Maine Notice to Owner - Corporation or LLC

What is this form?

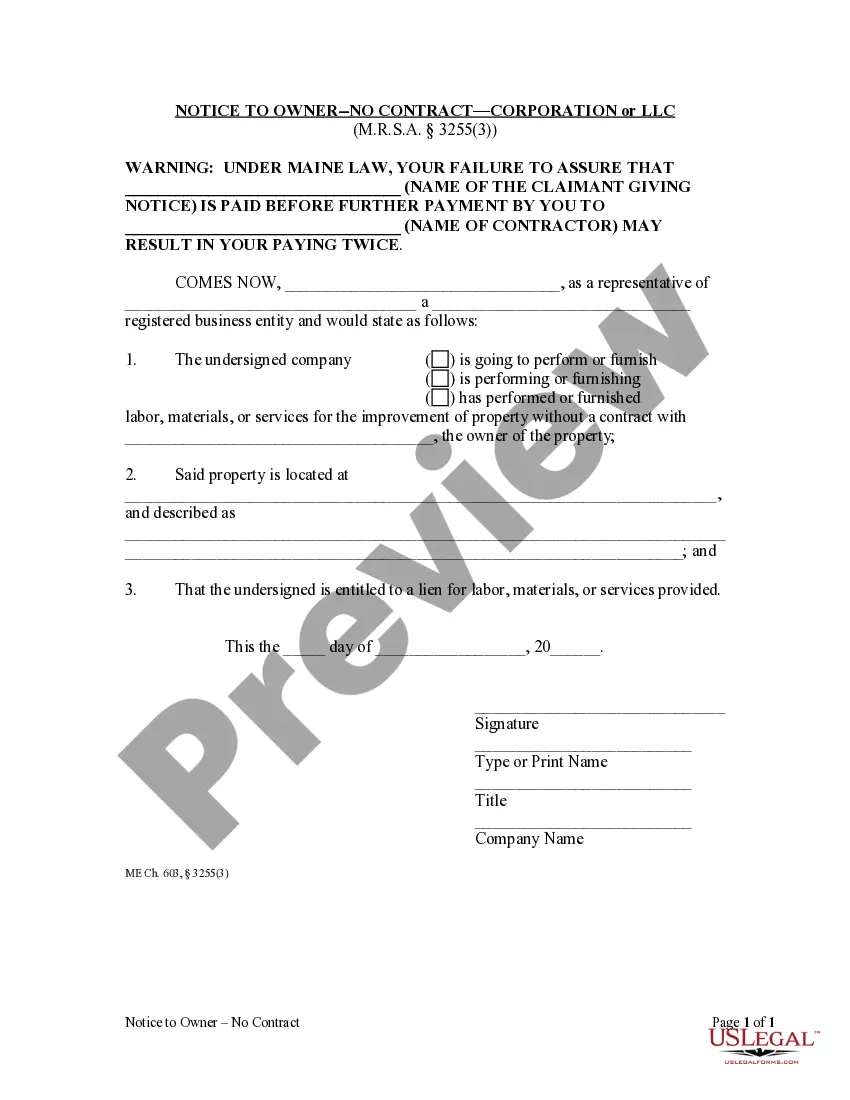

The Notice to Owner - Corporation or LLC is a legal document that serves to inform property owners about the rights of subcontractors who provide labor, materials, or services without a direct contract with the owner. This form is crucial in protecting the interests of subcontractors by ensuring they are compensated for their work, while also alerting property owners to their potential liability for double payment if proper procedures are not followed.

Key components of this form

- Name of the claimant giving notice.

- Name of the contractor performing the work.

- Description of the property where the work is being performed.

Situations where this form applies

This form should be utilized when a corporation or LLC performs work on a property without a formal contract with the property owner. It is specifically important in scenarios where the subcontractor seeks to establish their right to a lien for unpaid work or materials. Property owners should also use this notice to ensure they understand their responsibilities in relation to payments made to the principal contractor.

Who should use this form

- Subcontractors providing labor, materials, or services without a direct contract.

- Corporations or LLCs engaged in construction or improvement projects.

- Property owners who wish to comply with legal requirements regarding subcontractor payments.

How to complete this form

- Identify and enter the name of the claimant (subcontractor).

- Provide the name of the contractor with whom the owner has a contract.

- Specify the exact location and description of the property in question.

- Outline the labor, materials, or services provided.

- Have the designated representative sign the form and print their name and title.

Does this document require notarization?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include all necessary parties' names, which can invalidate the notice.

- Not completing the property description accurately, leading to confusion.

- Ignoring the deadline for filing the notice, which can result in losing lien rights.

Why complete this form online

- Immediate access to the form without needing to visit an office.

- Editable templates that allow for easy customization to fit specific needs.

- Reliability in terms of legal compliance, ensuring adherence to state laws.

Looking for another form?

Form popularity

FAQ

Forming an LLC or a corporation will allow you to take advantage of limited personal liability for business obligations. LLCs are favored by small, owner-managed businesses that want flexibility without a lot of corporate formality. Corporations are a good choice for a business that plans to seek outside investment.

A limited liability company (LLC) is a type of business entity defined by state law. An individual may do business as an LLC in what is called a single-member LLC. A sole proprietorship, on the other hand, is a business owned and operated by one person, but it is neither an LLC nor a corporation.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

The main difference between an LLC and a corporation is that an llc is owned by one or more individuals, and a corporation is owned by its shareholders. No matter which entity you choose, both entities offer big benefits to your business. Incorporating a business allows you to establish credibility and professionalism.

How is a corporation formed? When individuals decide that they wish to form a corporation, they must file articles of incorporation with the Office of the Secretary of State. The articles of incorporation establish the individuals' intent to form the corporation and indicate who is forming the corporation.

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

Can Two LLCs or Companies Have the Same Name? Yes, with some exceptions. When you're forming a corporation or an LLC in a state, the name must be unique to your business within that state. Others can form LLCs and businesses in other states that have the same name as yours.

All states recognize businesses formed as corporations, limited liability companies (LLCs) or partnerships, or variations of these forms. Forming an LLC. An LLC is formed by one or more business people, as owners. The owners, called "members," file Articles of Organization with a state.

An LLC can achieve pass-through taxation status without any of those restrictions. LLCs also offer more income tax choices in how you are taxed. By default, LLCs enjoy pass-through taxation under IRS rules. However, by making an IRS election, you could have your LLC taxed as a C corporation or an S Corporation.