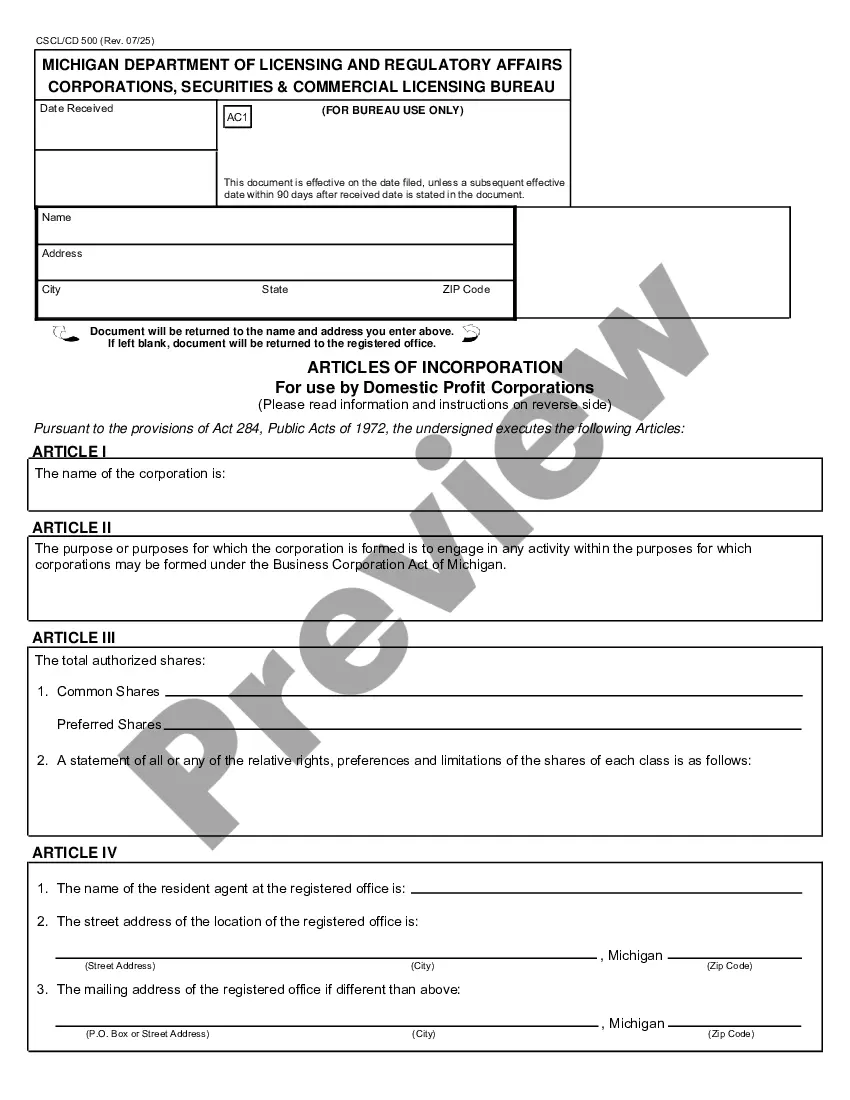

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Michigan Articles of Incorporation for Domestic Nonprofit Corporation

Description

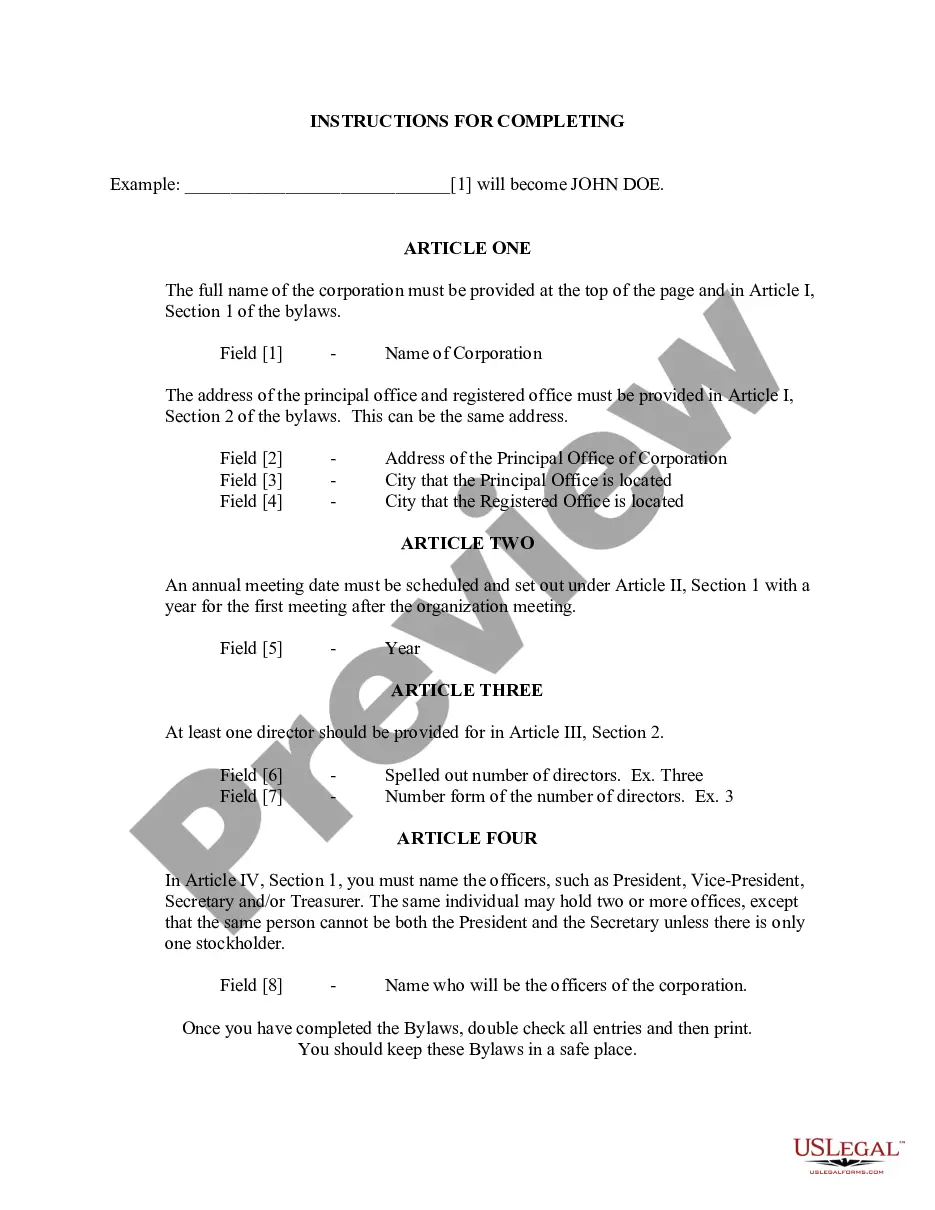

How to fill out Michigan Articles Of Incorporation For Domestic Nonprofit Corporation?

Have any form from 85,000 legal documents such as Michigan Articles of Incorporation for Domestic Nonprofit Corporation online with US Legal Forms. Every template is drafted and updated by state-accredited lawyers.

If you have already a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Michigan Articles of Incorporation for Domestic Nonprofit Corporation you want to use.

- Look through description and preview the sample.

- When you are confident the template is what you need, click Buy Now.

- Choose a subscription plan that works for your budget.

- Create a personal account.

- Pay out in just one of two appropriate ways: by card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the right downloadable sample. The platform provides you with access to documents and divides them into groups to streamline your search. Use US Legal Forms to obtain your Michigan Articles of Incorporation for Domestic Nonprofit Corporation fast and easy.

Form popularity

FAQ

Contact the Michigan Department of Licensing and Regulatory Affairs for copies, certificates, or general information. Lansing, Michigan 48909-7554.

In many instances, the Secretary of State's office allows businesses to request a copy of their articles of incorporation by phone, or in person. In some instances, a request for copies of incorporation may be initiated by fax, email, or by writing the Secretary of State or Department of State's office.

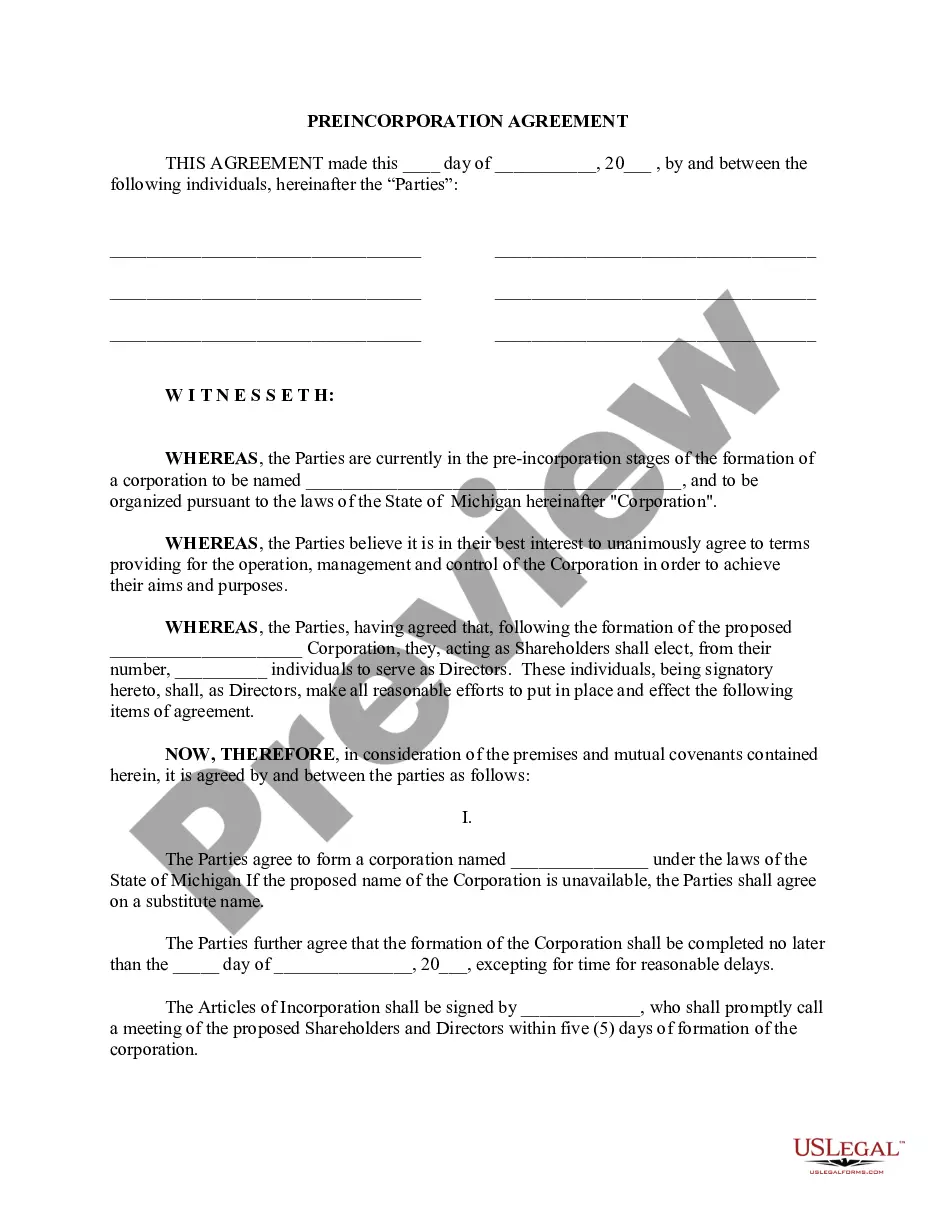

The articles must include the: corporate name; purpose; the number of shares the corporation is authorized to issue (if there is more than one class or series of shares, state the relative rights, preferences, and limitations of the shares of each class); the name and address of agent for service of process; the number

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

Contact the Michigan Department of Licensing and Regulatory Affairs for copies, certificates, or general information. Lansing, Michigan 48909-7554.

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

The nonprofit corporation definition is an organization that is legally incorporated and also recognized by the IRS as tax-exempt based on business activity. The vast majority of nonprofits are classified as 501(c)3 organizations by the IRS. However, that is not the only designation for a nonprofit.

Within the United States, you should find the 501(c)(3) tax code. When determining the nonprofit status of an organization, begin by using the IRS Select Check database. The IRS provides an Exempt Organization List on its website. You can also ask the nonprofit for proof of their status.

501(c)(3) organization. A 501(c)(3) organization is a corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.