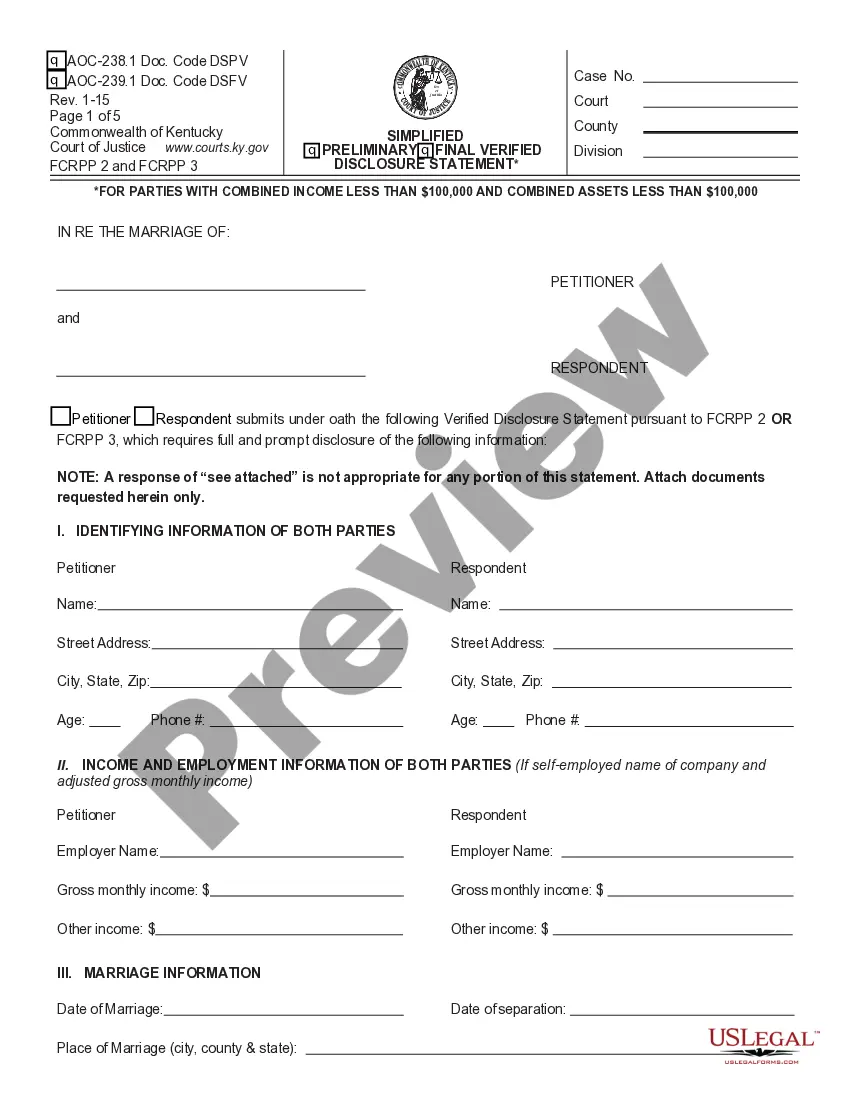

This Notice of Assignment is for use by a corporate lien claimant to provide notice to an owner that the lien claimant assigned the lien claimant's claim and lien which was recorded on a certain date for labor, materials, or laborers furnished for the purpose of improvements of real property to a specified individual.

North Carolina Notice of Assignment - Corporation

Description

How to fill out North Carolina Notice Of Assignment - Corporation?

Steer clear of expensive attorneys and discover the North Carolina Notice of Assignment - Corporation or LLC you desire at a reasonable cost on the US Legal Forms website.

Utilize our easy grouping feature to search for and retrieve legal and tax documents. Review their details and preview them before downloading.

Select to download the form in PDF or DOCX format. Click on Download and locate your template in the My documents section. You can save the template to your device or print it out. After downloading, you may complete the North Carolina Notice of Assignment - Corporation or LLC by hand or using editing software. Print it and reuse the form multiple times. Achieve more for less with US Legal Forms!

- Additionally, US Legal Forms offers subscribers step-by-step instructions on how to obtain and complete each document.

- US Legal Forms members simply need to Log In and access the specific file they require in their My documents section.

- Those who do not have a subscription yet should follow the instructions below.

- Verify that the North Carolina Notice of Assignment - Corporation or LLC is suitable for use in your state.

- If available, review the details and use the Preview feature before downloading the templates.

- If you are confident the document is correct for you, click Buy Now.

- If the template is incorrect, use the search bar to find the appropriate one.

- Next, create your account and choose a subscription plan.

- Make payment via credit card or PayPal.

Form popularity

FAQ

Key takeaway: Having your LLC taxed as an S corporation can save you money on self-employment taxes. However, you will have to file an individual S-corp tax return, which means paying your CPA to file an additional form. An S-corp is also less structurally flexible than an LLC.

The LLC Organizer is the individual or entity that files the Articles of Organization (referred to as a Certificate of Formation in some states) on behalf of a Limited Liability Company.A member is defined as an owner of the LLC, and an organizer merely facilitates the technical formation of the LLC.

Key takeaway: Having your LLC taxed as an S corporation can save you money on self-employment taxes. However, you will have to file an individual S-corp tax return, which means paying your CPA to file an additional form. An S-corp is also less structurally flexible than an LLC.

The State of North Carolina requires you to file an annual report for your LLC.The annual report must be filed each year by April 15 except that new LLCs don't need to file a report until the first year after they're created. The filing fee is $200.

You can file your North Carolina LLC Articles of Organization by mail or online. The filing fee is $125 for both methods. If you form your LLC by mail, it will be approved in 10-15 days (this accounts for mail time). If you form your LLC online, it will be approved in 7-10 business days.

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

S Corps have more advantageous self-employment taxes than LLC's. S Corp owners can be considered employees and paid a reasonable salary. FICA taxes are taken out and paid on the amount of the salary.

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

The articles of organization document typically includes the name of the LLC, the type of legal structure (e.g. limited liability company, professional limited liability company, series LLC), the registered agent, whether the LLC is managed by members or managers, the effective date, the duration (perpetual by default