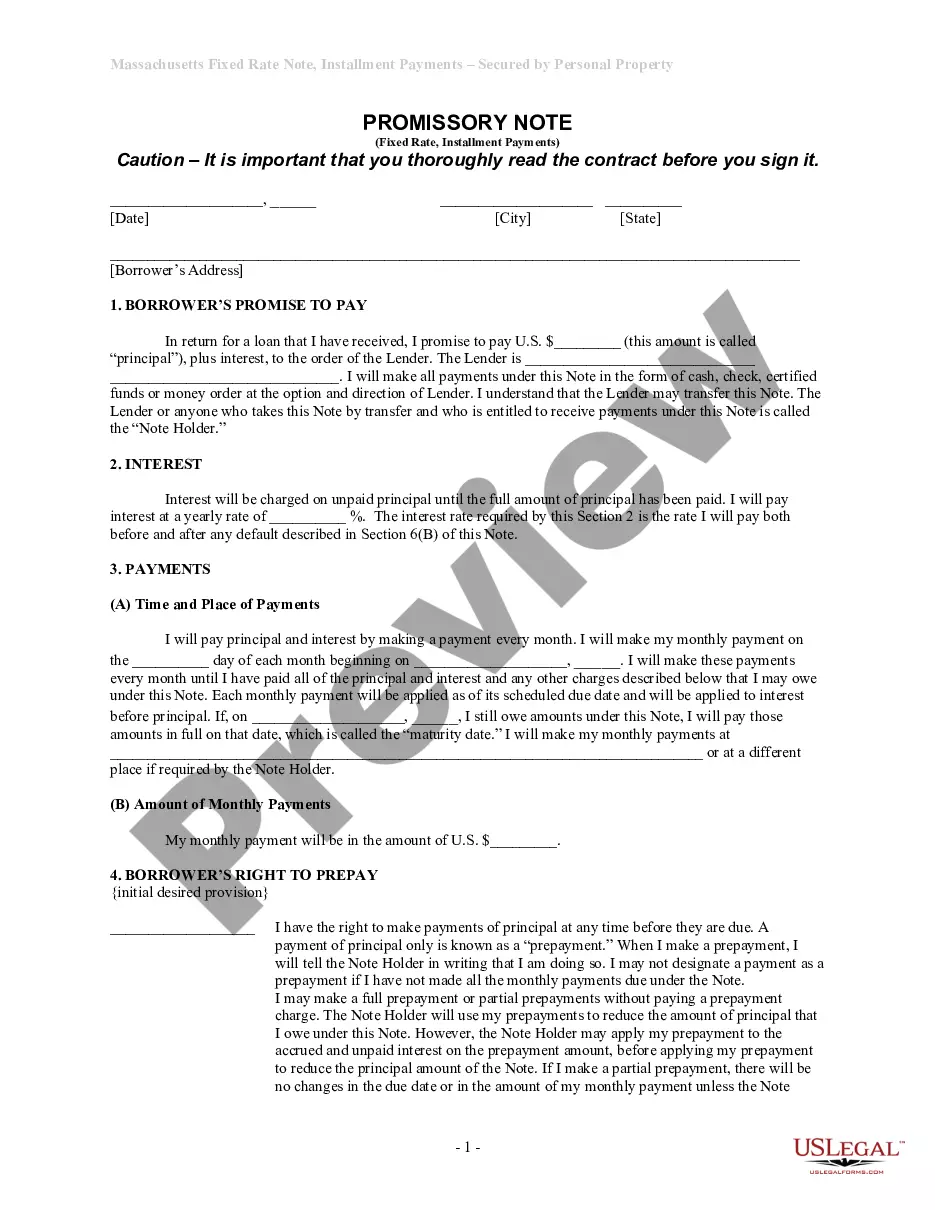

Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate

What is this form?

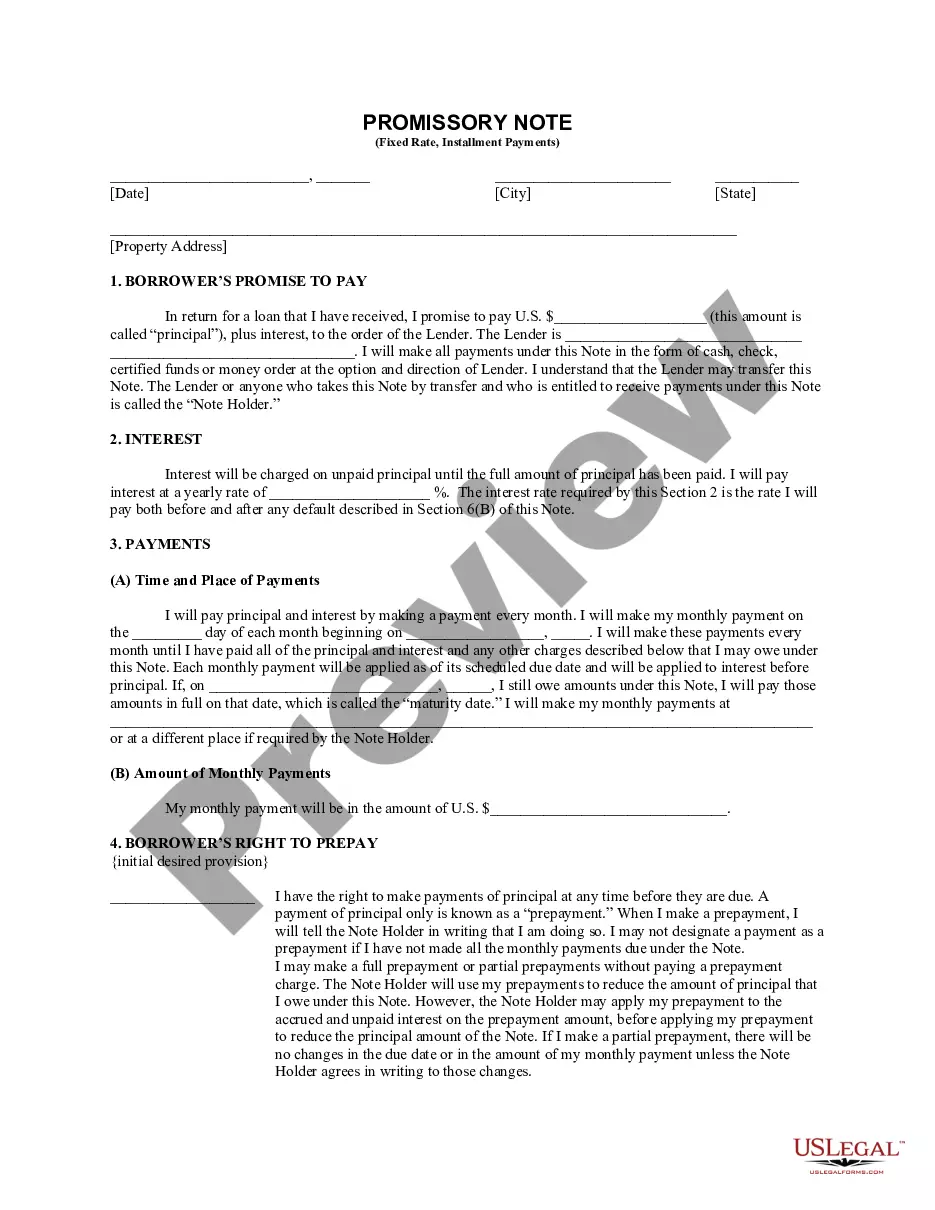

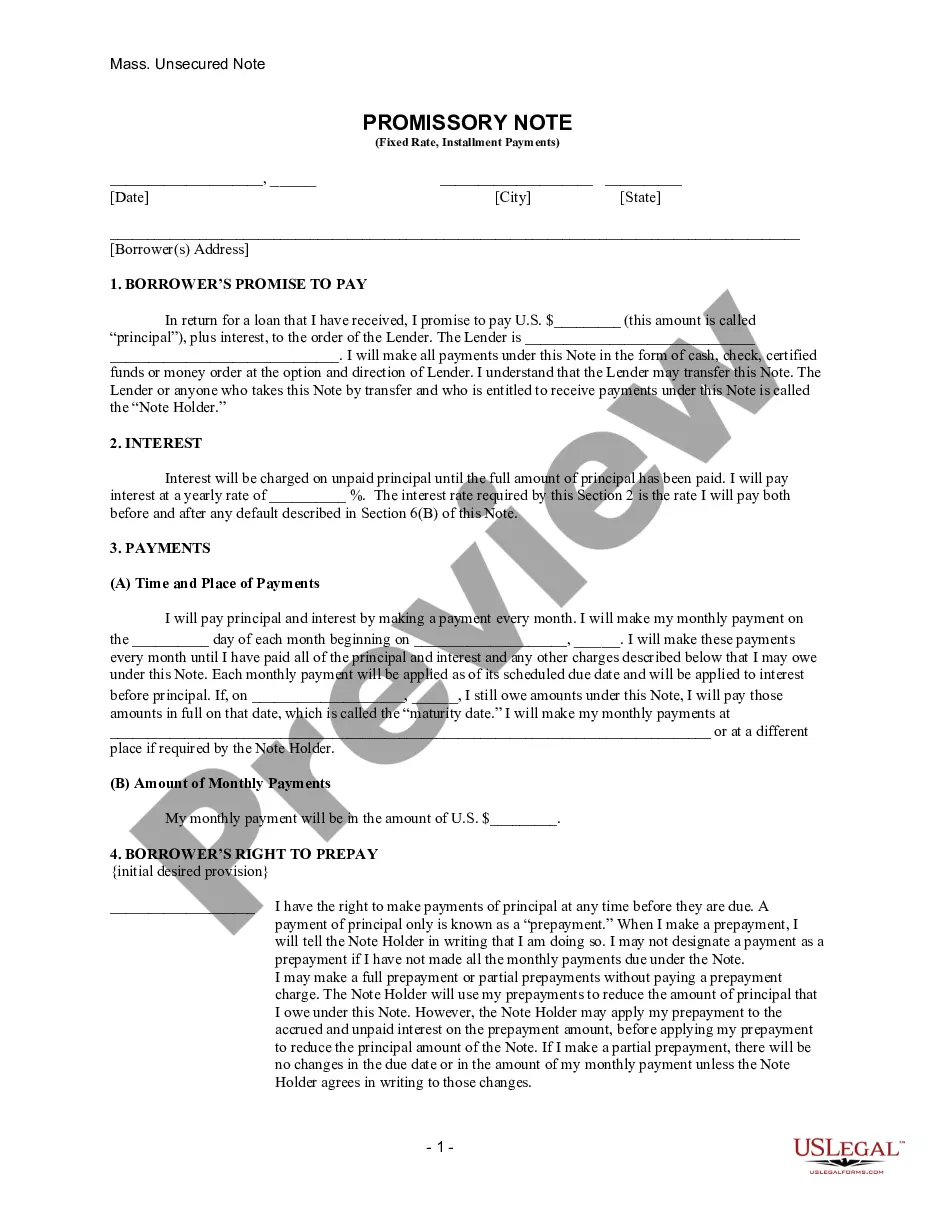

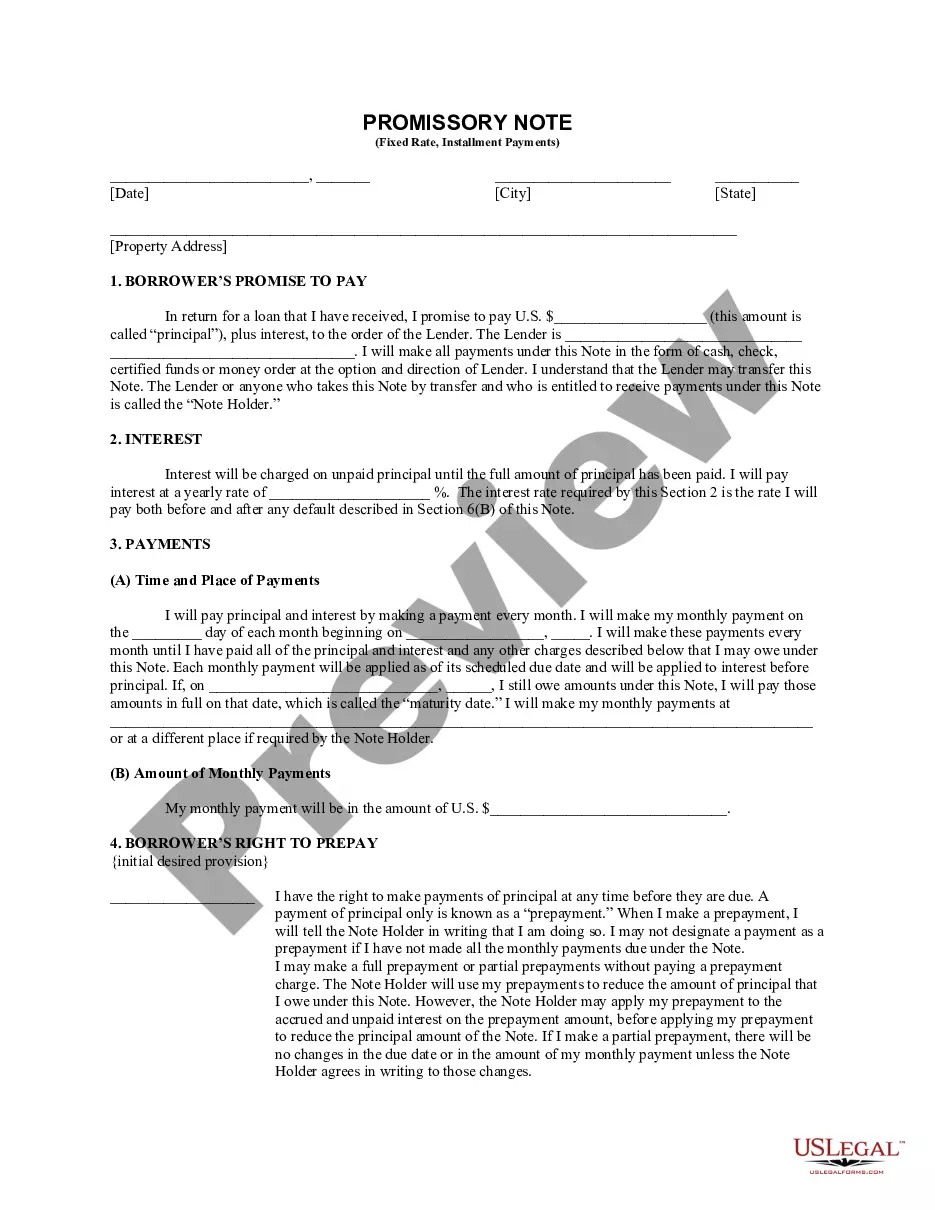

The Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that serves as a written promise for borrowers to pay back a loan secured by residential property. Unlike unsecured loans, this promissory note includes collateral, providing security for the lender. It outlines the terms of repayment, interest rates, and borrower obligations, making it essential for structured loan agreements in residential settings.

Key parts of this document

- Borrower's Promise to Pay: Details the loan amount, lender identity, and payment methods.

- Interest Rate: Specifies the yearly interest rate applicable until the principal is fully paid.

- Payment Schedule: Outlines the frequency and due dates of monthly payments.

- Prepayment Rights: Allows the borrower to repay the loan amount early without significant penalties.

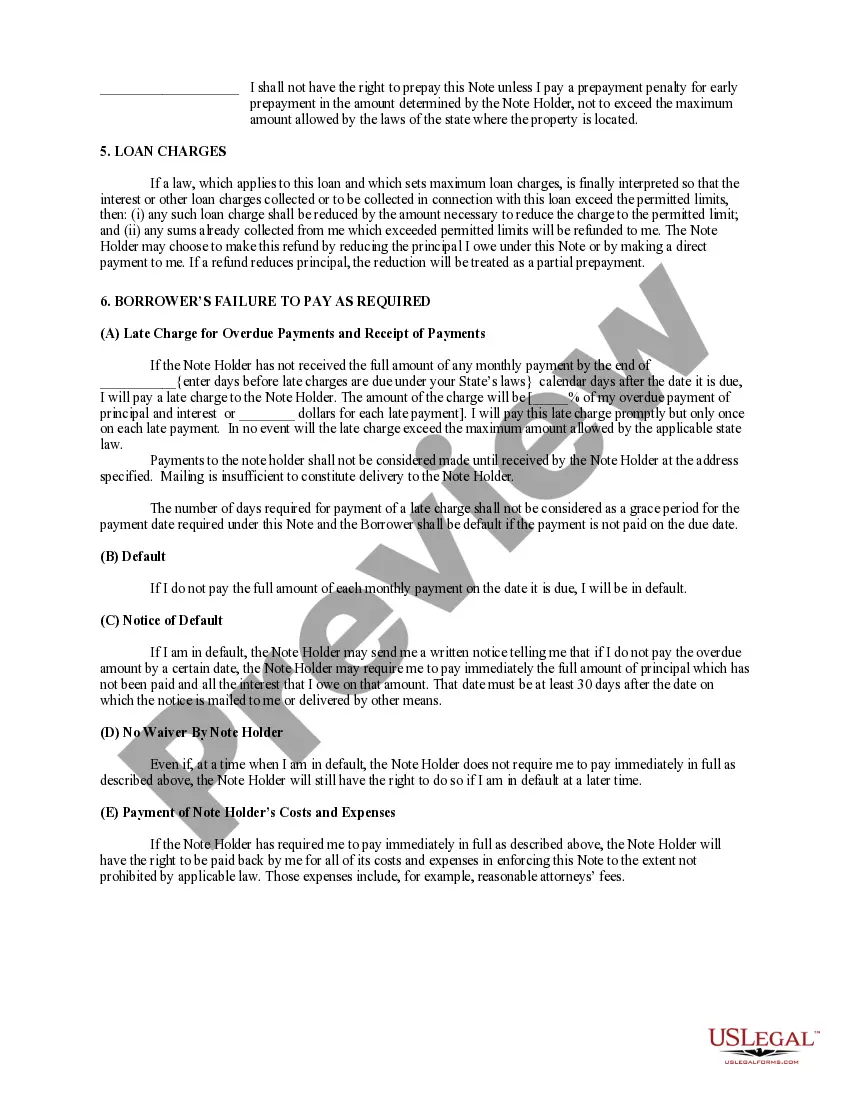

- Default Terms: Defines what constitutes default and the consequences of late payments.

Situations where this form applies

This form is necessary when a borrower secures a loan for purchasing or refinancing residential real estate. Use it when you need a structured repayment plan, especially if you want to offer the property as collateral for added security. It is suitable for both individual borrowers and joint borrowers looking for clarity on their payment obligations and rights.

Who needs this form

This form is intended for:

- Individuals seeking a loan secured against residential property.

- Homeowners refinancing their existing mortgage with a new note.

- Real estate investors needing structured payment terms for property acquisitions.

- Borrowers who prefer a clear legal structure for their loan arrangements.

How to prepare this document

- Identify the parties involved: Fill in the names of the borrower(s) and lender.

- Specify the loan details: Enter the loan amount and interest rate.

- Outline the payment schedule: Specify the monthly payment amount and due dates.

- Include property information: Provide the address of the secured residential property.

- Sign and date the document: Ensure all parties sign the note to make it legally binding.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to enter the correct interest rate or payment amounts.

- Neglecting to specify the property address.

- Not signing the document properly or forgetting to have all parties sign.

- Misunderstanding prepayment rights and terms.

Benefits of using this form online

- Convenience of immediate download for quick use.

- Editability allows customization to fit your specific loan terms.

- Reliability ensures compliance with Massachusetts legal standards.

- Access to attorney-drafted content reduces the risk of errors.

Looking for another form?

Form popularity

FAQ

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

Small businesses frequently borrow money, or extend credit, in the course of their operations. A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.