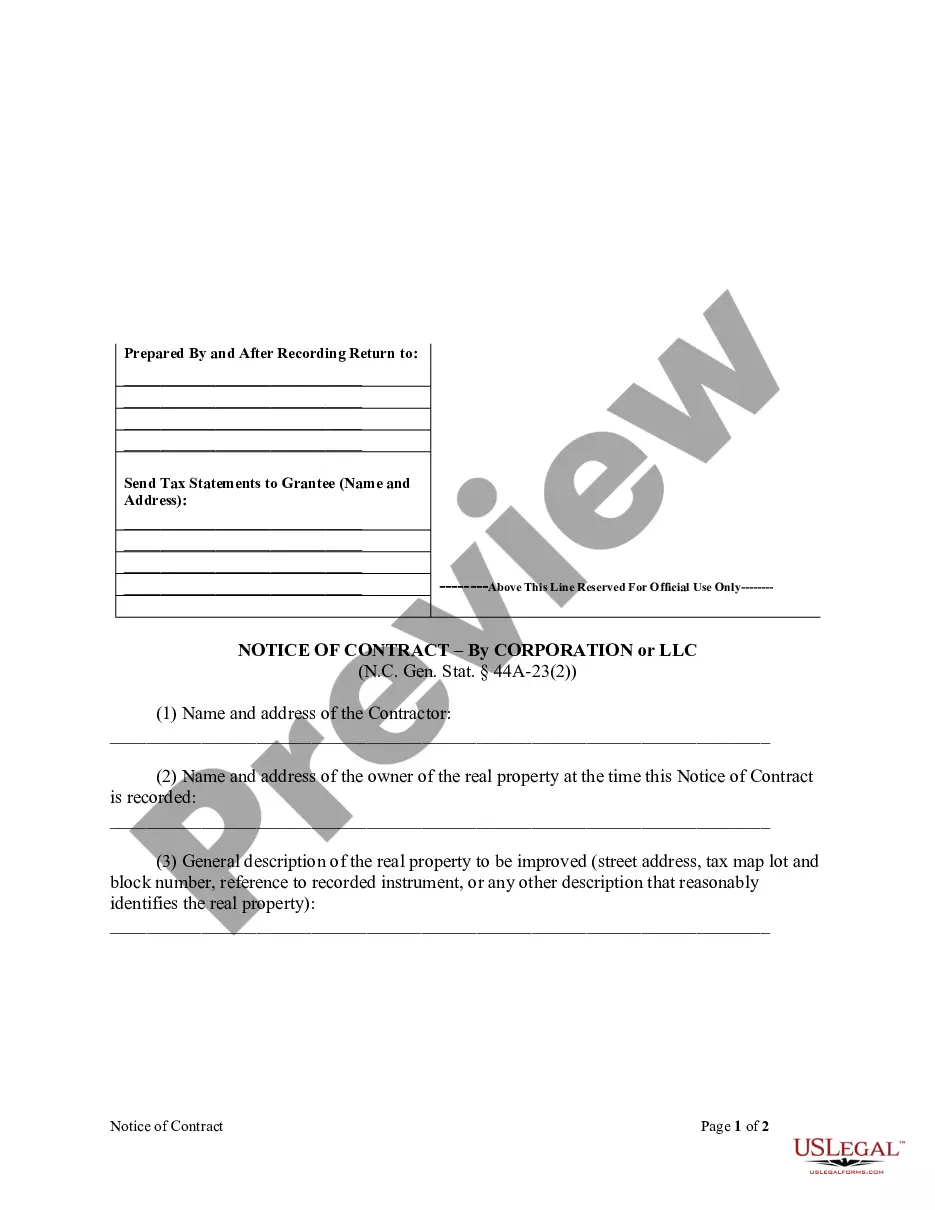

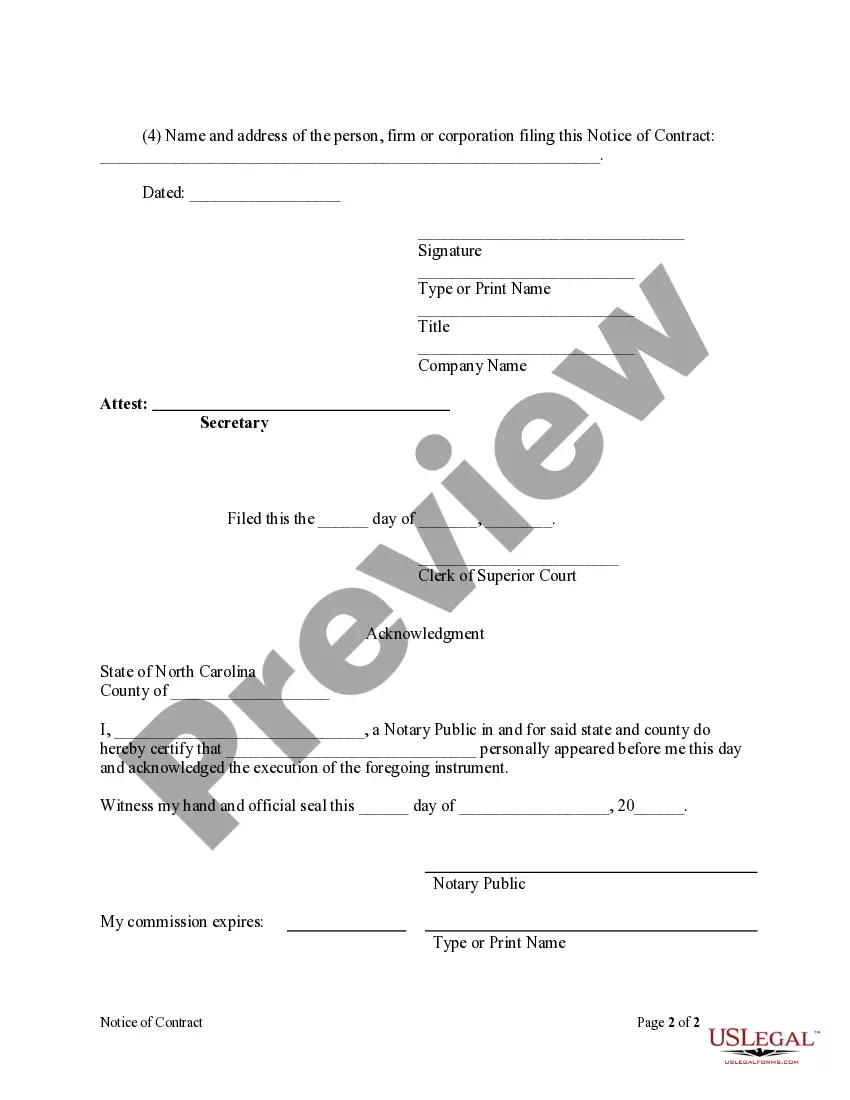

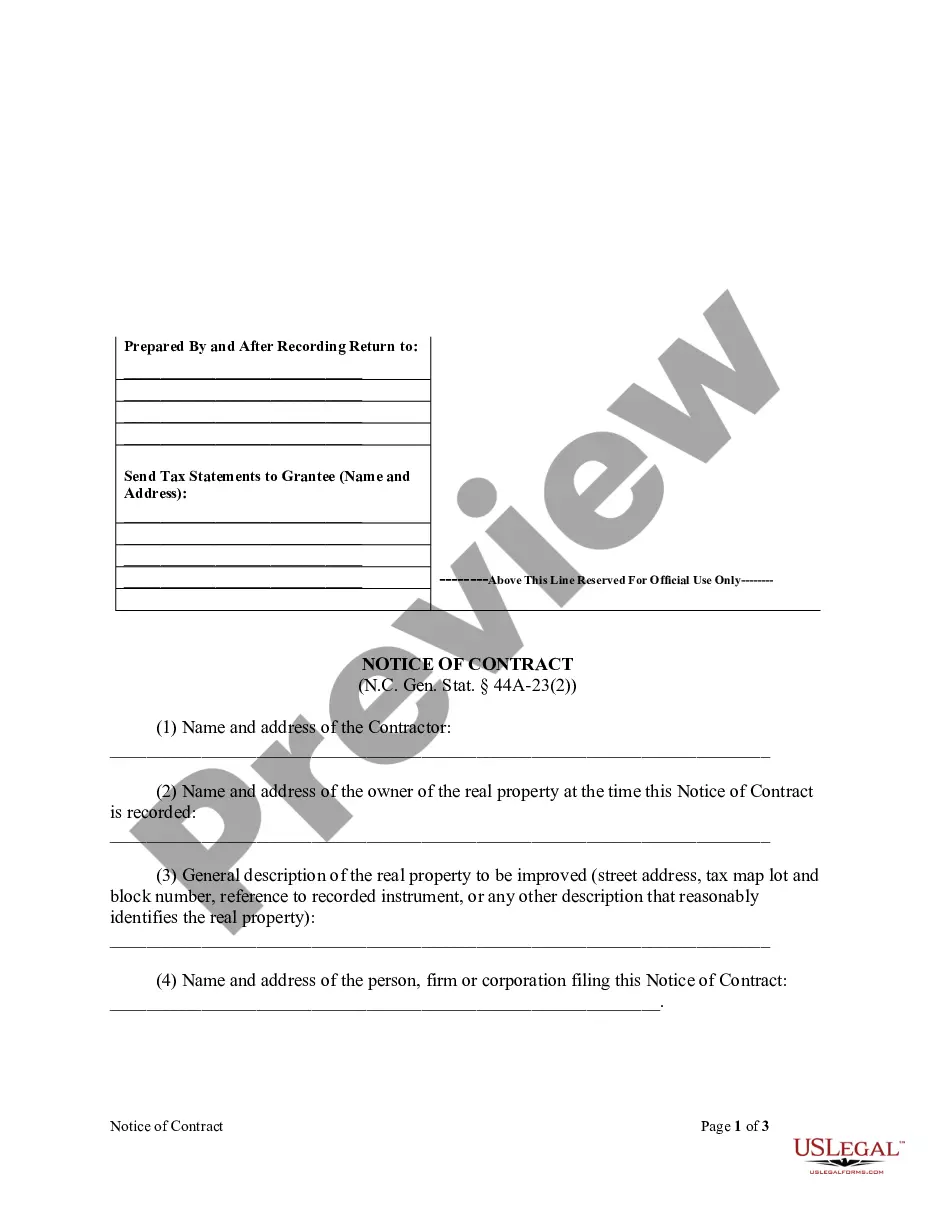

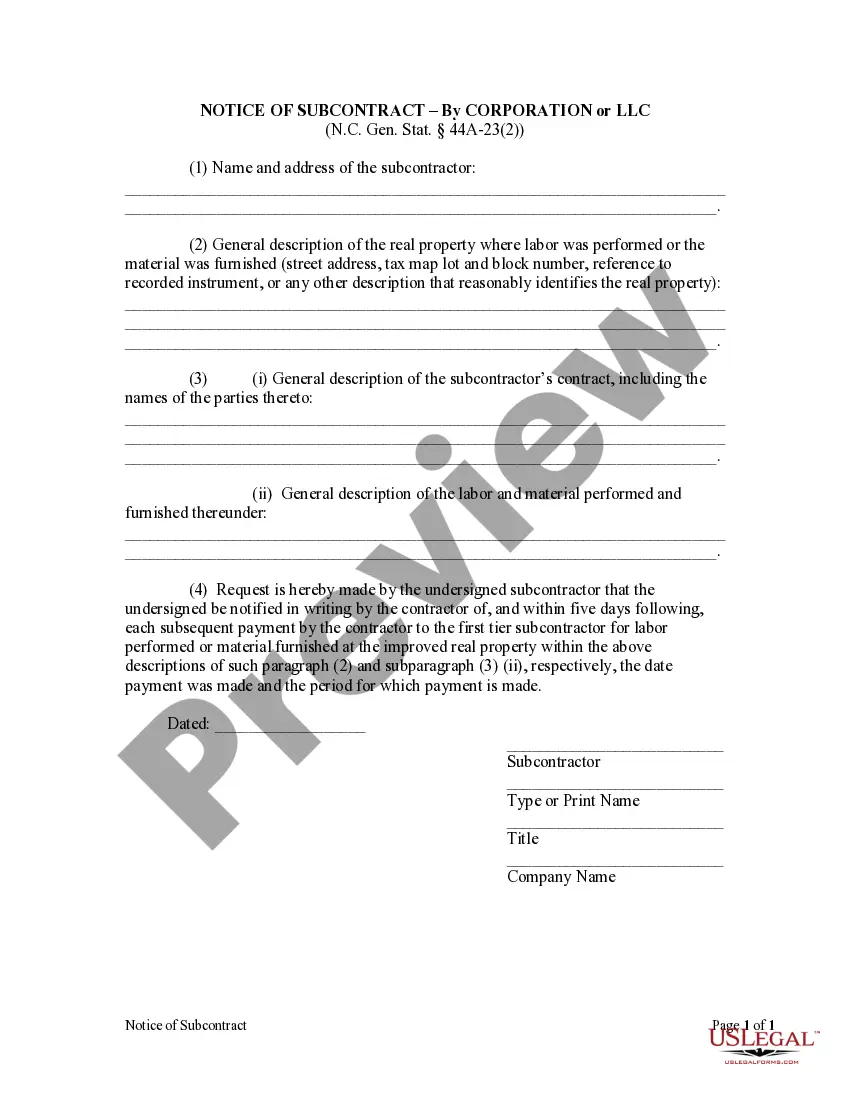

A second or third tier subcontractor is barred from enforcing a lien when a contractor, within thirty (30) days following the date the building permit is issued, posts on the property and files in the office of the Clerk of the Superior Court a completed and signed Notice of Contract form.

North Carolina Notice of Contract - Corporation

Description

How to fill out North Carolina Notice Of Contract - Corporation?

Avoid pricey attorneys and find the North Carolina Notice of Contract - Corporation or LLC you want at a reasonable price on the US Legal Forms site. Use our simple categories functionality to find and obtain legal and tax documents. Go through their descriptions and preview them before downloading. In addition, US Legal Forms enables customers with step-by-step instructions on how to download and complete each and every form.

US Legal Forms subscribers basically need to log in and download the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the guidelines below:

- Make sure the North Carolina Notice of Contract - Corporation or LLC is eligible for use in your state.

- If available, look through the description and use the Preview option before downloading the templates.

- If you are sure the document suits you, click on Buy Now.

- If the form is wrong, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you are able to complete the North Carolina Notice of Contract - Corporation or LLC by hand or with the help of an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

The LLC Organizer is the individual or entity that files the Articles of Organization (referred to as a Certificate of Formation in some states) on behalf of a Limited Liability Company.A member is defined as an owner of the LLC, and an organizer merely facilitates the technical formation of the LLC.

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

The articles of organization document typically includes the name of the LLC, the type of legal structure (e.g. limited liability company, professional limited liability company, series LLC), the registered agent, whether the LLC is managed by members or managers, the effective date, the duration (perpetual by default

Is an S Corp or LLC better? That is a bit of a misguided question. An LLC is a legal entity only and must choose to pay tax either as an S Corp, C Corp, Partnership, or Sole Proprietorship. Therefore, for tax purposes, an LLC can be an S Corp, so there is really no difference.