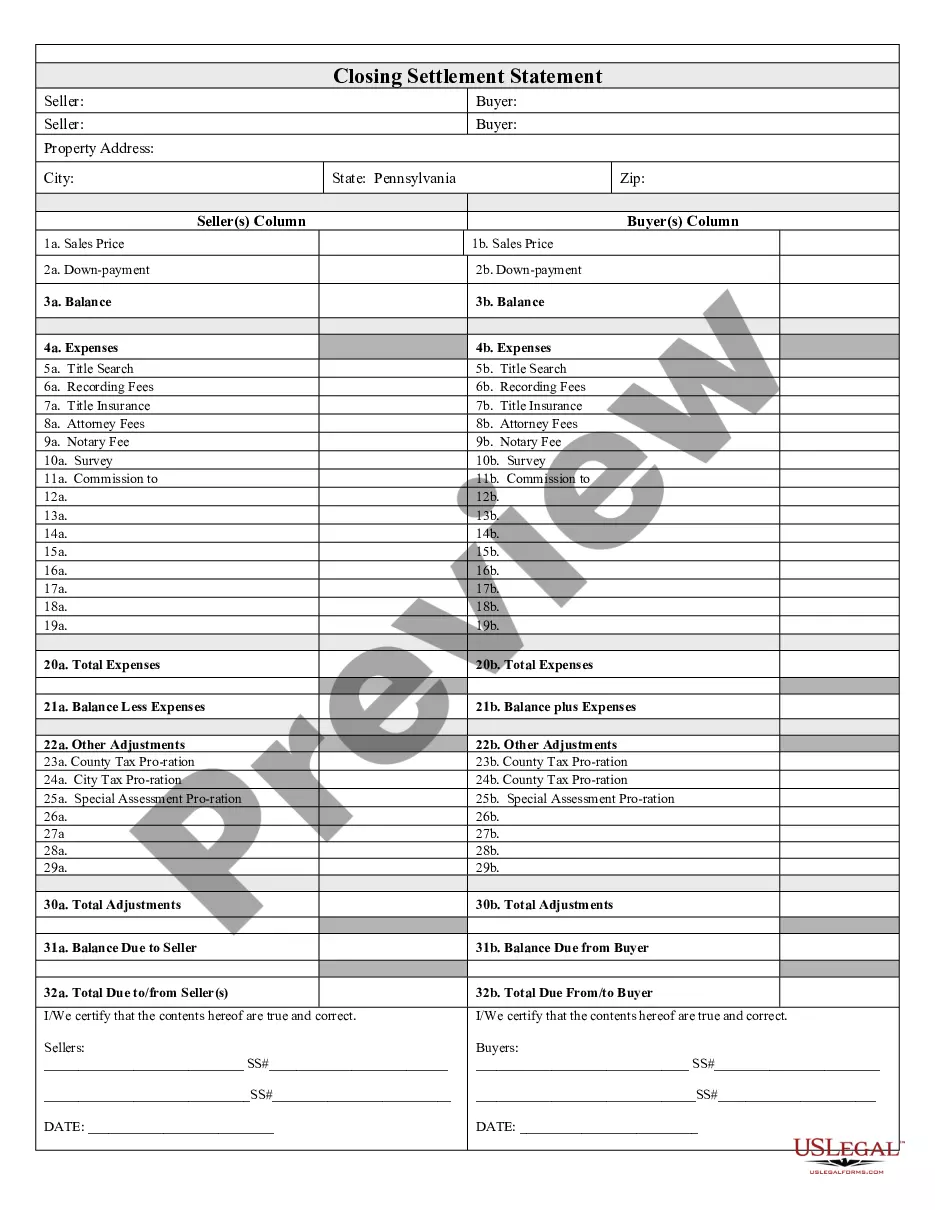

Pennsylvania Closing Statement

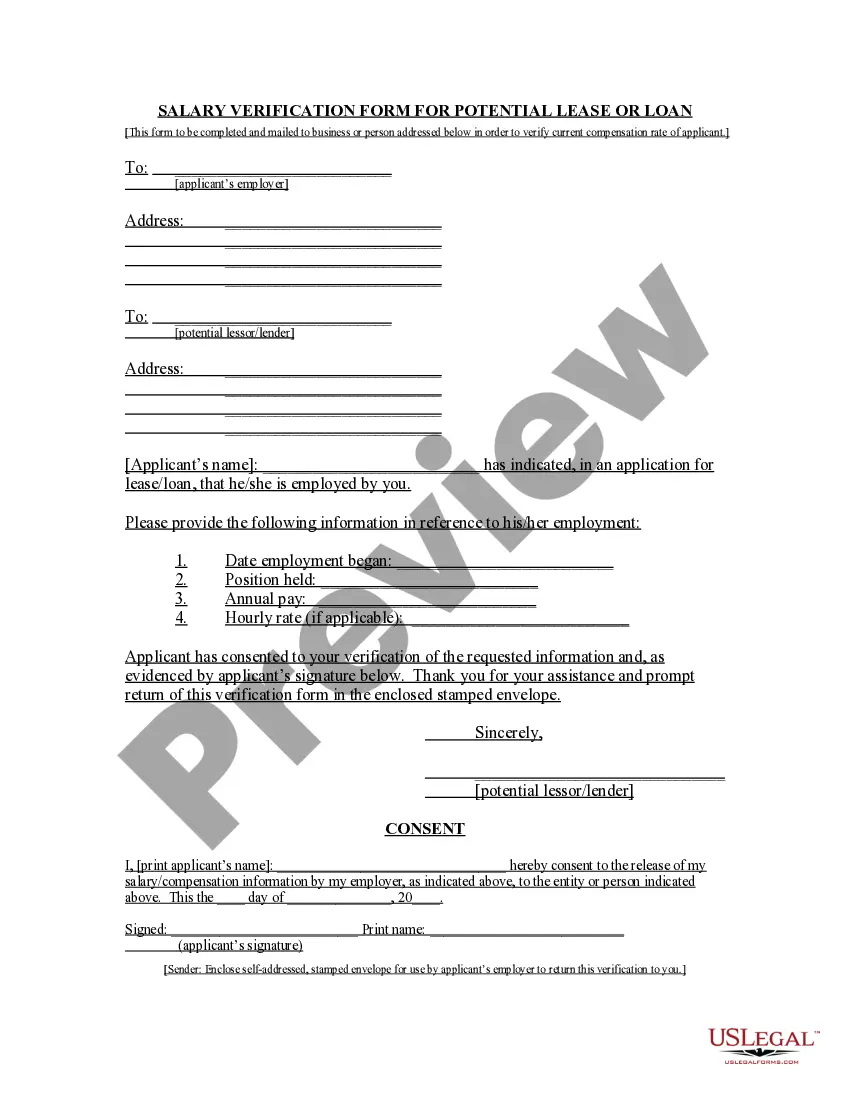

What is this form?

The Closing Statement is a crucial document in real estate transactions involving cash sales or owner financing. This form serves as a verified settlement statement that summarizes the financial aspects of the sale, including expenses, credits, and final balances. It distinguishes itself from other closing documents by providing a comprehensive breakdown of all financial transactions, ensuring that both the seller and buyer have a clear understanding of their respective obligations and receipts.

What’s included in this form

- Balance: Records the overall financial summary after expenses are deducted.

- Expenses: Details various costs associated with the transaction, such as title search, recording fees, and attorney fees.

- Adjustments: Captures any necessary prorations for taxes or special assessments.

- Certification: Statement affirming the accuracy of the contents, signed by both the seller and buyer.

- Total Due: Summarizes the final amounts owed to or from each party.

When this form is needed

This Closing Statement should be utilized whenever a real estate transaction occurs, especially in cases of cash sales or owner-financed purchases. It is essential during the closing process to ensure that all parties are aware of financial terms, to settle any outstanding fees, and to finalize the transaction correctly.

Who needs this form

- Buyers engaged in purchasing real estate with cash or owner financing.

- Sellers who need documentation of the financial aspects of the property sale.

- Real estate agents or attorneys assisting in the transaction.

- Title companies managing the closing process.

How to complete this form

- Identify the parties involved, including the seller and buyer details.

- Specify the property being sold, including the address and legal description.

- Document all expenses related to the transaction, such as title searches and attorney fees.

- Calculate the total expenses and adjust for any credits or prorations.

- Obtain signatures from both seller and buyer to certify the statement's accuracy.

Does this document require notarization?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all relevant expenses, leading to discrepancies in final totals.

- Not obtaining signatures from both parties, which may invalidate the statement.

- Incorrectly calculating prorated taxes and fees, resulting in financial misunderstandings.

Benefits of completing this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows adjustments to be made quickly without starting over.

- Reliability from using templates drafted by licensed attorneys for legal accuracy.

Looking for another form?

Form popularity

FAQ

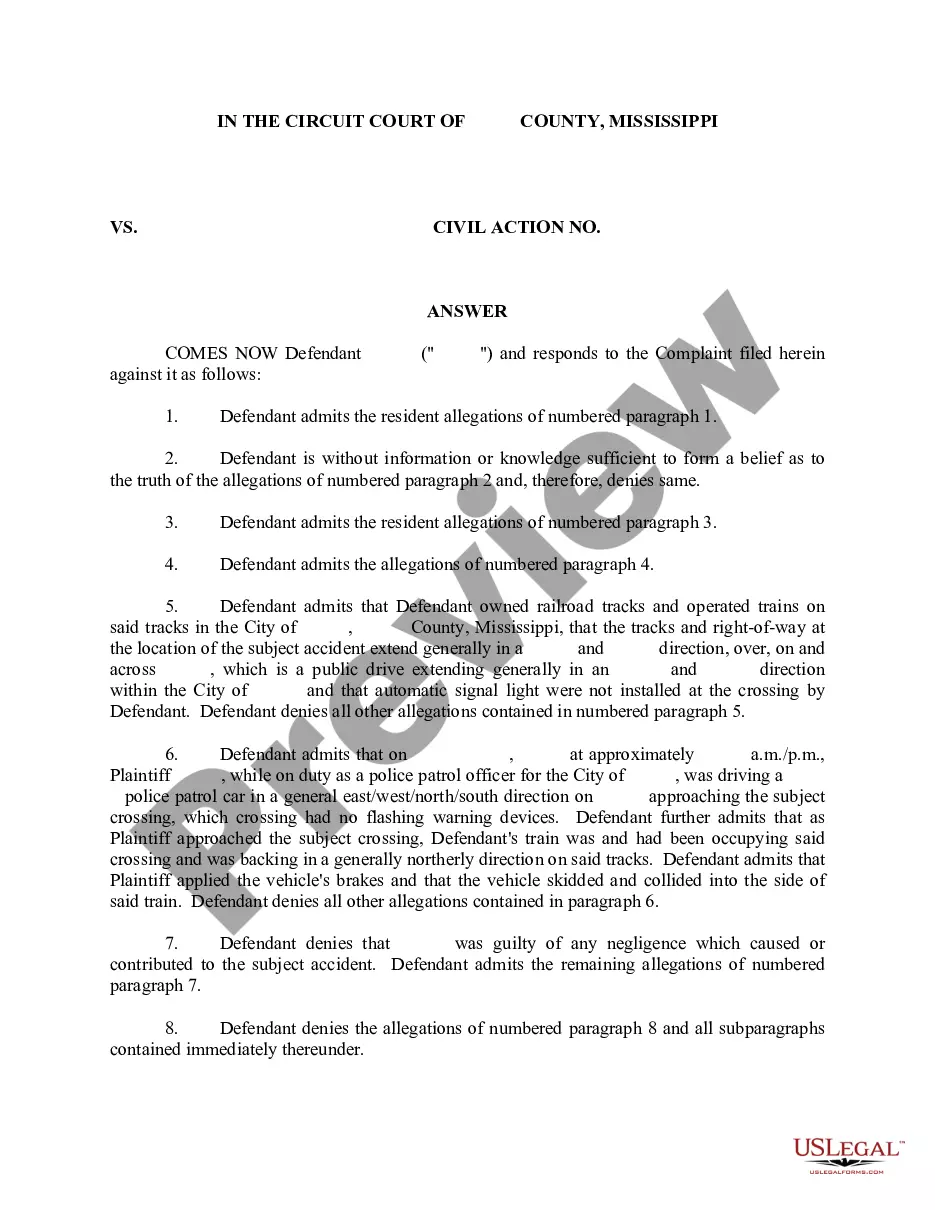

Factual Evidence. How it supports your case. Factual Evidence. How it supports your case. Factual Evidence. How it supports your case. Comments on the credibility of witnesses: How do the puzzle pieces of evidence and testimony fit into a compelling whole? This is your narrative of what happened.

The prosecution goes first, followed by the defense and a rebuttal by the prosecution. Because the prosecution has the burden of proof, it gets the final word. After the closing arguments, the judge will give the jury its final instructions.Criminal juries must reach a unanimous verdict of guilty or not guilty.

As the terms suggest, an opening statement comes at the beginning of the trial, while a closing argument occurs at the end of the trial after all the evidence is established.An opening statement is a time to state to the judge and jury the forthcoming evidence.

The closing statement is the attorney's final statement to the jury before deliberation begins. The attorney reiterates the important arguments, summarizes what the evidence has and has not shown, and requests jury to consider the evidence and apply the law in his or her client's favor.

Each closing argument usually lasts 20-60 minutes. Some jurisdictions limit how long the closing may be, and some jurisdictions allow some of that time to be reserved for later.

A closing argument, summation, or summing up is the concluding statement of each party's counsel reiterating the important arguments for the trier of fact, often the jury, in a court case.A closing argument may not contain any new information and may only use evidence introduced at trial.

A summary of the evidence. any reasonable inferences that can be draw from the evidence. an attack on any holes or weaknesses in the other side's case. a summary of the law for the jury and a reminder to follow it, and.

The lawyer for the plaintiff or government usually goes first. The lawyer sums up and comments on the evidence in the most favorable light for his or her side, showing how it proved what he or she had to prove to prevail in the case. After that side has made its case, the defense then presents its closing arguments.

In a criminal trial by judge alone, these final arguments are delivered by Crown and defence counsel after the defence's case is finished. If defence counsel has presented evidence then she or he will be the first to make final arguments. Crown counsel will speak last.