New Jersey Business Credit Application

Overview of this form

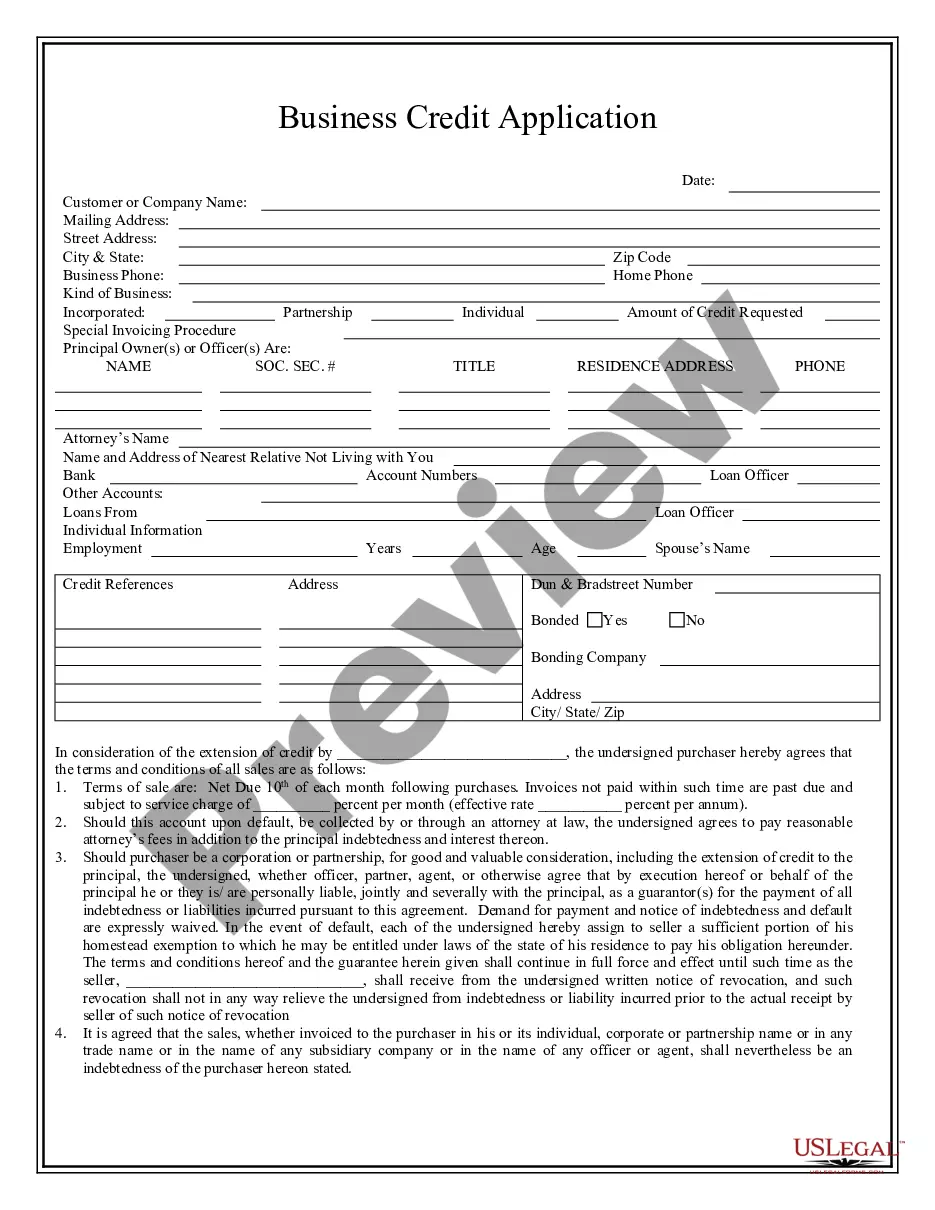

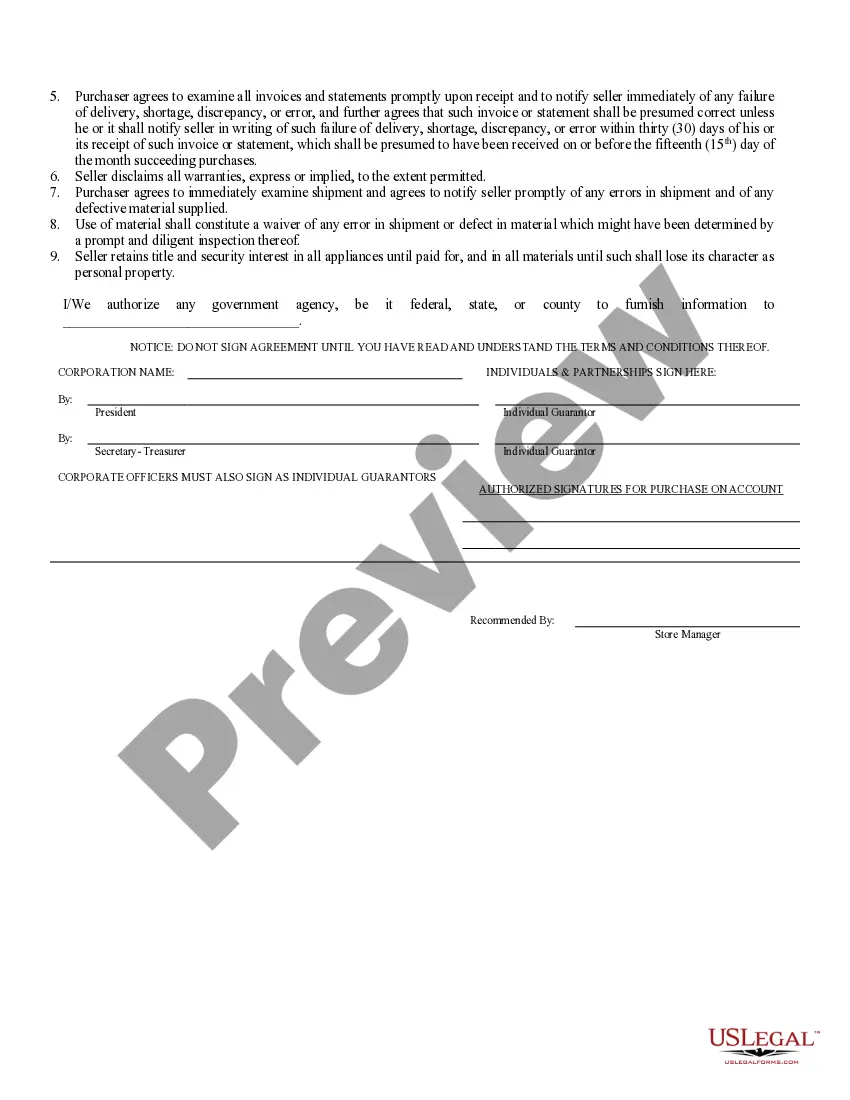

The Business Credit Application is a legal document used by individuals or businesses seeking to obtain credit for purchases. This form establishes the terms of credit, including payment conditions, interest on overdue amounts, and responsibilities in case of default. By clearly outlining the terms of sale and credit extension, it helps both purchasers and sellers understand their obligations and rights when engaging in credit transactions.

Main sections of this form

- Identification of the seller providing the credit.

- Payment terms specifying when payments are due and interest on late payments.

- Clauses detailing the responsibilities of the purchaser and possible default actions.

- Disclaimer of warranties by the seller concerning the goods sold.

- Retention of title clause ensuring the seller retains ownership until full payment is made.

When to use this document

This form should be used when a business or individual intends to request credit from a seller for purchasing goods or services. It is particularly useful in scenarios where payment is expected to occur after the sale, allowing the seller to protect their financial interests in the event of non-payment or default.

Who should use this form

- Business owners who need to offer credit to customers for purchases.

- Individuals seeking to establish a credit arrangement with a company.

- Corporations and partnerships looking for terms and conditions under which credit will be extended.

How to complete this form

- Identify and fill out the name of the seller issuing the credit.

- Specify the payment terms, including due dates and applicable interest rates.

- Complete the purchaser's details while noting any applicable corporate or partnership designations.

- Sign the agreement in the appropriate areas, ensuring all required parties are included.

- Review the document for accuracy and ensure you understand all the terms before submitting.

Notarization guidance

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to read the terms and conditions thoroughly before signing.

- Not specifying the interest rate or payment terms clearly.

- Overlooking the requirement for all necessary signatures, especially for corporate entities.

- Not notifying the seller of any discrepancies in invoices within the stipulated time frame.

Benefits of completing this form online

- Convenience of accessing and downloading the form anytime.

- Quick editing for customization according to specific business needs.

- Reliable templates drafted by licensed attorneys, ensuring legal validity.

Looking for another form?

Form popularity

FAQ

STEP 1: Name your New Jersey LLC. STEP 2: Choose a Registered Agent in New Jersey. STEP 3: File the New Jersey Certificate of Formation. STEP 4: Register your Business for Tax & Employer Purposes. STEP 5: Create a New Jersey LLC Operating Agreement. STEP 6: Get a New Jersey LLC EIN.

Choose a name for your business. Choose the right type of business entity. Register your business with the New Jersey Division of Revenue. Get your EIN Number (Federal Tax ID Number) Open a bank account and get a debit/credit card. Get a state business license.

If money's tight, or you don't want to use a company formation service, we've got good news for you you can form an LLC yourself. Although you'll still need to pay your state filing fees (they're unavoidable!), you can save on the costs of having your LLC filed through a professional incorporation business.

Name Your SMLLC. Complete the Public Records Filing. Prepare an Operating Agreement. Do You Need an EIN? Register With the Department of Revenue. Obtain Business Licenses. File Your Annual Report.

First, file a Certificate of formation/authorization. The fee is $125 for all for-profit entities and Foreign Non-Profit corporations. The fee is $75 for Domestic Non-Profit corporations. File your certificate online.

All companies doing business within the State of New Jersey must obtain a Business Registration Certificate from the New Jersey Treasury Department. It's easy to do online, or you may apply on paper via a NJ-REG form. Check zoning and decide on a location for your business before registering.

STEP 1: Name your New Jersey LLC. STEP 2: Choose a Registered Agent in New Jersey. STEP 3: File the New Jersey Certificate of Formation. STEP 4: Register your Business for Tax & Employer Purposes. STEP 5: Create a New Jersey LLC Operating Agreement. STEP 6: Get a New Jersey LLC EIN.

Forms and fees. LLC registrants are required to complete and submit a public records filing with the New Jersey Department of Treasury, Division of Revenue. There is a $125 filing fee that must be paid upon submission of the documents. The filing fee may be paid by check, money order, credit card or cash.