Ohio Bylaws for Corporation

What this document covers

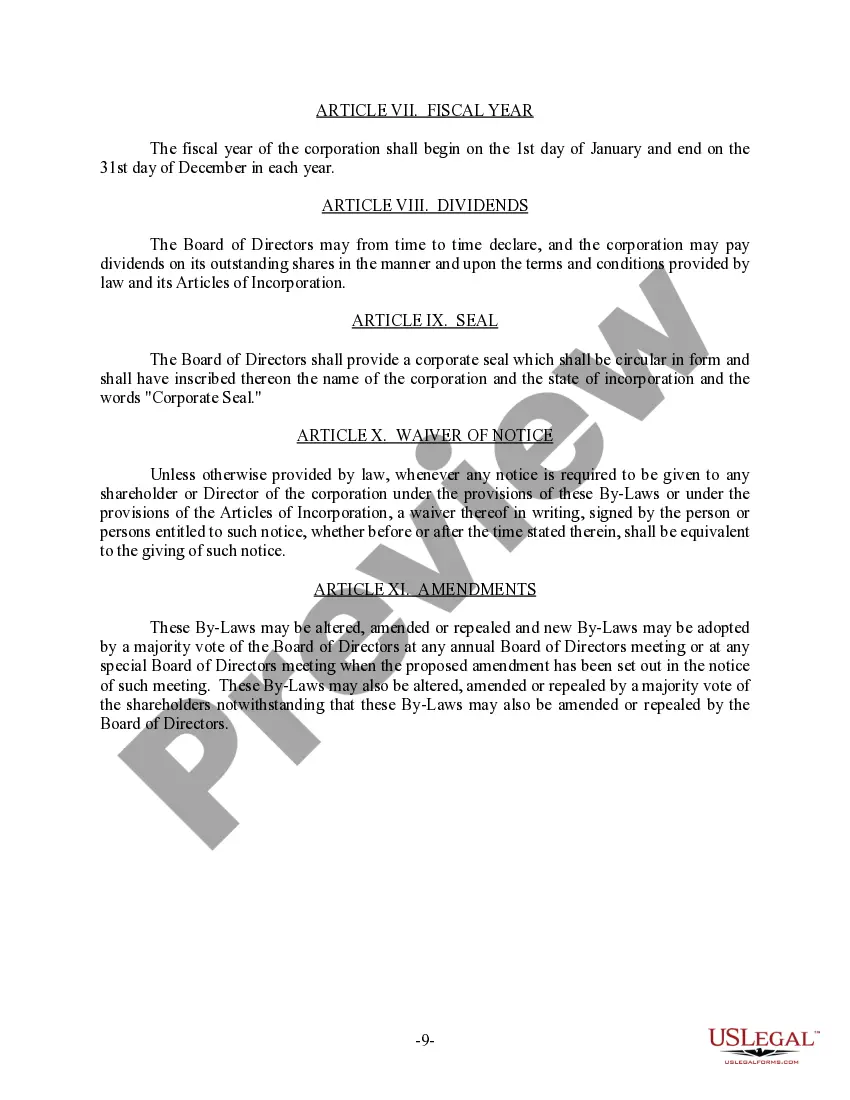

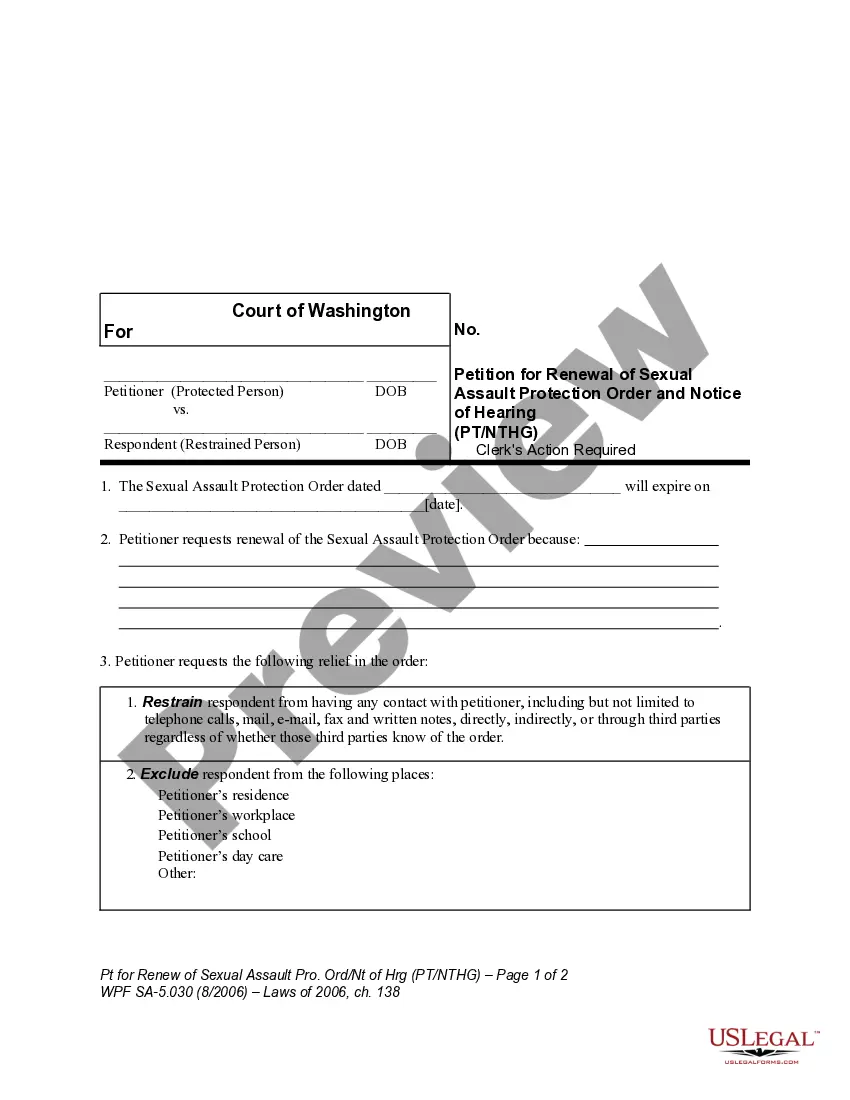

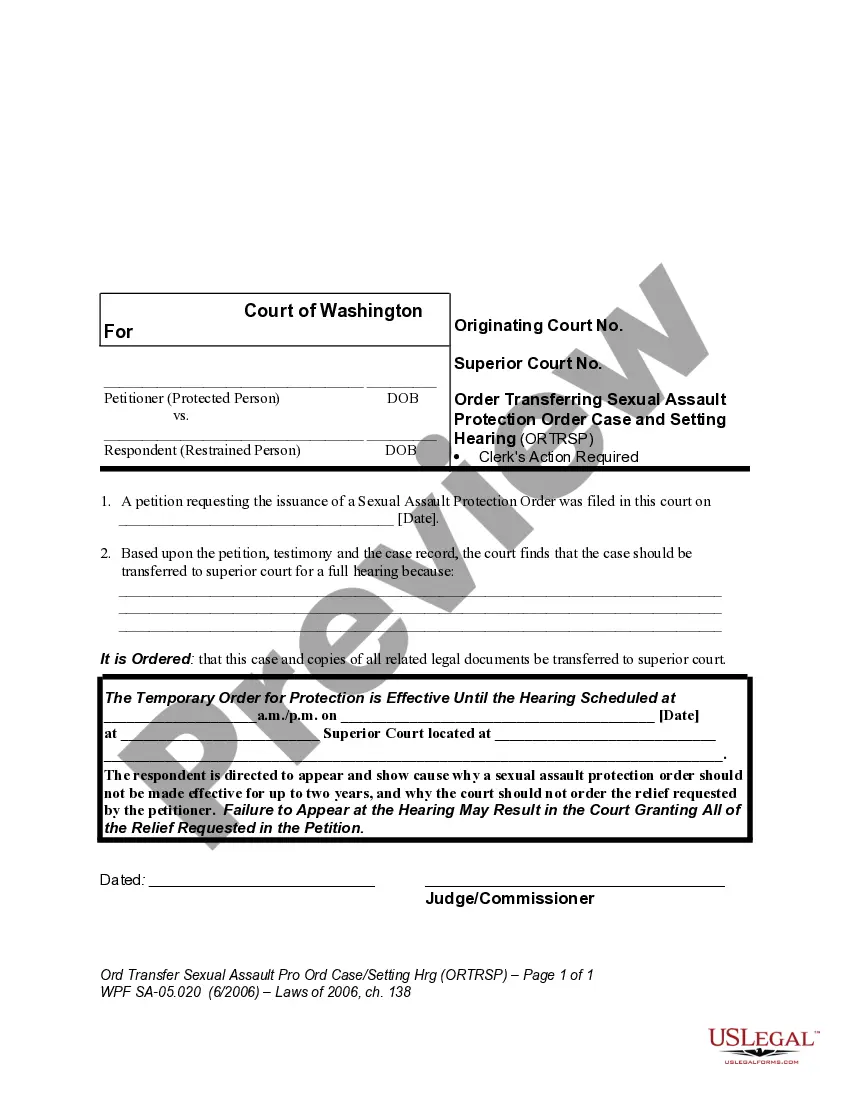

The Ohio Bylaws for Corporation is a legal document that outlines the rules and procedures for managing a corporation in Ohio. This form is essential for establishing how the corporation will operate, including the governance of shareholder meetings, the roles of officers and directors, and the handling of stock records. This document differs from other corporate forms as it specifically addresses internal management policies rather than external agreements or registrations.

Main sections of this form

- Name and location of the corporation

- Provisions for annual and special shareholder meetings

- Roles and responsibilities of officers and directors

- Voting procedures for shareholders

- Amendment procedures for the bylaws

- Fiscal year and dividend policies

Common use cases

This form should be used when establishing a corporation in Ohio or when updating the governance policies of an existing corporation. It is necessary for ensuring compliance with state laws and for providing clarity on how the corporation will function on a day-to-day basis.

Intended users of this form

This form is suitable for:

- Business owners planning to incorporate in Ohio

- Existing corporations needing to formalize their internal governance structure

- Directors and officers looking to clarify their roles and responsibilities

- Shareholders interested in understanding their rights and the voting process

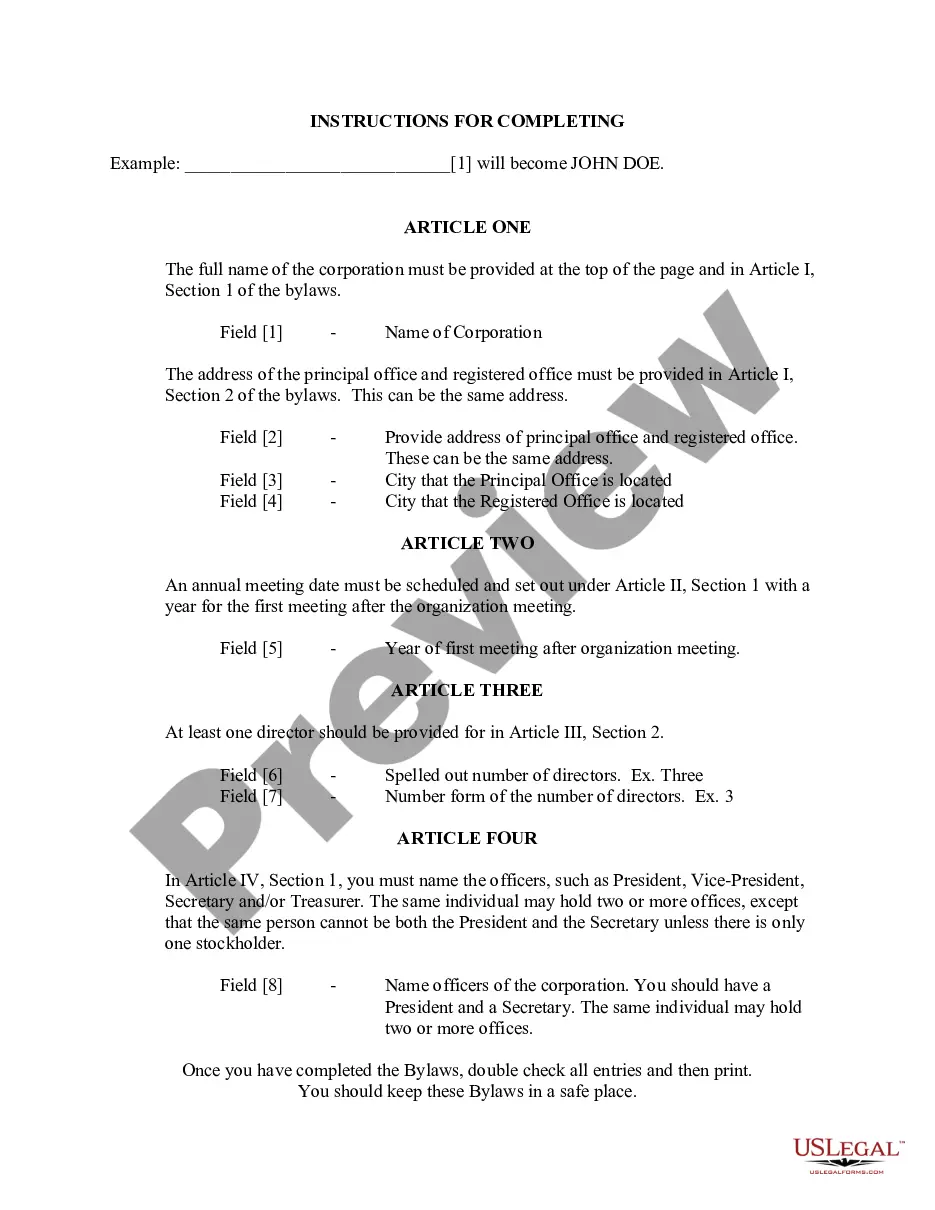

Completing this form step by step

- Identify and enter the name of the corporation at the top of the form.

- Provide the principal and registered office addresses in the designated fields.

- Specify the date for the first annual shareholder meeting and the number of directors.

- Name the officers of the corporation, including at least a President and a Secretary.

- Review all entries for accuracy and print the document for records.

Notarization requirements for this form

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to provide a complete and accurate name for the corporation.

- Missing the required number of directors or omitting their names.

- Not setting a specific date for the annual shareholder meeting.

- Ignoring the importance of reviewing and maintaining the bylaws regularly.

Benefits of completing this form online

- Convenience of downloading and completing the form at your own pace.

- Editability to customize the bylaws according to specific corporate needs.

- Reliability, with forms drafted by licensed attorneys familiar with Ohio law.

Looking for another form?

Form popularity

FAQ

For a corporation, it's the articles of incorporation. The second concerns the internal operating procedures of the company. For corporations, these are bylaws, and for LLCs, this is an operating agreement. Corporate bylaws give a clear structure to a business, helping it run smoothly.

An Ohio corporation may adopt bylaws, but they are not required.The Ohio Secretary of State requires a fee when filing articles of incorporation or reserving a corporation name. The cost for filing the articles is dependent on the number of shares of stock.

Bylaws generally define things like the group's official name, purpose, requirements for membership, officers' titles and responsibilities, how offices are to be assigned, how meetings should be conducted, and how often meetings will be held.

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation.Aside from number of directors, all the matters typically covered in the bylaws are otherwise covered by California statute, which would apply in the absence of any contrary lawful bylaw provision.

Corporate bylaws commonly include information that specifies, for example, the number of directors the corporation has, how they will be elected, their qualification, and the length of their terms. It can also specify when, where, and how your board of directors can call and conduct meetings, and voting requirements.

Most states require you to memorialize your bylaws and, even in the states where there is no such requirement, having bylaws is a great idea. After all, corporate bylaws define your business' structure, roles, and specifies how your company will conduct its affairs.

Bylaws are required when the articles of incorporation do not specify the number of directors in a corporation. Any corporation whose articles of incorporation do not specify the number of directors must adopt bylaws before the first meeting of the board of directors specifying the number of directors.

Taxes. Corporations must file their annual tax returns. Securities. Corporations must issue stock as their security laws and articles of incorporation mandate. Bookkeeping. Board meetings. Meeting minutes. State registration. Licensing.