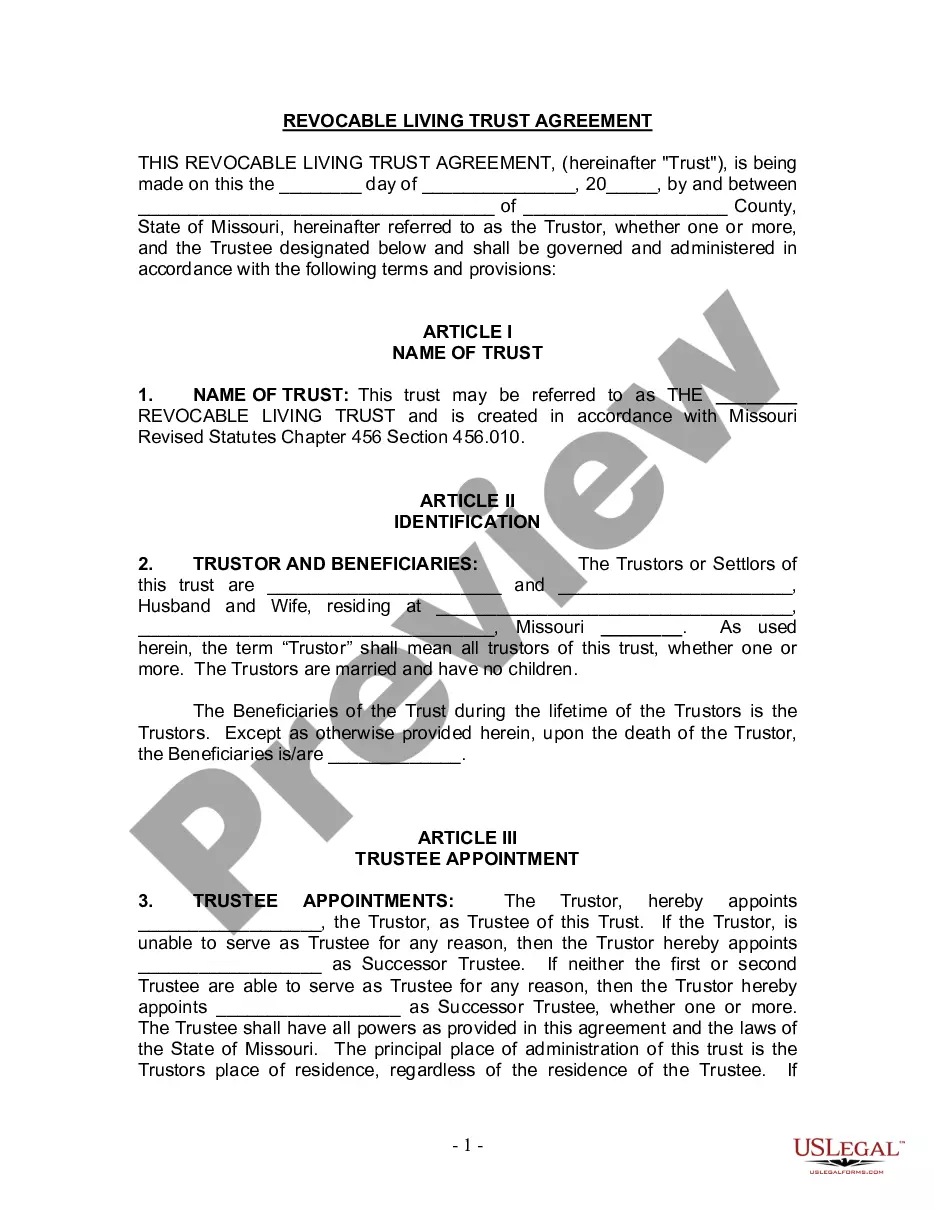

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Missouri Living Trust for Husband and Wife with No Children

Description

How to fill out Missouri Living Trust For Husband And Wife With No Children?

Have any form from 85,000 legal documents including Missouri Living Trust for Husband and Wife with No Children on-line with US Legal Forms. Every template is prepared and updated by state-accredited legal professionals.

If you already have a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Missouri Living Trust for Husband and Wife with No Children you need to use.

- Look through description and preview the sample.

- When you’re confident the sample is what you need, just click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in a single of two suitable ways: by credit card or via PayPal.

- Select a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you will always have quick access to the proper downloadable sample. The service gives you access to forms and divides them into groups to streamline your search. Use US Legal Forms to get your Missouri Living Trust for Husband and Wife with No Children easy and fast.

Form popularity

FAQ

Generally, trusts are considered the separate property of the beneficiary spouse and the assets in a trust are not subject to equitable distribution unless they contain marital property.Putting marital assets into a trust does not make those assets separate property.

The term usually means your nearest blood relative. In the case of a married couple or a civil partnership it usually means their husband or wife. Next of kin is a title that can be given, by you, to anyone from your partner to blood relatives and even friends.

Dying Without a Will in Missouri Most importantly, if you die without a will in Missouri, your entire estate must pass through probate (with the above-noted exceptions, of course). This isn't ideal, as probate can often be an expensive and lengthy process.

If the deceased has no children or spouse, then according to Missouri law, the estate is divided evenly among their father, mother, siblings, or descendants, then to grandparents, aunts and uncles or other descendants. Spouse gets 50% of intestate property, stepchildren get 50%.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Yes you can set up a trust independent of your husband. You could fund the trust with your personal property now and/or designate any community property that is yours at the time of your death to pour over into the trust.

Can I disinherit a spouse from a will or trust, legally? Yes, and no. Yes, a spouse can be disinherited. As set forth above, if a spouse legally, contractually agrees to be disinherited they can and likely will be.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

Children If there is no surviving spouse or civil partner, the deceased's children should be regarded as their next of kin (except if they are under 18). 3. Parents If the person who died has no surviving spouse or civil partner, and no children over 18, their parents are considered their next of kin. 4.