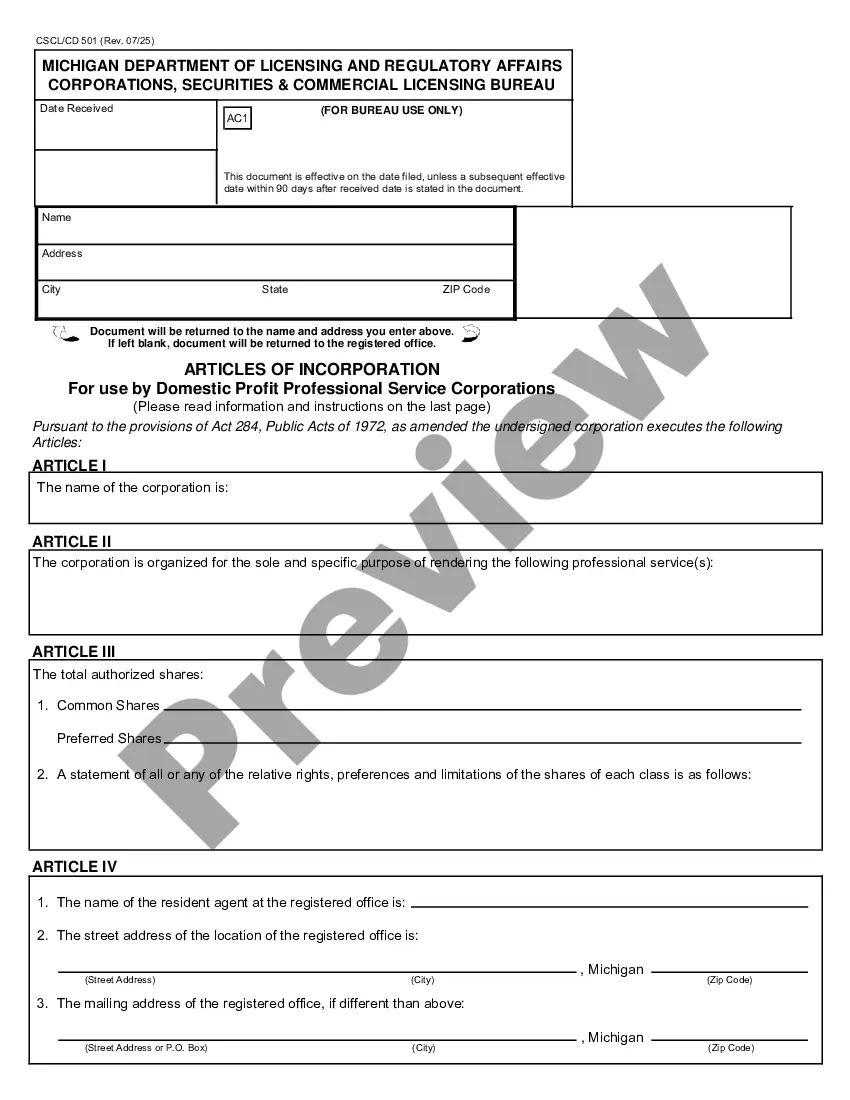

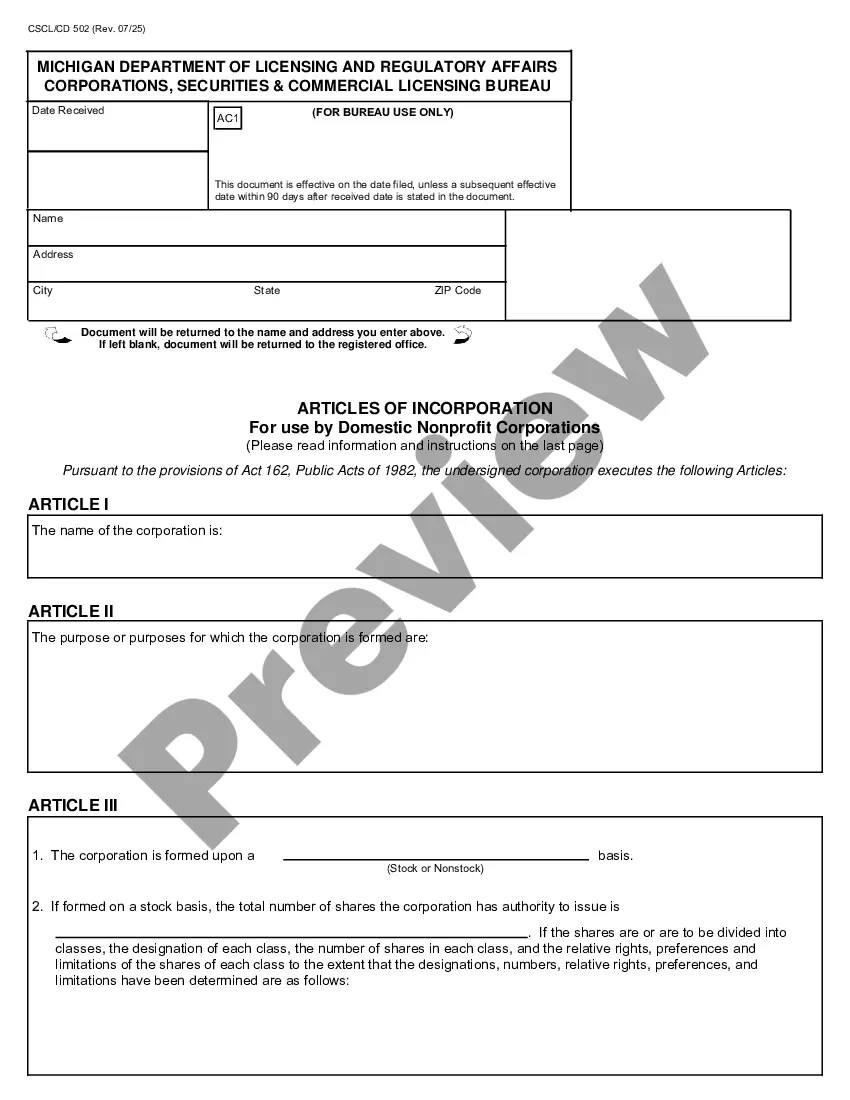

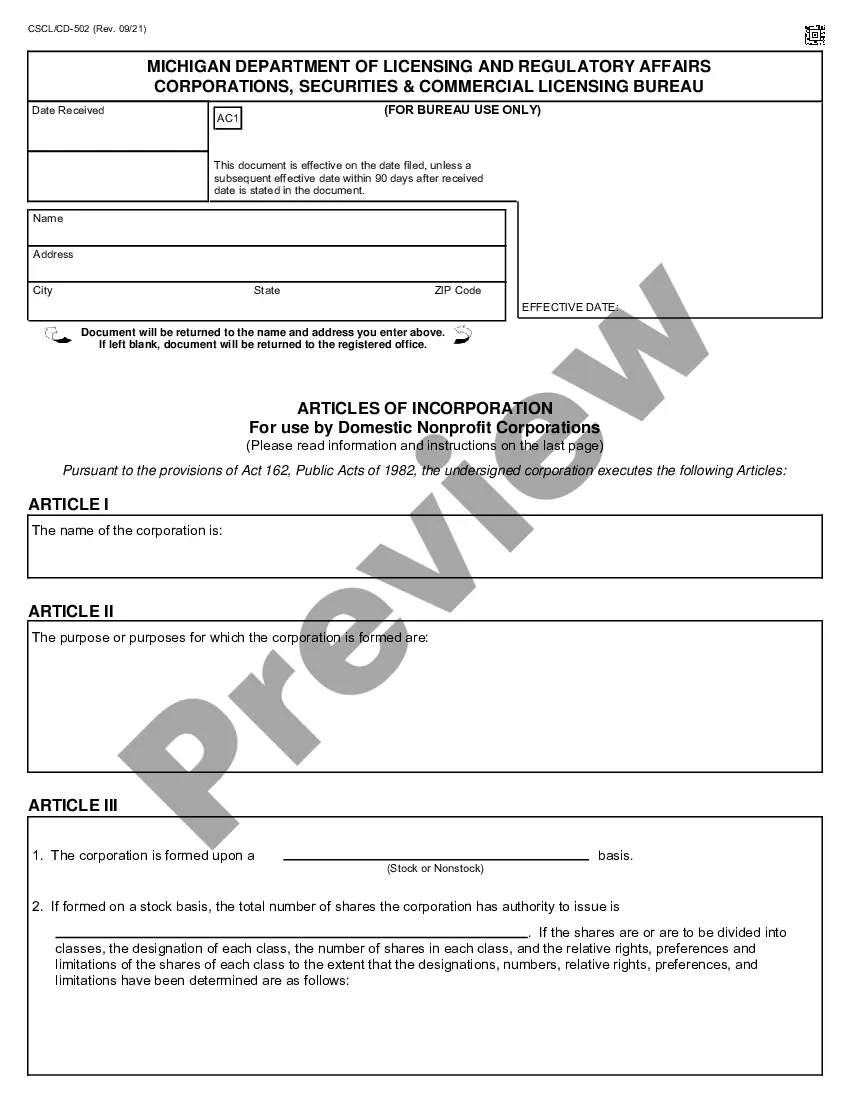

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Michigan Articles of Incorporation for Domestic For-Profit Corporation

Description

How to fill out Michigan Articles Of Incorporation For Domestic For-Profit Corporation?

Access any template from 85,000 legal forms, including Michigan Articles of Incorporation for Domestic For-Profit Corporation, available online at US Legal Forms. Each template is prepared and refreshed by state-certified attorneys.

If you already possess a subscription, Log In. After navigating to the form’s page, click the Download button and go to My documents to retrieve it.

If you haven’t yet subscribed, adhere to the following steps.

With US Legal Forms, you will always gain immediate access to the suitable downloadable template. The platform grants you access to documents, organized into categories to facilitate your search. Utilize US Legal Forms to procure your Michigan Articles of Incorporation for Domestic For-Profit Corporation quickly and efficiently.

- Verify the state-specific criteria for the Michigan Articles of Incorporation for Domestic For-Profit Corporation you require.

- Review the description and view the template.

- When confident that the sample meets your needs, simply click Buy Now.

- Select a subscription plan that fits your financial needs.

- Set up a personal account.

- Complete payment using one of two available methods: by card or through PayPal.

- Choose a format for downloading the file; two options are available (PDF or Word).

- Download the document into the My documents section.

- Once your reusable form is prepared, either print it out or save it to your device.

Form popularity

FAQ

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

Entity Name. Business Purpose. Duration of LLC. Registered Agent Name and Registered Office Address. Governing Authority.

For tax reasons, the IRS acknowledges any company that originated in the U.S. and is bound by the laws of the state in which it resides as a domestic profit corporation. For instance, any corporation created in and doing business in Pennsylvania, Nevada, or Puerto Rico is known as a domestic profit corporation.

The different types of corporations and business structures. When it comes to types of corporations, there are typically four that are brought up: S corps, C corps, non-profit corporations, and LLCs.

The biggest difference between C and S corporations is taxes. A C corporation pays tax on its income, plus you pay tax on whatever income you receive as an owner or employee. An S corporation doesn't pay tax. Instead, you and the other owners report the company revenue as personal income.

A domestic for-profit LLC is a limited liability company that does business in the state where it was formed.

Definition of Domestic Profit Corporations A domestic profit corporation operates in the country in which it began, whereas a foreign corporation operates in a country outside of its home country.An additional definition of a domestic profit corporation takes into consideration the state in which a company is based.

A domestic corporation is a company that conducts its affairs in its home country.Companies also may be referred to as foreign businesses when they are outside of the state in which they were formed.

Domestic profit corporations are formed for the purpose of generating profit for shareholders. A corporation is generally composed of three classes of persons: shareholders, directors, and officers. The shareholders own the corporation, elect the directors, and have the right to vote on major events of the corporation.