New York Renunciation And Disclaimer of Property from Will by Testate

Understanding this form

The Renunciation and Disclaimer of Property from Will by Testate is a legal document allowing a beneficiary to renounce their interest in property inherited through a decedent's will. This form differs from similar documents by specifically adhering to New York State laws, which permit beneficiaries to disclaim their property interests. By filling out this form, the property will pass on to other heirs as if the beneficiary predeceased the decedent, ensuring legal clarity in the inheritance process.

Key parts of this document

- Recipient's decision to disclaim a partial or entire interest in the inherited property.

- Details regarding the property as specified in the decedent's last will and testament.

- A declaration of irrevocable refusal to accept the property.

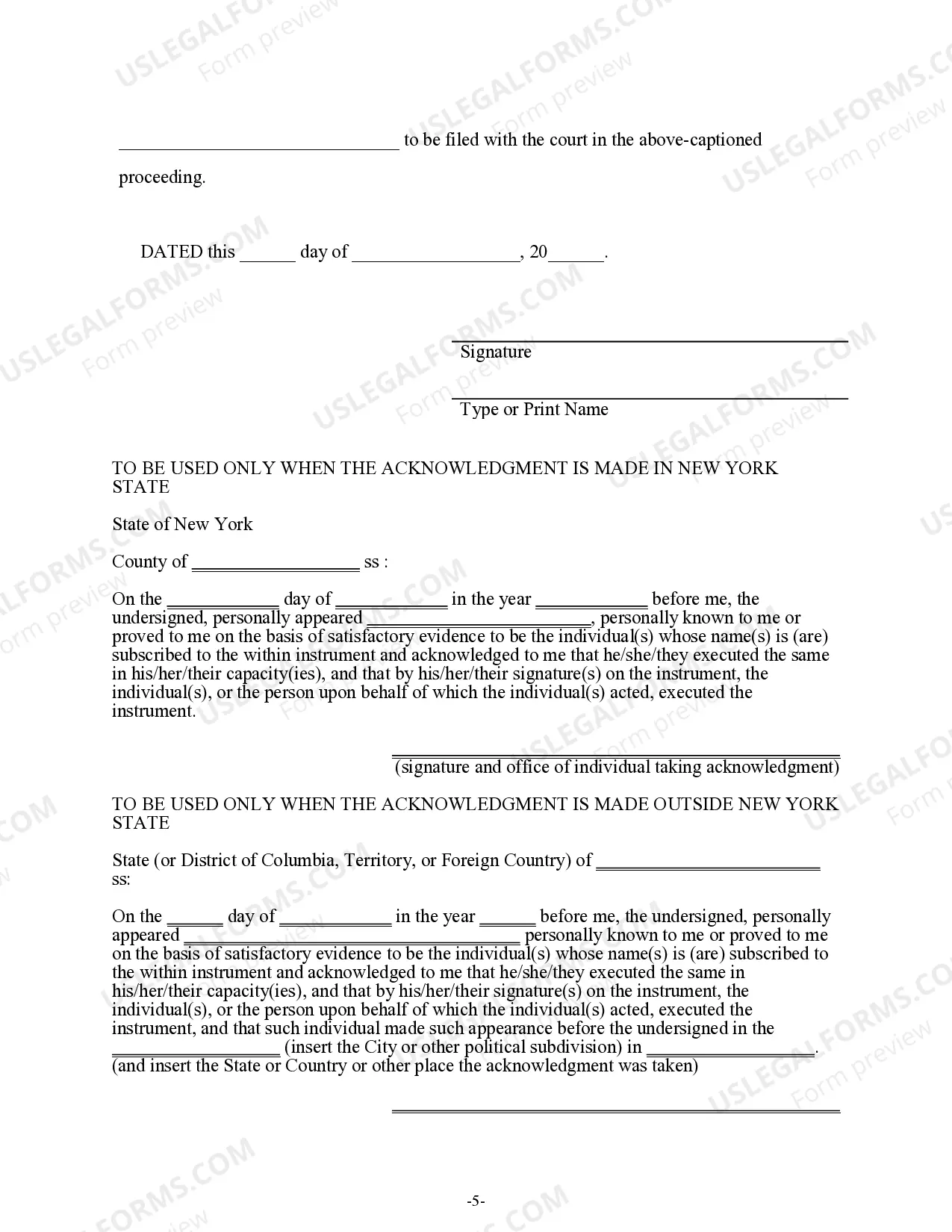

- An acknowledgment section for notarization or verification of the disclaimer.

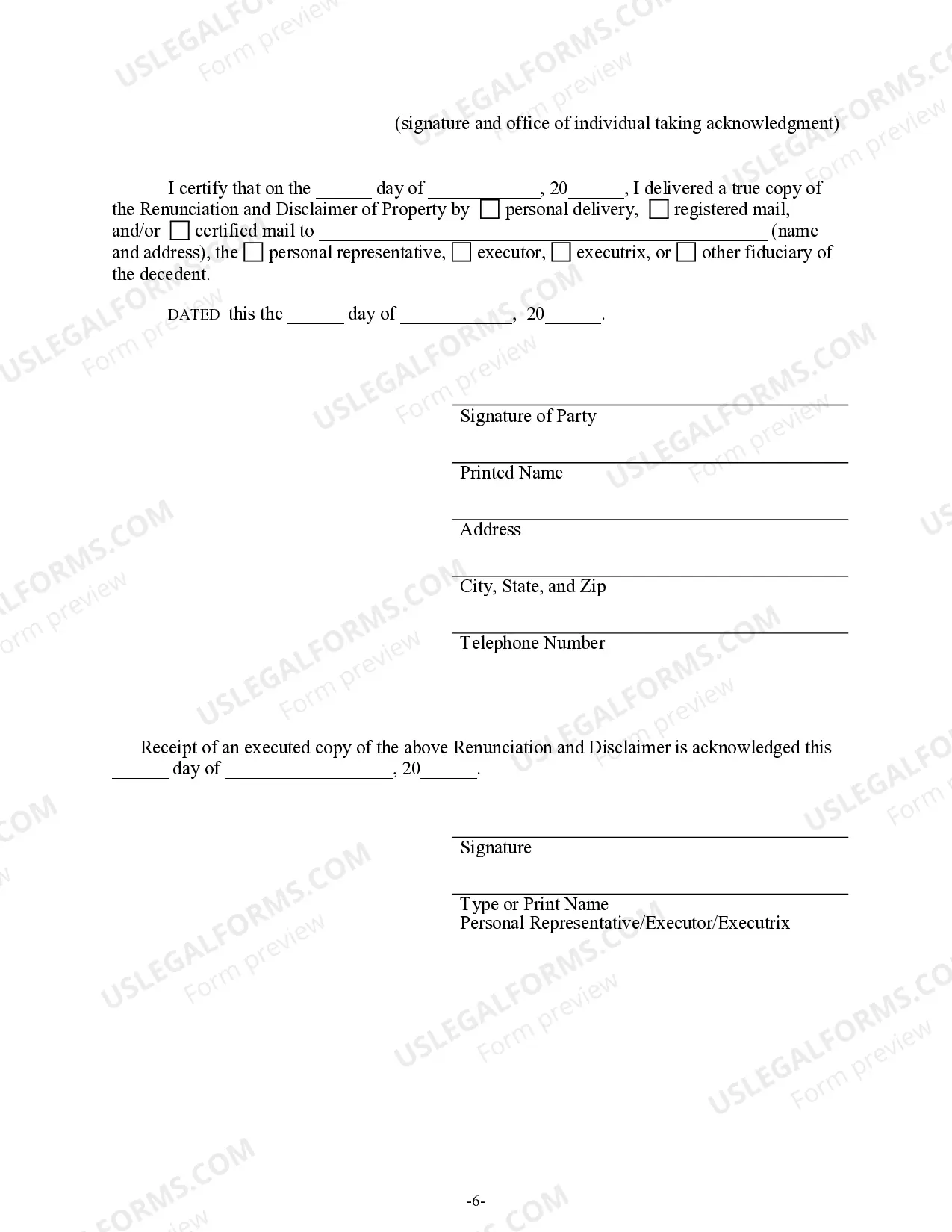

- Certificate of delivery to the personal representative or executor of the estate.

When to use this form

This form should be used when a beneficiary of a will decides not to accept their inheritance, whether in whole or in part. Situations may include: - Choosing to renounce property due to personal financial situations or obligations.- Avoiding potential tax implications associated with inheriting the property.- Settling family disputes regarding the division of inherited assets.

Who should use this form

- Beneficiaries named in a decedent's will who wish to renounce their interest in the property.

- Individuals seeking to clarify their intentions regarding inherited assets to avoid future legal disputes.

- Personal representatives or executors who need to ensure accurate distribution of the estate according to the beneficiary's wishes.

Steps to complete this form

- Identify the beneficiary's name and their relationship to the decedent.

- Specify the property that is being disclaimed, referencing the relevant sections of the will.

- Enter the date of the will and sign the document.

- Complete the acknowledgment section if notarization is required or if executing outside New York State.

- Deliver a copy of the completed form to the personal representative or executor of the estate.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide correct details of the property being disclaimed.

- Not signing the form or omitting necessary dates.

- Overlooking the requirement of notarization where applicable.

- Filing the form late or without the correct personal representative's acknowledgment.

Benefits of using this form online

- Convenient access to legal templates at any time.

- Ability to complete the form digitally for accuracy and ease of use.

- Downloadable formats for easy printing or sharing with legal counsel.

- Enhanced reliability by using professionally drafted forms checked for compliance with state laws.

Looking for another form?

Form popularity

FAQ

CLOSING THE ESTATE: FORM 207.42 must be prepared and executed by the fiduciary and the attorney and filed after 7 months or by the end of 2 years from the date of fiduciary appointment. RELEASES from all beneficiaries of the estate must be executed and filed at this time, if not already filed.

These documents can include the will, death certificate, transfer of ownership forms and letters from the estate executor or probate court.If you received the inheritance in the form of cash, request a copy of the bank statement that reflects the deposit.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

Disclaim Inheritance, Definition In a nutshell, it means you're refusing any assets that you stand to inherit under the terms of someone's will, a trust or, in the case of a person who dies intestate, the inheritance laws of your state.

In your disclaimer, cover any and all liabilities for the product or service that you provide. You should warn consumers of any dangers or hazards posed by your product. You should list specific risks while at the same time acknowledging that the list is not exhaustive. For example, you could write, NOTICE OF RISK.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.