Kentucky Notice to Owner - Individual

Overview of this form

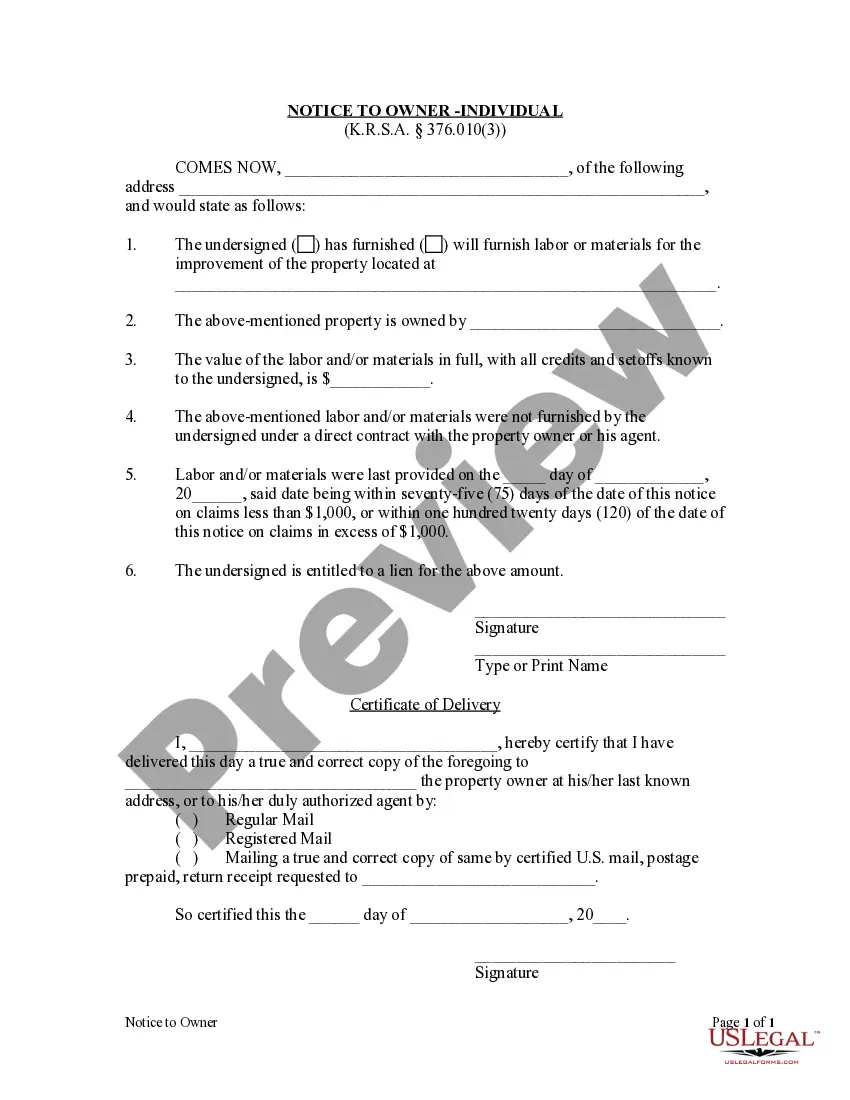

The Notice to Owner - Individual is a legal document used by a lien claimant who has not contracted directly with the property owner. Its primary purpose is to provide notice to the property owner that the claimant has provided labor or materials for the improvement of a specific property. Unlike other notices, this form is crucial for lien claimants seeking to enforce their right to file a lien, ensuring that the property owner is aware of any potential claims against their property.

Main sections of this form

- Identification of the lien claimant and their address.

- Details about the labor or materials provided for property improvements.

- Ownership information, including the name of the property owner.

- Value of the labor and materials provided.

- Certification of the notice delivery to the property owner or authorized agent.

Situations where this form applies

This form should be used when a contractor, supplier, or subcontractor has provided labor or materials to a property but does not have a direct contract with the property owner. It is essential to send this notice within the specified time frames: seventy-five days for claims under $1,000 and one hundred twenty days for claims exceeding $1,000. Failure to provide this notice could result in losing the right to file a lien against the property.

Who needs this form

- Contractors who have provided labor or materials but lack a direct contract with the property owner.

- Suppliers of materials or subcontractors who worked on a property without a direct agreement with the property owner.

- Individuals or companies seeking to protect their right to file a lien in the event of non-payment.

How to prepare this document

- Identify the lien claimant by entering their name and address in the designated fields.

- Specify the property being improved, including its address.

- Indicate the value of the labor and/or materials provided.

- Document the last date labor or materials were provided to ensure compliance with the notice period.

- Sign the form and provide your printed name in the appropriate sections.

- Certify that the notice was delivered to the property owner or their agent by selecting the delivery method and completing the certificate of delivery.

Is notarization required?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to send the notice within the required time frame.

- Not providing accurate property details or value estimates.

- Omitting the proper mailing method or failing to complete the certificate of delivery.

- Not signing the form or missing to include the printed name.

Why use this form online

- Convenience of downloading the form anytime from any location.

- Editable format allows for easy customization to suit specific needs.

- Access to attorney-drafted forms ensures legal compliance and accuracy.

Looking for another form?

Form popularity

FAQ

Colorado does not require lien waivers to be notarized in order to be effective.

A lien waiver is signed before a lien is actually filed. The party submitting the lien waiver states that they waive the right to lien against the project. In some instances, the property owner or general contractor may request that you sign and deliver a lien waiver before payment is disbursed.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

A lien waiver is quite common in the construction business. Essentially, it is a document from a contractor, subcontractor, supplier, or another party who holds a mechanic's lien that states they have been paid in full and waive future lien rights to the disputed property.

How much does it cost to file a mechanics lien in Kentucky? As of January 1, 2020, the cost to file a mechanics lien with a county recorder in Kentucky is $46 for the first 5 pages, and $3 for each page thereafter.

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

LIen waivers are not required to be notarized. The primary times that a document needs to be notarized is if it is going to be filed with the county recorder or it is an affidavit. There are some other documents that often use notarization, but lien waivers don't fall into any of those that "need to be notarized."