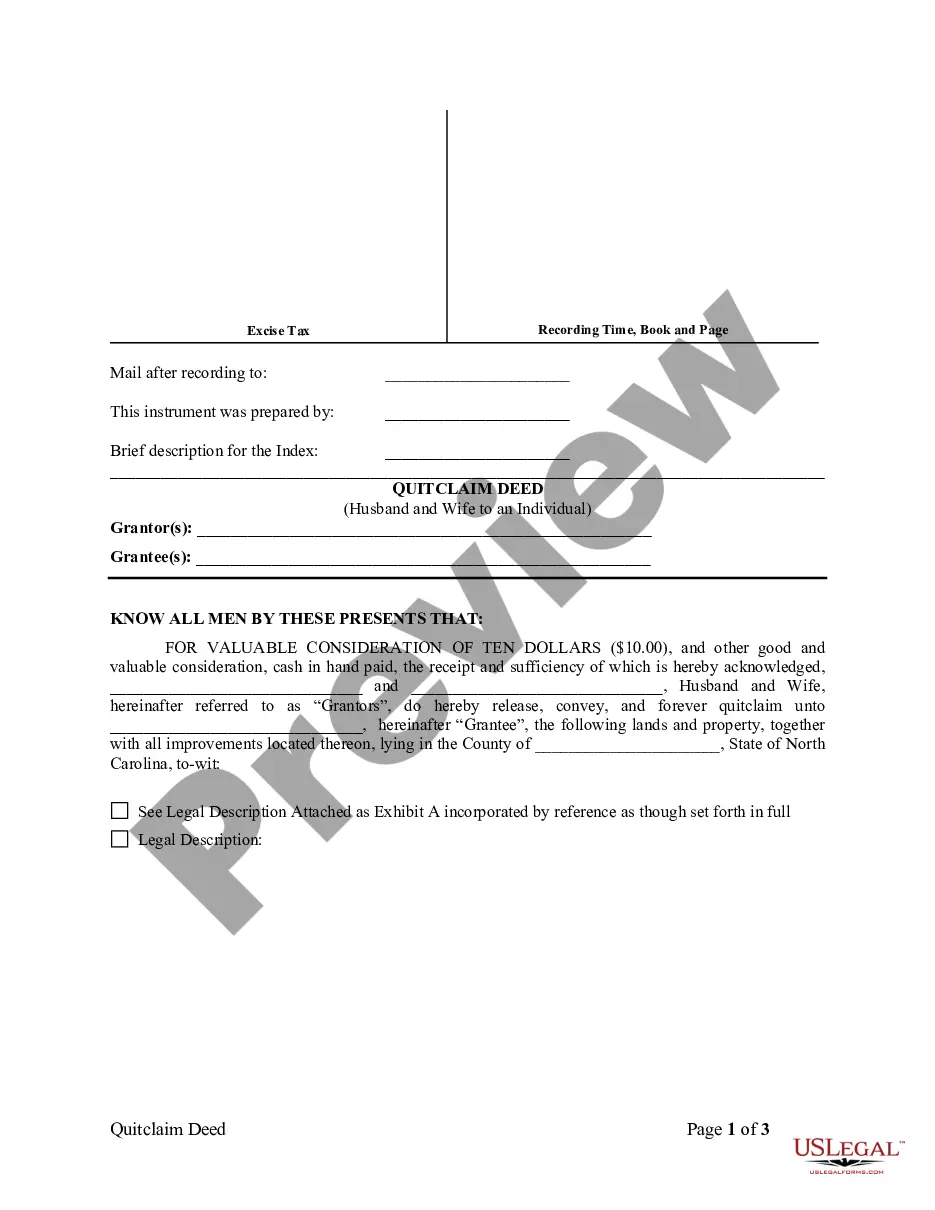

North Carolina Quitclaim Deed from Husband and Wife to an Individual

Description

How to fill out North Carolina Quitclaim Deed From Husband And Wife To An Individual?

Steer clear of pricey lawyers and locate the North Carolina Quitclaim Deed from Husband and Wife to an Individual you require at an affordable price on the US Legal Forms site.

Utilize our easy grouping feature to search for and download legal and tax documents. Review their descriptions and preview them prior to downloading. Moreover, US Legal Forms provides clients with step-by-step guidance on how to acquire and fill out each form.

Just click Download and locate your template in the My documents section. You are welcome to save the template to your device or print it out. After downloading, you can fill out the North Carolina Quitclaim Deed from Husband and Wife to an Individual manually or with editing software. Print it and reuse the form multiple times. Achieve more for less with US Legal Forms!

- US Legal Forms members simply need to Log In and retrieve the specific document they require from their My documents section.

- Those who have not yet subscribed should adhere to the following instructions.

- Verify that the North Carolina Quitclaim Deed from Husband and Wife to an Individual is permissible for use in your state.

- If accessible, read the description and utilize the Preview feature before downloading the document.

- If you are certain the template meets your requirements, click Buy Now.

- If the form is incorrect, use the search tool to locate the appropriate one.

- Next, create your account and choose a subscription plan.

- Pay using a card or PayPal.

- Select to download the form in PDF or DOCX.

Form popularity

FAQ

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances.If a mortgage exists, it's best to work with the lender to make sure everyone on the title is protected.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

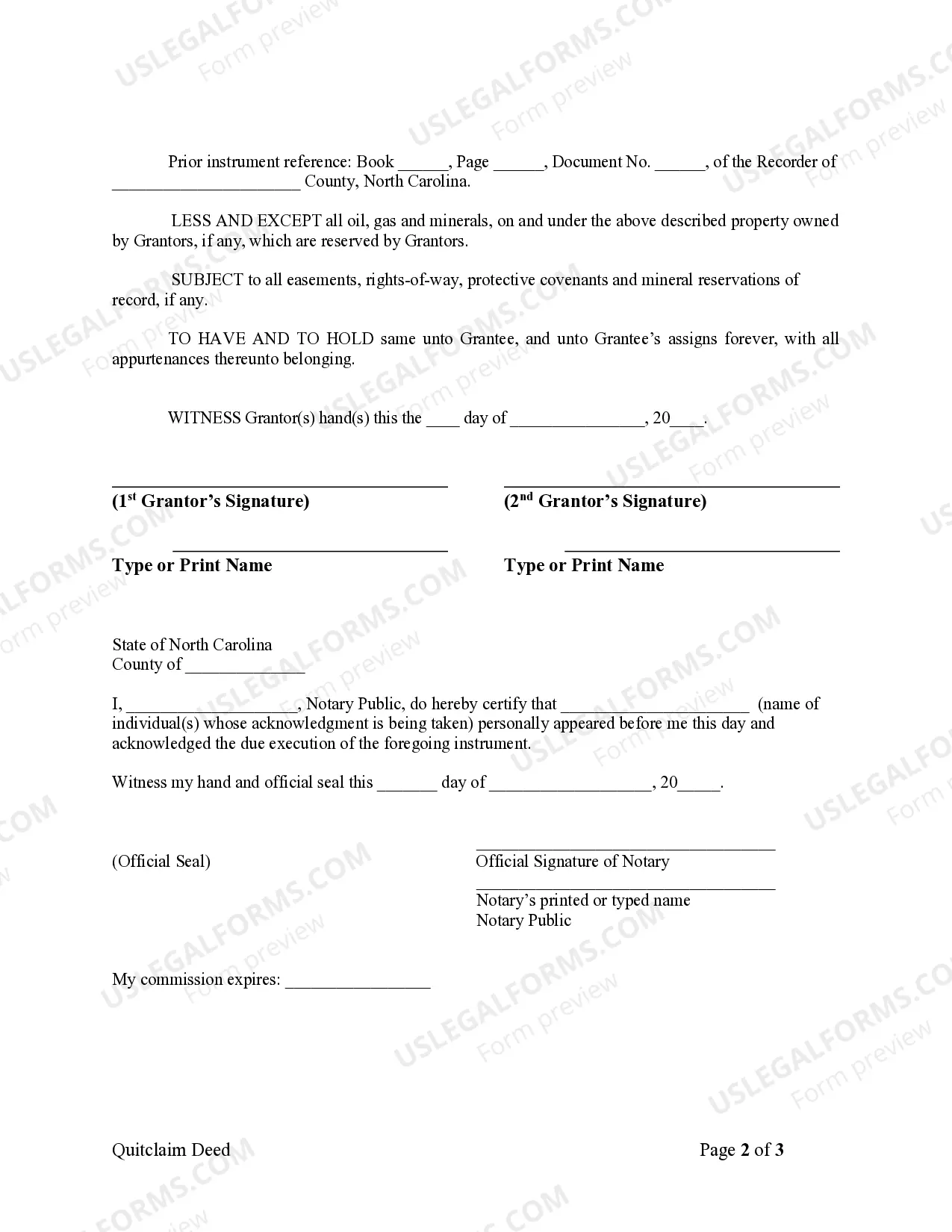

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

No law forbids adding someone to your mortgaged home's deed or in signing your home over to others through one. Mortgage lenders understand deeds, though, and use loan due-on-sale clauses to prevent unauthorized property sales or transfers.

One of the simplest ways to add your wife to the home title is by using an interspousal deed. You can transfer the property from your sole and separate property to mutual tenancy, such as joint tenants with right of survivorship, with your wife.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

You usually do this by filing a quitclaim deed, in which your ex-spouse gives up all rights to the property. Your ex should sign the quitclaim deed in front of a notary. One this document is notarized, you file it with the county. This publicly removes the former partner's name from the property deed and the mortgage.