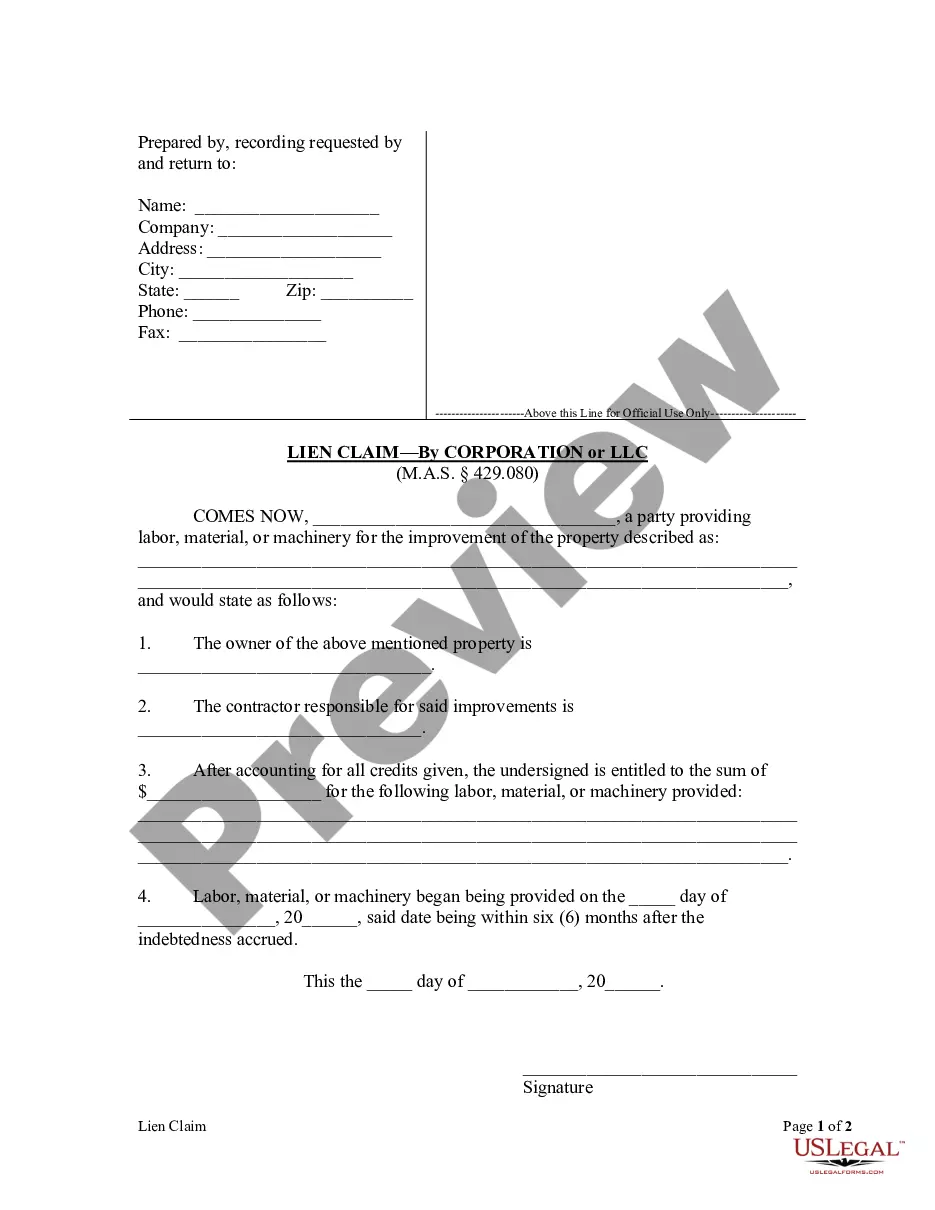

Missouri Lien Claim - Corporation

Overview of this form

The Lien Claim - Corporation form is a legal document used in Missouri by contractors, laborers, or material suppliers to assert their right to a lien on a property for unpaid services or materials provided. This form is essential for protecting the financial interests of corporations that have not been compensated for their work within the statutory timeframe. Unlike other lien forms, this version is specifically tailored for corporate entities, ensuring adherence to Missouri statutes regarding lien claims.

Key parts of this document

- Prepared by, recording requested by, and return to section: Captures the constituencies involved.

- Property details: Specifies the property where the work or materials were provided.

- Owner and contractor information: Identifies the property owner and the contractor responsible for the improvements.

- Claim amount: States the sum owed after credits.

- Dates: Records the start date of service to establish timeliness within the six-month period.

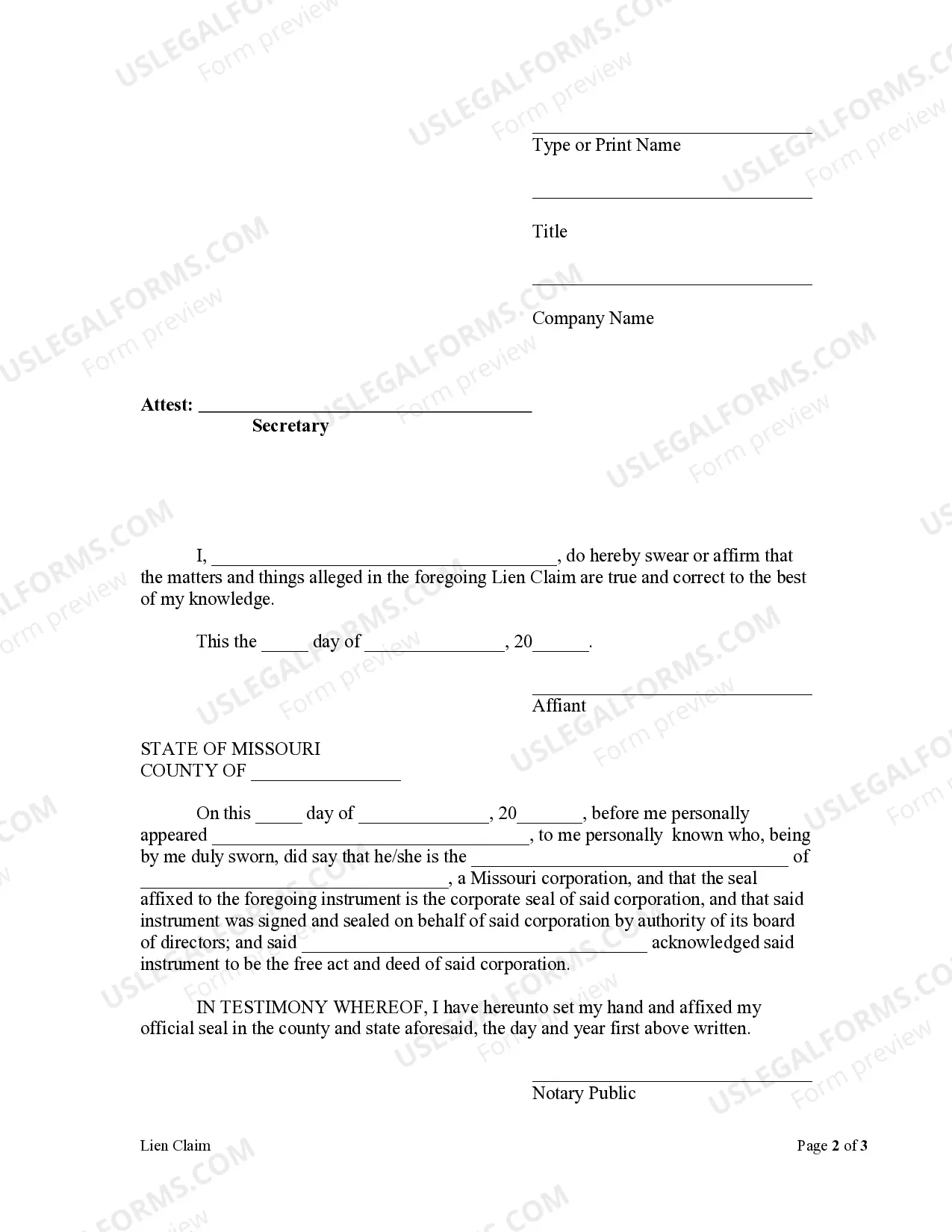

- Oath verification: Includes a statement affirming the truthfulness of the claim, which is crucial for legal validity.

Situations where this form applies

This form should be used by corporations that have provided labor, materials, or machinery in Missouri and have not received payment within six months of delivering those services or materials. It is important to file this lien claim to secure a legal right to the property, enhancing collection efforts for the unpaid amounts due.

Who needs this form

- Corporation owners who have provided construction-related services or materials.

- Contractors who are seeking to enforce a lien for unpaid work.

- Legal representatives of corporations involved in property improvements.

How to prepare this document

- Gather information about the property owner and contractor involved.

- Specify the property where the labor or materials were supplied.

- Detail the total amount owed after credits have been applied.

- Indicate the start date of service or materials provided.

- Sign the document and have it notarized to ensure legal standing.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Typical mistakes to avoid

- Failing to file the form within the six-month deadline after accruing debt.

- Not providing accurate or complete information about services rendered.

- Omitting required notarization, which can invalidate the claim.

Why use this form online

- Convenient access to legally compliant templates.

- Edit and customize forms easily to fit specific situations.

- Downloadable for quick filing with local courts.

Form popularity

FAQ

Yes, you can place a lien on a corporation in Missouri, provided you follow the appropriate legal procedures. A Missouri Lien Claim - Corporation allows creditors to secure their debts by establishing a legal claim against the corporation's assets. Utilizing resources from platforms like USLegalForms can help you navigate this process and ensure your lien is properly filed.

The 407.675 law in Missouri pertains to consumer protection and defines certain practices related to liens on property. It emphasizes fair dealings and transparency in lien claims, particularly those involving Missouri Lien Claim - Corporation. Familiarity with this law can help you ensure compliance and protect your rights as a creditor.

To file a lien in Missouri, you must provide essential information such as the debtor's name, the amount owed, and a description of the property involved. Additionally, you must comply with specific procedural steps to ensure your Missouri Lien Claim - Corporation is valid and enforceable. This process can be complex, but platforms like USLegalForms can simplify your experience and guide you through the necessary documentation.

The statute 492.100 in Missouri outlines the requirements for establishing and enforcing liens, particularly in relation to corporations. This statute provides the legal framework for filing a Missouri Lien Claim - Corporation, ensuring that creditors can protect their interests effectively. Understanding this statute is crucial for anyone looking to navigate the lien process in Missouri.

Keep in mind, however, that you must file this notice within 6 months after you recorded the mechanics lien. If you do not initiate foreclosure within the 6-month period, the mechanics lien will expire and it will no longer hold a claim against the property.

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

File your lien. If you're claiming a lien on real property, it must be filed in the recorder's office of the county where the property is located. Expect to pay a filing fee between $25 and $50 depending on the location where you file.

In Missouri, a mechanics lien must be filed within 6 months after the last day of services or materials were provided. This date is crucial to the rights of the project participant. The lien should be filed with the recorder of deeds in the county where the property is located.

A Missouri mechanics lien stays effective for 6 months from the date the lien was filed.

Missouri does not require that lien waivers be notarized in order to be effective. However, there are specific signature requirements that apply to residential jobs.