New Hampshire Last Will and Testament with All Property to Trust called a Pour Over Will

About this form

This Last Will and Testament, also known as a Pour Over Will, is a legal document that ensures any property not previously transferred to a living trust will be directed to that trust upon your death. This form is specifically designed for individuals who have established or are establishing a living trust, serving as a vital complement to your estate planning. Unlike a standard will, this form facilitates the transfer of assets into a trust, effectively allowing for streamlined management of your estate according to your wishes.

What’s included in this form

- Conveyance to Trust: Details the transfer of all assets to the living trust.

- Debts and Expenses: Outlines who is responsible for paying debts and expenses following your death.

- Guardian of Minor Children: Designates guardianship for minor children, if applicable.

- Appointment of Personal Representative: Names an executor responsible for managing your estate.

- Powers of Personal Representative: Grants authority to the personal representative to administer your estate according to your trust's provisions.

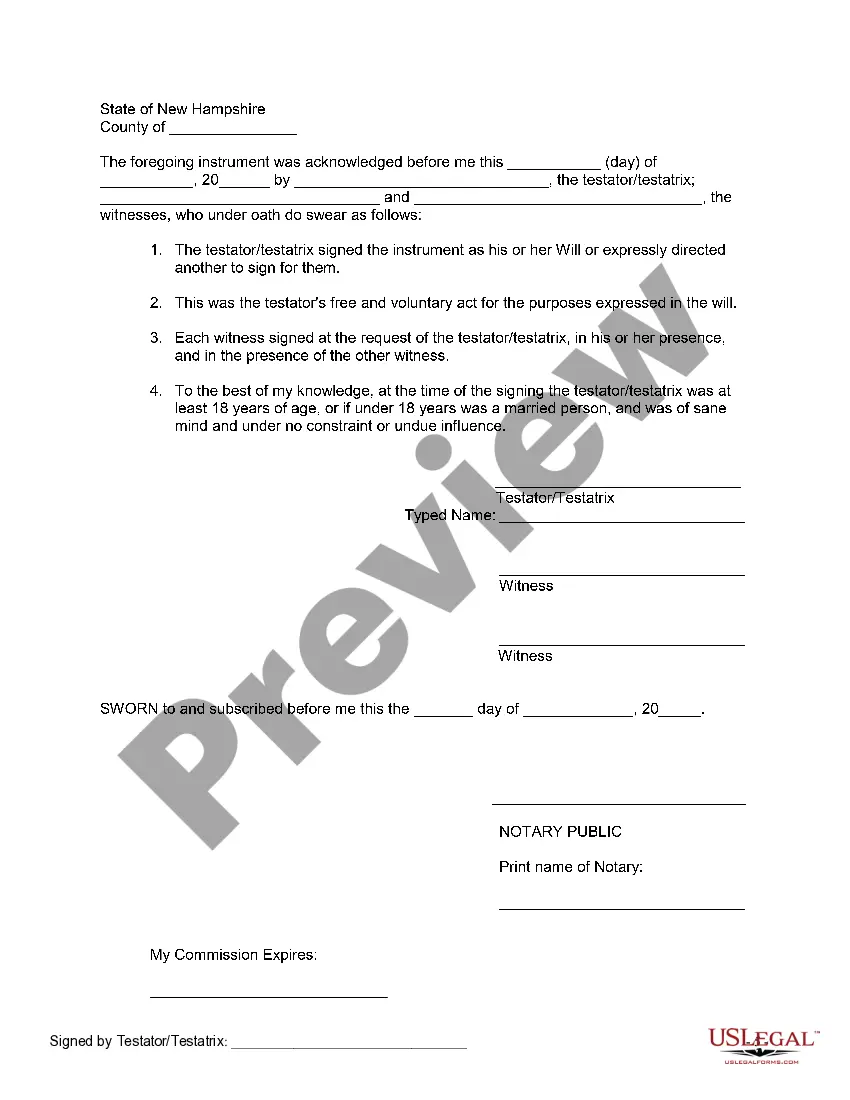

- Signature and Witness Requirements: Specifies the need for signatures and witnessing to validate the will.

State-specific requirements

This form is specifically designed for use in the state of New Hampshire, following state laws governing wills and trusts. It's important to ensure that this document meets New Hampshire's legal requirements for it to be valid.

Situations where this form applies

This form is ideal for anyone who has established or wants to establish a living trust and wants to ensure that any assets not already included in the trust are directed to it upon their death. It is particularly useful for individuals who anticipate that some of their possessions may not have been transferred to the trust before their passing, ensuring all assets are managed according to their estate planning wishes.

Intended users of this form

- Individuals who have established a living trust.

- People seeking to ensure complete control over their assets after death.

- Those who want to appoint guardians for minor children.

- Anyone wanting to assign an executor to manage their estate.

- Individuals planning for a smooth transfer of their estate according to their wishes.

Steps to complete this form

- Identify the parties involved, including yourself as the testator and any personal representative.

- Specify the property that will be transferred to your living trust.

- Assign a guardian for any minor children, if applicable.

- Complete the section appointing your personal representative or executor.

- Sign the will in the presence of two witnesses, and ensure they do the same to validate the document.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Failing to transfer all assets to the living trust before death.

- Not updating the will after significant life changes, such as marriage or divorce.

- Not having the will properly signed and witnessed according to state laws.

- Ignoring the inclusion of contingent beneficiaries in case the primary ones are unable to inherit.

Advantages of online completion

- Convenient editing capabilities allow personalized instructions to be easily inputted.

- Instant access to legal forms without the need for in-person visits to legal offices.

- Forms can be completed at your own pace and saved for later use.

- Reduces the risk of errors by providing clear guidance through the completion process.

Form popularity

FAQ

In most situations, a will template is an easy and inexpensive way to make sure your wishes are known and carried out. Most people can get everything they need by using a will template, with little cost or hassle.

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

In New Hampshire, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

The Free Last Will and Testament Template for Word is compatible with Word 2003 or later versions.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

A handwritten or typed will can be created at no cost. Many online services set a price at less than $100 for a will. Most estate planners charge more than your average do-it-yourself service, Farrell says. For help with a will, an attorney will likely charge several hundred dollars or more.

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

A TOD account skips the probate process and takes precedence over a will. If you will all of your money and property to your children, but have a TOD account naming your brother the beneficiary, he will receive what's in the account and your children will get everything else.