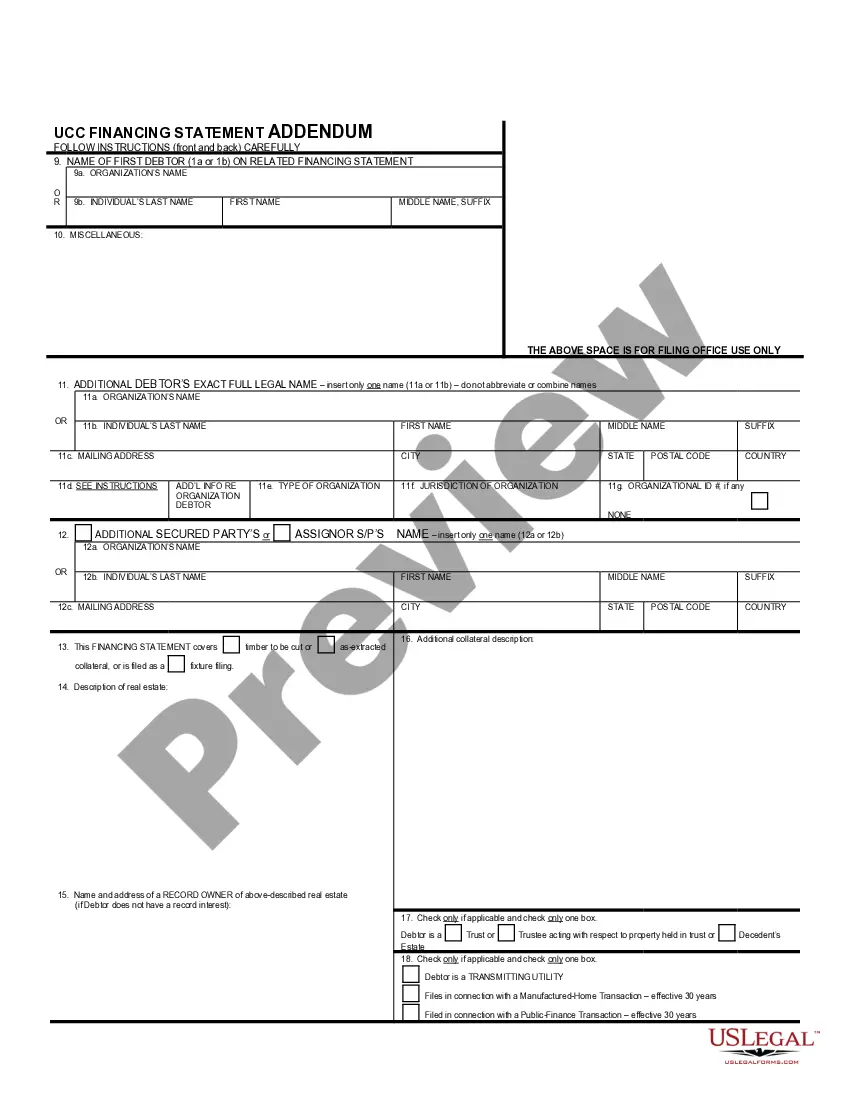

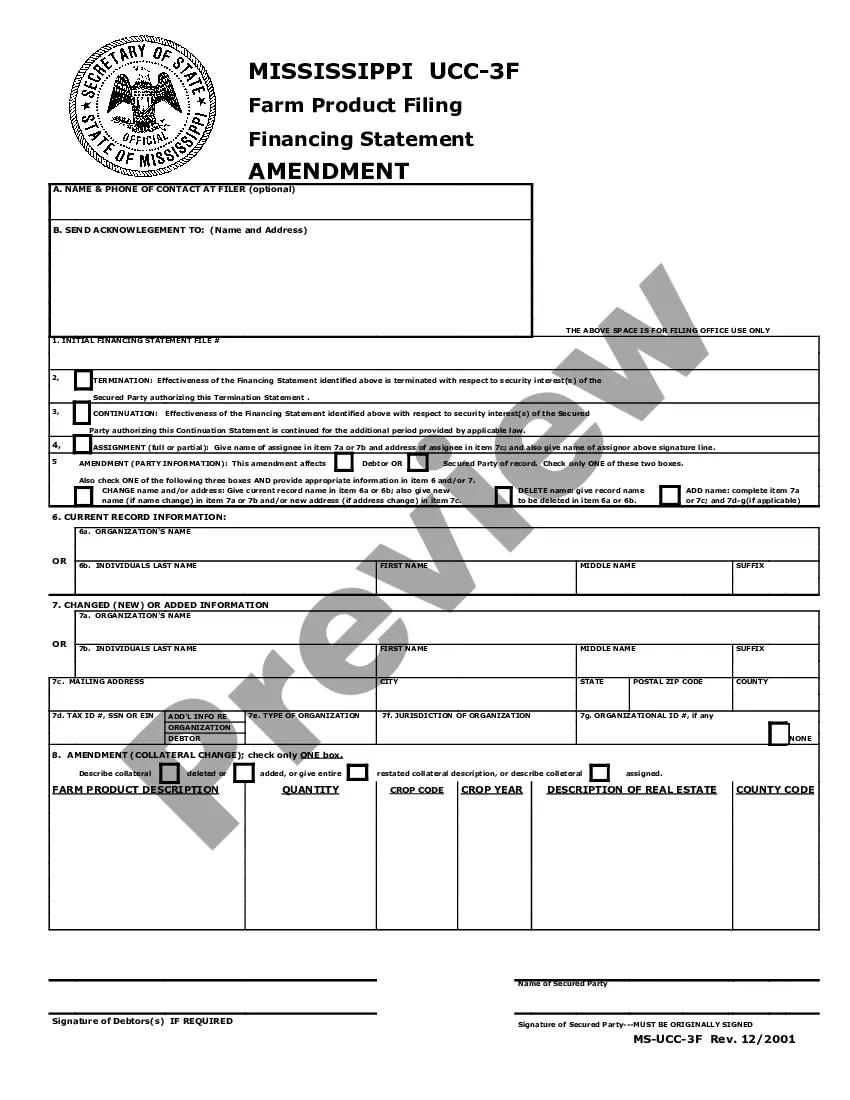

Financing Statement Amendment Addendum form for adding information to an amended Financing Statement filed with the Mississippi filing office.

Mississippi UCC3 Financing Statement Amendment Addendum

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Mississippi UCC3 Financing Statement Amendment Addendum?

Acquire a printable Mississippi UCC3 Financing Statement Amendment Addendum with just a few clicks in the most comprehensive collection of legal e-forms. Locate, download, and print professionally crafted and certified samples on the US Legal Forms website. US Legal Forms has been the leading provider of affordable legal and tax templates for US citizens and residents online since 1997.

Users who already possess a subscription must Log In directly to their US Legal Forms account, download the Mississippi UCC3 Financing Statement Amendment Addendum, and find it saved in the My documents section. Clients without a subscription should adhere to the following instructions.

After you have downloaded your Mississippi UCC3 Financing Statement Amendment Addendum, you can fill it out in any online editor or print it and complete it by hand. Utilize US Legal Forms to gain access to 85,000 professionally drafted, state-specific forms.

- Ensure your form complies with your state's regulations.

- If provided, review the form's description for further information.

- If available, examine the template to discover additional content.

- Once you are confident the template fits your needs, click on Buy Now.

- Create a personal account.

- Choose a plan.

- Pay via PayPal or credit card.

- Download the document in Word or PDF format.

Form popularity

FAQ

The UCC-1 Financing Statement is filed to protect a lender's or creditor's security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor.

A UCC-3 termination statement (a Termination) is a required filing that terminates a security interest that has been perfected by a UCC-1 filing. 1. A Termination for personal property is accomplished by completing and filing form UCC-3 with the Secretary of State's office in the appropriate state.

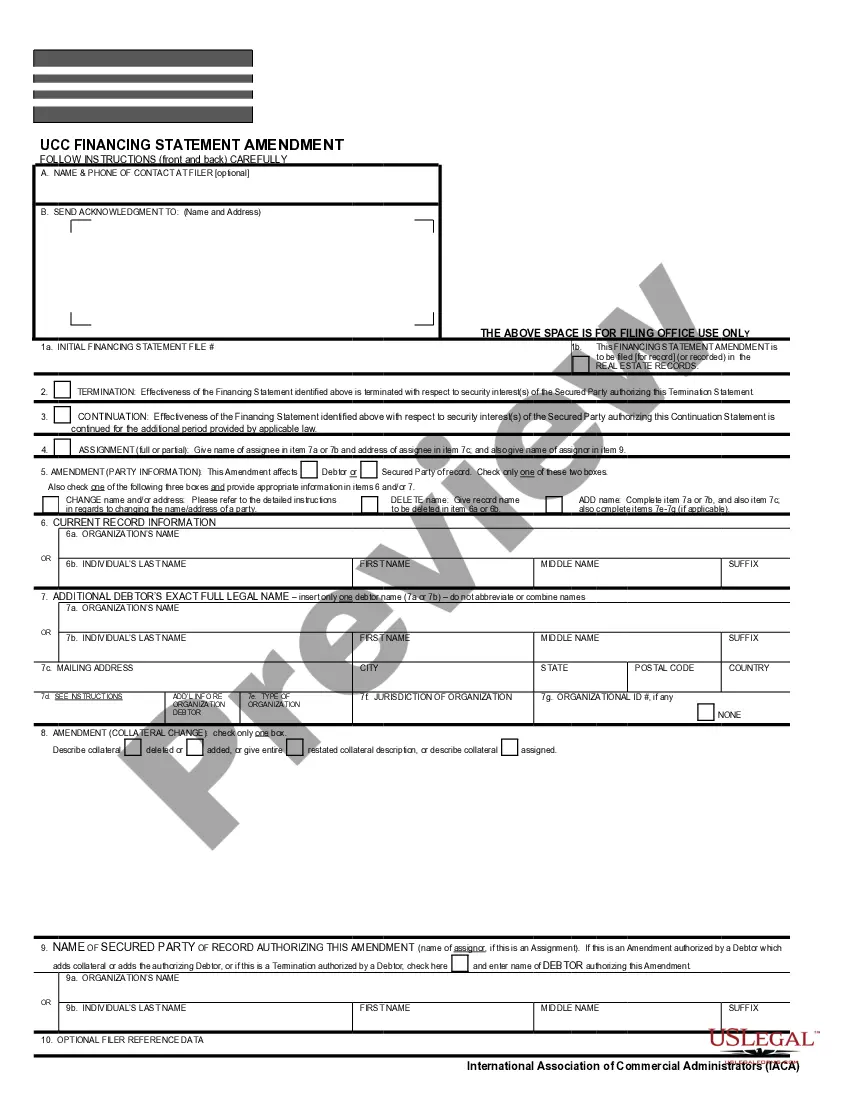

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.

To continue the effectiveness of a UCC-1 financing statement beyond its initial 5-year effective period, a secured party must file a Continuation. A Continuation extends the life of the financing statement for an additional five years.Each Continuation must identify, by its file number, the UCC-1 to which it relates.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

Why file a UCC-3 form? The UCC-3 is the Swiss-Army-Knife of forms. Unlike a UCC 1, a UCC 3 can be used for multiple purposes. The actions one can take are Amendment, Assignment, Continuation, and Termination.