Missouri Assignment of Mortgage Package

What is this form package?

The Missouri Assignment of Mortgage Package is a legally structured collection of forms designed for the owner of a deed of trust or mortgage. This package allows the owner to effectively convey their interest in the deed of trust or mortgage to a third party. Unlike other general legal form packages, this set includes specific documents that meet the legal requirements in Missouri, ensuring that the transfer of mortgage interests is properly documented and compliant with state laws.

What’s included in this form package

When to use this form package

This form package is useful in several scenarios, such as:

- Transferring mortgage interests to another party for sale or assignment.

- When a mortgage holder wishes to notify the borrower of a change in mortgage ownership.

- If a corporate entity is involved in the transfer of a mortgage, requiring specific documentation.

- When formally submitting assignment documents to the local recording office for public records.

Who can use this document

- Individual mortgage holders seeking to assign their mortgage.

- Corporate entities holding a deed of trust or mortgage.

- Fiduciaries handling mortgage assignments on behalf of clients or estates.

- Attorneys preparing documents for clients dealing with mortgage assignments.

How to complete these forms

- Review the included forms to understand their purposes and requirements.

- Identify all parties involved, including the original mortgage holder and the assignee.

- Fill out the appropriate forms with specific details such as names, dates, and relevant legal descriptions.

- Sign all necessary documents to validate the assignment.

- Submit the Letter to Recording Office to ensure the assignment is recorded publicly, if required.

Do forms in this package need to be notarized?

Some included forms must be notarized to ensure validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all required parties in the assignment.

- Not providing accurate legal descriptions of the property involved.

- Omitting the notification to the borrower about the assignment.

- Not completing the forms before submitting them for recording.

Benefits of completing this package online

- Convenience: Download and complete the forms from your home or office at any time.

- Editability: Modify the forms to suit your specific needs and ensure accuracy.

- Reliability: Forms created by licensed attorneys to ensure compliance with Missouri laws.

Main things to remember

- This package provides essential forms for transferring mortgage interests in Missouri.

- Clear guidance on when and how to properly use the forms is included.

- Common mistakes can be avoided by following the outlined steps for completion.

Looking for another form?

Form popularity

FAQ

The assignment of rights in Missouri refers to the legal transfer of rights related to a mortgage, including the right to receive payments. This process allows lenders to sell their rights to another lender, making it a vital aspect of mortgage transactions. With the Missouri Assignment of Mortgage Package, you can navigate this process with ease, ensuring all rights are transferred legally and efficiently. This package equips you with the necessary tools to manage your mortgage rights confidently.

The assignment of mortgage serves to formally transfer the rights and responsibilities of a mortgage from one lender to another. This process is essential for maintaining clear records of ownership and ensuring that payments are directed to the correct entity. By using the Missouri Assignment of Mortgage Package, you can streamline this process, ensuring that all legal requirements are met. This package provides peace of mind, knowing your assignment is handled properly.

The Tod rule, or Transfer on Death deed, allows property owners in Missouri to transfer real estate to beneficiaries upon their death, avoiding probate. This rule is beneficial for estate planning, providing a smooth transition of property ownership. By incorporating the Missouri Assignment of Mortgage Package, individuals can manage their mortgage assignments effectively while adhering to the Tod rule. This package assists in ensuring all aspects of property transfer are correctly documented.

The right of transfer or assignment allows a mortgage lender to transfer their interest in a mortgage to another party. This process is crucial for lenders as it enables them to sell or refinance loans without losing their investment. When you utilize the Missouri Assignment of Mortgage Package, you can ensure that all necessary paperwork is completed accurately. This package simplifies the assignment process, making it efficient and straightforward.

Typically, the lender or their authorized representative prepares an assignment of a mortgage. This ensures that all details are accurate and legally compliant, which is essential for the validity of the transfer. When using the Missouri Assignment of Mortgage Package, you can follow clear guidelines that help anyone involved in the process, including homeowners and real estate professionals, to create and execute these documents efficiently. This package streamlines the preparation process and provides peace of mind.

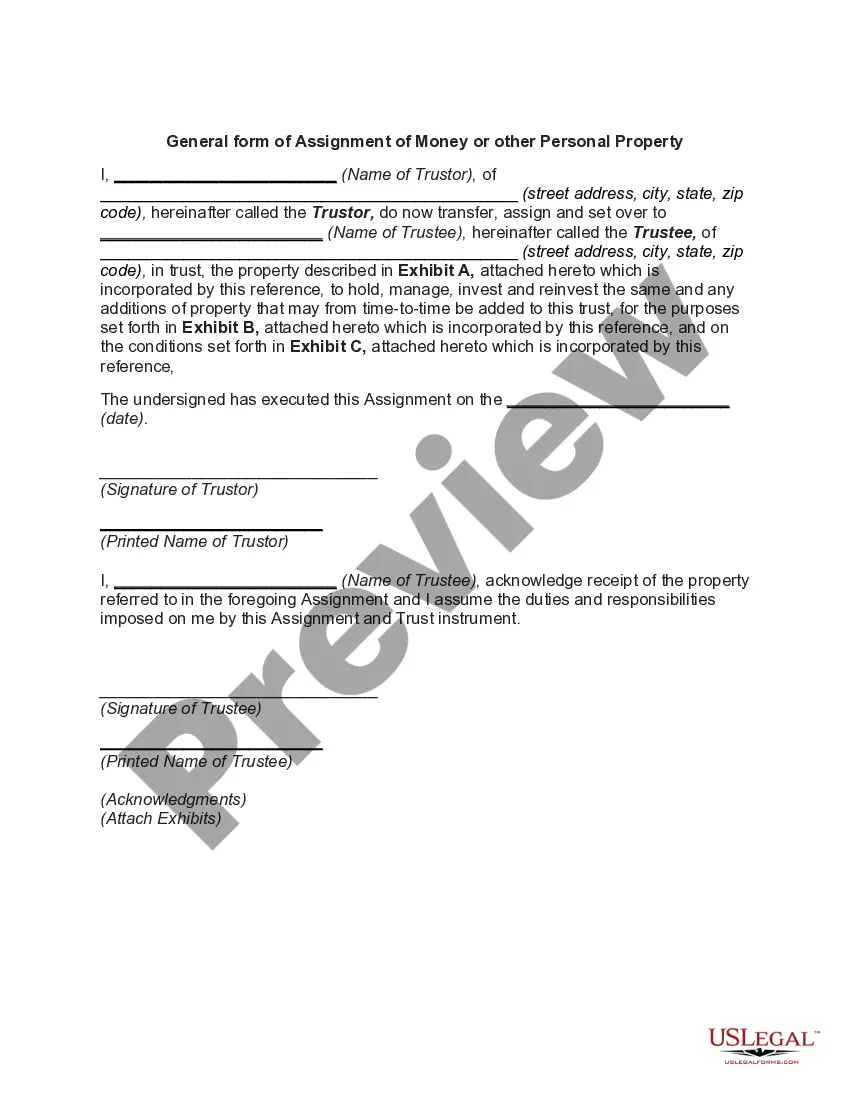

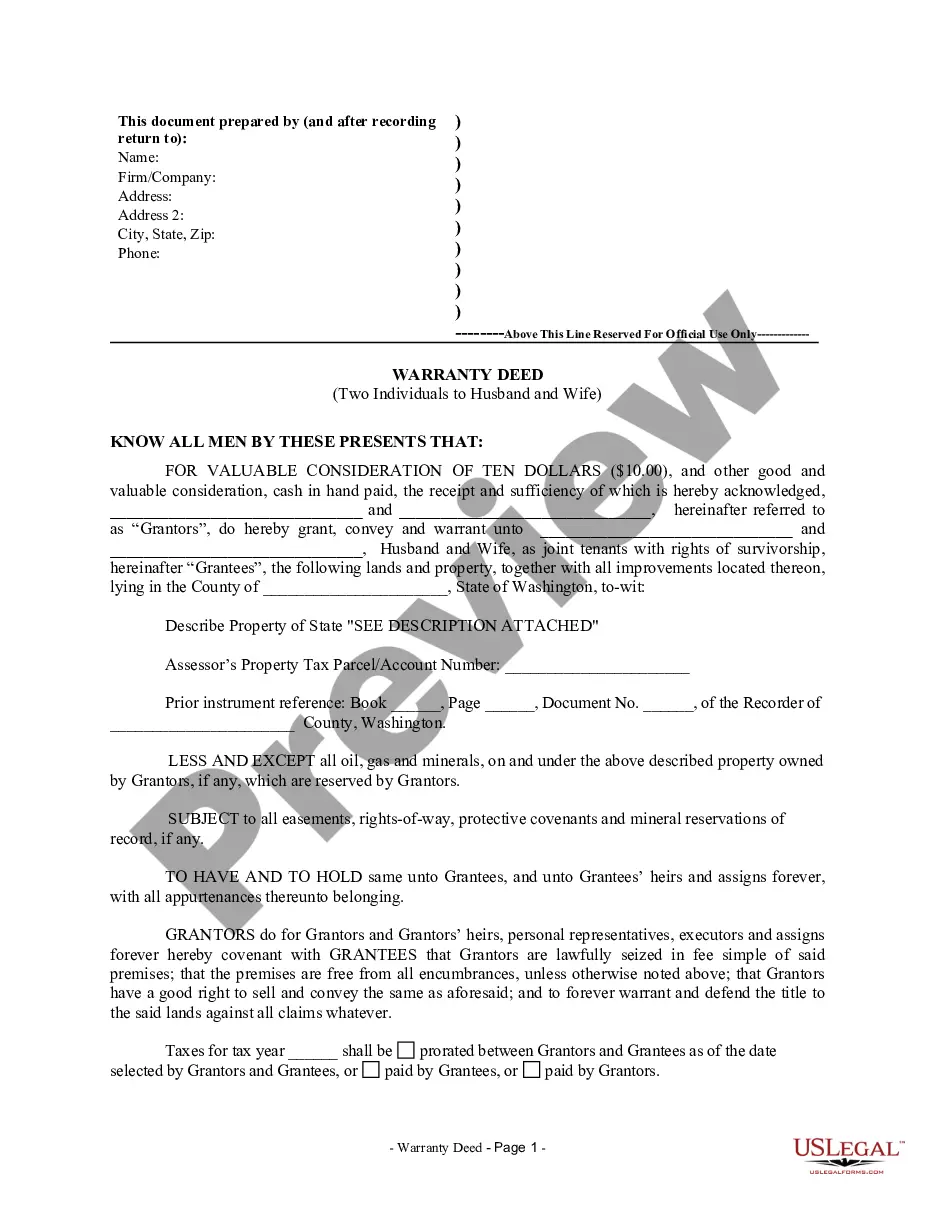

A Deed of Trust is essentially an agreement between a lender and a borrower to give the property to a neutral third party who will serve as a trustee. The trustee holds the property until the borrower pays off the debt.The trustee, however, holds the legal title to the property.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.