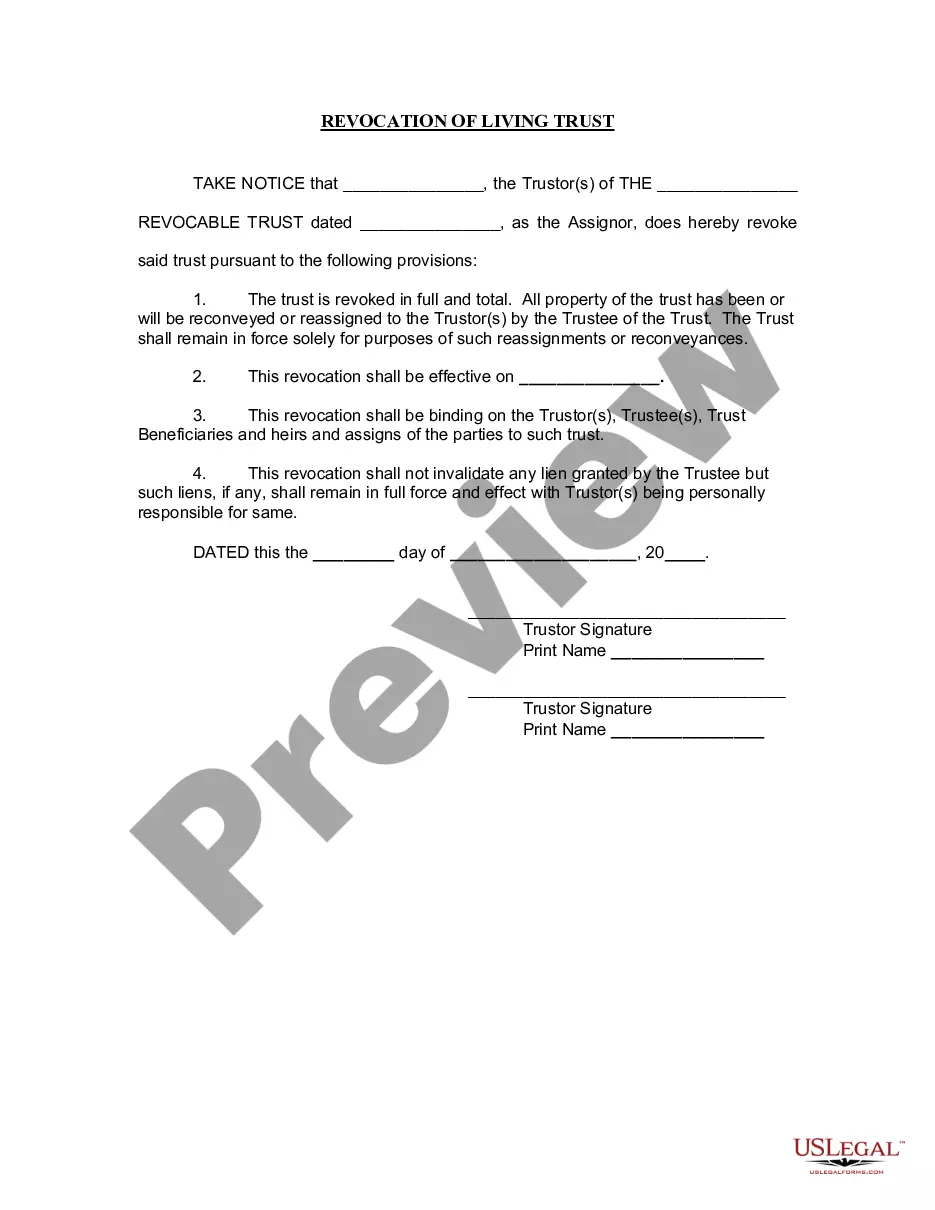

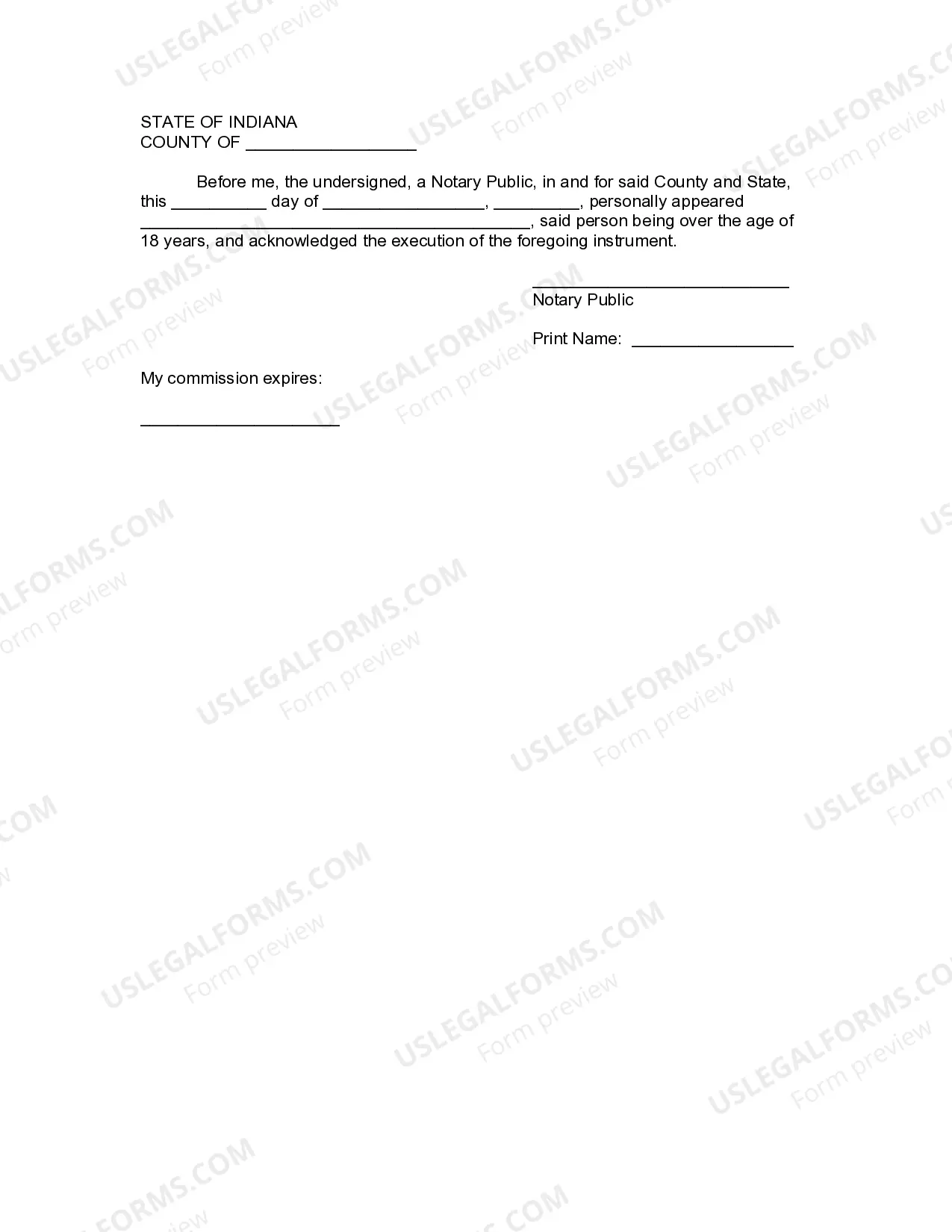

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Indiana Revocation of Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Revocation of Living Trust: The process by which the grantor of a revocable trust cancels or alters the trust. Living Trust: Also known as a revocable trust, this legal document allows individuals to place assets within a trust with the ability to modify or revoke it as long as they are alive. Estate Planning: The preparation for the transfer of a person's wealth and assets after their death. Power of Attorney: A legal document allowing one person to make decisions on behalf of another.

Step-by-Step Guide: How to Revoke a Living Trust

- Review the trust document for any specific instructions regarding revocation.

- Consult with an estate planning attorney to understand the legal implications.

- Prepare a revocation document stating your intentions.

- Have the revocation document notarized to ensure legality.

- Inform all relevant parties (trustees, beneficiaries) about the revocation.

- Update your estate plan to reflect the changes made after revoking the trust.

Risk Analysis of Revoking a Living Trust

- Legal Risks: Incorrect revocation may lead to disputes among beneficiaries or issues with asset distribution.

- Financial Risks: Potential financial instability for beneficiaries relying on trust assets.

- Emotional Risks: Family conflicts can arise from sudden changes to estate plans.

Best Practices in Revoking a Revocable Trust

- Always work with a qualified attorney to avoid legal pitfalls.

- Clearly communicate your reasons and plans to all affected parties to prevent misunderstandings.

- Consider the timing of the revocation to protect family members' financial needs.

- Regularly review and update your estate plan to adapt to changing circumstances.

Common Mistakes & How to Avoid Them

- Failing to Notify All Parties: Ensure that all beneficiaries and trustees are informed of the revocation.

- Not Updating Estate Plan: After revoking a trust, immediately revise your estate plan to reflect your current wishes and circumstances.

- Lack of Proper Documentation: Always have legal papers properly drafted and notarized.

FAQ

- Can I revoke any type of living trust? Only revocable trusts can be terminated or changed; irrevocable trusts cannot.

- What happens to the assets if a living trust is revoked? The assets revert to the grantor's direct control and will be distributed as per their estate plan.

- Is it expensive to revoke a living trust? Costs vary based on attorney fees and any associated legal processes.

How to fill out Indiana Revocation Of Living Trust?

Looking for a sample Indiana Revocation of Living Trust and completing it can pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate sample tailored for your state with just a few clicks.

Our legal experts prepare every document, so all you need to do is fill them out.

Select your payment method via credit card or PayPal. Save the document in your preferred file format. You can print the Indiana Revocation of Living Trust template or complete it with any online editor. Don’t fret about typos, as your template can be used, submitted, and printed as many times as needed. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's webpage to download the sample.

- All your downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven't subscribed yet, it's advisable to register.

- Follow our comprehensive guidelines to obtain your Indiana Revocation of Living Trust sample in just a few minutes.

- To acquire a valid sample, verify its applicability for your state.

- Examine the example using the Preview feature (if available).

- If a description is included, read it to understand the crucial details.

- Click Buy Now if you discover what you're looking for.

Form popularity

FAQ

This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer. How long it takes to settle a revocable living trust can depend on numerous factors.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.

Dissolving irrevocable trusts if you're a beneficiary or trustee. State trust law may also permit a trust beneficiary or trustee to petition the court if they want to dissolve (or amend) the trust. The court may grant approval based on reasons cited above.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.Such documents, often called a trust revocation declaration or revocation of living trust," can be downloaded from legal websites; local probate courts may also provide copies of them.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

A revocation of a will generally means that the beneficiaries will no longer receive the specified property or financial assets. A beneficiary may have been depending on the trust property for various reasons. If the revocation occurs at a certain time, it can cause legal conflicts in many cases.

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.