Mississippi UCC3 Financing Statement

Description

How to fill out Mississippi UCC3 Financing Statement?

Acquire a printable Mississippi UCC3 Financing Statement in just a few clicks in the most extensive collection of legal electronic files.

Discover, download, and print professionally prepared and certified samples on the US Legal Forms platform.

After downloading your Mississippi UCC3 Financing Statement, you can complete it in any online editor or print it out and fill it out by hand. Use US Legal Forms to access 85,000 professionally drafted, state-specific documents.

- US Legal Forms has been the premier provider of affordable legal and tax documents for US citizens and residents online since 1997.

- Clients who already possess a subscription need to Log In to their US Legal Forms account to find the Mississippi UCC3 Financing Statement stored in the My documents section.

- Users without a subscription must follow the steps outlined below.

- Ensure that your form complies with your state's regulations.

- If available, check the form's description for additional information.

- If provided, examine the form to access more details.

- Once you are certain that the template fulfills your needs, click Buy Now.

- Create a personal account.

- Select a plan.

- Make a payment via PayPal or credit card.

- Download the form in Word or PDF format.

Form popularity

FAQ

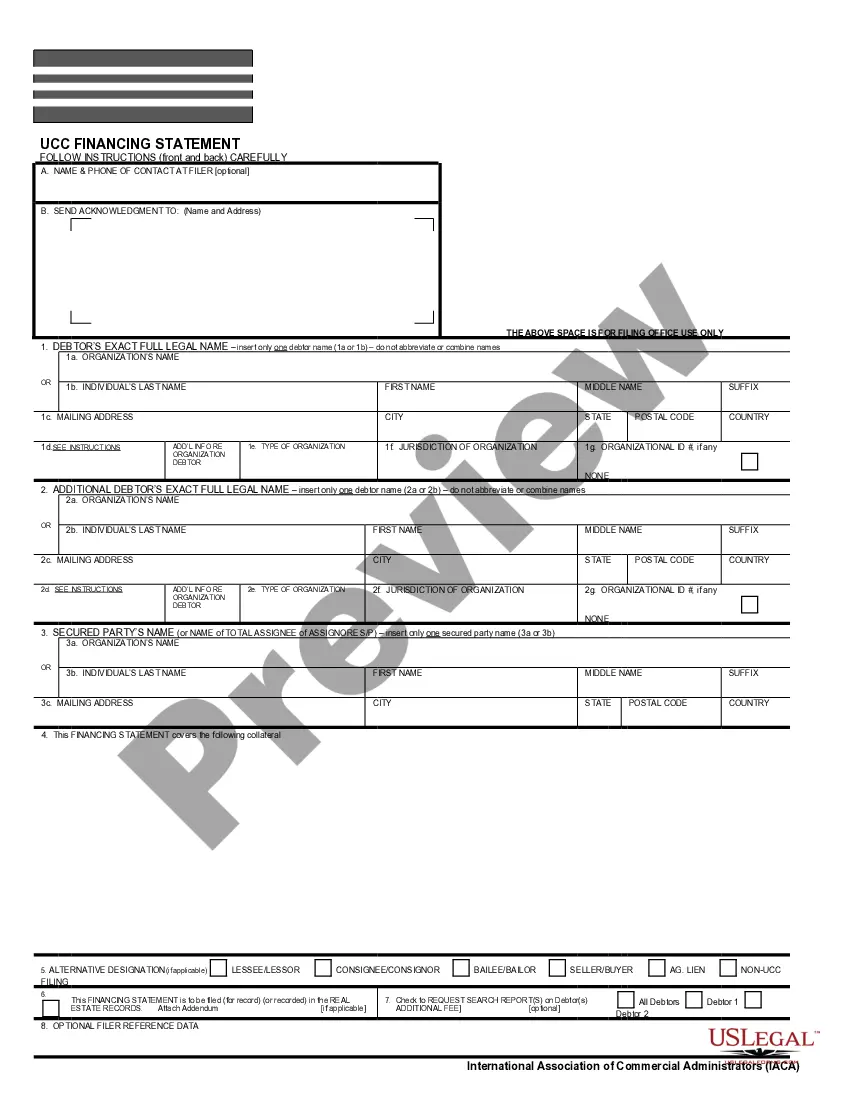

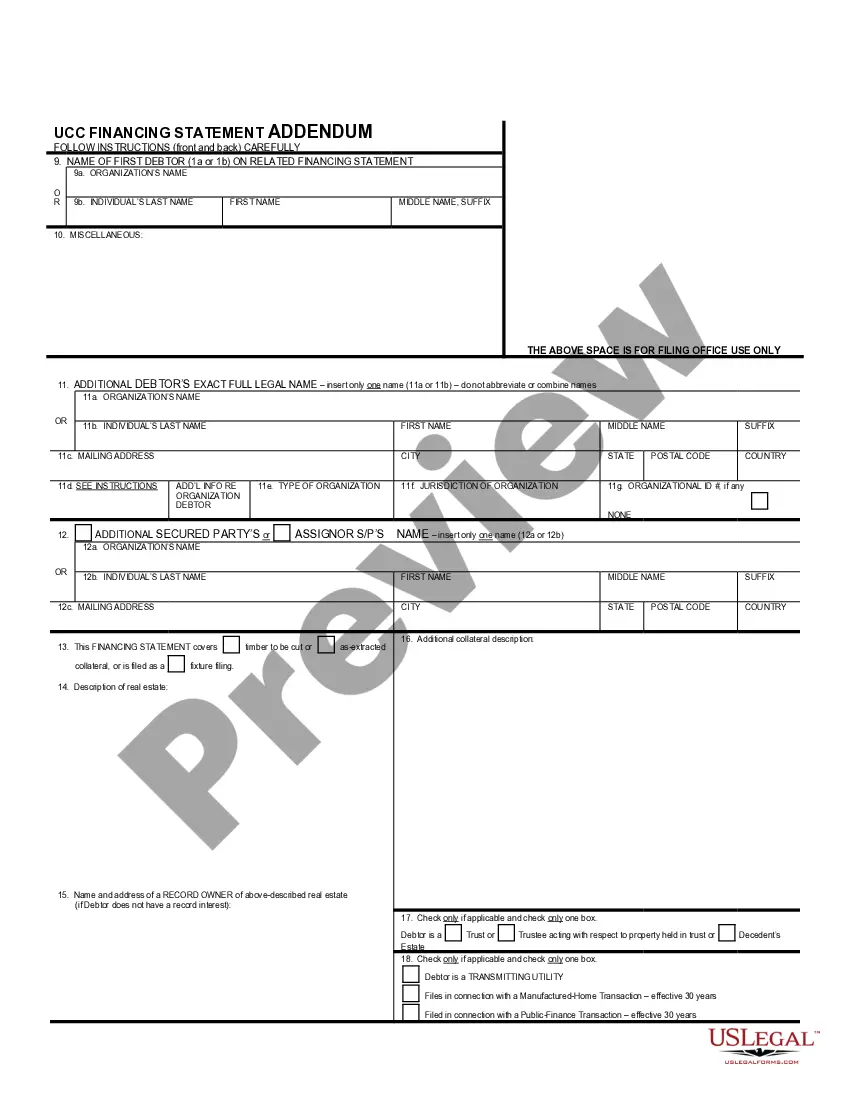

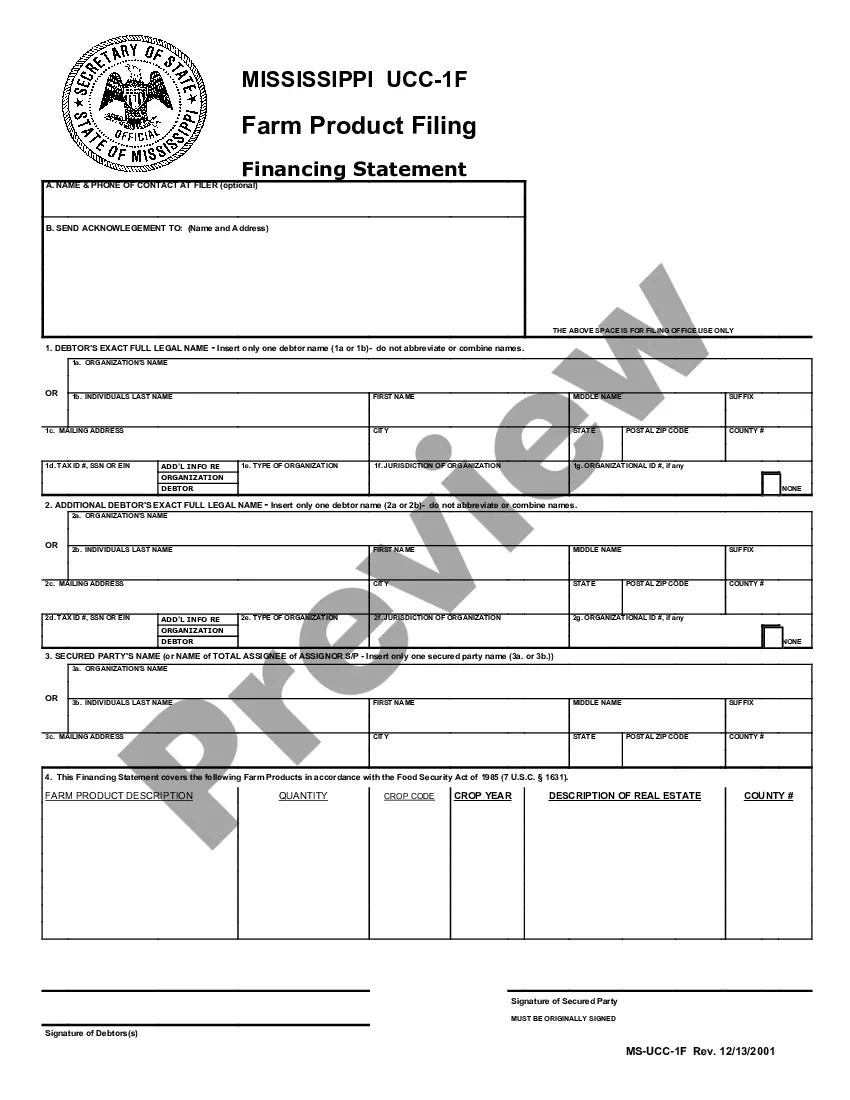

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

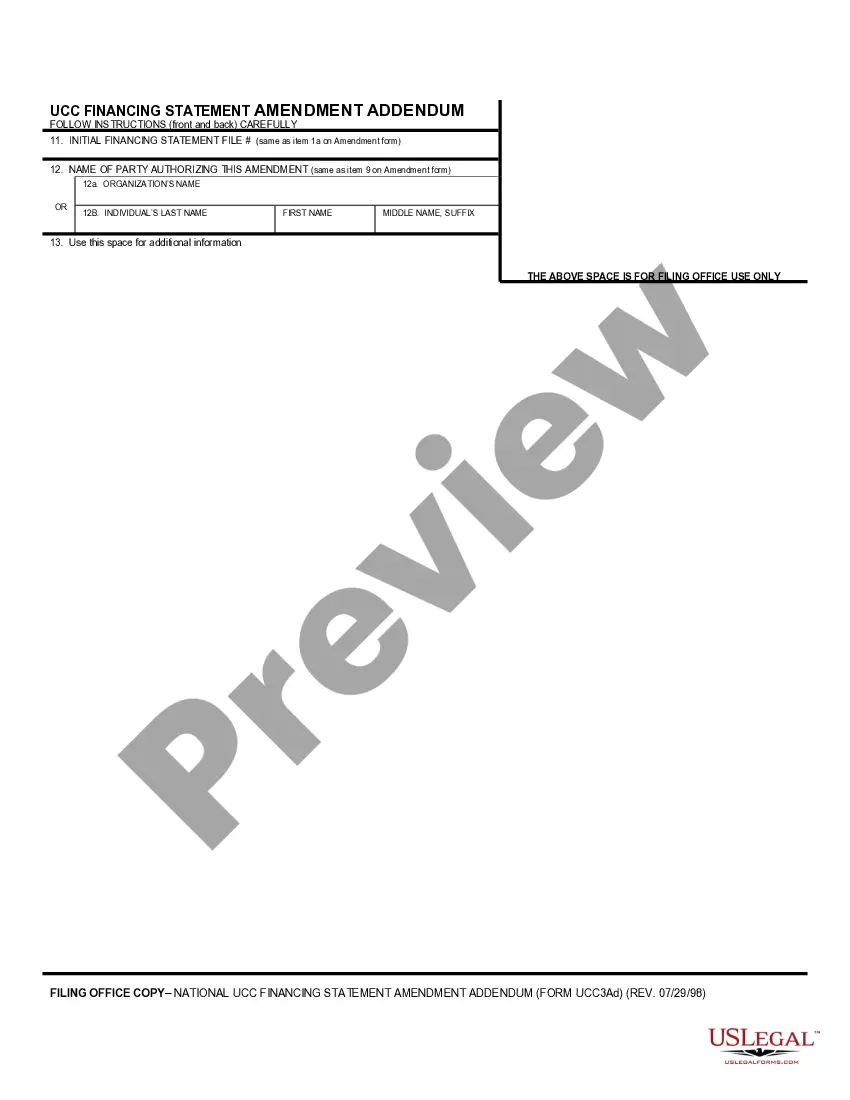

A UCC 3 form, also known as a Financing Statement Amendment, is a document tracking changes to the UCC 1 such as the termination, the continuation, and the transfer of the Financing Statement. Other amendments are also filed, such as amending the names of the two parties or amending the collateral.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

Why file a UCC-3 form? The UCC-3 is the Swiss-Army-Knife of forms. Unlike a UCC 1, a UCC 3 can be used for multiple purposes. The actions one can take are Amendment, Assignment, Continuation, and Termination.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

The financing statement describes the types of collateral or personal property that is pledged against the value of the loan, and it identifies the parties that have an interest or stake in the collateral if the debtor defaults.

A UCC filing is a legal notice a lender files with the secretary of state when they have a security interest against one of your assets. It gives notice that the lender has an interest, or lien, against the asset being used by you to secure the financing. The term UCC filing comes from the uniform commercial code.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).