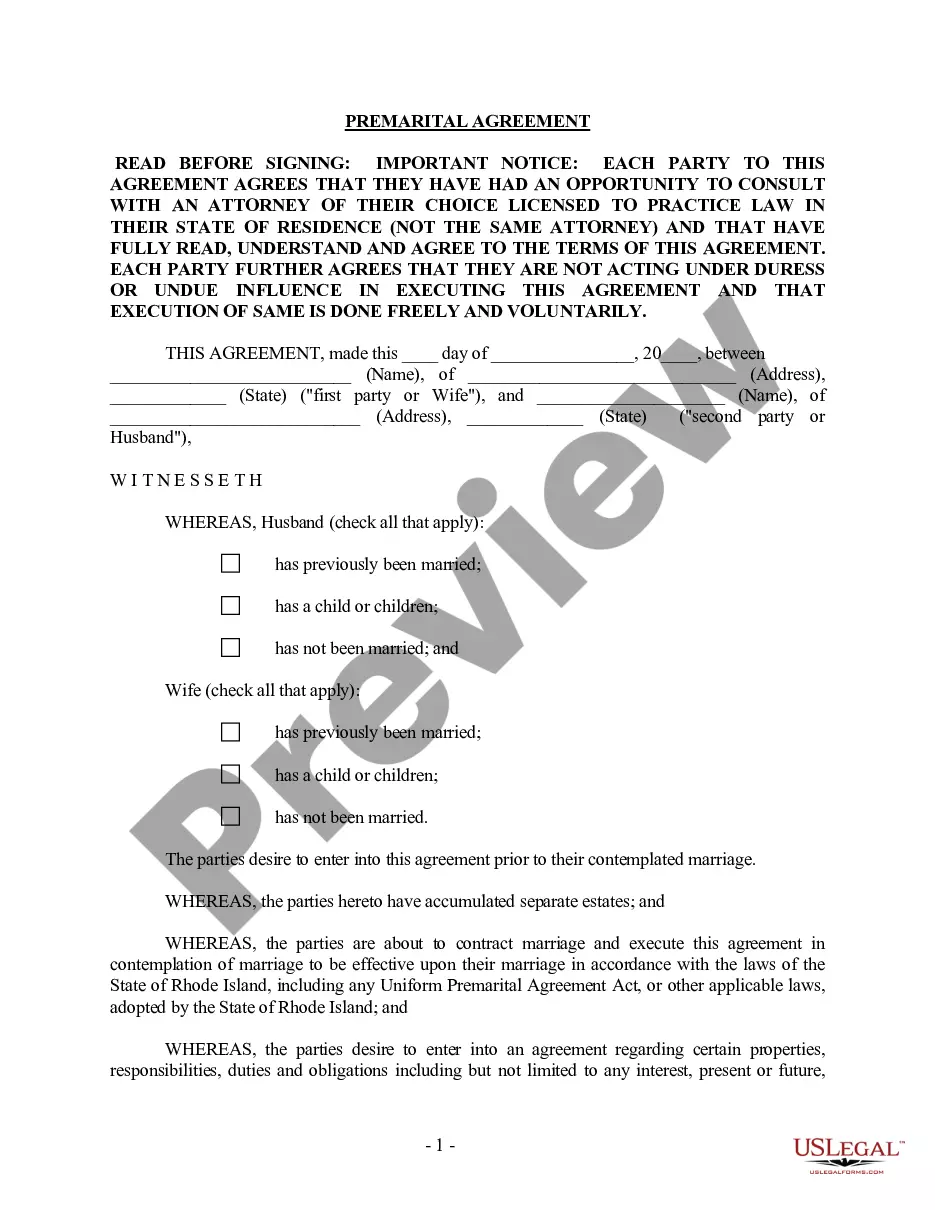

Here are the top 10 reasons why a prenup could be invalid: There Isn't A Written Agreement: Premarital agreements are required to be in writing to be enforced. Not Correctly Executed: Each party is required to sign a premarital agreement prior to the wedding for the agreement to be deemed valid.

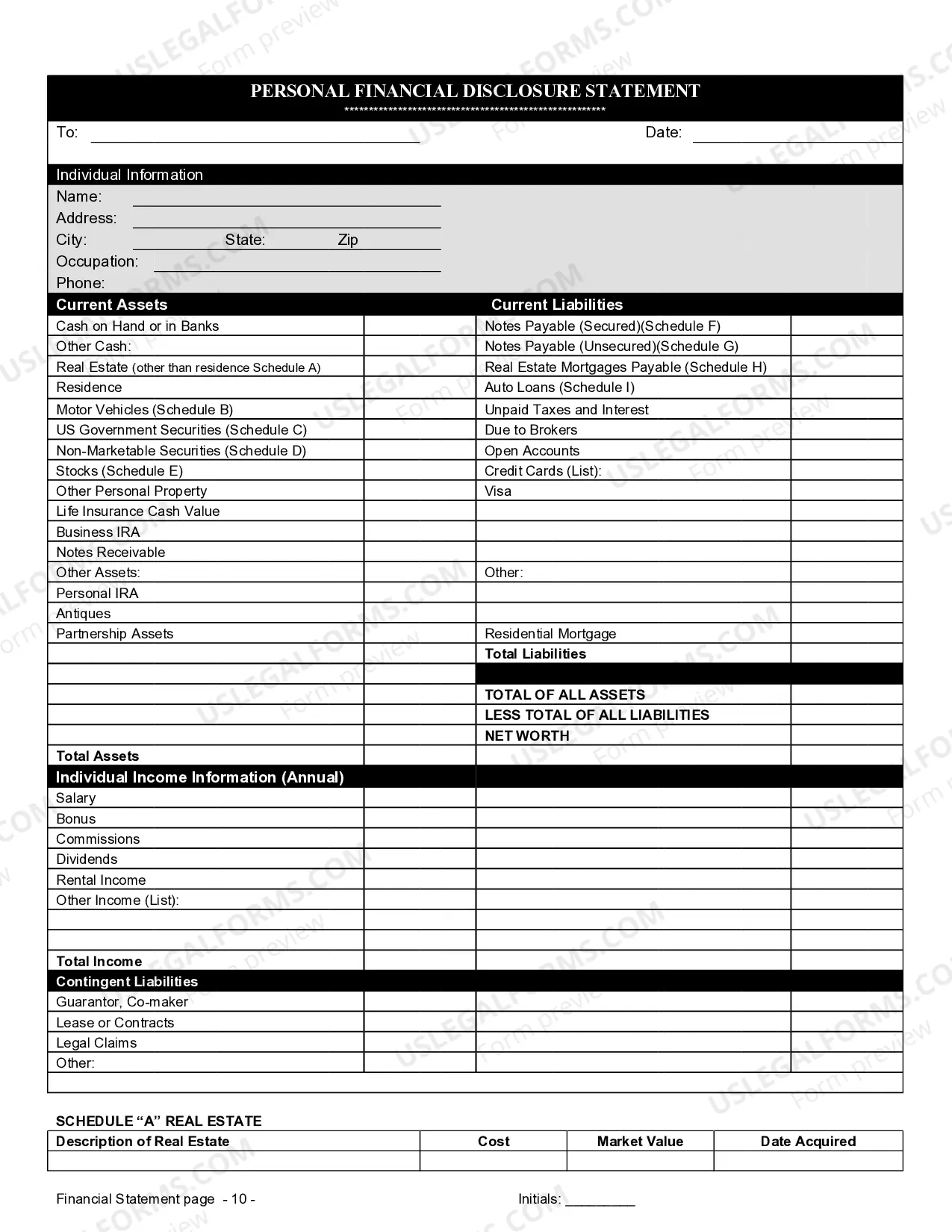

One formality that many do not realize the importance of is a full and fair disclosure of assets and debts prior to the prenuptial agreement being signed. In other words, both parties are supposed to disclosure all the assets and debts that they are bringing into the marriage.

Prenuptial agreements can also protect each party from being responsible for any debts that existed prior to the marriage. Without an agreement, these debts can become marital property in some states if there's nothing that defines them otherwise.

The three most common grounds for nullifying a prenup are unconscionability, failure to disclose, or duress and coercion.Duress and coercion can also invalidate a prenup. If the prenup was signed the day before your wedding, it may appear that the parties didn't have much time to fully review the agreement.