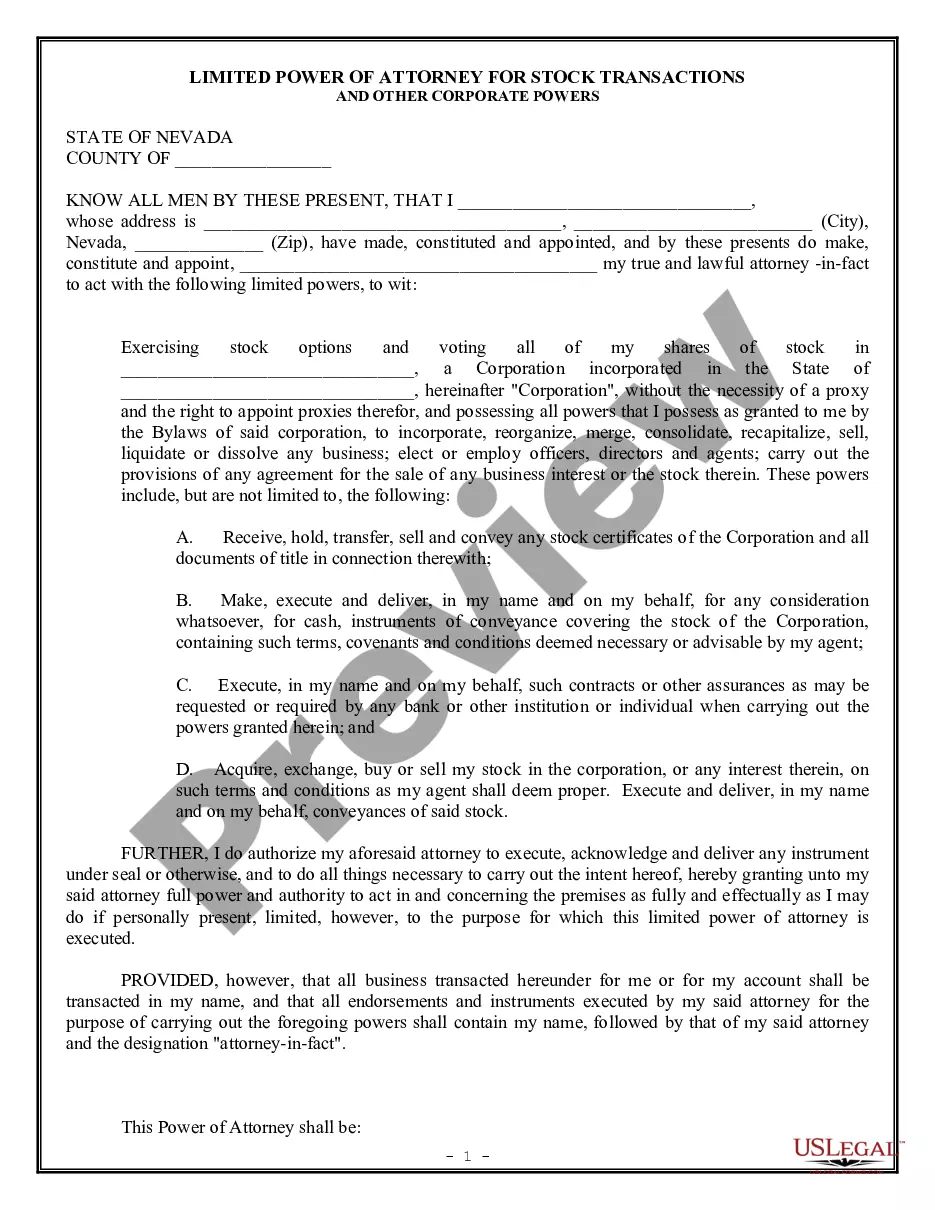

Nevada Limited Power of Attorney for Stock Transactions and Corporate Powers

What this document covers

The Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal document that allows a shareholder to designate another individual as their attorney-in-fact. This form specifically grants authority for stock transactions and certain corporate actions, differentiating it from broader power of attorney forms that cover general financial or legal matters. By using this form, shareholders can facilitate smoother management of their corporate shares without the need for continual personal involvement.

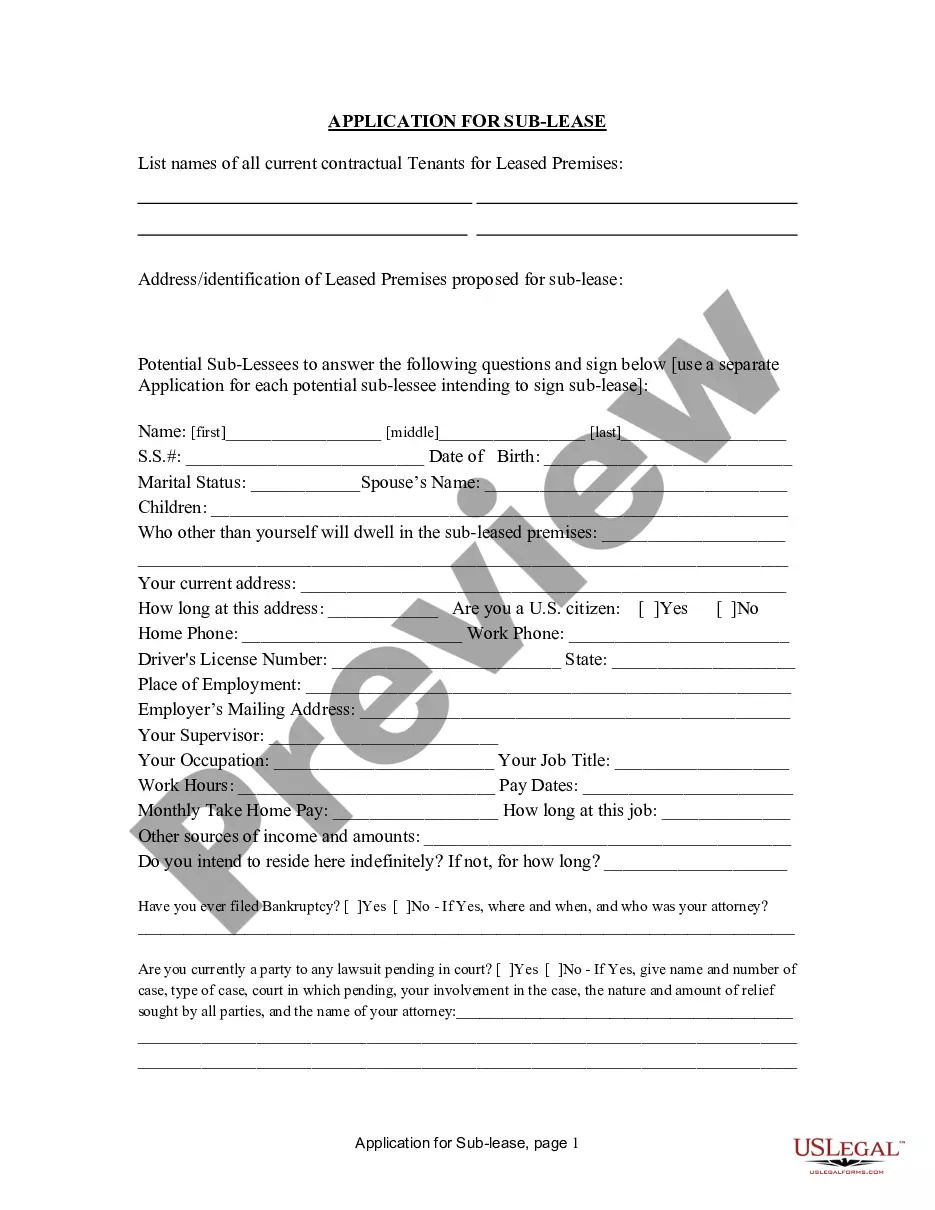

Main sections of this form

- Identification of the principal and attorney-in-fact with their names and addresses.

- Specific powers granted to the attorney-in-fact, such as voting shares and executing stock transactions.

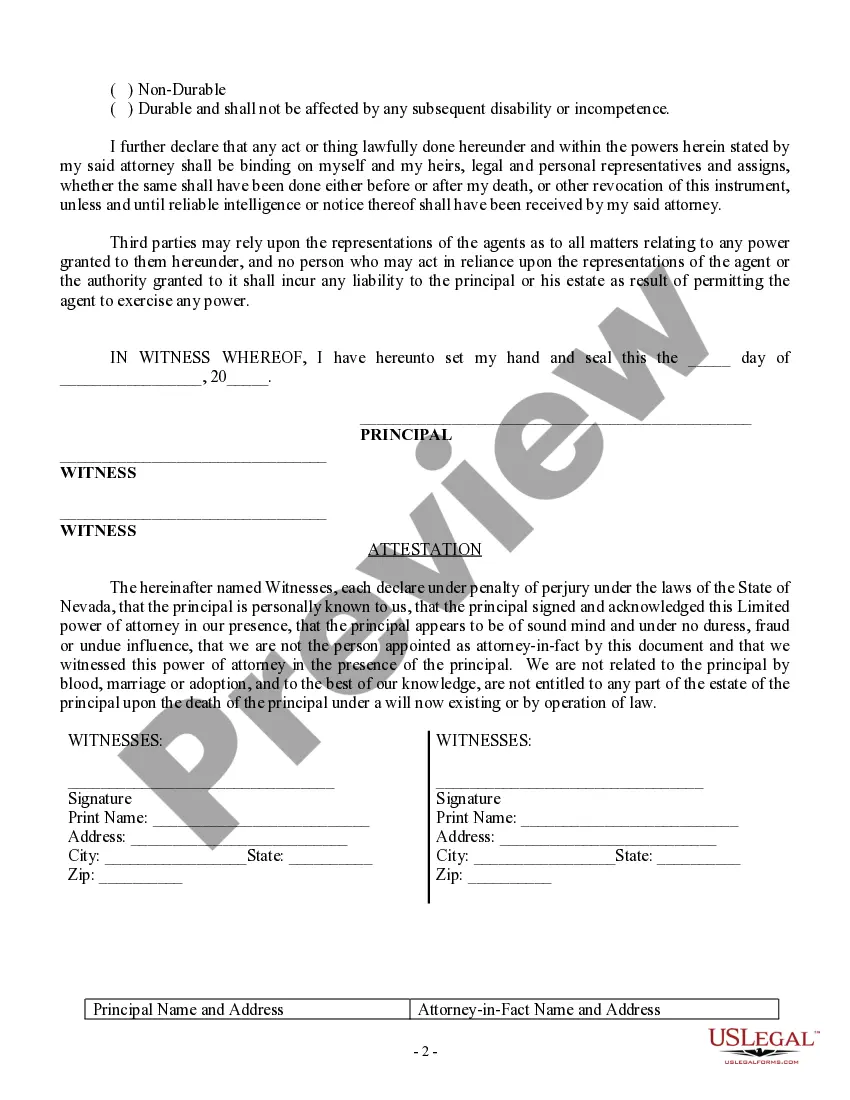

- Indication of whether the power of attorney is durable or non-durable.

- Signature lines for the principal and two witnesses, along with attestation statements.

- Provisions for third-party reliance on the authority granted within the document.

When to use this document

This form is essential when a shareholder is unable to personally attend corporate meetings or make decisions regarding their stock. It is particularly useful during instances such as relocation, health issues, or when a shareholder desires to delegate their voting rights and stock management duties to a trusted individual. By enabling an attorney-in-fact to perform these functions, a shareholder ensures that their interests are still represented in the corporate arena.

Who needs this form

- Shareholders who wish to authorize another person to manage their stock transactions.

- Individuals who may be temporarily unavailable to vote or make corporate decisions.

- Investors looking to simplify corporate governance and stock management through delegation.

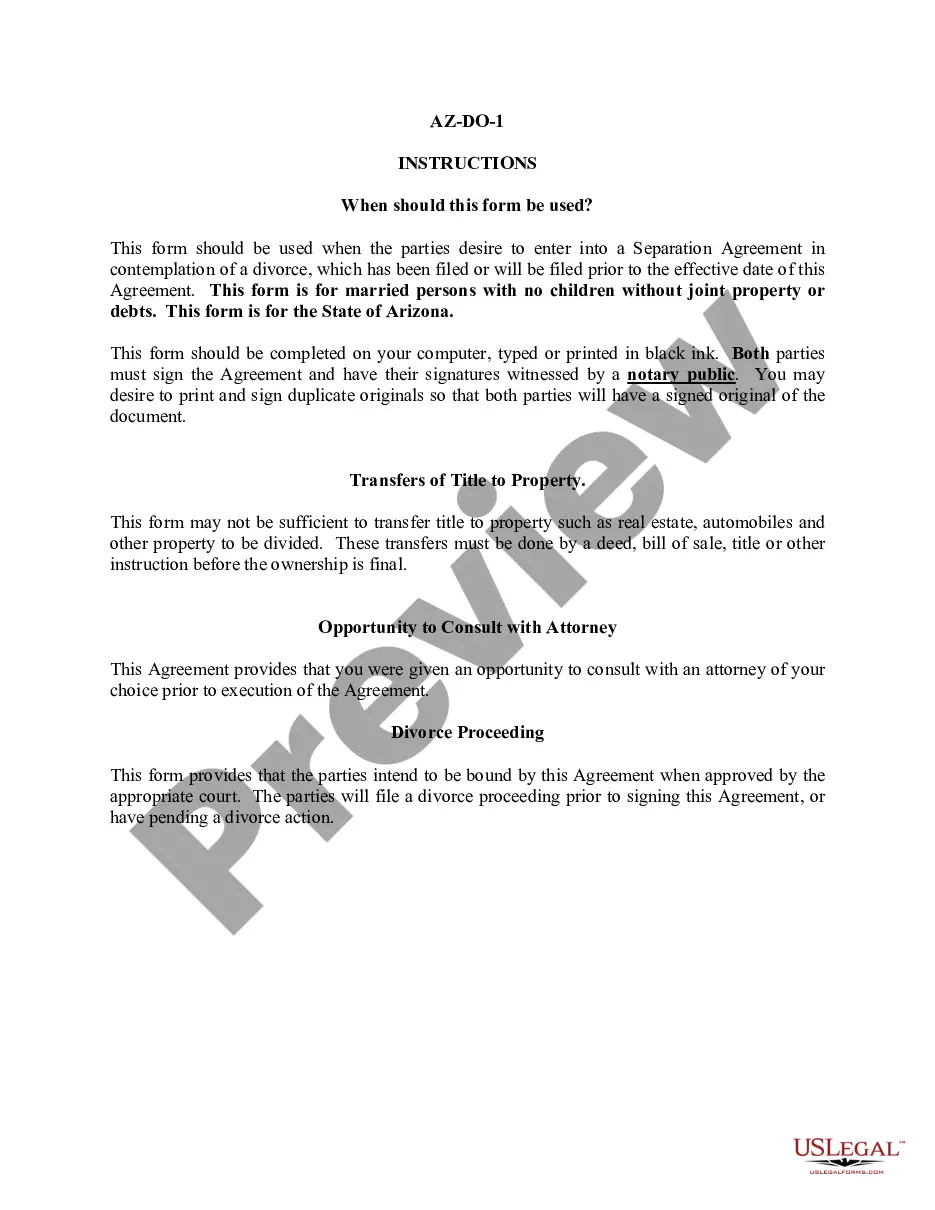

Instructions for completing this form

- Identify and fill in the principal's name and address at the top of the document.

- Specify the name and address of the attorney-in-fact designated to act on behalf of the principal.

- Clearly define the powers granted to the attorney-in-fact, tailored to stock transactions and corporate matters.

- Choose whether the power of attorney is durable or non-durable by marking the appropriate box.

- Ensure that the principal signs the document in the presence of two witnesses, who should also sign and provide their information.

Notarization guidance

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to have the document witnessed by the required number of witnesses.

- Not specifying the powers granted, leading to ambiguity.

- Forgetting to indicate whether the power of attorney is durable or non-durable.

Benefits of completing this form online

- Convenience of downloading and completing the form at your own pace.

- Easily editable sections allow personalization for specific stock and corporate requirements.

- Access to professionally drafted legal templates ensures compliance with state regulations.

Looking for another form?

Form popularity

FAQ

Besides a Power of Attorney, you may have a Guardian appoint to handle your affairs. If you desire to select someone with Power of Attorney on your own and, while you are still able to do, you may give this power to one or more individuals.

There is no recording of a power of attorney in Nevada. Typically when a new power of attorney is created, it will read that it supersedes and/or revokes any prior power of attorney made.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner.Before signing an LPOA, the client should be aware of the specific functions they have delegated to the portfolio manager, as the client remains liable for the decisions.

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.

When you give someone the POA, there are important limitations to the power the agent has. First, your agent must make decisions within the terms of the legal document and can't make decisions that break the agreement, and the agent can be held liable for any fraud or negligence.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

Download the form. In just a few minutes, you can locate appropriate power of attorney forms from reputable sources. Appoint an agent. Your agent is the person you authorize to act on your behalf. Draft a statement of authority. Set time limits. Sign and date the form.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.