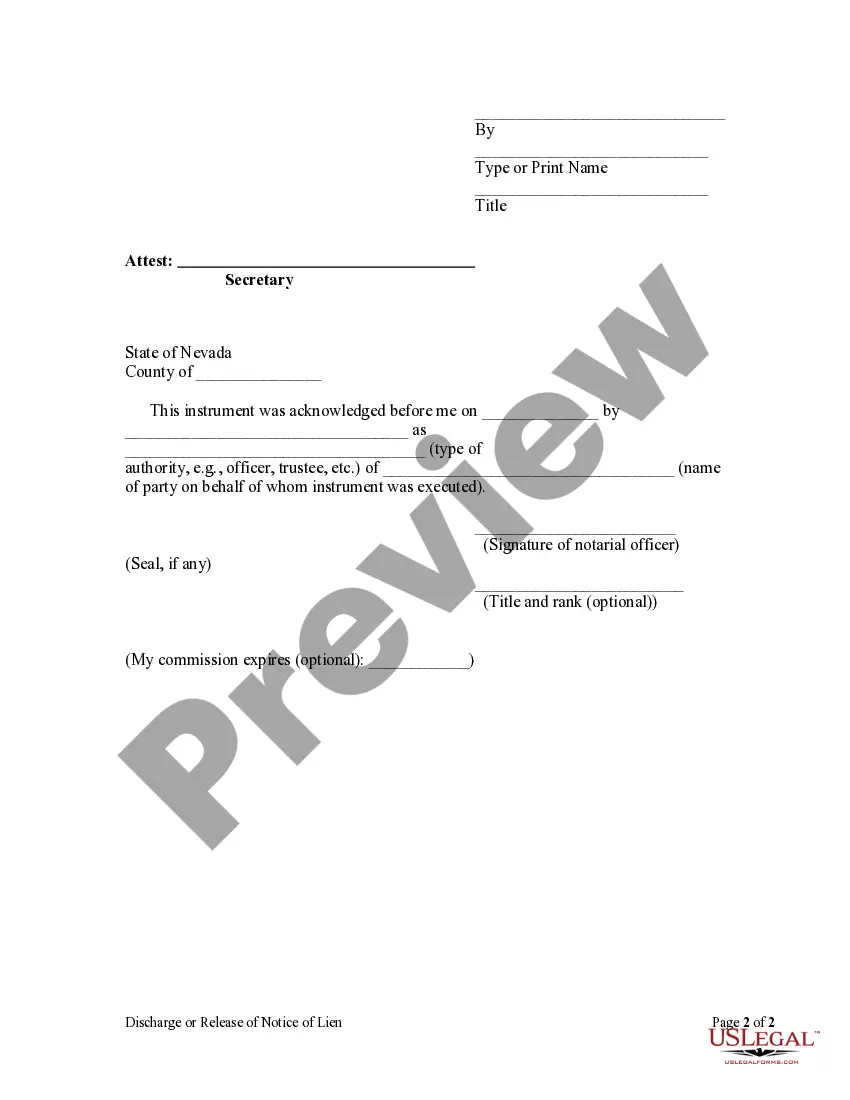

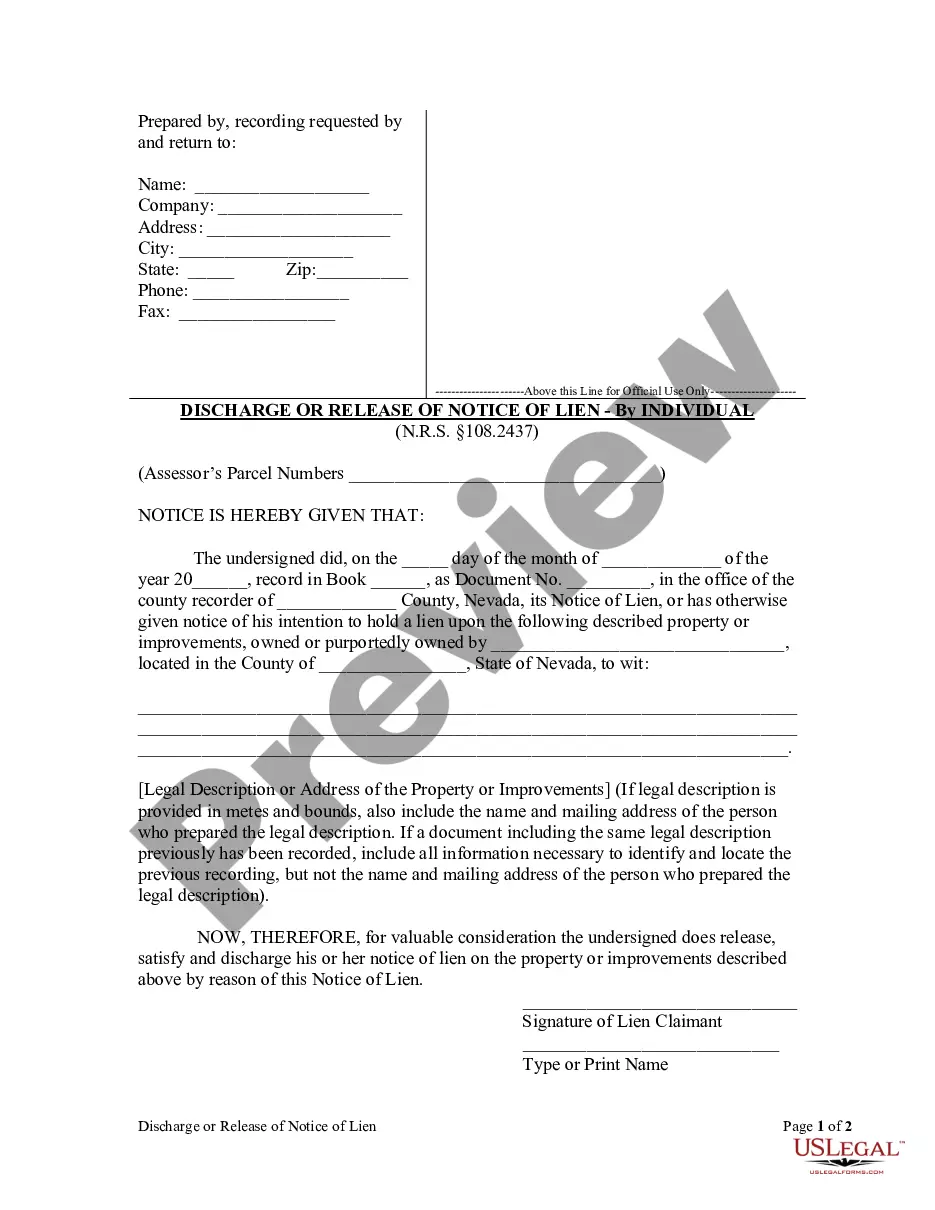

If a property owner or other party adversely affected by a lien satisfies that lien, Nevada statutes require that the lienholder file a release of lien with the county recorder within ten days of the date the lien was satisfied. Failure to do so within ten days will result in the lienholder being liable in a civil action for any actual damages or for $100, whichever is greater.

Nevada Discharge or Release of Lien - Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nevada Discharge Or Release Of Lien - Corporation?

US Legal Forms is really a special platform where you can find any legal or tax template for submitting, such as Nevada Discharge or Release of Lien - Corporation. If you’re fed up with wasting time seeking suitable examples and paying money on file preparation/lawyer service fees, then US Legal Forms is exactly what you’re trying to find.

To reap all the service’s advantages, you don't need to download any software but just select a subscription plan and create your account. If you already have one, just log in and get a suitable sample, save it, and fill it out. Saved files are all stored in the My Forms folder.

If you don't have a subscription but need to have Nevada Discharge or Release of Lien - Corporation, have a look at the recommendations below:

- make sure that the form you’re taking a look at applies in the state you want it in.

- Preview the form and look at its description.

- Simply click Buy Now to access the sign up page.

- Pick a pricing plan and continue signing up by providing some information.

- Pick a payment method to finish the sign up.

- Download the file by choosing your preferred format (.docx or .pdf)

Now, complete the file online or print it. If you are uncertain concerning your Nevada Discharge or Release of Lien - Corporation template, speak to a legal professional to examine it before you send or file it. Get started without hassles!

Form popularity

FAQ

The release of lien is then recorded by the title company in the real property records at the county recorder's office. The fee is generally included in your settlement costs or as a separate lien release fee paid at closing. Your new mortgage company places a mortgage lien on the home and records it.

To attach the lien, the creditor files the judgment with the county recorder in any Nevada county where the debtor has property now or may have property in the future.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

Put simply, a lien release is a written contract in which you agree to release your rights as of a certain date. Details like the dating, wording, and content of the release can impact your rights in unanticipated ways, which is why it is so critical to learn how lien releases work in construction.

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.