General Durable Power of Attorney for Property and Finances or Financial Effective upon Disability

Power of Attorney and Health Care - General - Kansas

As used in the Kansas power of attorney act:

(a) Attorney in fact means an individual, corporation or other legal entity appointed to act as agent of a principal in a written power of attorney.

(b) Court means the district court.

(c) Disabled means a person who is wholly or partially disabled as defined in K.S.A. 77-201, and amendments thereto, or a similar law of the place having jurisdiction of the person whose capacity is in question.

(d) Durable power of attorney means a written power of attorney in which the authority of the attorney in fact does not terminate in the event the principal becomes disabled or in the event of later uncertainty as to whether the principal is dead or alive and which complies with subsection (a) of K.S.A. 2003 Supp. 58-652, and amendments thereto, or is durable under the laws of any of the following places:

(1) The law of the place where executed;

(2) the law of the place of the residence of the principal when executed; or

(3) the law of a place designated in the written power of attorney if that place has a reasonable relationship to the purpose of the instrument.

(e) Legal representative means a decedent's personal representative, a guardian or a conservator.

(f) Nondurable power of attorney means a written power of attorney which does not meet the requirements of a durable power of attorney.

(g) Person means an adult individual, corporation or other legal entity.

(h) Personal representative means a legal representative as defined in K.S.A. 59-102, and amendments thereto.

(i) Power of attorney means a written power of attorney, either durable or nondurable.

(j) Principal's family means the principal's parent, grandparent, uncle, aunt, brother, sister, son, daughter, grandson, granddaughter and their descendants, whether of the whole blood or the half blood, or by adoption, and the principal's spouse, stepparent and stepchild.

(k) Third person means any individual, corporation or legal entity that acts on a request from, contracts with, relies on or otherwise deals with an attorney in fact pursuant to authority granted by a principal in a power of attorney and includes a partnership, either general or limited, governmental agency, financial institution, issuer of securities, transfer agent, securities or commodities broker, real estate broker, title insurance company, insurance company, benefit plan, legal representative, custodian or trustee.

58-652. Effectiveness of power of attorney; recording; revocation; attorney in fact

(a) The authority granted by a principal to an attorney in fact in a written power of attorney is not terminated in the event the principal becomes wholly or partially disabled or in the event of later uncertainty as to whether the principal is dead or alive if:

(1) The power of attorney is denominated a durable power of attorney;

(2) the power of attorney includes a provision that states in substance one of the following:

(A) This is a durable power of attorney and the authority of my attorney in fact shall not terminate if I become disabled or in the event of later uncertainty as to whether I am dead or alive; or

(B) This is a durable power of attorney and the authority of my attorney in fact, when effective, shall not terminate or be void or voidable if I am or become disabled or in the event of later uncertainty as to whether I am dead or alive; and

(3) the power of attorney is signed by the principal, and dated and acknowledged in the manner prescribed by K.S.A. 53-501 et seq., and amendments thereto.

(b) All acts done by an attorney in fact pursuant to a durable power of attorney shall inure to the benefit of and bind the principal and the principal's successors in interest, notwithstanding any disability of the principal.

(c)(1) A power of attorney does not have to be recorded to be valid and binding between the principal and attorney in fact or between the principal and third persons.

(2) A power of attorney may be recorded in the same manner as a conveyance of land is recorded. A certified copy of a recorded power of attorney may be admitted into evidence.

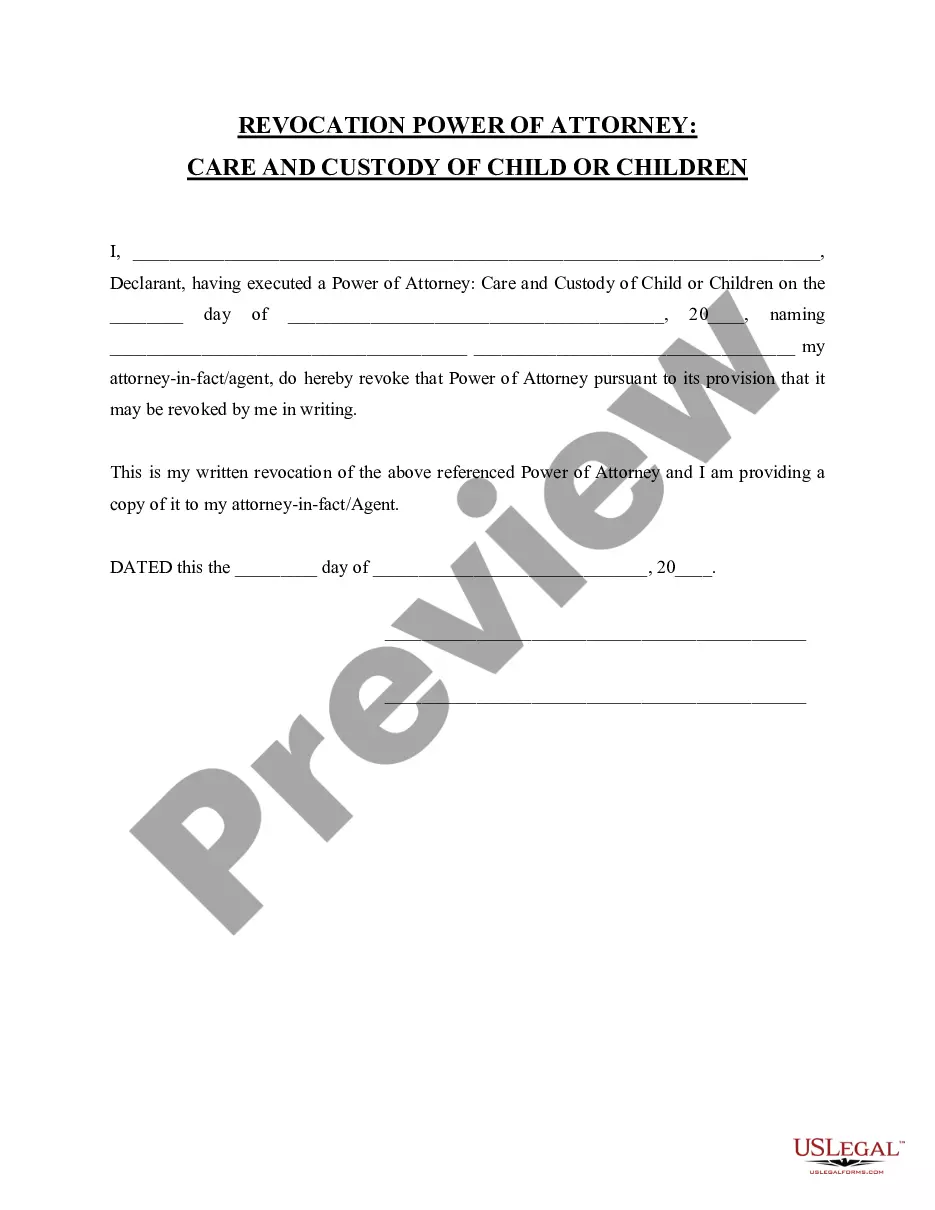

(3) If a power of attorney is recorded any revocation of that power of attorney must be recorded in the same manner for the revocation to be effective. If a power of attorney is not recorded it may be revoked by a recorded revocation or in any other appropriate manner.

(4) If a power of attorney requires notice of revocation be given to named persons, those persons may continue to rely on the authority set forth in the power of attorney until such notice is received.

(d) A person who is appointed an attorney in fact under a durable power of attorney has no duty to exercise the authority conferred in the power of attorney, unless the attorney in fact has agreed expressly in writing to act for the principal in such circumstances. An agreement to act on behalf of the principal is enforceable against the attorney in fact as a fiduciary without regard to whether there is any consideration to support a contractual obligation to do so. Acting for the principal in one or more transactions does not obligate an attorney in fact to act for the principal in subsequent transactions.

(e) The grant of power or authority conferred by a power of attorney in which any principal shall vest any power or authority in an attorney in fact, if such writing expressly so provides, shall be effective only upon:

(1) A specified future date;

(2) the occurrence of a specified future event; or

(3) the existence of a specified condition which may occur in the future. In the absence of actual knowledge to the contrary, any person to whom such writing is presented shall be entitled to rely on an affidavit, executed by the attorney in fact, setting forth that such event has occurred or condition exists.

58-653. Appointment of multiple attorneys in fact; qualifications; persons disqualified

(a) A principal may appoint more than one attorney in fact in one or more powers of attorney and may provide that the authority conferred on two or more attorneys in fact shall or may be exercised either jointly or severally or in a manner, with such priority and with respect to such subjects as is provided in the power of attorney. In the absence of specification in a power of attorney, the attorneys in fact must act jointly.

(b) The designation of a person not qualified to act as an attorney in fact for a principal under a power of attorney subjects the person to removal as attorney in fact but does not affect the immunities of third persons nor relieve the unqualified person of any duties or responsibilities to the principal or the principal's successors.

58-654. General powers

(a) A principal may delegate to an attorney in fact in a power of attorney general powers to act in a fiduciary capacity on the principal's behalf with respect to all lawful subjects and purposes or with respect to one or more express subjects or purposes. A power of attorney with general powers may be durable or nondurable.

(b) If the power of attorney states that general powers are granted to the attorney in fact and further states in substance that it grants power to the attorney in fact to act with respect to all lawful subjects and purposes or that it grants general powers for general purposes or does not by its terms limit the power to the specific subject or purposes set out in the instrument, then the authority of the attorney in fact acting under the power of attorney shall extend to and include each and every action or power which an adult who is nondisabled may carry out through an agent specifically authorized in the premises, with respect to any and all matters whatsoever, except as provided in subsection (f) and (g). When a power of attorney grants general powers to an attorney in fact to act with respect to all lawful subjects and purposes, the enumeration of one or more specific subjects or purposes does not limit the general authority granted by that power of attorney, unless otherwise provided in the power of attorney.

(c) If the power of attorney states that general powers are granted to an attorney in fact with respect to one or more express subjects or purposes for which general powers are conferred, then the authority of the attorney in fact acting under the power of attorney shall extend to and include each and every action or power, but only with respect to the specific subjects or purposes expressed in the power of attorney that an adult who is nondisabled may carry out through an agent specifically authorized in the premises, with respect to any and all matters whatsoever, except as provided in subsection (f) and (g).

(d) Except as provided in subsections (f) and (g), an attorney in fact with general powers has, with respect to the subjects or purposes for which the powers are conferred, all rights, power and authority to act for the principal that the principal would have with respect to the principal's own person or property, including property owned jointly or by the entireties with another or others, as a nondisabled adult. Without limiting the foregoing an attorney in fact with general powers has, with respect to the subject or purposes of the power, complete discretion to make a decision for the principal, to act or not act, to consent or not consent to, or withdraw consent for, any act, and to execute and deliver or accept any deed, bill of sale, bill of lading, assignment, contract, note, security instrument, consent, receipt, release, proof of claim, petition or other pleading, tax document, notice, application, acknowledgment or other document necessary or convenient to implement or confirm any act, transaction or decision. An attorney in fact with general powers, whether power to act with respect to all lawful subjects and purposes, or only with respect to one or more express subjects or purposes, shall have the power, unless specifically denied by the terms of the power of attorney, to make, execute and deliver to or for the benefit of or at the request of a third person, who is requested to rely upon an action of the attorney in fact, an agreement indemnifying and holding harmless any third person or persons from any liability, claims or expenses, including legal expenses, incurred by any such third person by reason of acting or refraining from acting pursuant to the request of the attorney in fact. Such indemnity agreement shall be binding upon the principal who has executed such power of attorney and upon the principal's successor or successors in interest. No such indemnity agreement shall protect any third person from any liability, claims or expenses incurred by reason of the fact that, and to the extent that, the third person has honored the power of attorney for actions outside the scope of authority granted by the power of attorney. In addition, the attorney in fact has complete discretion to employ and compensate real estate agents, brokers, attorneys, accountants and subagents of all types to represent and act for the principal in any and all matters, including tax matters involving the United States government or any other government or taxing entity, including, but not limited to, the execution of supplemental or additional powers of attorney in the name of the principal in form that may be required or preferred by any such taxing entity or other third person, and to deal with any or all third persons in the name of the principal without limitation. No such supplemental or additional power of attorney shall broaden the scope of authority granted to the attorney in fact in the original power of attorney executed by the principal.

(e) An attorney in fact, who is granted general powers for all subjects and purposes or with respect to any express subjects or purposes, shall exercise the powers conferred according to the principal's instructions, in the principal's best interest, in good faith, prudently and in accordance with K.S.A. 2003 Supp. 58-655 and 58-656, and amendments thereto.

(f) Any power of attorney, whether or not it grants general powers for all subjects and purposes or with respect to express subjects or purposes, shall be construed to grant power or authority to an attorney in fact to carry out any of the actions described in this subsection only if the actions are expressly enumerated and authorized in the power of attorney. Any power of attorney may grant power or authority to an attorney in fact to carry out any of the following actions if the actions are expressly authorized in the power of attorney:

(1) To execute, amend or revoke any trust agreement;

(2) to fund with the principal's assets any trust not created by the principal;

(3) to make or revoke a gift of the principal's property in trust or otherwise;

(4) to disclaim a gift or devise of property to or for the benefit of the principal;

(5) to create or change survivorship interests in the principal's property or in property in which the principal may have an interest. The inclusion of the authority set out in this paragraph shall not be necessary in order to grant to an attorney in fact acting under a power of attorney granting general powers with respect to all lawful subjects and purposes the authority to withdraw funds or other property from any account, contract or other similar arrangement held in the names of the principal and one or more other persons with any financial institution, brokerage company or other depository to the same extent that the principal would be authorized to do if the principal were present, not disabled and seeking to act in the principal's own behalf;

(6) to designate or change the designation of beneficiaries to receive any property, benefit or contract right on the principal's death;

(7) to give or withhold consent to an autopsy or postmortem examination;

(8) to make a gift of, or decline to make a gift of, the principal's body parts under the uniform anatomical gift act, K.S.A. 65-3209 through 65-3217, and amendments thereto;

(9) to nominate a guardian or conservator for the principal; and if so stated in the power of attorney, the attorney in fact may nominate such attorney in fact's self as such;

(10) to alienate the homestead without the joint consent of husband and wife when that relationship exists, if the power of attorney specifically: Gives the attorney in fact the power to sell, transfer and convey the homestead in question; gives the legal description and street address of the property; and states that by the execution of the power of attorney it is the intention of the parties that the act shall constitute the joint consent required by Article 15, Section 9 of the Kansas Constitution and the power of attorney is executed by both the husband and wife in the same instrument;

(11) to designate one or more substitute or successor or additional attorneys in fact; or

(12) to delegate any or all powers granted in a power of attorney pursuant to subsection (a) of K.S.A. 2003 Supp. 58-660, and amendments thereto.

(g) No power of attorney, whether or not it delegates general powers, may delegate or grant power or authority to an attorney in fact to do or carry out any of the following actions for the principal:

(1) To make, publish, declare, amend or revoke a will for the principal;

(2) to make, execute, modify or revoke a declaration under K.S.A. 65-28,101 et seq., and amendments thereto, for the principal or to make, execute, modify or revoke a do not resuscitate directive under K.S.A. 65-4941, and amendments thereto, for the principal or to make, execute, modify or revoke a durable power of attorney for health care decisions pursuant to K.S.A. 58-625, et seq., and amendments thereto, for the principal;

(3) to require the principal, against the principal's will, to take any action or to refrain from taking any action; or

(4) to carry out any actions specifically forbidden by the principal while not under any disability or incapacity.

(h) A third person may freely rely on, contract and deal with an attorney in fact delegated general powers with respect to the subjects and purposes encompassed or expressed in the power of attorney without regard to whether the power of attorney expressly identifies the specific property, account, security, storage facility or matter as being within the scope of a subject or purpose contained in the power of attorney, and without regard to whether the power of attorney expressly authorizes the specific act, transaction or decision by the attorney in fact.

(i) It is the policy of this state that an attorney in fact acting pursuant to the provisions of a power of attorney granting general powers shall be accorded the same rights and privileges with respect to the personal welfare, property and business interests of the principal, and if the power of attorney enumerate some express subjects or purposes, with respect to those subjects or purposes, as if the principal was personally present and acting or seeking to act; and any provision of law and any purported waiver, consent or agreement executed or granted by the principal to the contrary shall be void and unenforceable.

(j) K.S.A. 2003 Supp. 58-650 through 58-665, and amendments thereto, shall not be construed to preclude any person or business enterprise from providing in a contract with the principal as to the procedure that thereafter must be followed by the principal or the principal's attorney in fact in order to give a valid notice to the person or business enterprise of any modification or termination of the appointment of an attorney in fact by the principal. Any such contractual provision for notice shall be valid and binding on the principal and the principal's successors so long as such provision is reasonably capable of being carried out.