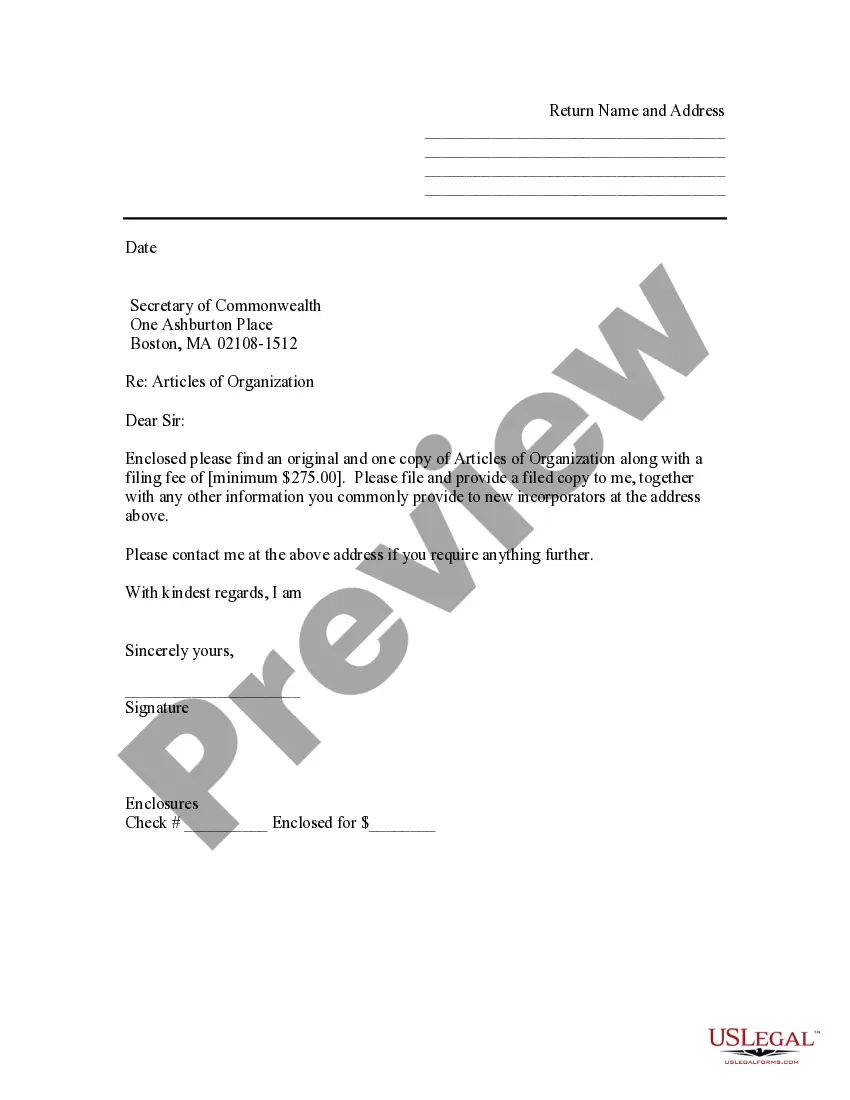

Use this sample letter as a cover sheet to accompany the Articles of Incorporation for filing with the Secretary of State's Office.

Massachusetts Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

Description

How to fill out Massachusetts Sample Transmittal Letter To Secretary Of State's Office To File Articles Of Incorporation?

You are welcome to the greatest legal documents library, US Legal Forms. Right here you will find any sample including Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Massachusetts forms and download them (as many of them as you want/require). Prepare official documents in a several hours, rather than days or weeks, without having to spend an arm and a leg with an attorney. Get your state-specific sample in clicks and be confident knowing that it was drafted by our accredited legal professionals.

If you’re already a subscribed consumer, just log in to your account and click Download near the Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Massachusetts you want. Because US Legal Forms is online solution, you’ll always have access to your saved templates, regardless of the device you’re using. Find them in the My Forms tab.

If you don't come with an account yet, what exactly are you awaiting? Check out our guidelines below to start:

- If this is a state-specific sample, check its applicability in the state where you live.

- See the description (if readily available) to understand if it’s the proper example.

- See far more content with the Preview function.

- If the sample meets your requirements, just click Buy Now.

- To make your account, select a pricing plan.

- Use a card or PayPal account to join.

- Download the template in the format you need (Word or PDF).

- Print out the file and complete it with your/your business’s info.

After you’ve completed the Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation - Massachusetts, send out it to your lawyer for verification. It’s an extra step but an essential one for making certain you’re totally covered. Become a member of US Legal Forms now and get a large number of reusable samples.

Form popularity

FAQ

Do the Articles of Organization need to be notarized? Some states require that you have your Articles of Organization documents notarized. For your state's notarization requirements, choose your state from the drop-down list above.

Submit your articles of incorporation to the Office of the Judge of Probate in the county where the corporation's initial registered office is located. You must submit a packet containing the original articles of incorporation (also called Certificate of Formation), two copies, and the Certificate of Name Reservation.

The State of Massachusetts requires you to file an annual report for your LLC. You can mail in the report or complete it online at the Corporations Division website. You'll need a customer ID number and PIN to access the online form.

All foreign and domestic corporations registered in Massachusetts are required to file an annual report with the Secretary of the Commonwealth within two and one-half months after the close of their fiscal year. To learn about the various types of corporations select here.

Step 1: Get Your Certificate of Organization Forms. You can download and mail in your Massachusetts Certificate of Organization, OR you can file online. Step 2: Fill Out the Certificate of Organization. Step 3: File the Certificate of Organization.

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.

The State of Massachusetts requires you to file an annual report for your LLC. You can mail in the report or complete it online at the Corporations Division website.

How to File Your Annual Report. If you do need to file an annual report for your LLC or corporation, you can normally do so online, through your state's website. In addition to filing your annual report, you will also need to pay a fee These fees do vary from state to state and could range between $50 and $400.