Massachusetts Limited Liability Company LLC Operating Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts Limited Liability Company LLC Operating Agreement?

Greetings to the finest archive of legal paperwork, US Legal Forms. Here, you can discover any template, including Massachusetts Limited Liability Company LLC Operating Agreement forms and save as many as you desire or need.

Prepare official documents in a matter of hours, instead of days or weeks, all without expending a fortune on a lawyer.

Obtain your state-specific template with just a few clicks and have confidence in the knowledge that it was crafted by our experienced attorneys.

To create an account, choose a payment plan. Utilize a credit card or PayPal account for registration. Save the document in your preferred format (Word or PDF). Print the document and fill it with your or your business’s information. Once you’ve completed the Massachusetts Limited Liability Company LLC Operating Agreement, submit it to your attorney for verification. It’s an additional step, but a crucial one to ensure you’re fully protected. Register for US Legal Forms today and access thousands of reusable templates.

- If you are already a subscribed customer, simply Log In to your profile and then click Download next to the Massachusetts Limited Liability Company LLC Operating Agreement you need.

- As US Legal Forms is an online service, you will typically have access to your saved documents, regardless of the device you are utilizing.

- Find them in the My documents section.

- If you do not yet have an account, what are you waiting for.

- Review our instructions below to get started.

- If this is a form specific to your state, verify its legitimacy in your residing state.

- Read the description (if available) to determine if it’s the appropriate template.

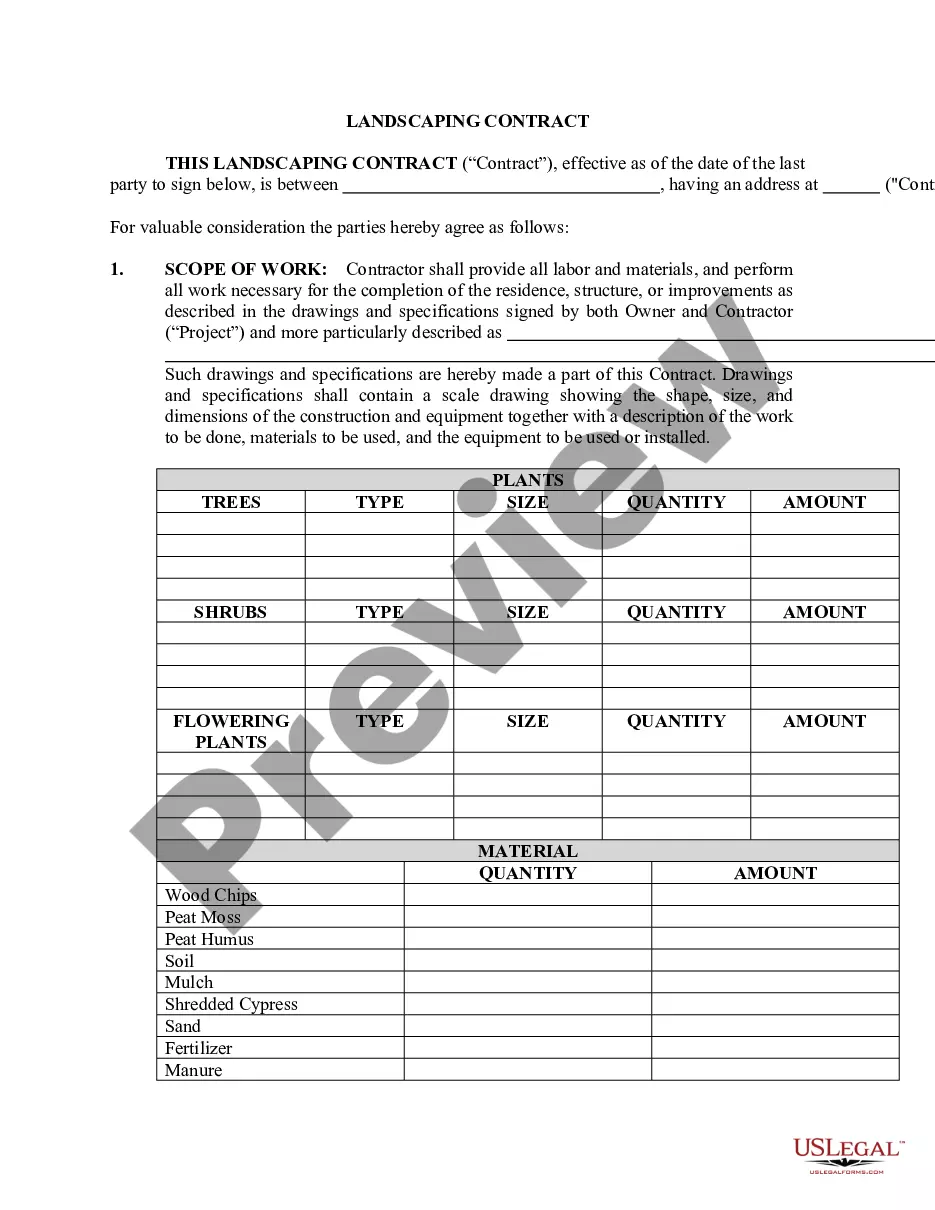

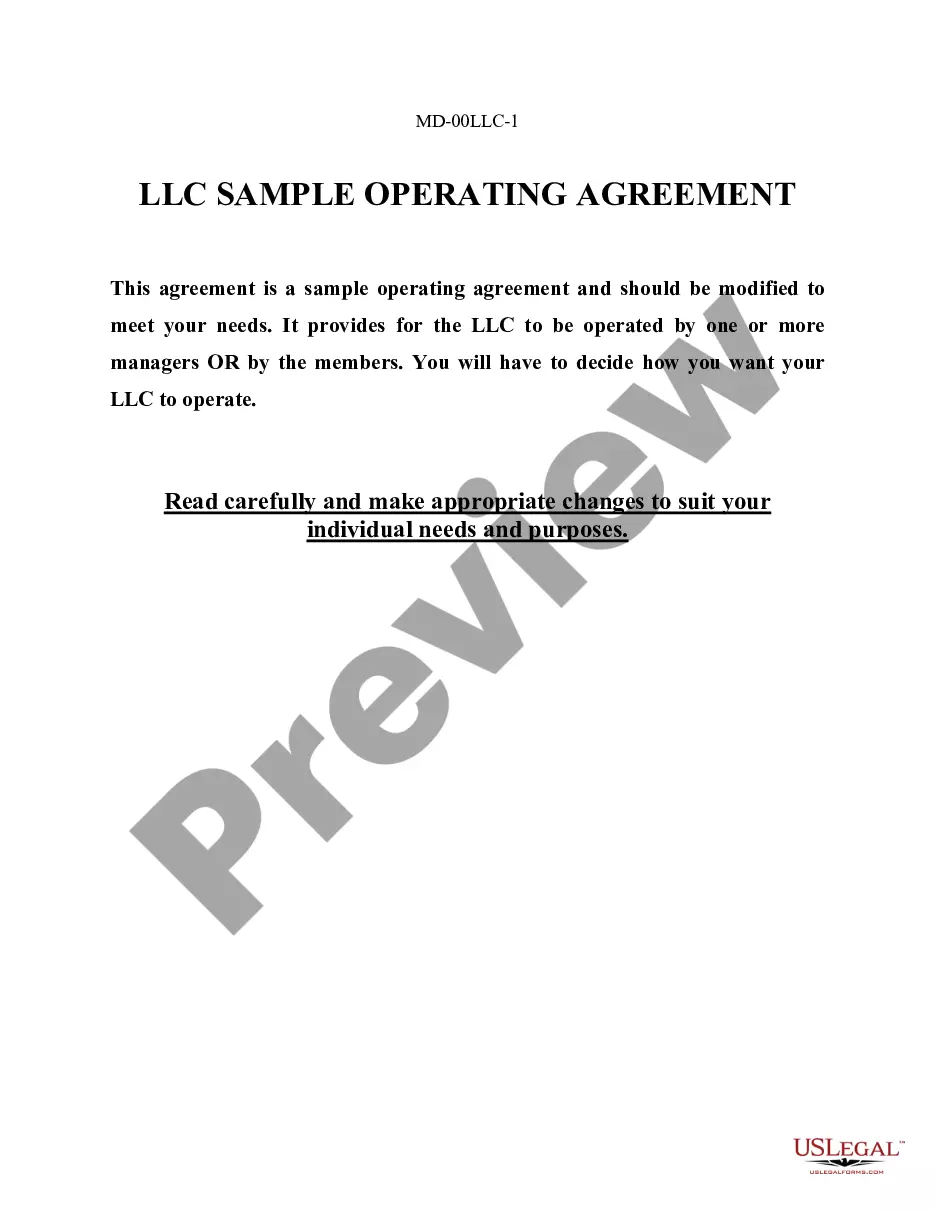

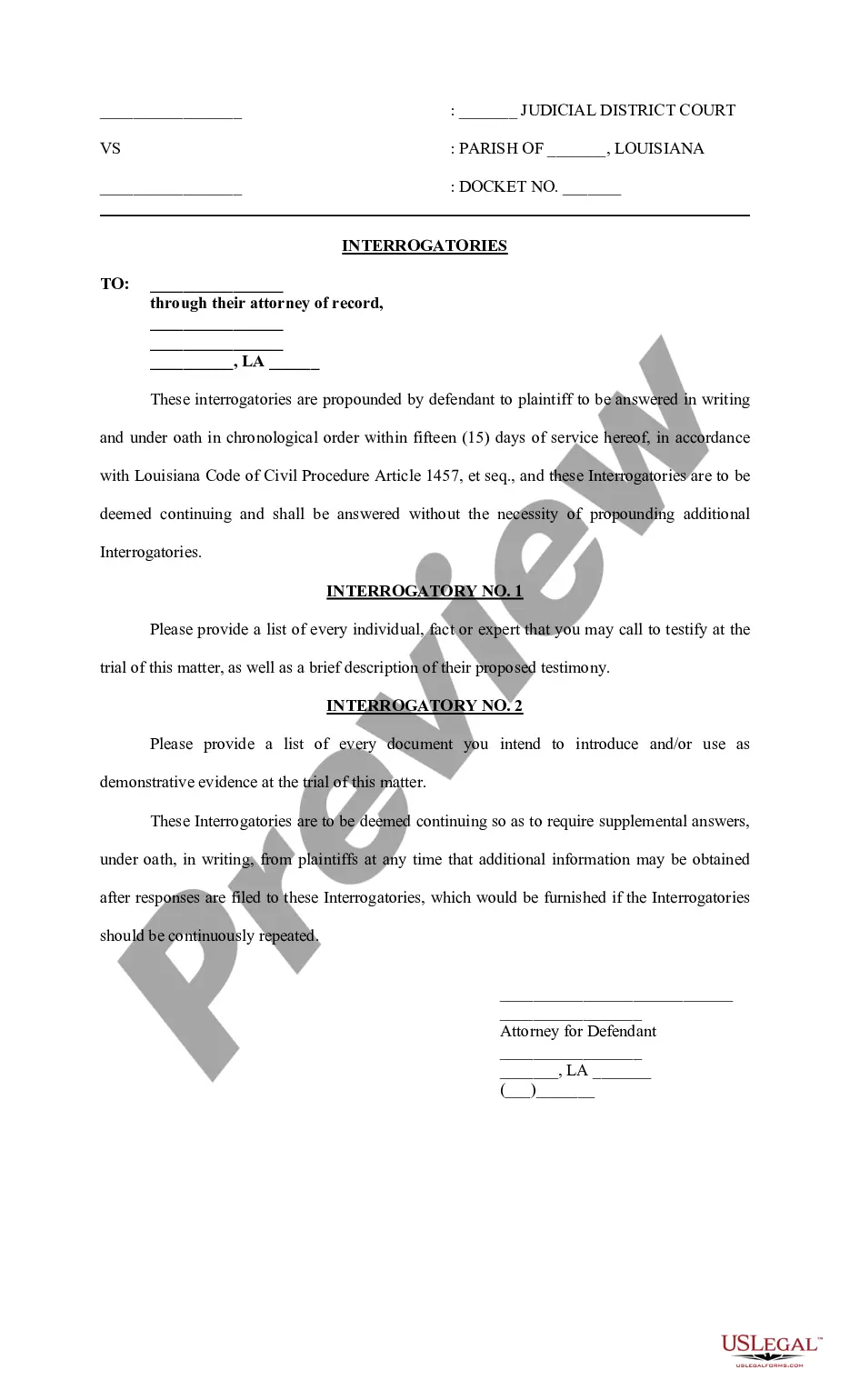

- Examine more details using the Preview function.

- If the template fulfills all your requirements, click Buy Now.

Form popularity

FAQ

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

A limited liability company can choose to have officers in charge of everyday operations, but is not required to do so. Officers will serve under either members in the LLC or managers in the LLC. Managers or members can also be officers.

Call, write or visit the secretary of state's office in the state in which the LLC does business. Call, email, write or visit the owner of the company for which you want to see the LLC bylaws or operating agreement.

Pursuant to California Corporation's Code §17050, every California LLC is required to have an LLC Operating Agreement. Next to the Articles of Organization, the LLC Operating Agreement is the most important document in the LLC.

An LLC can be structured to be taxed in the same manner as a partnership however the owners or partners of a partnership are jointly and severally liable for the debts and obligations of the partnership.The operating agreement is a separate document and is an agreement between the owners of the LLC.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.