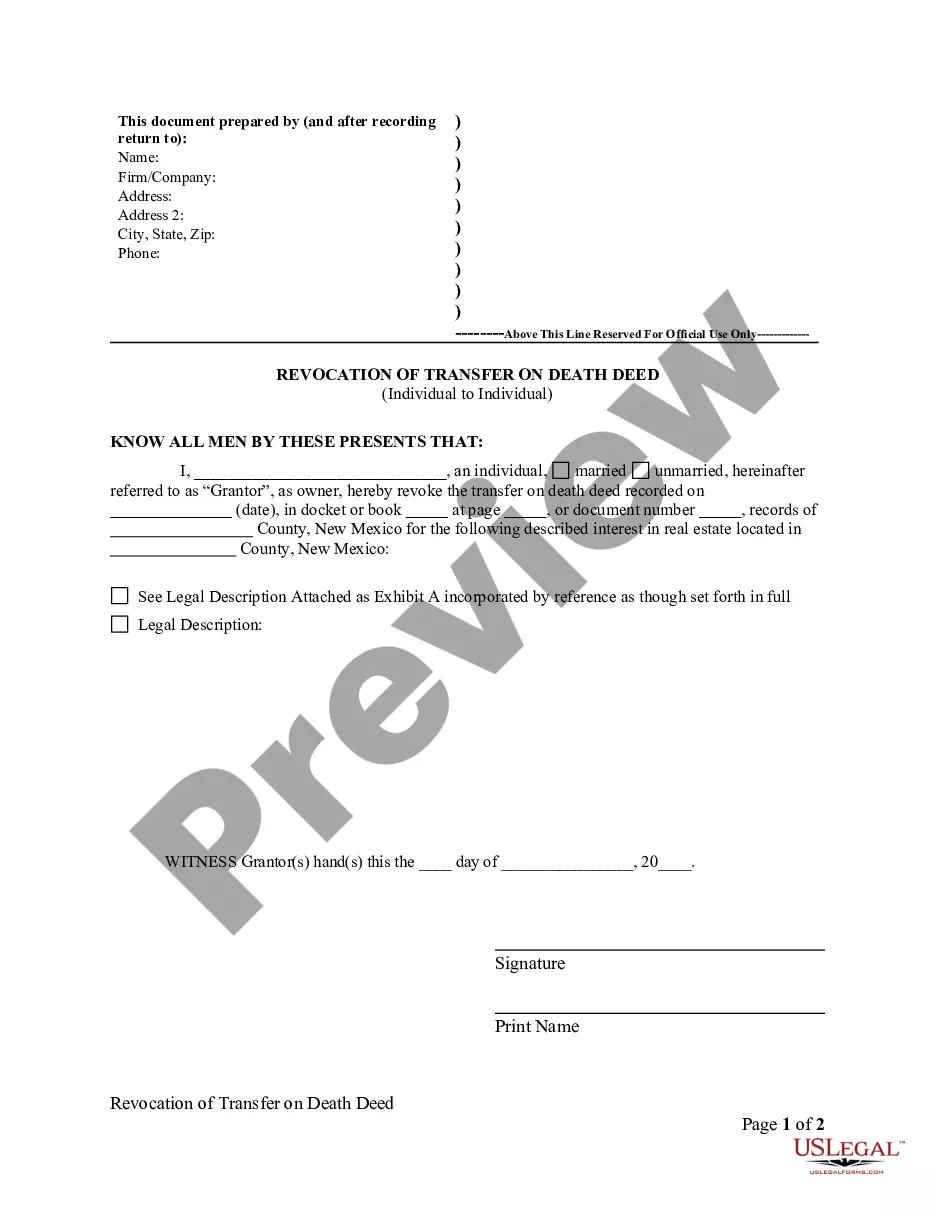

New Mexico Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

About this form

The Revocation of Transfer on Death Deed or TOD - Beneficiary Deed is a legal document used to cancel a previously executed transfer on death deed. This form allows the record owner to revoke the designation of a beneficiary for real property while they are still alive. Unlike a will, a properly executed transfer on death deed remains valid until revoked through this formal process, which does not require consent from the beneficiary.

Main sections of this form

- Identification of the record owner making the revocation.

- Description of the real property for which the deed is being revoked.

- Clear statement revoking the previous transfer on death designation.

- Signature of the record owner.

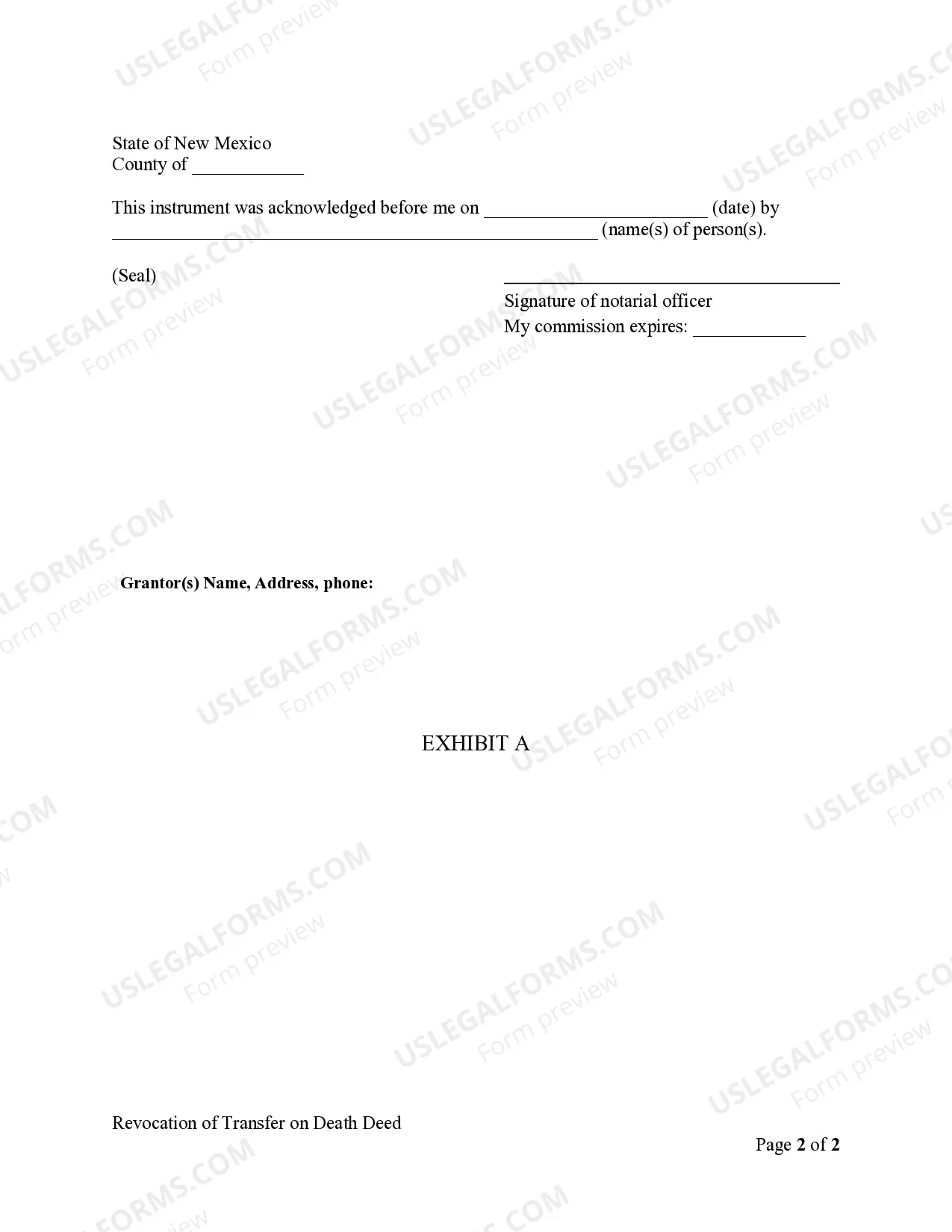

- Verification by acknowledging the deed before a notary public (if applicable).

- Recording information for submission to the county clerk's office.

When this form is needed

This form should be used when a record owner wishes to revoke a transfer on death deed they previously executed. Situations may include changes in personal relationships, decisions to alter beneficiaries, or a desire to revert back to individual ownership without a designated beneficiary.

Intended users of this form

- Individuals who have executed a transfer on death deed.

- Record owners looking to change their designated beneficiary.

- Those seeking to ensure their real property does not transfer upon their death.

Instructions for completing this form

- Identify yourself as the record owner and provide your contact information.

- Clearly describe the property you wish to revoke the transfer on death deed for, including address and legal description.

- Clearly state your intention to revoke the previous beneficiary designation.

- Sign and date the form in the presence of a notary public (if required).

- File the completed form with the county clerk's office where the property is located.

Does this form need to be notarized?

Yes, this form must be notarized to be legally valid. US Legal Forms offers integrated online notarization services, providing convenience and compliance through secure video calls that eliminate the need for in-person visits.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide a complete description of the property.

- Not signing the document in the presence of a notary, if required.

- Neglecting to file the revocation with the county clerkâs office.

- Not keeping a copy of the revocation for your records.

Benefits of completing this form online

- Convenient access to legal forms from anywhere.

- Forms can be easily customized to fit specific needs.

- Reliable templates drafted by licensed attorneys, ensuring legal compliance.

Quick recap

- The Revocation of Transfer on Death Deed allows you to cancel the designation of a beneficiary for your real property.

- Proper execution and recording of this form are essential for it to take effect.

- Consulting with a legal professional is advisable when making significant decisions regarding real property.

Looking for another form?

Form popularity

FAQ

Overall, New Mexico's statutory transfer on death deed is a flexible estate planning tool that allows owners of real property in the state to convey a potential future interest in real property to one or more beneficiaries.

You can contest that too, it turns out. The same legal principles that allow a will contest forgery, fraud, undue influence, for example also apply to changes in beneficiary designation.It's not unusual for someone to have a large portion of his or her assets in beneficiary designated accounts.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

200dA transfer-on-death account set up for your mutual funds or securities directs who receives the funds after your passing. A TOD designation supersedes a will.Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

Because transfer-on-death beneficiary deeds do not become effective until you pass away, someone can challenge the validity of the deed after you die.Or, beneficiaries and family members can sue each other to take the property entirely. In this case, a court proceeding may be required to resolve the issue.

A transfer on death (TOD) account will avoid probate because assets transfer automatically to a beneficiary when the owner dies.

The bottom line: you have the right to contest a TOD Deed, just as you can a Will or Trust, but in many cases that will be no easy task.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.