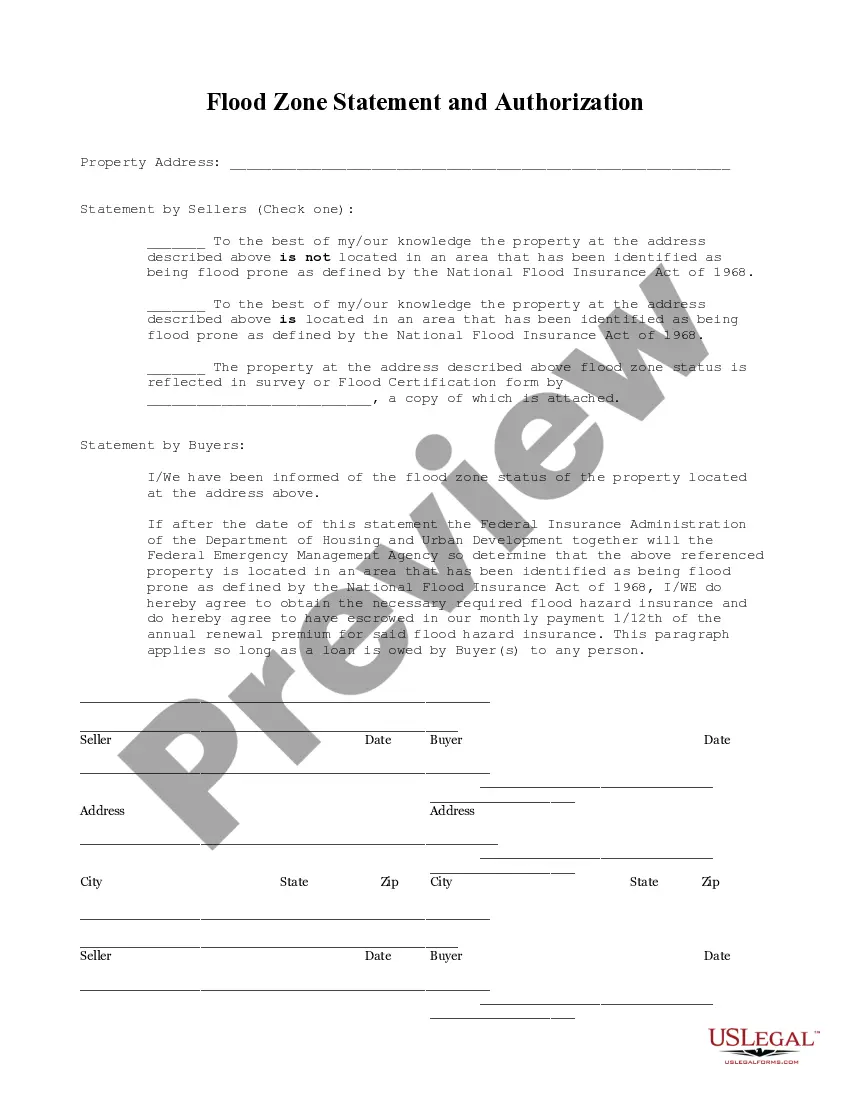

Minnesota Flood Zone Statement and Authorization

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Flood Zone Statement And Authorization?

Obtain any version from 85,000 legal documents, including the Minnesota Flood Zone Statement and Authorization, online with US Legal Forms. Each template is composed and refreshed by state-certified attorneys.

If you already possess a subscription, sign in. When you are on the form’s page, select the Download button and navigate to My documents to retrieve it.

If you haven't subscribed yet, follow the instructions below.

With US Legal Forms, you’ll always have swift access to the appropriate downloadable sample. The service offers you access to forms and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Minnesota Flood Zone Statement and Authorization quickly and effortlessly.

- Verify the state-specific prerequisites for the Minnesota Flood Zone Statement and Authorization you wish to utilize.

- Review the description and preview the template.

- Once you’re confident the sample meets your needs, click on Buy Now.

- Select a subscription plan that fits your budget.

- Establish a personal account.

- Make payment in one of two convenient methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents tab.

- After your reusable form is prepared, print it out or save it to your device.

Form popularity

FAQ

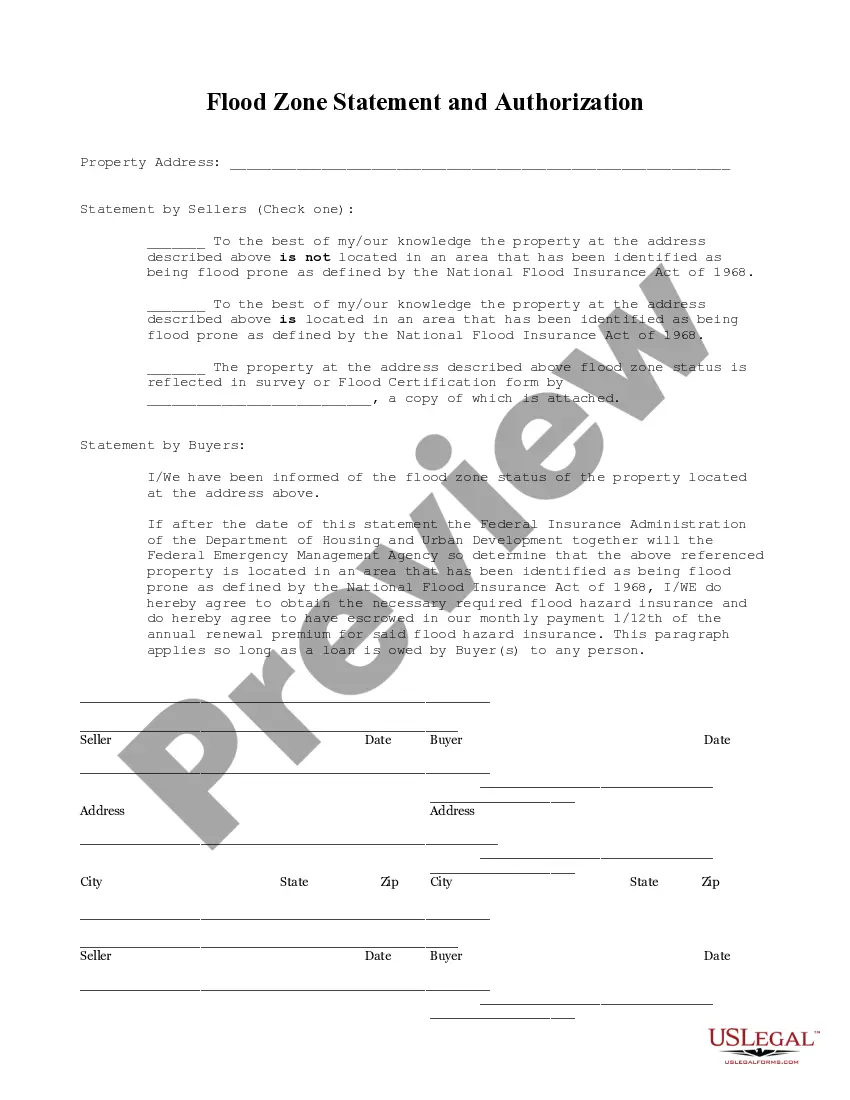

Yes, flood insurance is typically required in a 100-year flood zone, especially for properties with mortgages. Lenders usually ask for a Minnesota Flood Zone Statement and Authorization to evaluate the flood risk. Having flood insurance can protect your investment and provide peace of mind, as it covers damages from flooding that may occur.

A flood zone certificate is an official document that indicates whether a property falls within a flood zone. This certificate often includes a Minnesota Flood Zone Statement and Authorization, providing essential information to homeowners and lenders alike. Obtaining this certificate can help you make informed decisions about property insurance and potential risks.

In Minnesota, flood insurance is often required if your property is located in a designated flood zone. When you have a mortgage, lenders usually mandate a Minnesota Flood Zone Statement and Authorization to assess your risk. It's wise to consult with your insurance agent to understand the specific requirements for your area and property type.

To obtain a flood zone determination, you can start by contacting your local government or a licensed professional. They can help you request a Minnesota Flood Zone Statement and Authorization, which identifies your property's flood risk. Additionally, using an online service like US Legal Forms can streamline this process, providing you with the necessary documentation efficiently.

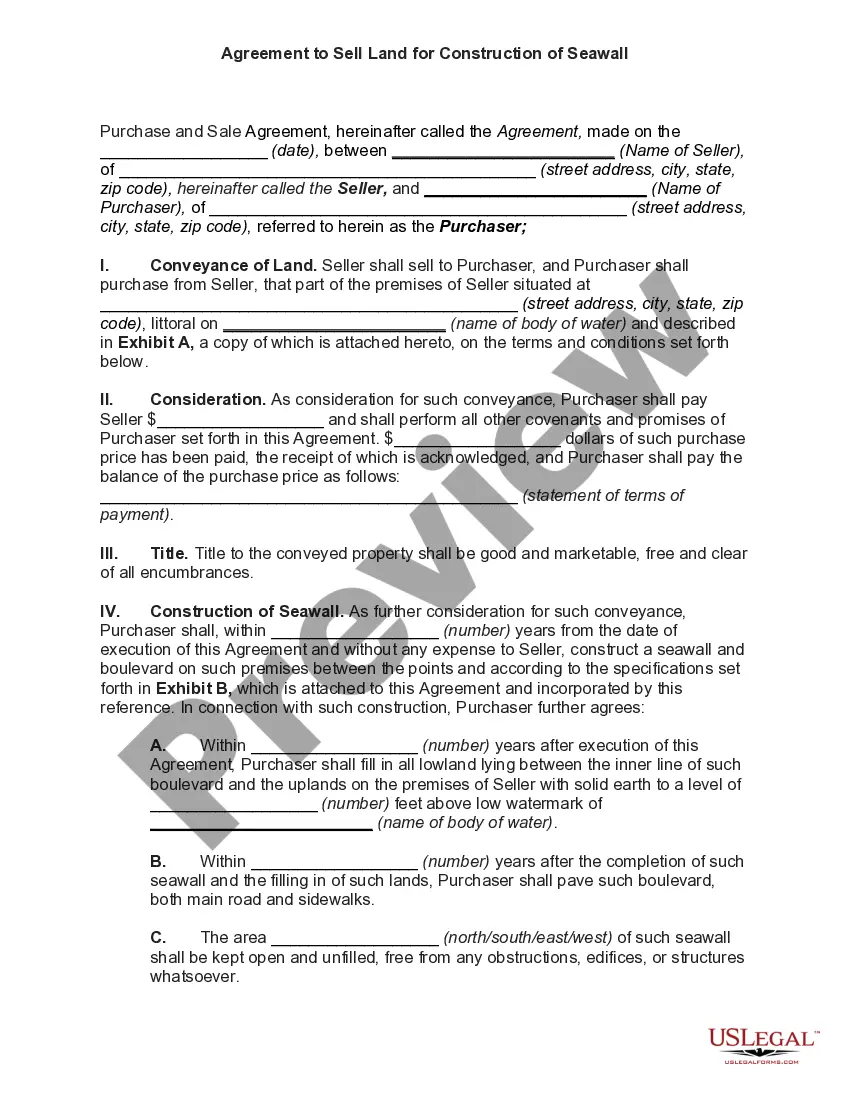

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

Flood Zone A is a special flood hazard area designation by the Federal Emergency Management Agency (FEMA). Zone A areas have a 1 percent annual chance of flooding. This flood is also called the 100-year flood.

Flood Zone A. Areas subject to inundation by the 1-percent-annual-chance flood event generally determined using approximate methodologies. Flood Zone AE, A1-30. Flood Zone AH. Flood Zone AO. Flood Zone AR. Flood Zone A99. Flood Zone V. Flood Zone VE, V1-30.

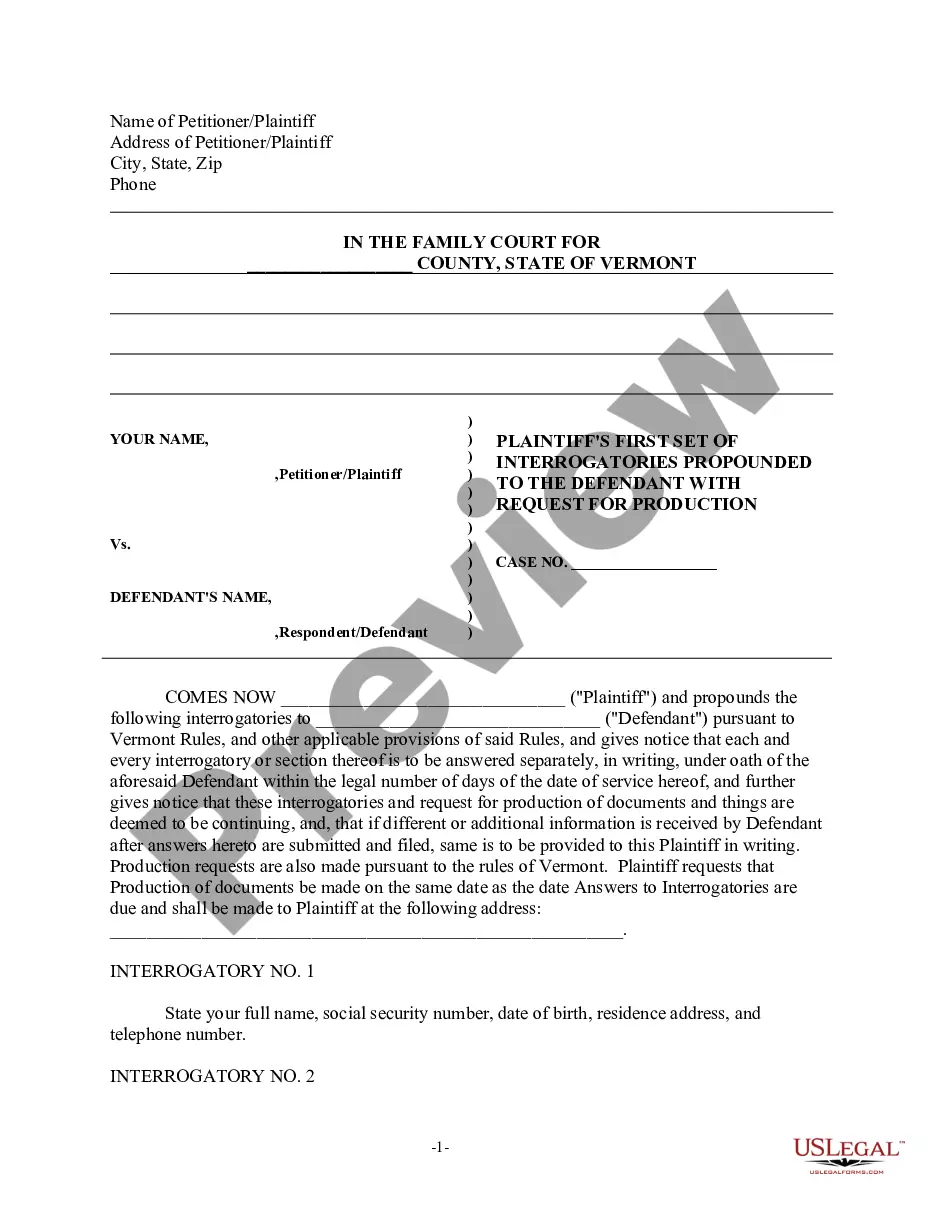

1Your local floodplain manager: Your local floodplain manager may already have a certificate on file.2The seller of your property: If you're buying a property, the sellers may already have the certificate, and you can ask them for it before purchasing.What Is An Elevation Certificate for Flood Insurance? - ValuePenguin\nwww.valuepenguin.com > elevation-certificate-flood-insurance

Areas in flood zone A have a 1 percent chance of flooding per year and a 25 percent chance of flooding at least once during a 30-year mortgage. Since there haven't been detailed hydraulic analysis in these areas, the base flood elevation and depths have not been determined.

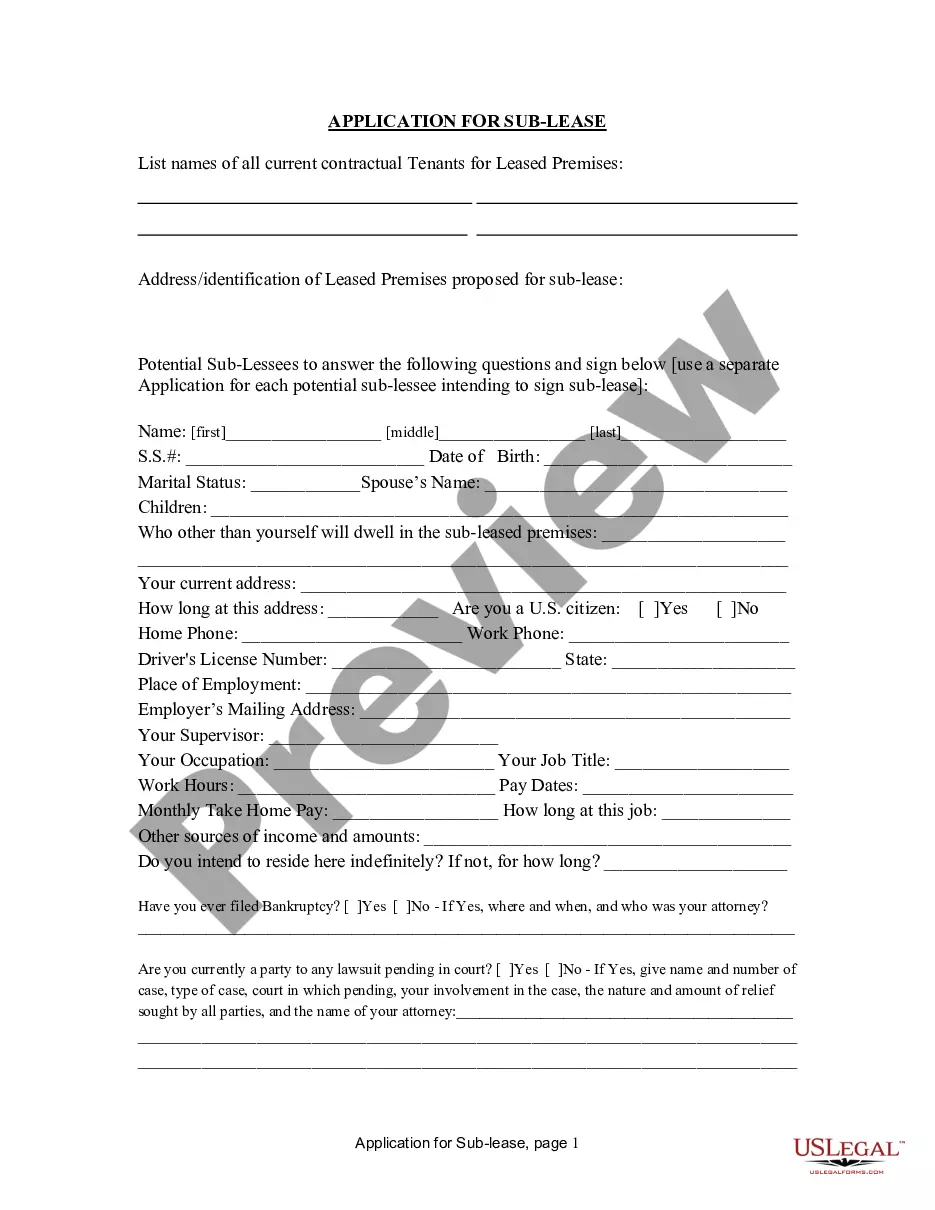

The federal government offers coverage through the National Flood Insurance Program at an average cost of about $700 per year. But premiums vary depending on your property's flood risk.