Minnesota Flood Zone Statement and Authorization

What this document covers

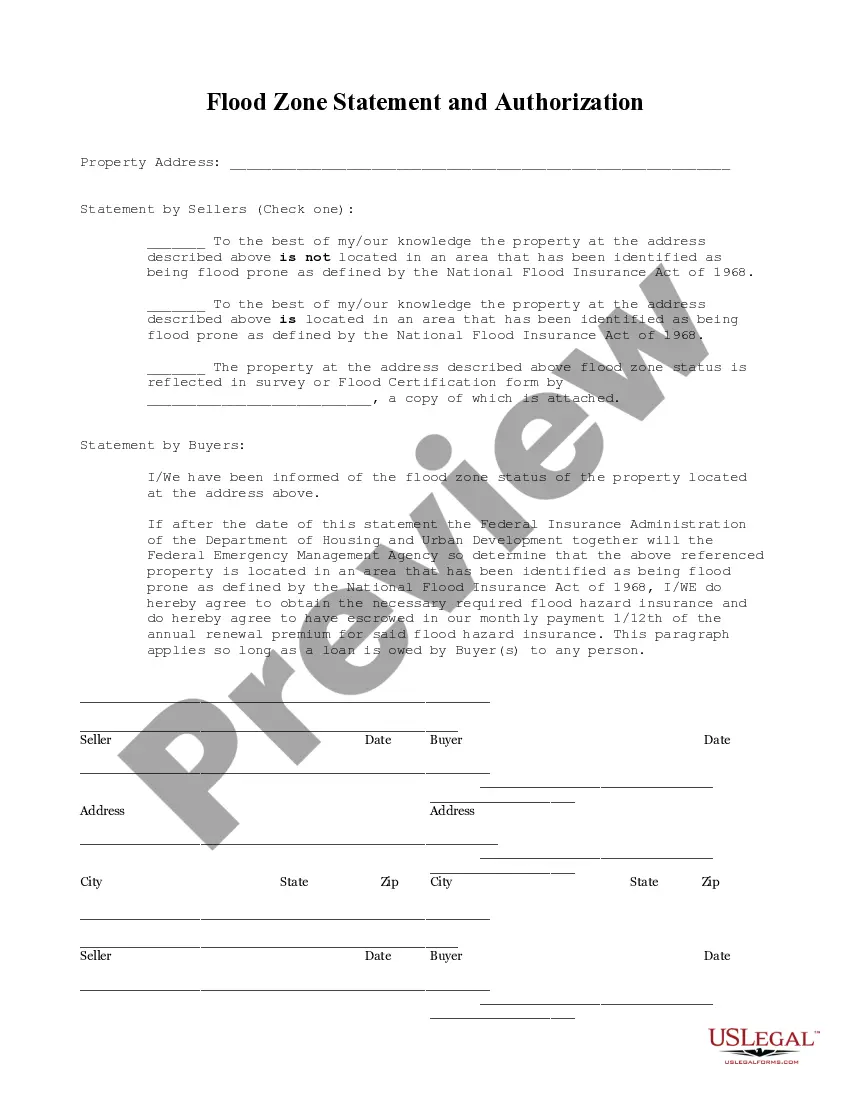

The Flood Zone Statement and Authorization form is a legal document that enables sellers to confirm the flood zone status of a property and ensures that buyers acknowledge this information. This form is essential for protecting both parties in real estate transactions, especially in areas identified as flood-prone by the National Flood Insurance Act of 1968. It is distinct from other property disclosure forms as it specifically addresses flood-related risks and the necessity of flood insurance for buyers should the property be designated as a flood zone in the future.

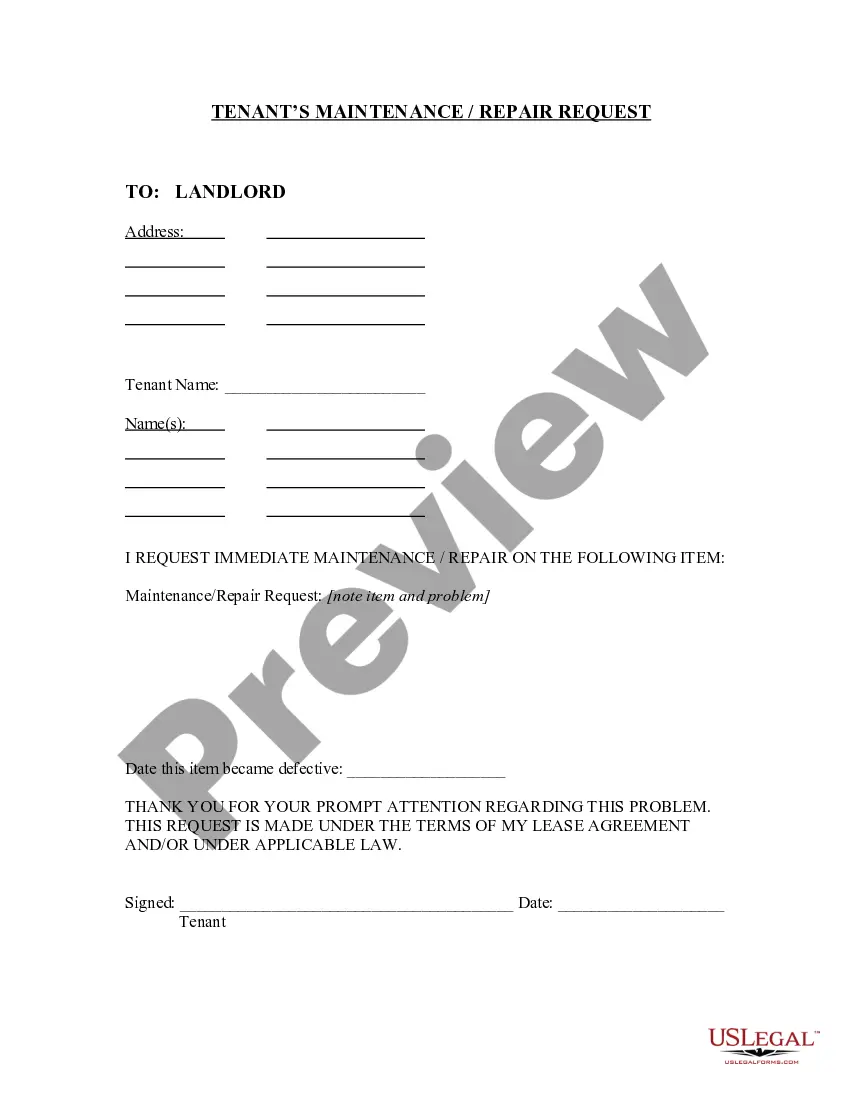

Main sections of this form

- Property address section for accurate identification.

- Sellersâ statement to declare the flood zone status.

- Buyersâ acknowledgment of the flood zone status and agreement to obtain flood insurance if necessary.

- Space for both sellersâ and buyersâ signatures and dates.

- Provision to attach a survey or Flood Certification for clarity and legal verification.

When this form is needed

This form should be used when a property is being sold or transferred, particularly in regions that may be subject to flooding. It is most relevant when the buyer is securing financing for the purchase, as lenders often require evidence of flood status and insurance compliance. Additionally, sellers should provide this form to ensure clear communication regarding potential flood risks associated with the property.

Who should use this form

- Property sellers wanting to disclose flood zone information to potential buyers.

- Buyers who are purchasing property in areas known to be at risk of flooding.

- Real estate agents facilitating transactions where flood zone considerations are relevant.

- Lenders requiring documentation of the propertyâs flood status for mortgage approvals.

How to prepare this document

- Identify and enter the property's address at the top of the form.

- Sellers should check the appropriate box to indicate the flood zone status known to them.

- If applicable, attach any relevant survey or Flood Certification with the seller's statement.

- Buyers must review and acknowledge the flood zone information by signing and dating the form.

- Ensure that all parties provide their addresses and necessary signatures for validity.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide accurate property address information.

- Not checking the correct flood zone status option, leading to potential legal issues.

- Neglecting to attach relevant Flood Certification documents if the property is flood-prone.

- Incomplete signatures or missing dates, making the form invalid.

Why use this form online

- Convenience of downloading and completing the form at your own pace.

- Instant access to the most current legal forms drafted by licensed attorneys.

- Editability to customize the document according to specific property details.

- Secure storage options to keep your documentation organized.

Looking for another form?

Form popularity

FAQ

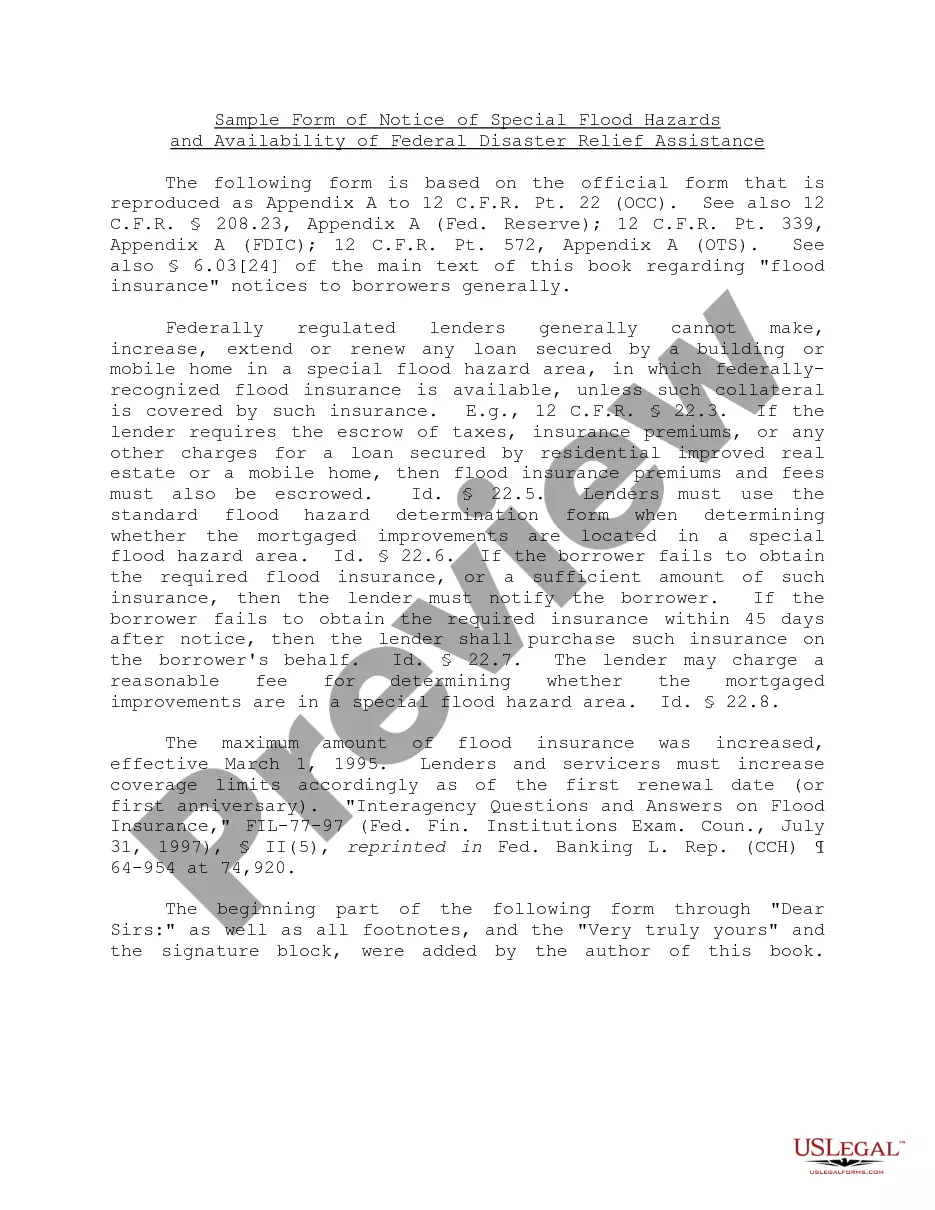

Yes, flood insurance is typically required in a 100-year flood zone, especially for properties with mortgages. Lenders usually ask for a Minnesota Flood Zone Statement and Authorization to evaluate the flood risk. Having flood insurance can protect your investment and provide peace of mind, as it covers damages from flooding that may occur.

A flood zone certificate is an official document that indicates whether a property falls within a flood zone. This certificate often includes a Minnesota Flood Zone Statement and Authorization, providing essential information to homeowners and lenders alike. Obtaining this certificate can help you make informed decisions about property insurance and potential risks.

In Minnesota, flood insurance is often required if your property is located in a designated flood zone. When you have a mortgage, lenders usually mandate a Minnesota Flood Zone Statement and Authorization to assess your risk. It's wise to consult with your insurance agent to understand the specific requirements for your area and property type.

To obtain a flood zone determination, you can start by contacting your local government or a licensed professional. They can help you request a Minnesota Flood Zone Statement and Authorization, which identifies your property's flood risk. Additionally, using an online service like US Legal Forms can streamline this process, providing you with the necessary documentation efficiently.

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

Flood Zone A is a special flood hazard area designation by the Federal Emergency Management Agency (FEMA). Zone A areas have a 1 percent annual chance of flooding. This flood is also called the 100-year flood.

Flood Zone A. Areas subject to inundation by the 1-percent-annual-chance flood event generally determined using approximate methodologies. Flood Zone AE, A1-30. Flood Zone AH. Flood Zone AO. Flood Zone AR. Flood Zone A99. Flood Zone V. Flood Zone VE, V1-30.

1Your local floodplain manager: Your local floodplain manager may already have a certificate on file.2The seller of your property: If you're buying a property, the sellers may already have the certificate, and you can ask them for it before purchasing.What Is An Elevation Certificate for Flood Insurance? - ValuePenguin\nwww.valuepenguin.com > elevation-certificate-flood-insurance

Areas in flood zone A have a 1 percent chance of flooding per year and a 25 percent chance of flooding at least once during a 30-year mortgage. Since there haven't been detailed hydraulic analysis in these areas, the base flood elevation and depths have not been determined.

The federal government offers coverage through the National Flood Insurance Program at an average cost of about $700 per year. But premiums vary depending on your property's flood risk.