Nebraska Sample Transmittal Letter for Articles of Incorporation

Understanding this form

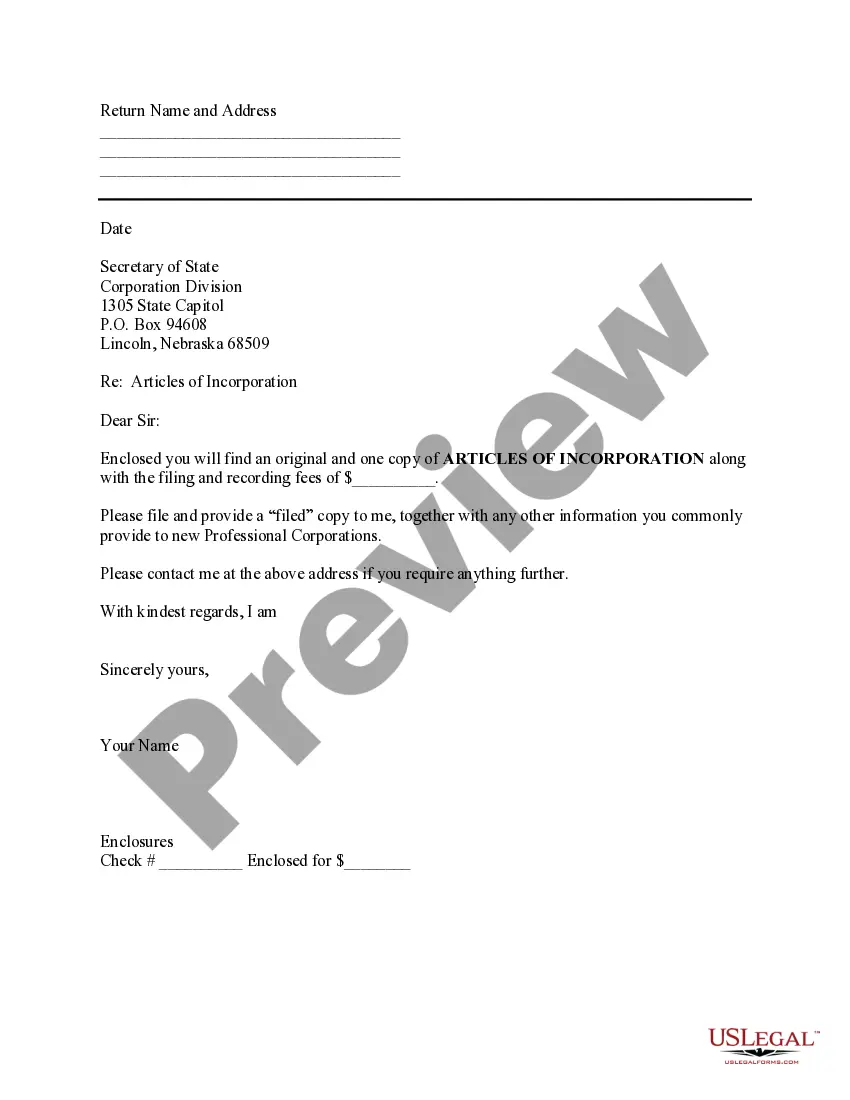

This Sample Transmittal Letter for Articles of Incorporation is a document used to accompany the Articles of Incorporation when filing with the Secretary of State. It provides a formal means of communication to ensure that the articles are processed correctly and any associated fees are acknowledged. This form is distinct from the Articles of Incorporation itself, which outlines the foundational details of the corporation.

Form components explained

- Date of the letter.

- Recipient information, including the Secretary of State's Corporation Division address.

- Reference to the Articles of Incorporation.

- Enclosed documents and filing fees information.

- Your name and signature.

When this form is needed

This form should be used when submitting Articles of Incorporation to establish a new corporation in the state. It is essential for providing a clear, formal introduction to the filing, ensuring that the administrative office has all necessary information for processing the incorporation.

Who needs this form

- Business owners looking to incorporate their company.

- Legal representatives or attorneys submitting incorporation documents on behalf of clients.

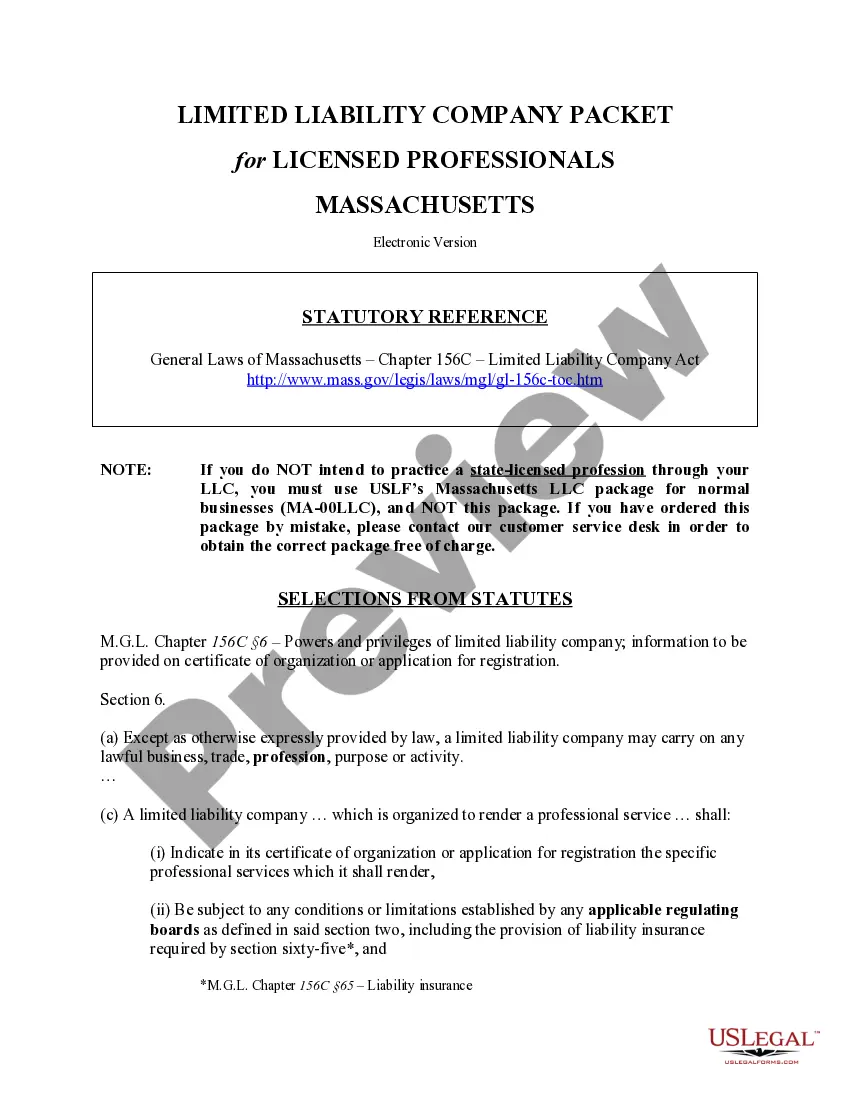

- Corporations forming as a Professional Corporation that require specific state filings.

How to complete this form

- Insert the current date at the top of the letter.

- Fill in the name and address of the Secretary of State Corporation Division.

- Indicate that you are submitting the Articles of Incorporation and provide a brief description.

- Specify the amount of filing and recording fees enclosed with the letter.

- Sign the letter and include your printed name below the signature.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Forgetting to include the proper filing fees.

- Not addressing the letter correctly to the Secretary of State.

- Omitting a signature or printed name.

Advantages of online completion

- Convenient download and editing capabilities to tailor the document to your needs.

- Access to reliable templates reviewed by licensed attorneys.

- Quick and easy submission process, reducing the time spent on paperwork.

Looking for another form?

Form popularity

FAQ

Depending on the type of license you are applying for, the state license can be any where from $10- $100.

All businesses in the Cornhusker state must apply for and receive a business license before they can open and legally operate in Nebraska. Depending on the type of business you wish to run, you may need county and local licenses in addition to federal and state licenses.

Minimum number. Corporations must have one or more directors. Residence requirements. Nebraska does not have a provision specifying where directors must reside. Age requirements. Inclusion in the Articles of Incorporation.

Name Your Nebraska LLC. Choose Your Registered Agent. Prepare and File Certificate of Organization. File an Affidavit of Publication. Receive a Certificate From the State. Create an Operating Agreement. Get an Employer Identification Number.

How much does it cost to form an LLC in Nebraska? The Nebraska Secretary of State charges $100 to file the Certificate of Organization, plus $5 per page. You can reserve your LLC name with the Nebraska Secretary of State for $15.

To form a Nebraska LLC, the Certificate of Organization needs to be filed with the Nebraska Secretary of State. The state filing fee is between $105 and $107, depending on how you file.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

How much does it cost to form an LLC in Nebraska? The Nebraska Secretary of State charges $100 to file the Certificate of Organization, plus $5 per page. You can reserve your LLC name with the Nebraska Secretary of State for $15.

Step 1: Register Business Name. Nebraska Secretary of State (402-471-4079) Step 2: Get Tax Identification Number. Internal Revenue Service (1-800-829-4933) Step 3: Register Business. Nebraska Department of Revenue (1-800-742-7474) Step 4: Determine Needed Insurance.

Step 1: Register Business Name. Nebraska Secretary of State (402-471-4079) Step 2: Get Tax Identification Number. Internal Revenue Service (1-800-829-4933) Step 3: Register Business. Nebraska Department of Revenue (1-800-742-7474) Step 4: Determine Needed Insurance.