Oregon Notice of Filing of Lien Claim - Individual

What this document covers

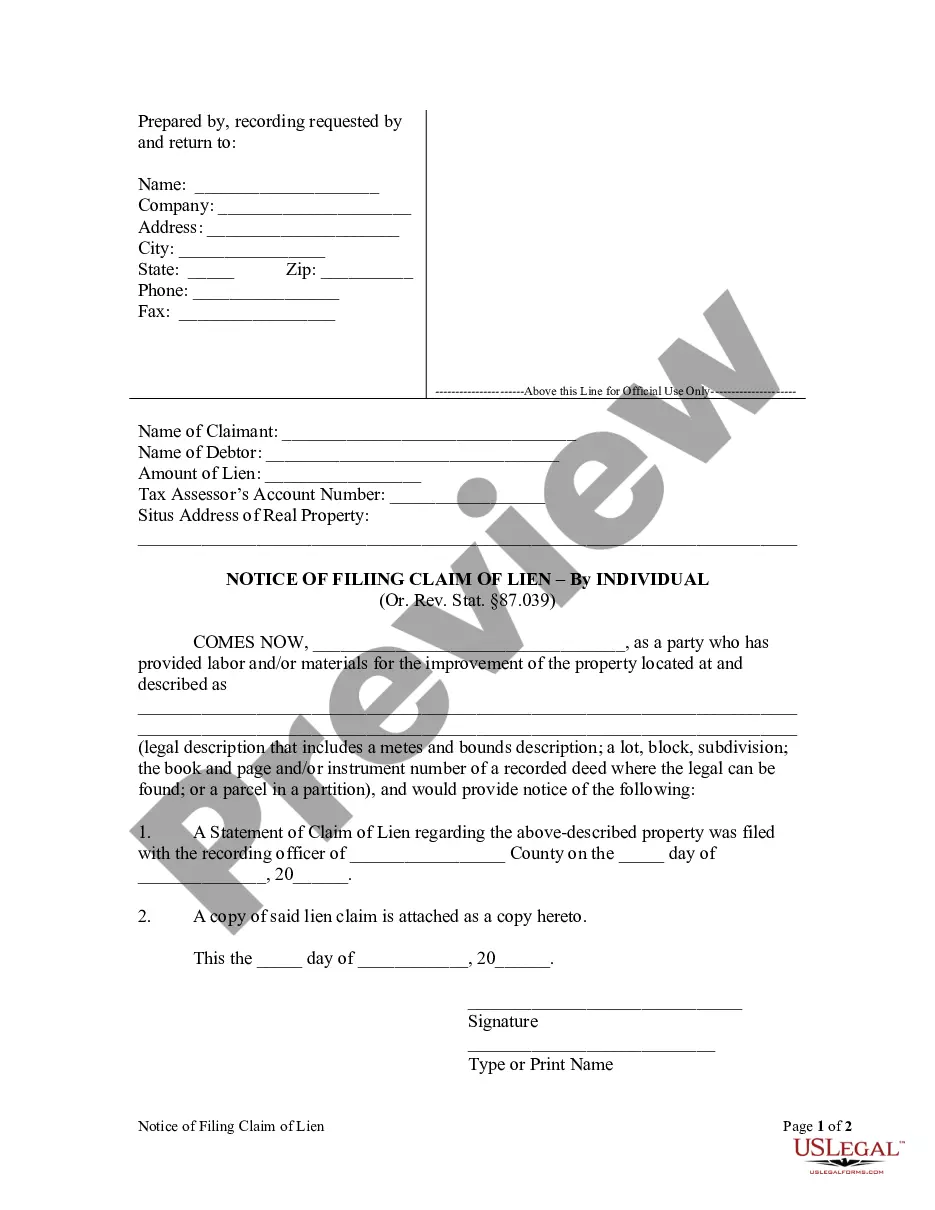

The Notice of Filing of Lien Claim - Individual is a legal document used by individuals who wish to notify relevant parties of their claim for a lien under Oregon law. This form is essential for those who have provided labor or materials for property improvement and need to perfect their lien rights. By filing this notice, creditors protect their interests by formally claiming a lien, which differs from informal claims or unrecorded notices. It is specifically geared towards individual claimants in Oregon who are seeking to comply with ORS 87.010 and secure their financial interests in a property project.

Key parts of this document

- Name and contact information of the claimant.

- Details of the debtor, including name and associated property information.

- Amount of the lien being claimed.

- Legal description of the property associated with the claim.

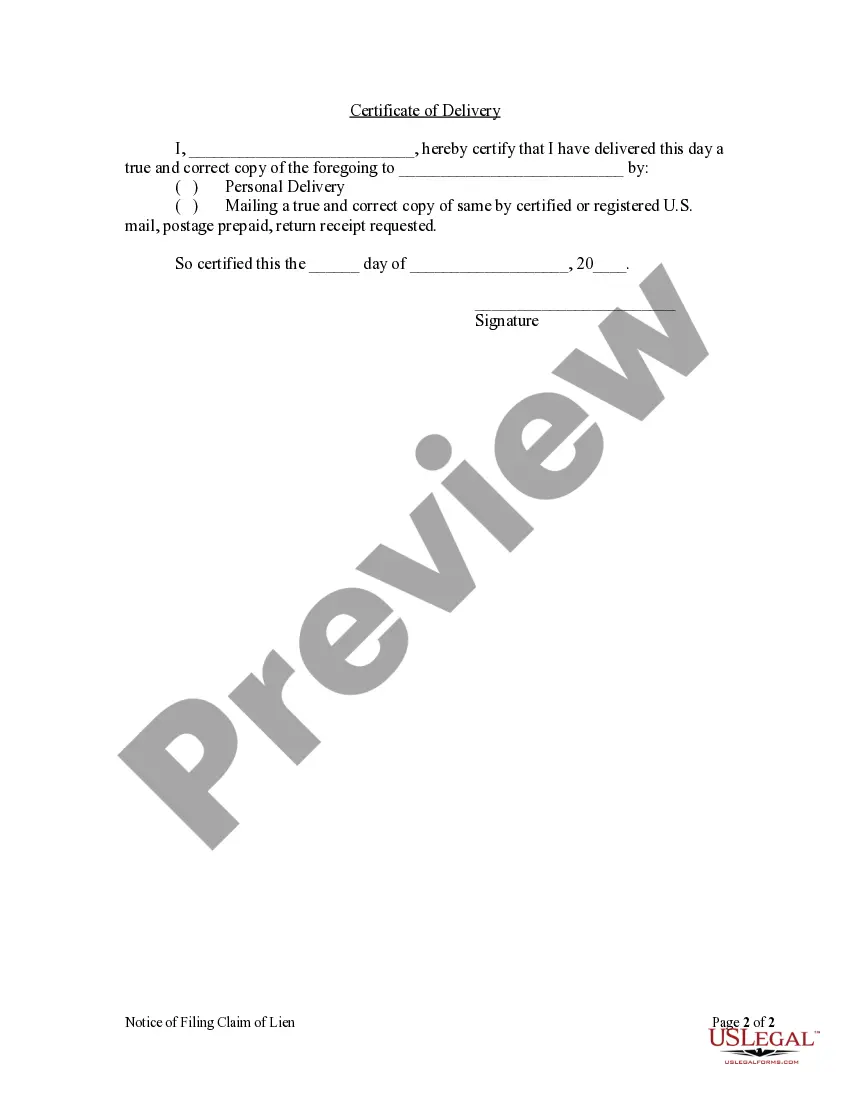

- Certification of delivery method to the debtor, confirming notification.

When to use this form

This form should be used when an individual who has provided labor, rented equipment, or furnished materials for property improvement needs to formally establish a lien. It is necessary to file this notice within 75 days after the last service provided or the completion of construction, making it critical for individuals seeking to secure their rights to payment and protect their financial interests.

Who needs this form

The following individuals should consider using this form:

- Contractors and subcontractors who provided services or materials for property improvements.

- Suppliers of materials or equipment necessary for construction projects.

- Individuals seeking to enforce their lien rights under Oregon law.

Completing this form step by step

- Fill in your name and contact information in the designated sections.

- Provide the debtor's name and relevant property details.

- State the amount of the lien claimed against the property.

- Include a complete legal description of the property in question.

- Sign the form, and ensure to date it on the specified line.

- Complete the certification of delivery section to confirm notification to the debtor.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to file the notice within the 75-day deadline.

- Providing incomplete or inaccurate property descriptions.

- Neglecting to inform the debtor of the claim, which can invalidate the lien.

Benefits of completing this form online

- Convenience of downloading and completing from anywhere.

- Editable format allows for easy customization of the form.

- Access to reliable templates drafted by licensed attorneys ensures compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

In Alberta, for example, your lien is valid for 180 days from the date the lien was placed. In Ontario, liens are only valid for 90 days from the date of last on site working.

Therefore, liens are not officially recorded, and personal property could be sold off to a third party who is unaware of the lien's existence. In most states, judgment liens must be filed by the creditor through the county or state.

In the state of Oregon, a lien must be filed within 75 days after the last day of performing labor or providing materials or within 75 days after the completion of construction.

2. States where the lien law doesn't require a written contract. In these states, contractors and suppliers are generally allowed to file a lien even if they don't have a written contract.These states typically permit parties with verbal, oral, or even implied contracts to claim lien rights.

To place a lien, you must first demonstrate that you have a valid debt that has not been paid by the property holder for example if you performed construction work as a contractor or subcontractor at company headquarters and the business did not pay your bill.

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.

A contractor's lien (often known as a mechanic's lien, or a construction lien) is a claim made by contractors or subcontractors who have performed work on a property, and have not yet been paid.After all, contractors would rather work out a deal than go through the hassle of filing a lien against your property.

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.