Pennsylvania Renunciation And Disclaimer of Property Received by Intestate Succession

What is this form?

This Renunciation and Disclaimer of Property Received by Intestate Succession form allows a beneficiary to renounce their right to property received from a decedent who died without a will (intestate). This legal document is essential when a beneficiary prefers to decline their interest in the estate, ensuring that the property is distributed according to Pennsylvania intestacy laws. It specifically adheres to the requirements set forth in Title 20, Chapter 62 of the Pennsylvania Statutes, establishing a clear process for disclaiming property rights.

What’s included in this form

- Identification of the decedent and the date of death.

- Statement of the beneficiary's interest in the property and their relationship to the decedent.

- Affirmation that the disclaimer will be filed within nine months of the decedent's death.

- Renunciation of all rights to the specified property or asset.

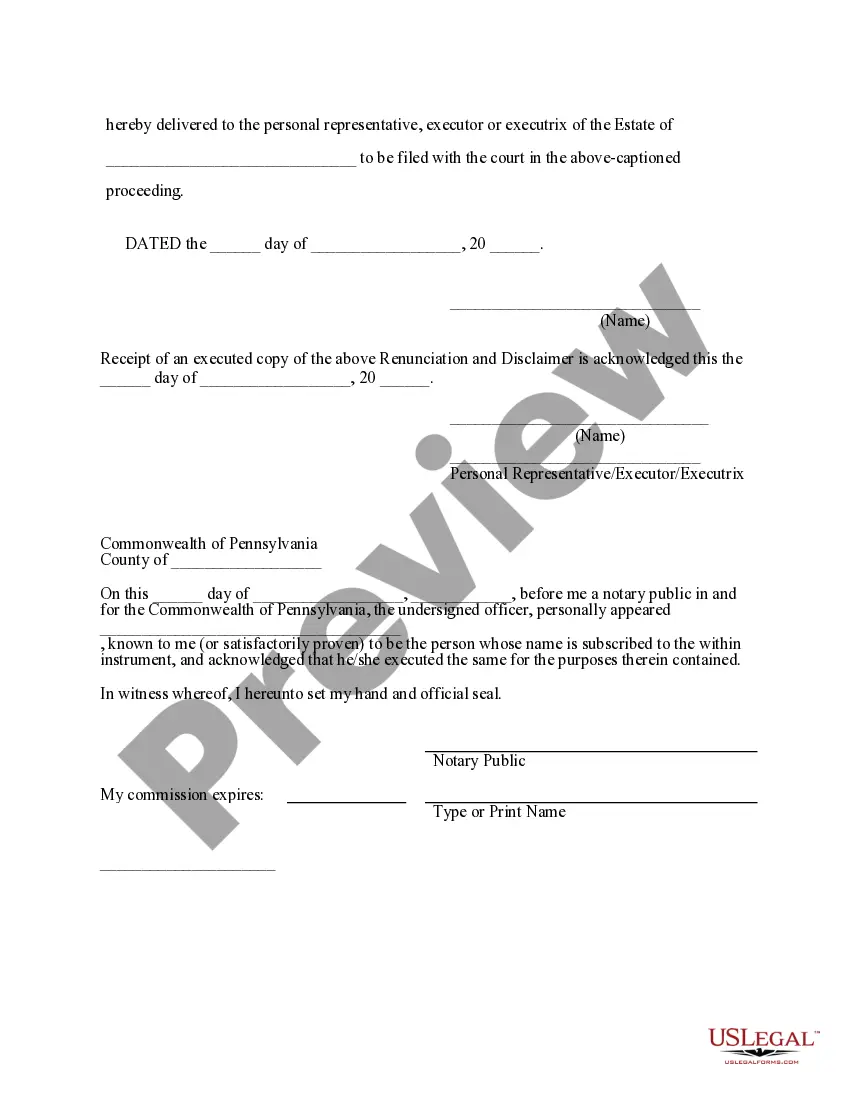

- Acknowledgment of receipt by the personal representative of the estate.

- Notary public section for the formal acknowledgment of the beneficiary's signature.

Common use cases

This form is typically used when an individual inherits property from a relative who has died intestate and wishes to disclaim their interest in that property. Scenarios where this form may be relevant include when a beneficiary does not want the inherited property due to associated debts or responsibilities, or to allow the property to pass directly to other heirs per state intestacy laws.

Who needs this form

- Beneficiaries who inherit property from a decedent that died without a will.

- Individuals who wish to refuse their interest in the property for personal, financial, or legal reasons.

- Individuals looking to ensure proper distribution of the estate according to Pennsylvania's intestacy laws.

Steps to complete this form

- Provide your name and the name of the decedent, along with the date of death.

- Specify your relationship to the decedent and detail the property you are renouncing.

- Indicate that you will file the disclaimer within the required nine-month period.

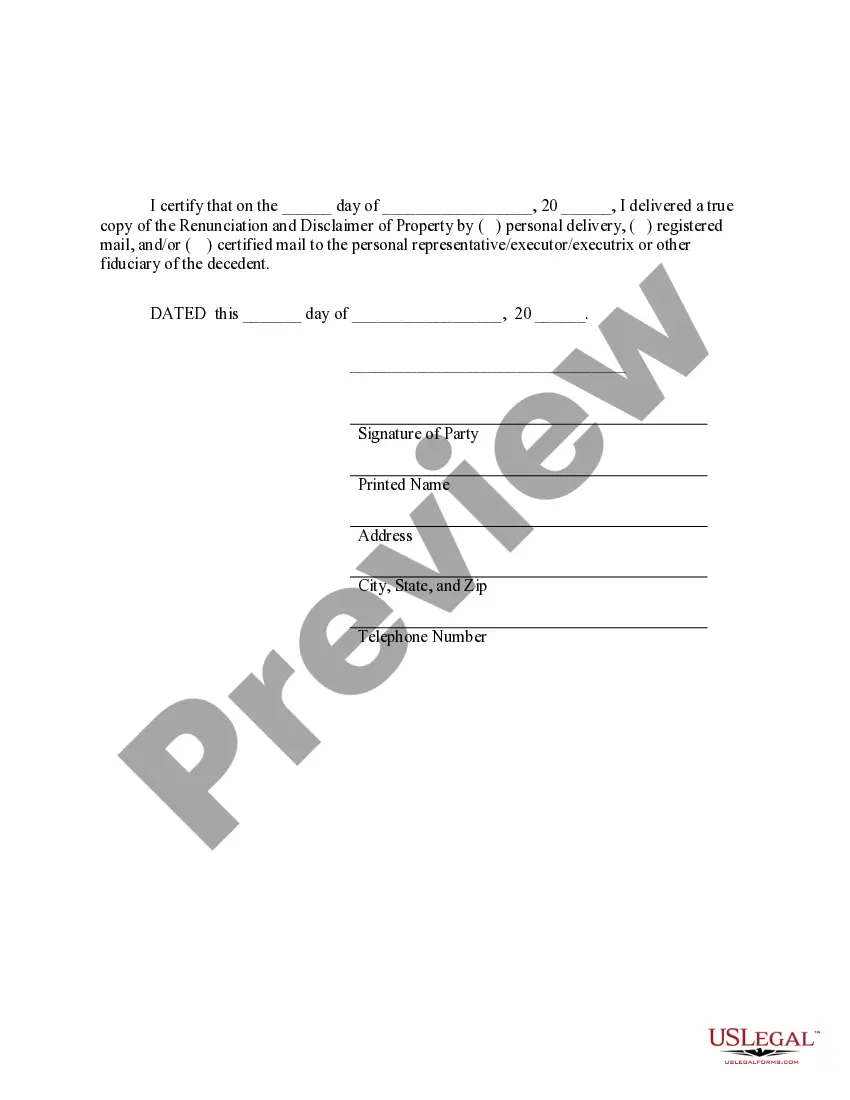

- Sign and date the form, acknowledging the renunciation of the property.

- Ensure the form is notarized by a certified notary public, if required.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes

- Failing to file the disclaimer within nine months of the decedent's death.

- Not properly identifying the property being disclaimed.

- Omitting necessary signatures or failing to notarize the document.

- Not keeping a copy of the filed disclaimer for personal records.

Benefits of using this form online

- Convenience of completing the form at your own pace from any location.

- Editability allows you to make changes easily without starting over.

- Access to professionally drafted templates by licensed attorneys, ensuring accuracy and compliance with legal standards.

Form popularity

FAQ

The disclaimer deed is a legal document that has legal consequences. Further, the disclaimer deed will clearly state that the spouse signing it is waiving (disclaiming) any interest in the house being purchased.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument.A gift, bequest, or other interest or obligation may be disclaimed via a written disclaimer of interest.

Disclaim Inheritance, Definition In a nutshell, it means you're refusing any assets that you stand to inherit under the terms of someone's will, a trust or, in the case of a person who dies intestate, the inheritance laws of your state.

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

A beneficiary of an estate, whether by Will or the laws of intestacy is perfectly within their rights to reject their inheritance. Beneficiaries may wish to vary dispositions of property following death in order to redirect benefits to other family members who are more in need or less well provided for and to save tax.