Maryland Renunciation and Disclaimer of Property from Will by Testate

Overview of this form

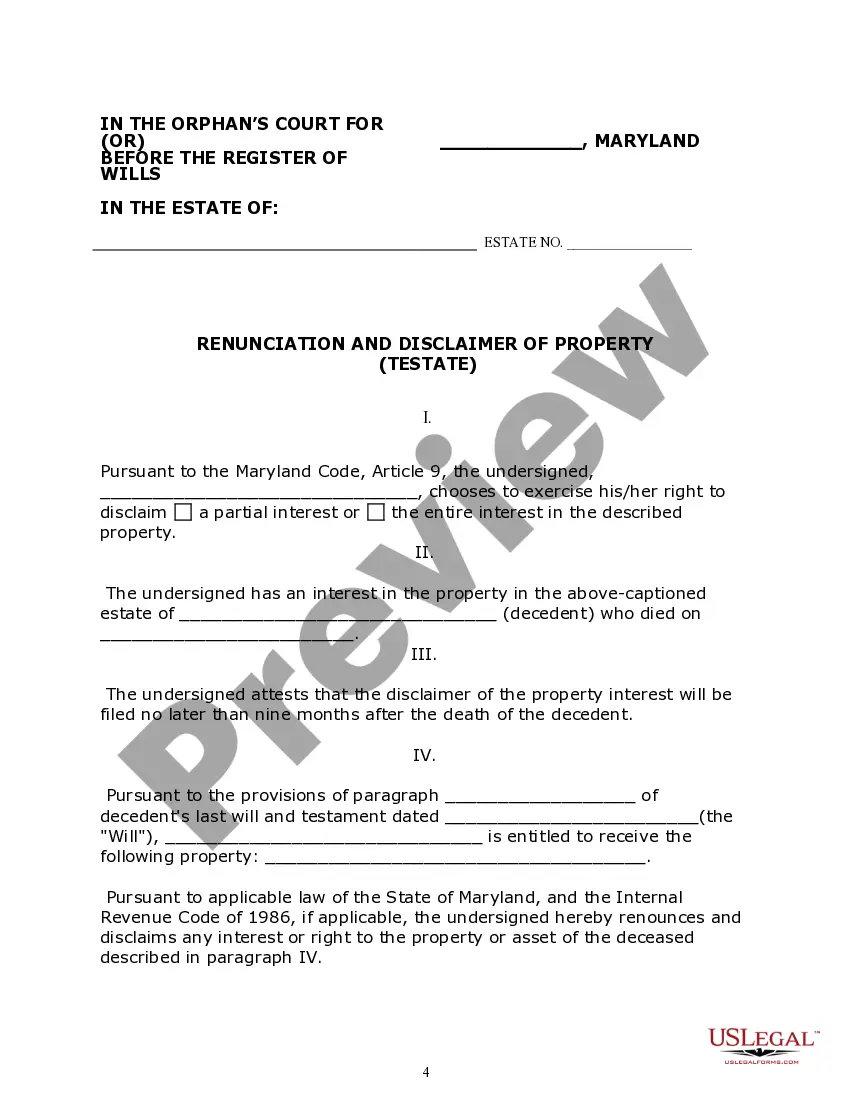

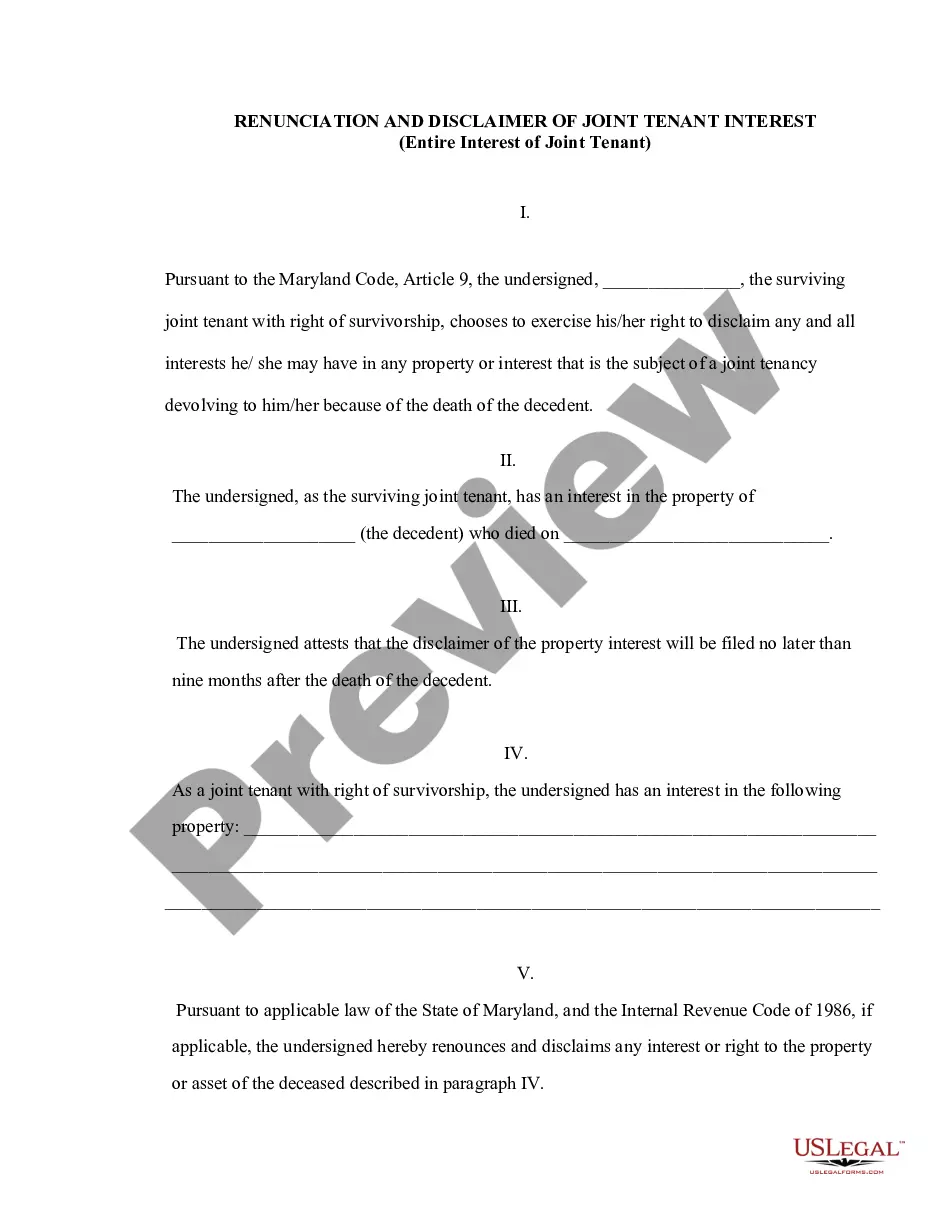

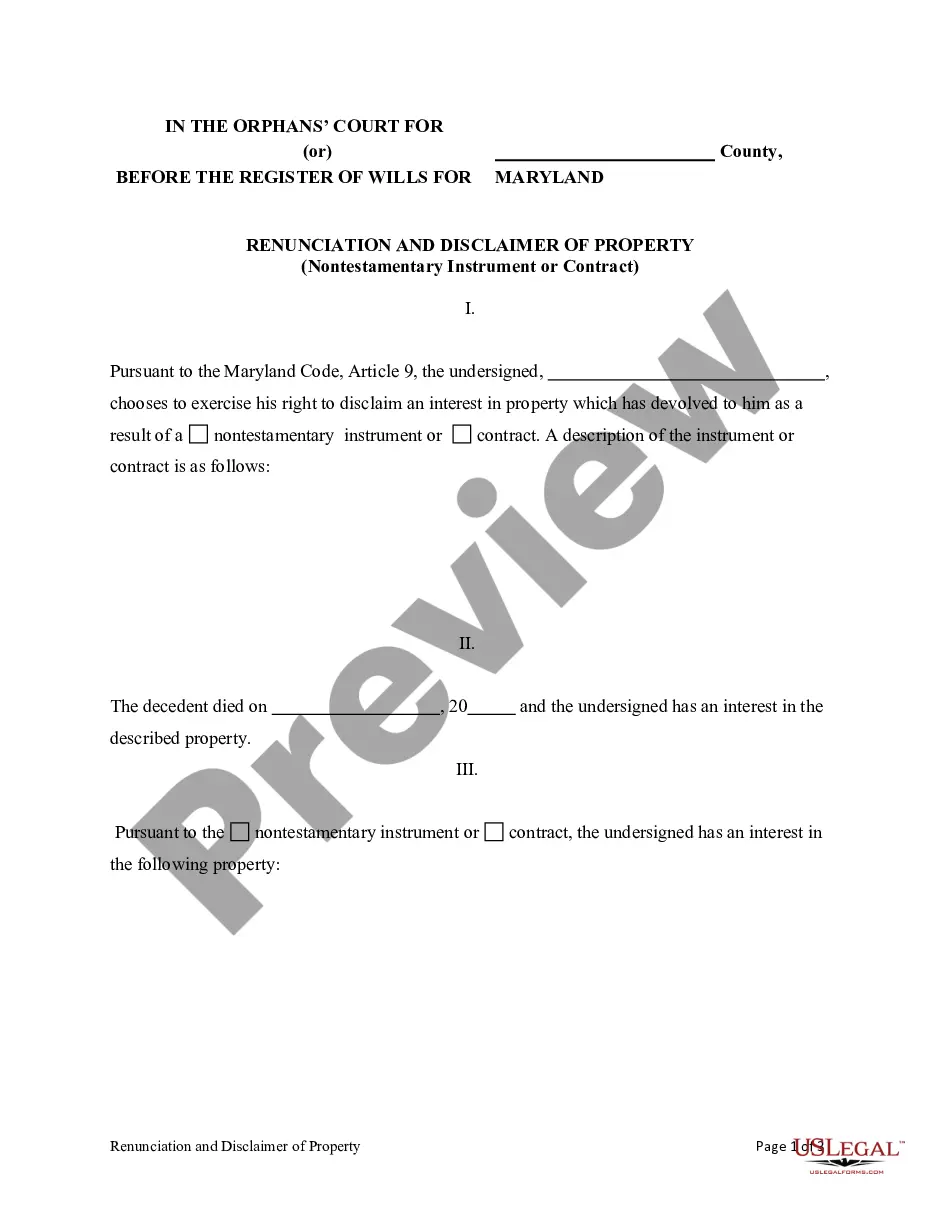

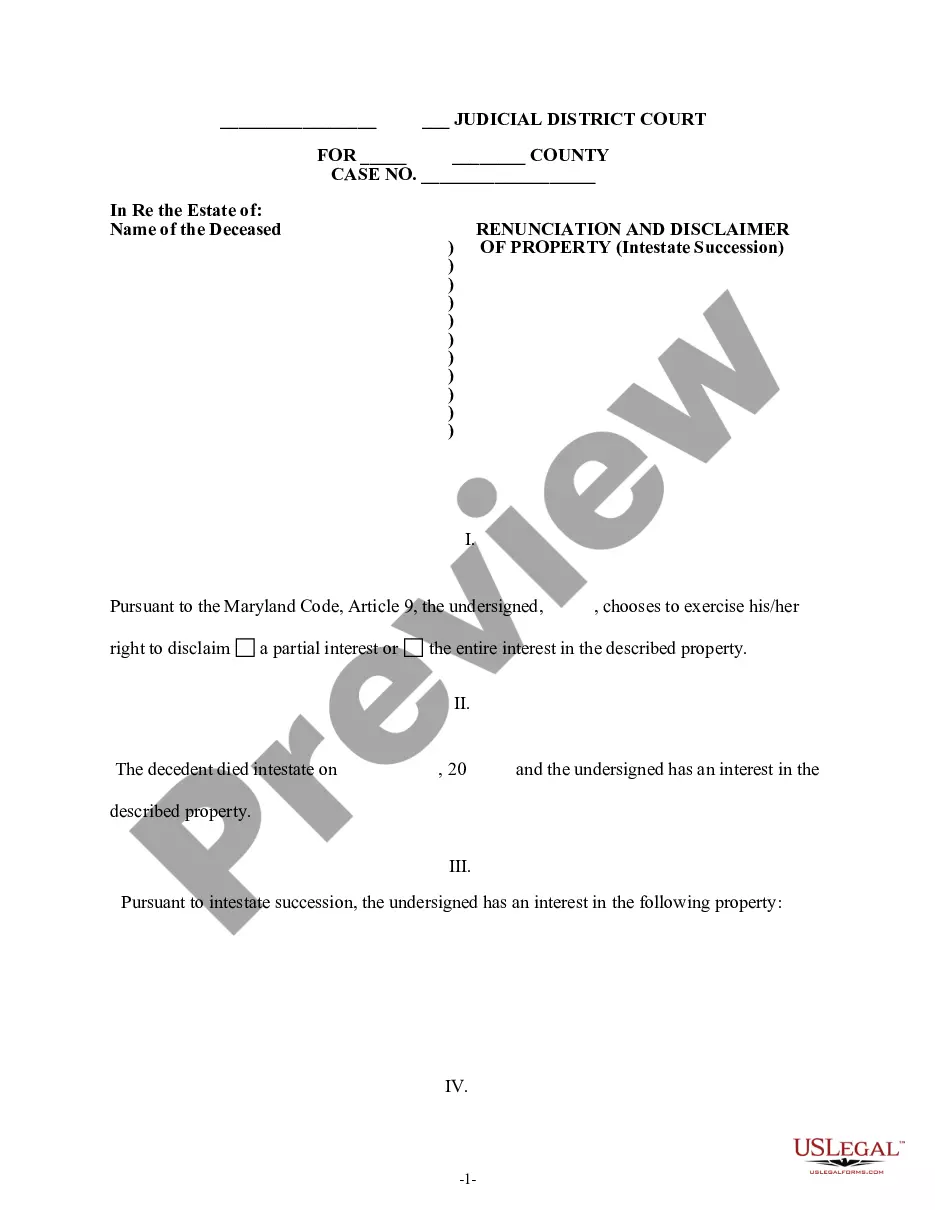

The Maryland Renunciation and Disclaimer of Property from Will by Testate is a legal document allowing a beneficiary to renounce their interest in property received through the last will and testament of a decedent. This form is essential for individuals who wish to disclaim a portion or the entirety of their inheritance, in accordance with Maryland law. By filing this disclaimer, beneficiaries can ensure that the property is redistributed as if they had predeceased the decedent, making it crucial for managing estate distributions appropriately.

What’s included in this form

- Identification of the decedent and the date of death.

- Declaration of the beneficiary's interest in the property.

- Attestation to file the disclaimer within nine months of the decedent's death.

- Specific details about the property being disclaimed.

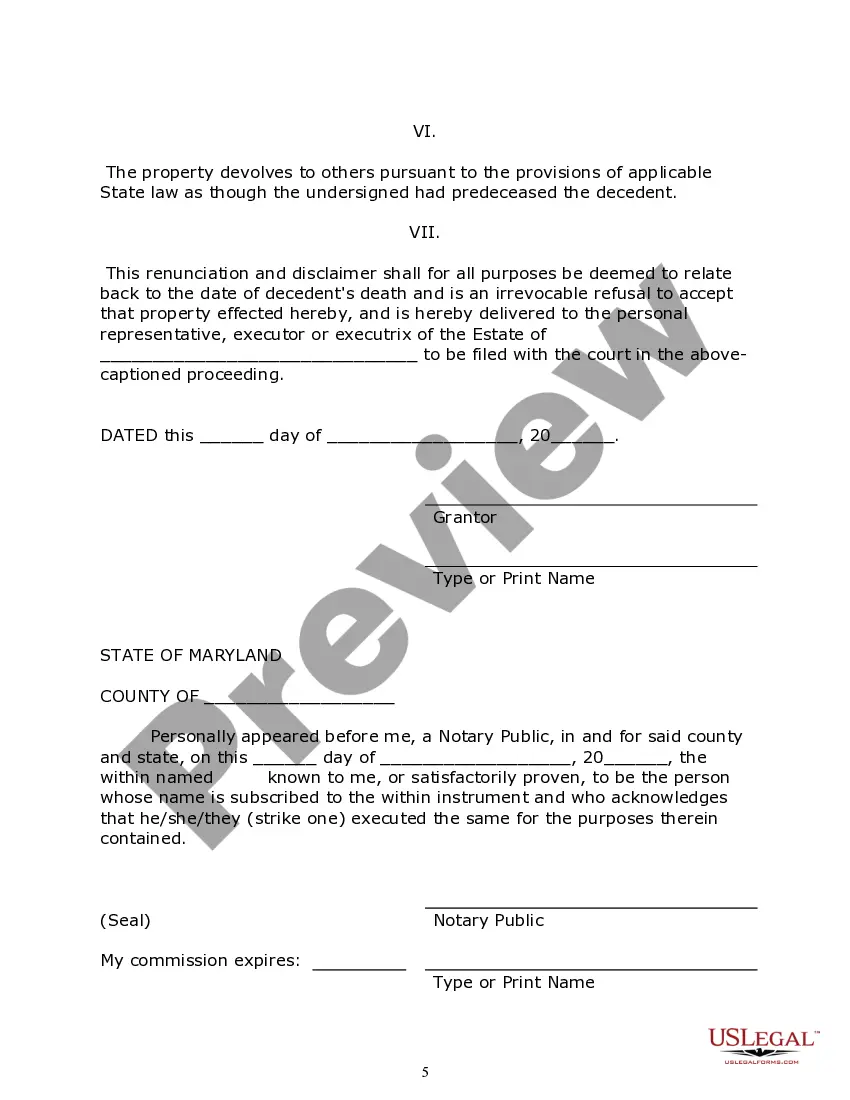

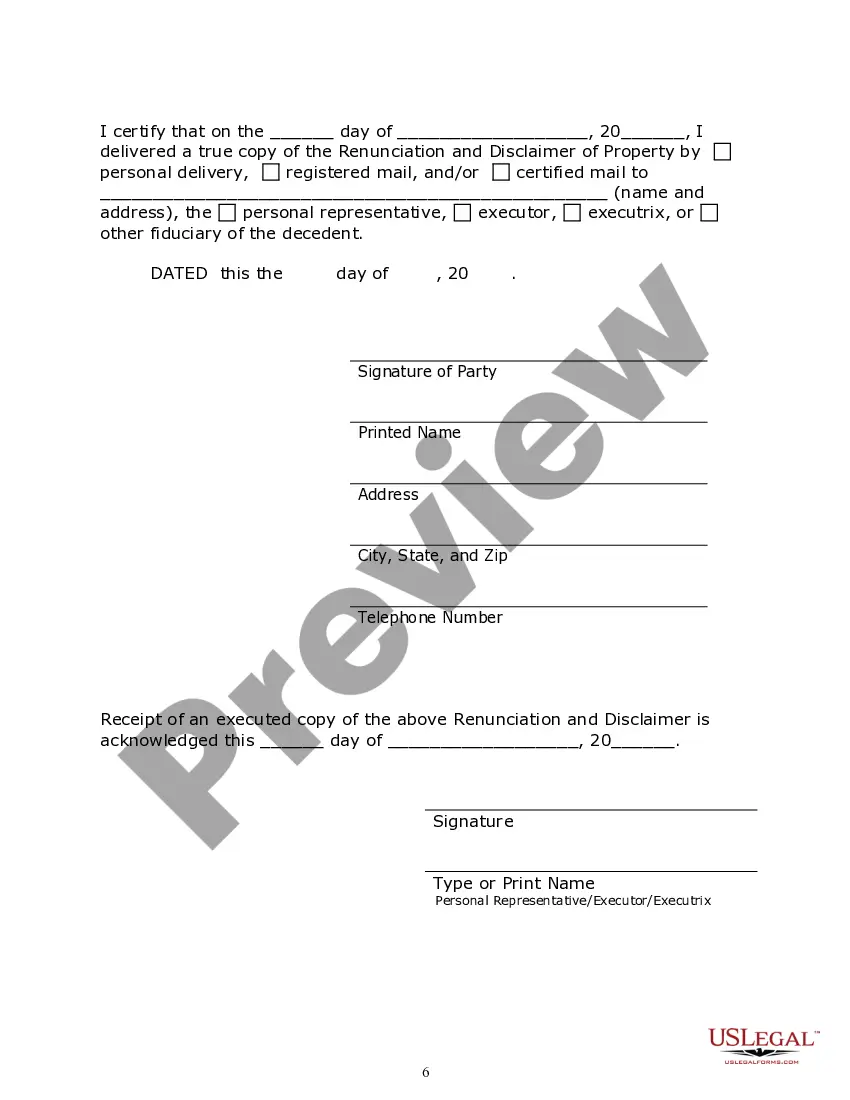

- Signature and acknowledgment section for verification purposes.

When to use this document

This form should be used when a beneficiary receiving property from a decedent's will decides not to accept that inheritance. Common scenarios include situations where accepting the property could lead to tax liabilities or when the beneficiary prefers that the property passes to another heir. Compliance with the nine-month timeline for filing the disclaimer is crucial to ensure its legality and effectiveness.

Intended users of this form

- Beneficiaries named in a decedent's will who wish to disclaim their interest in any property.

- Individuals seeking to redistribute property according to state law.

- Those who prefer not to accept an inheritance due to financial or personal reasons.

How to prepare this document

- Begin by entering the decedent's name and date of death at the top of the form.

- Provide your name as the beneficiary who is renouncing the property.

- Clearly specify the property being disclaimed in the designated section.

- Check the box confirming your intention to file the disclaimer within the required nine-month period.

- Sign and date the form in the appropriate areas to finalize the disclaimer.

Is notarization required?

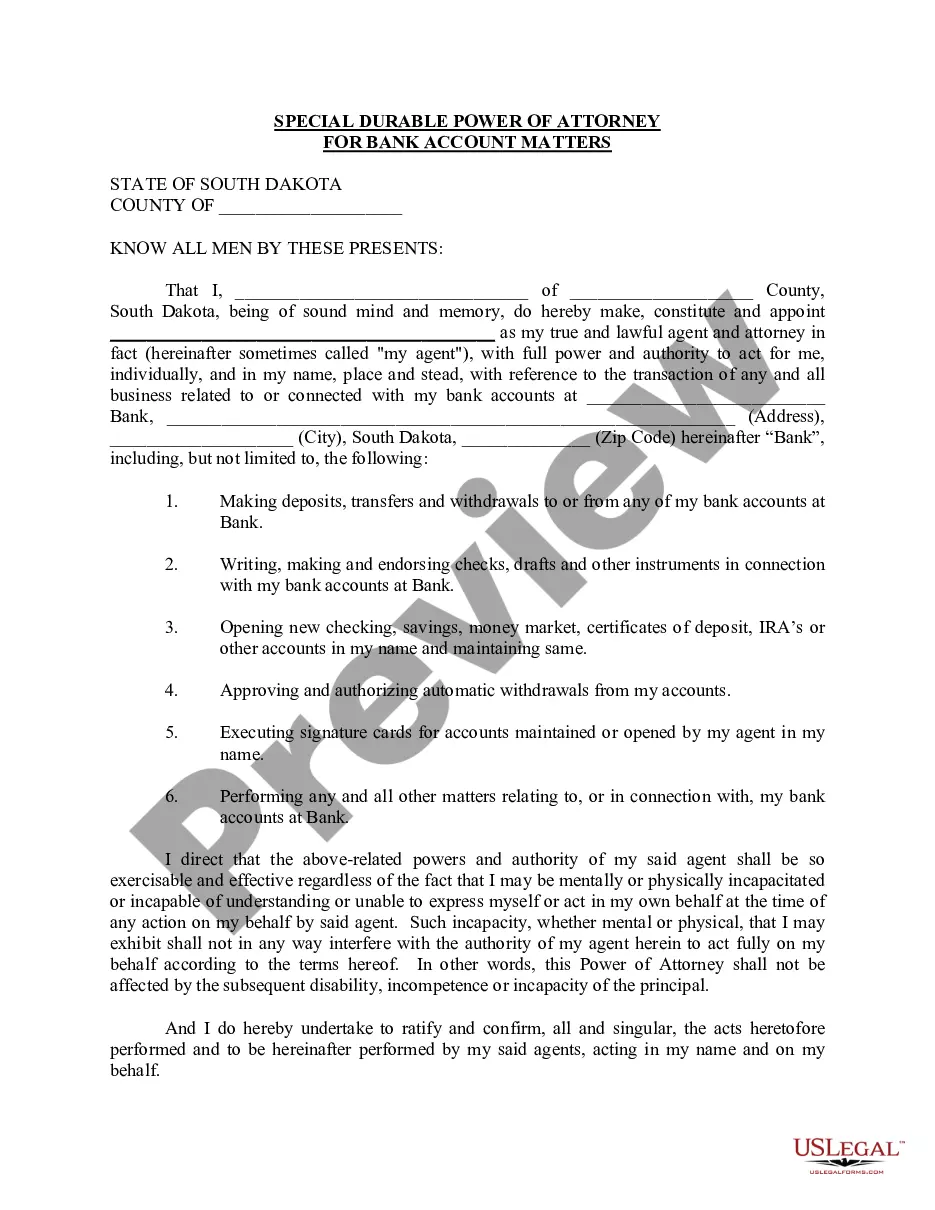

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to file the disclaimer within the nine-month deadline.

- Not providing complete information about the property in question.

- Neglecting to sign or date the form before submission.

- Overlooking the required acknowledgment and certification sections.

Why complete this form online

- Convenient access to downloadable forms that can be completed from anywhere.

- Editable fields allow for straightforward information entry and corrections.

- Reliable format that adheres to legal standards specific to the State of Maryland.

- Immediate processing helps avoid delays in estate administration.

Looking for another form?

Form popularity

FAQ

To transfer property after a parent's death with a will in Maryland, you must first probate the will. This process involves filing the will with the court and appointing an executor to manage the estate. The executor will handle debts, taxes, and ensure that the property is distributed according to the instructions in the will. For those considering the Maryland Renunciation and Disclaimer of Property from Will by Testate, it's important to consult with a legal professional to understand your options.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

Administrative Probate The estate is probated by filing an affidavit (usually a court-provided form) without any hearings or other process. Administrative probate is intended to make closing smaller or simpler estates faster and less expensive than a traditional probate estate.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line. It's not typical for people to disclaim inheritance assets.

1) Petition the court to be the estate representative. 2) Notify heirs and creditors. 3) Change legal ownership of assets. 4) Pay Funeral Expenses, Taxes, Debts and Transfer assets to heirs.

Under Maryland law, Estates & Trusts, the approved Information Report, as submitted to the Register of Wills, typically closes the small estate. If there are any creditors who filed with the Register of Wills any unpaid valid claims could cause the small estate to remain open.

How to Close an Estate in Maryland Probate. Under Maryland law, Estates & Trusts, the final approval of the final account, as submitted to the register of wills, automatically closes the estate.