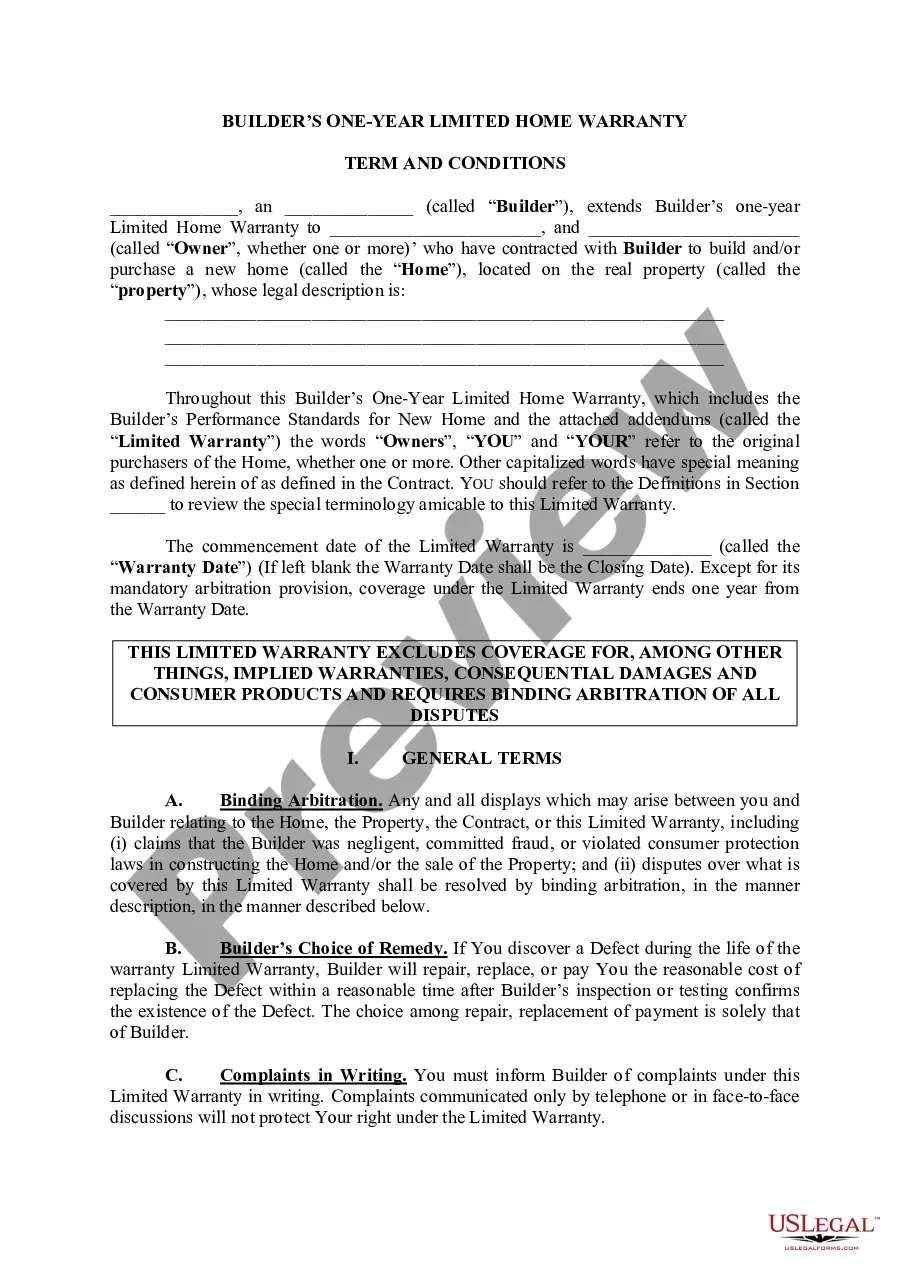

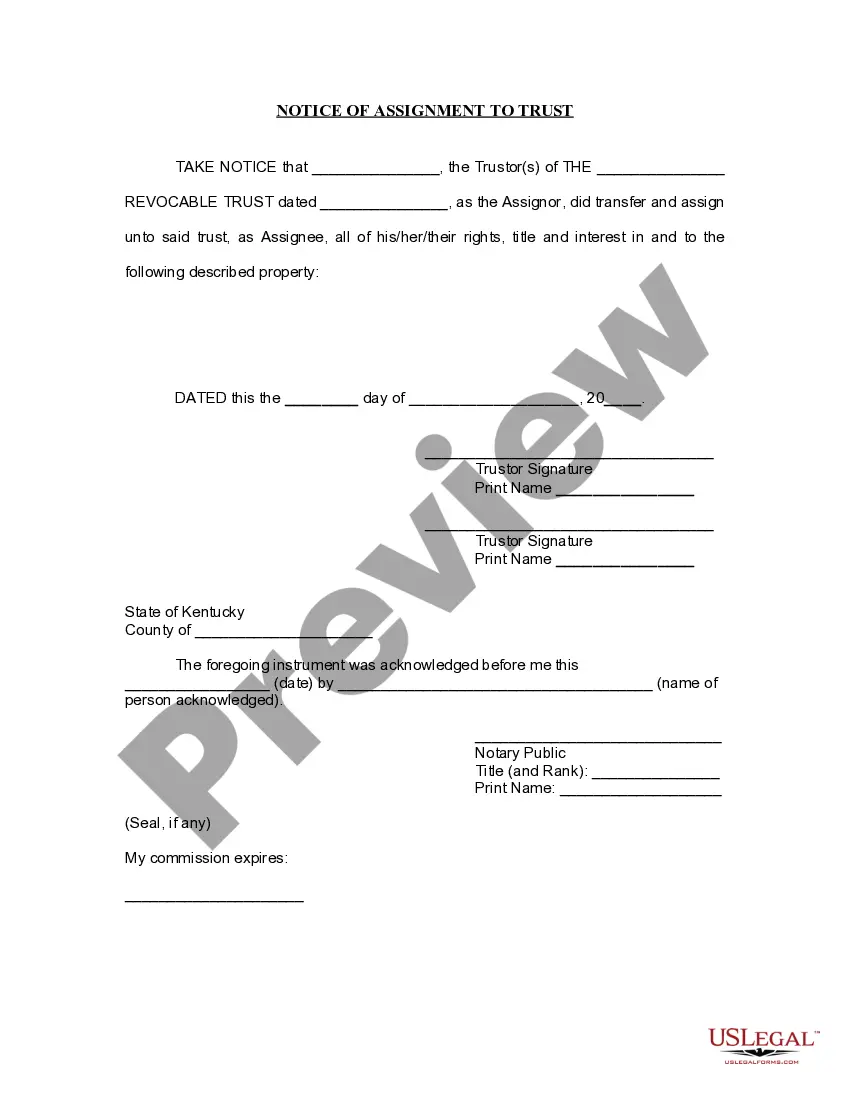

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Kentucky Notice of Assignment to Living Trust

Description

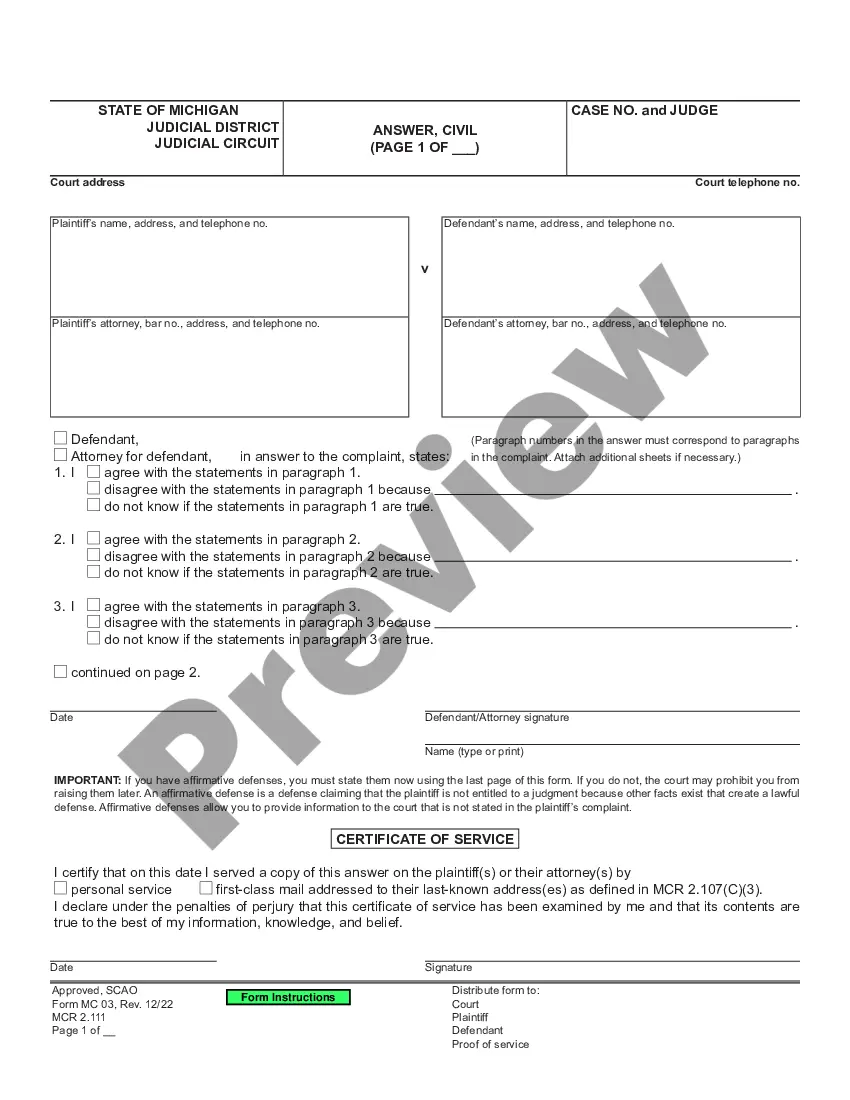

How to fill out Kentucky Notice Of Assignment To Living Trust?

Searching for Kentucky Notice of Assignment to Living Trust samples and completing them can be rather difficult.

To conserve significant amounts of time, money, and effort, utilize US Legal Forms to locate the suitable template tailored to your state in just a few clicks.

Our legal experts prepare each document, so you only need to complete them. It truly is that simple.

Click Buy Now if you found what you're looking for. Select your plan on the pricing page and set up your account. Choose your payment method with a credit card or via PayPal. Save the sample in your preferred format. You may print the Kentucky Notice of Assignment to Living Trust form or fill it out using any online editing tool. There’s no need to worry about making errors, as your form can be utilized and submitted, and printed as many times as you like. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the template.

- Your saved templates are kept in My documents and are accessible at any time for further use later.

- If you haven’t signed up yet, you need to register.

- Review our comprehensive instructions on how to obtain the Kentucky Notice of Assignment to Living Trust template in just a few minutes.

- To acquire a qualified form, verify its relevance for your state.

- Examine the form using the Preview feature (if it’s available).

- If there's a description, read it to understand the details.

Form popularity

FAQ

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

List Your Assets and Decide Which You'll Include in the Trust. Gather the Paperwork. Decide Whether You Will Be the Sole Grantor. Choose Beneficiaries. Choose a Successor Trustee. Choose Someone to Manage Property for Minor Children. Prepare the Trust Document. Sign and Notarize.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

Make a List of All Your Assets. Be sure to include make a list of your assets that includes everything you own. Find the Paperwork for Your Assets. Choose Beneficiaries. Choose a Successor Trustee. Choose a Guardian for Your Minor Children.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.