Kansas Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Kansas Quitclaim Deed From Husband And Wife To LLC?

Looking for a Kansas Quitclaim Deed from Spouses to LLC template and filling them out can be a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate example specifically for your region in just a few clicks.

Our lawyers prepare all documents, allowing you to only complete them. It's genuinely that straightforward.

Select your plan on the pricing page and set up an account. Choose your payment method with a credit card or through PayPal. Download the file in your preferred format. Now you can print the Kansas Quitclaim Deed from Spouses to LLC form or complete it using any online editor. Don't worry about making errors since your template can be utilized, submitted, and printed as many times as needed. Try US Legal Forms and gain access to around 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to save the template.

- All of your saved templates are kept in My documents and are therefore accessible at all times for future use.

- If you haven't registered yet, you should enroll.

- Examine our comprehensive instructions on how to obtain the Kansas Quitclaim Deed from Spouses to LLC template in just a few minutes.

- To acquire a suitable template, verify its relevance for your region.

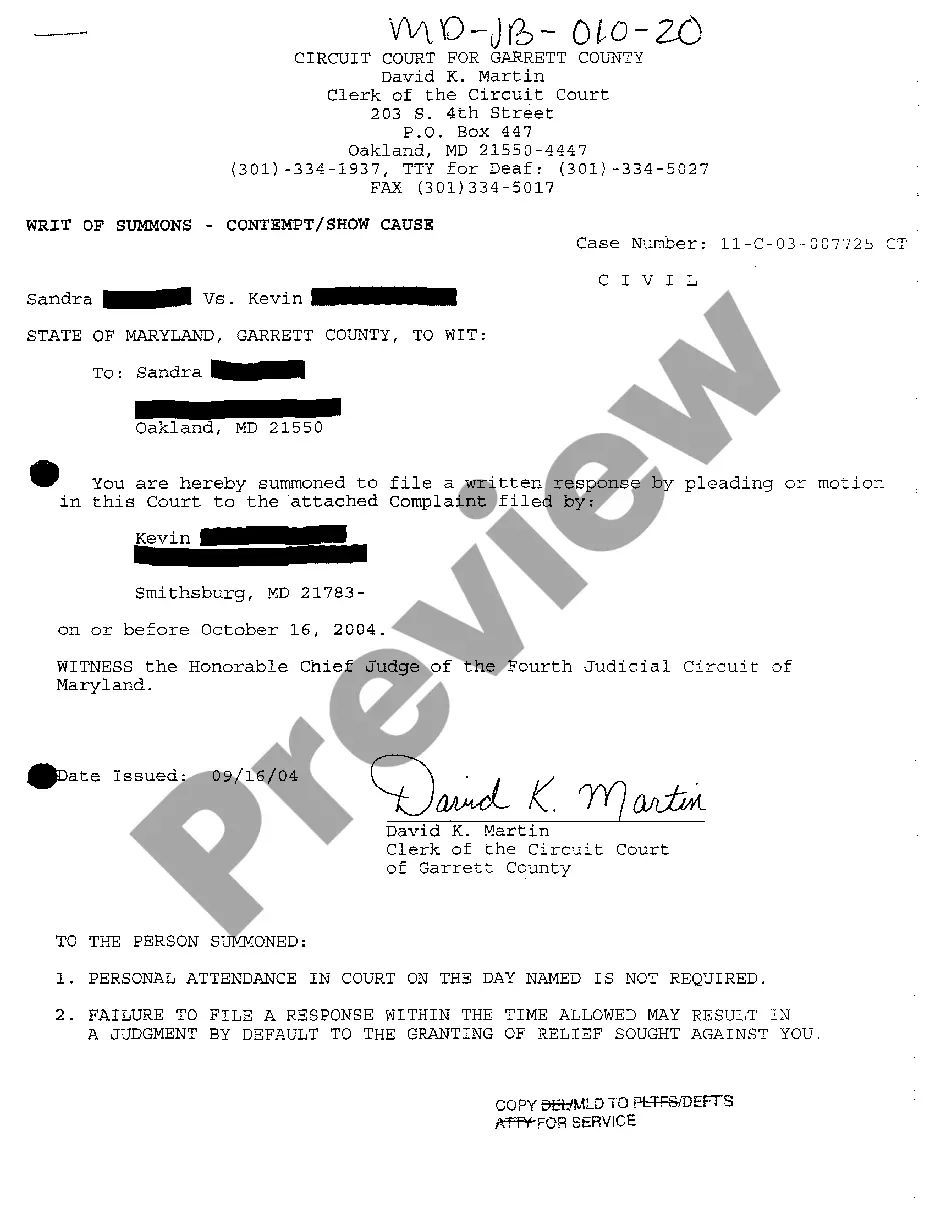

- Review the template using the Preview option (if available).

- If there’s a description, read it to understand the key points.

- Click Buy Now if you've found what you're looking for.

Form popularity

FAQ

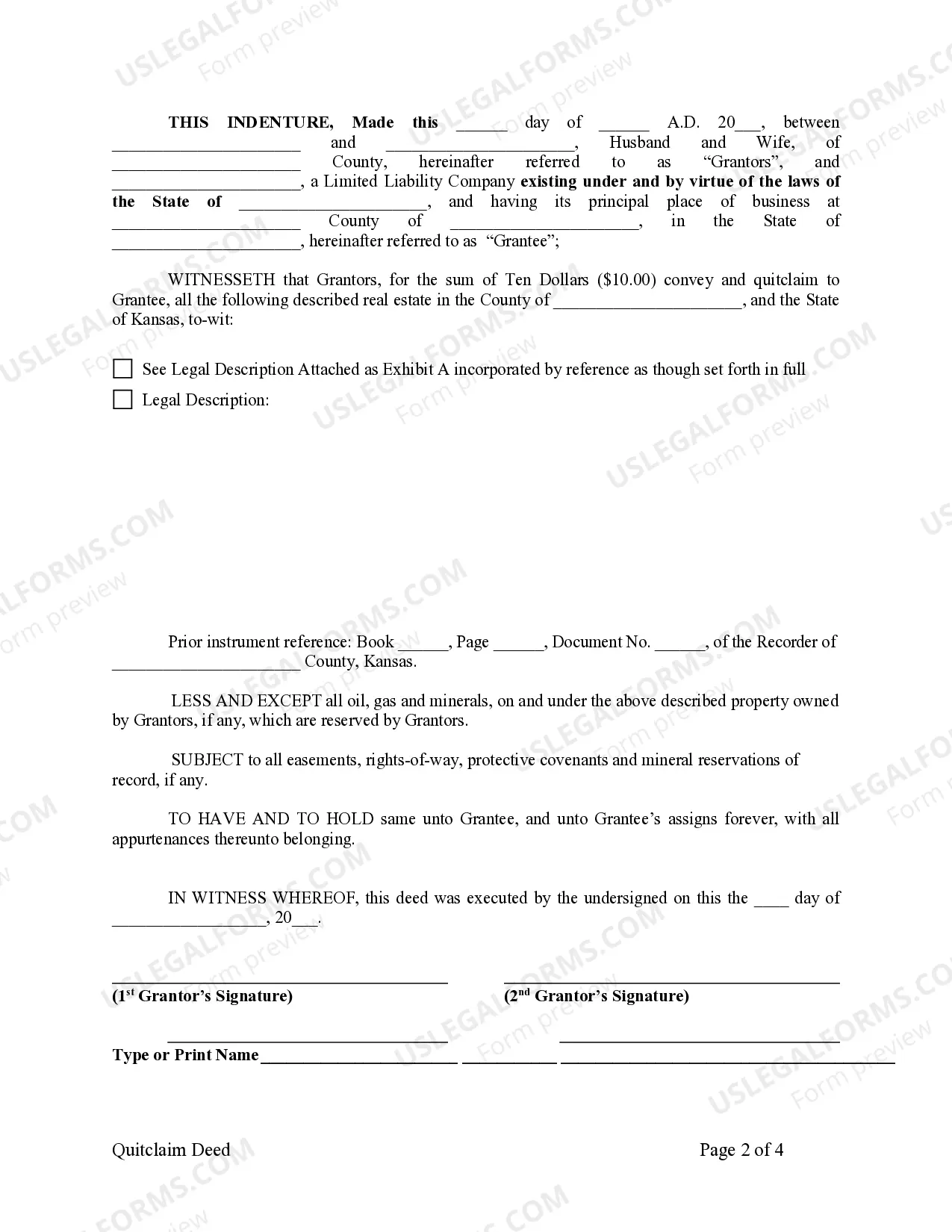

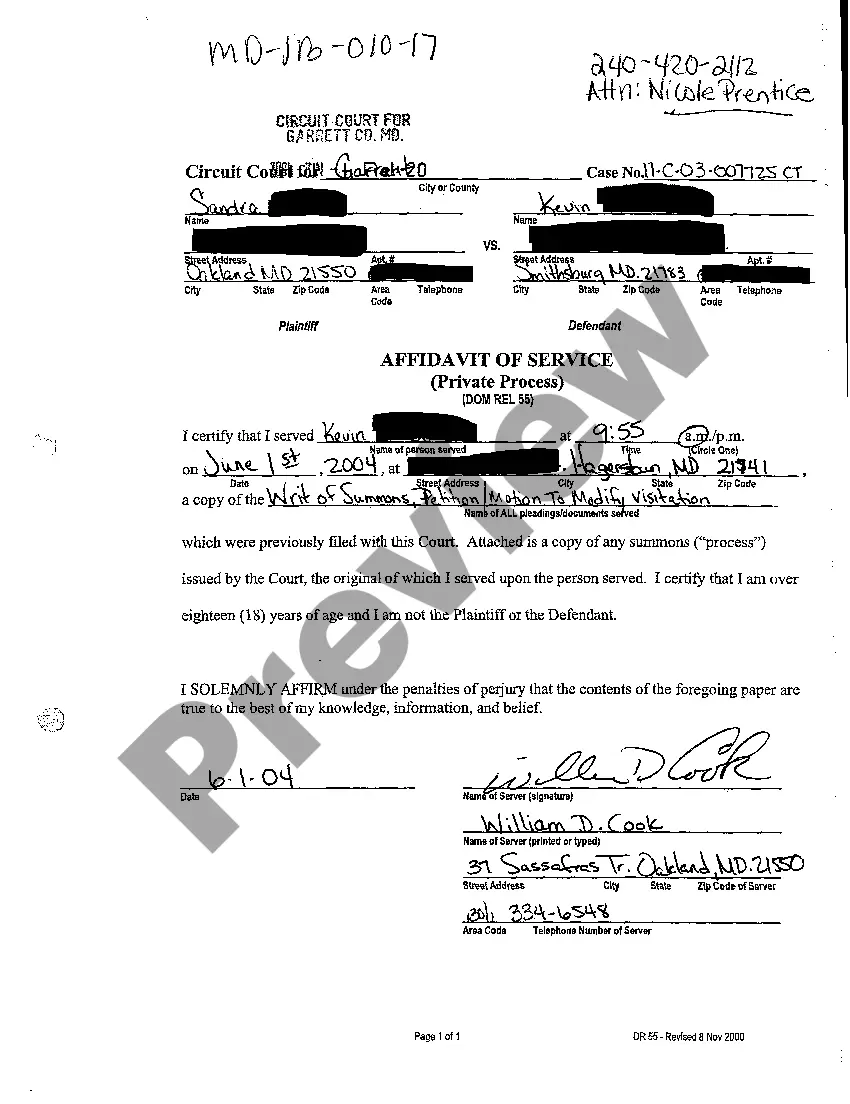

The most common use of a quitclaim deed involves transferring property between family members or into business entities, such as an LLC. A Kansas Quitclaim Deed from Husband and Wife to LLC is often employed during transitions such as divorces, estate planning, or business structuring. This approach works well for parties who trust one another or when property value is not in dispute. Its simplicity makes it a preferred choice in numerous situations.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

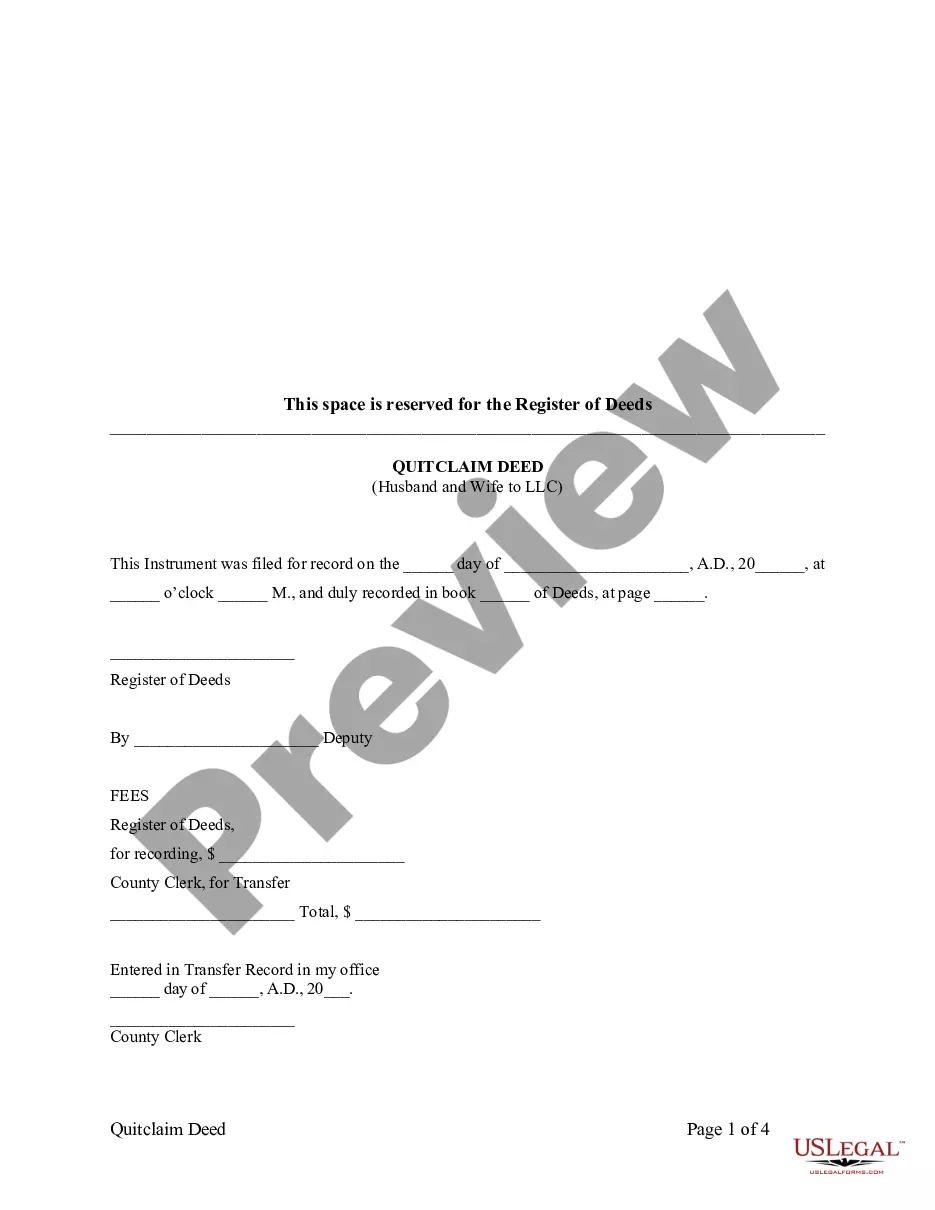

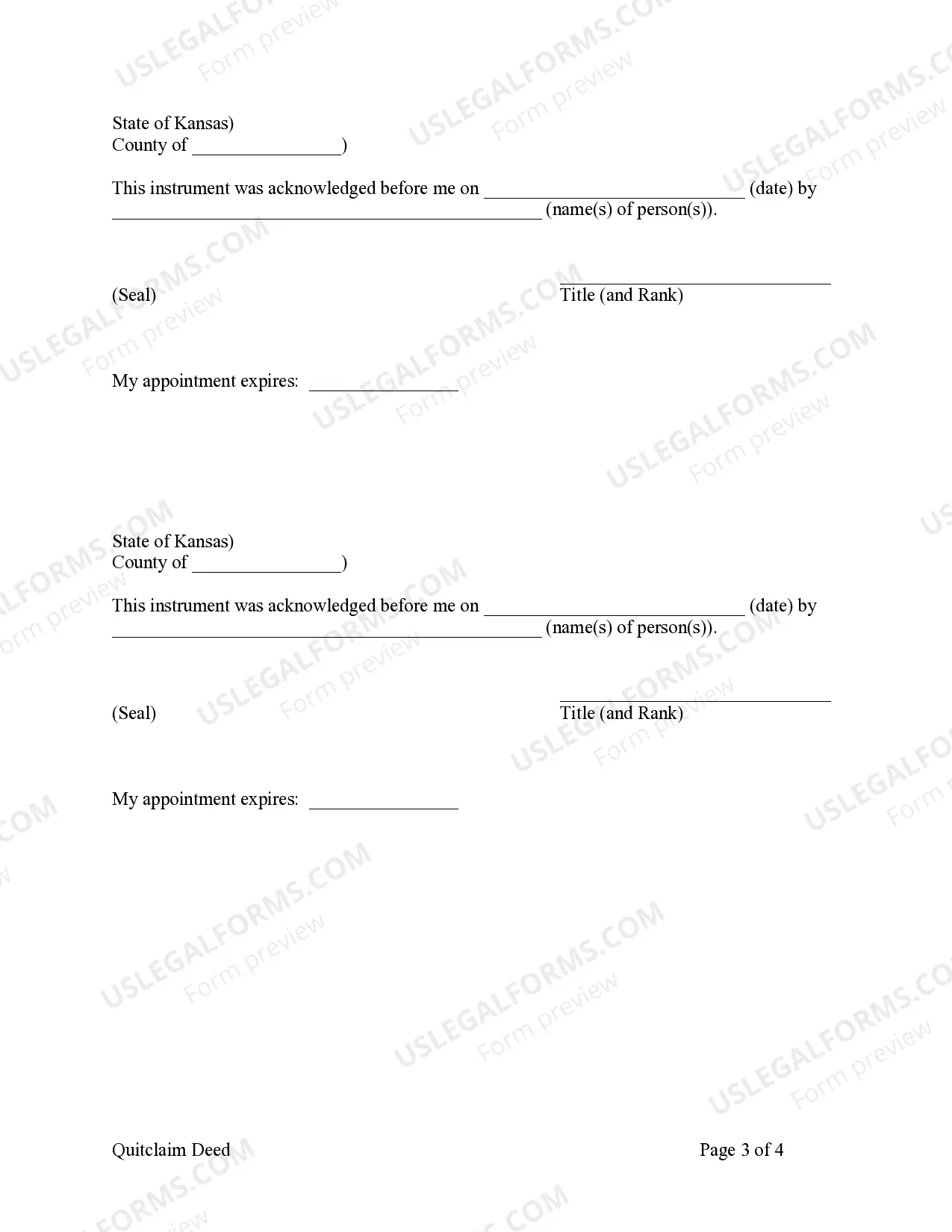

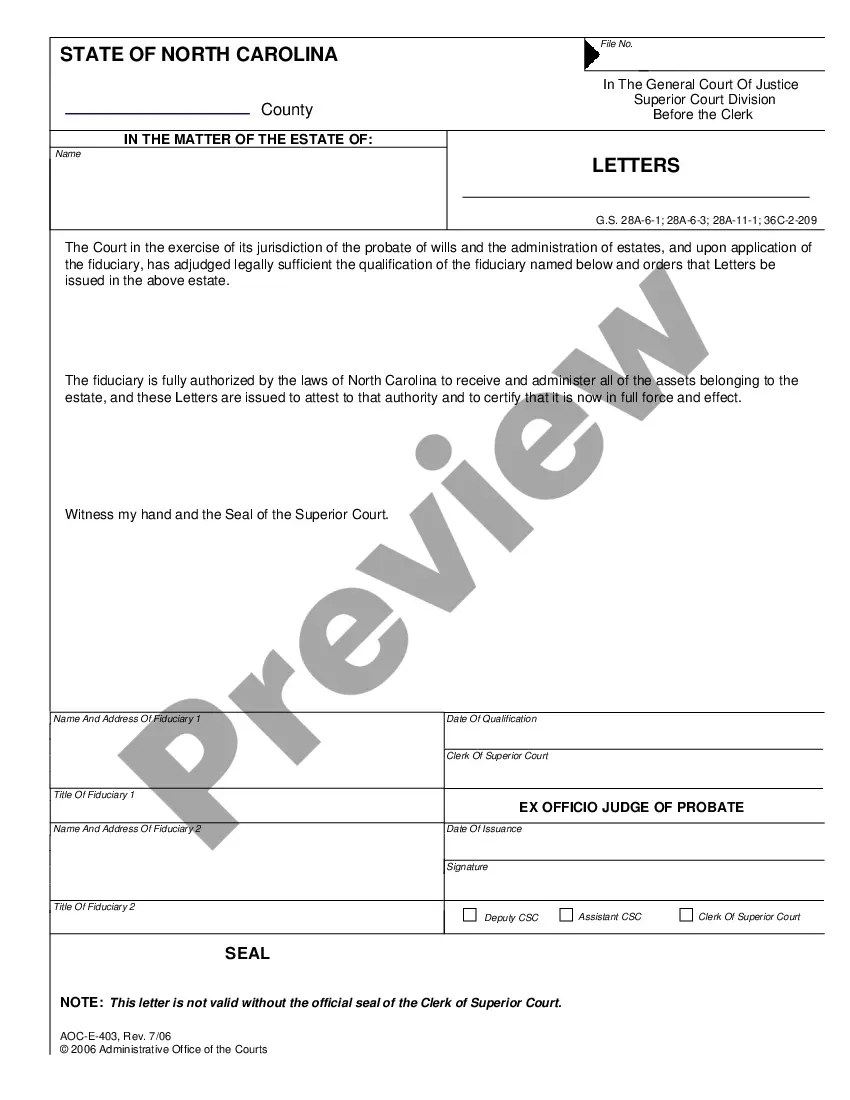

Recording A quitclaim deed must be filed with the County Recorder's Office where the real estate is located. Go to your County Website to locate the office nearest you. Signing (§ 58-2205) A quitclaim deed is required to be authorized with a notary public present.

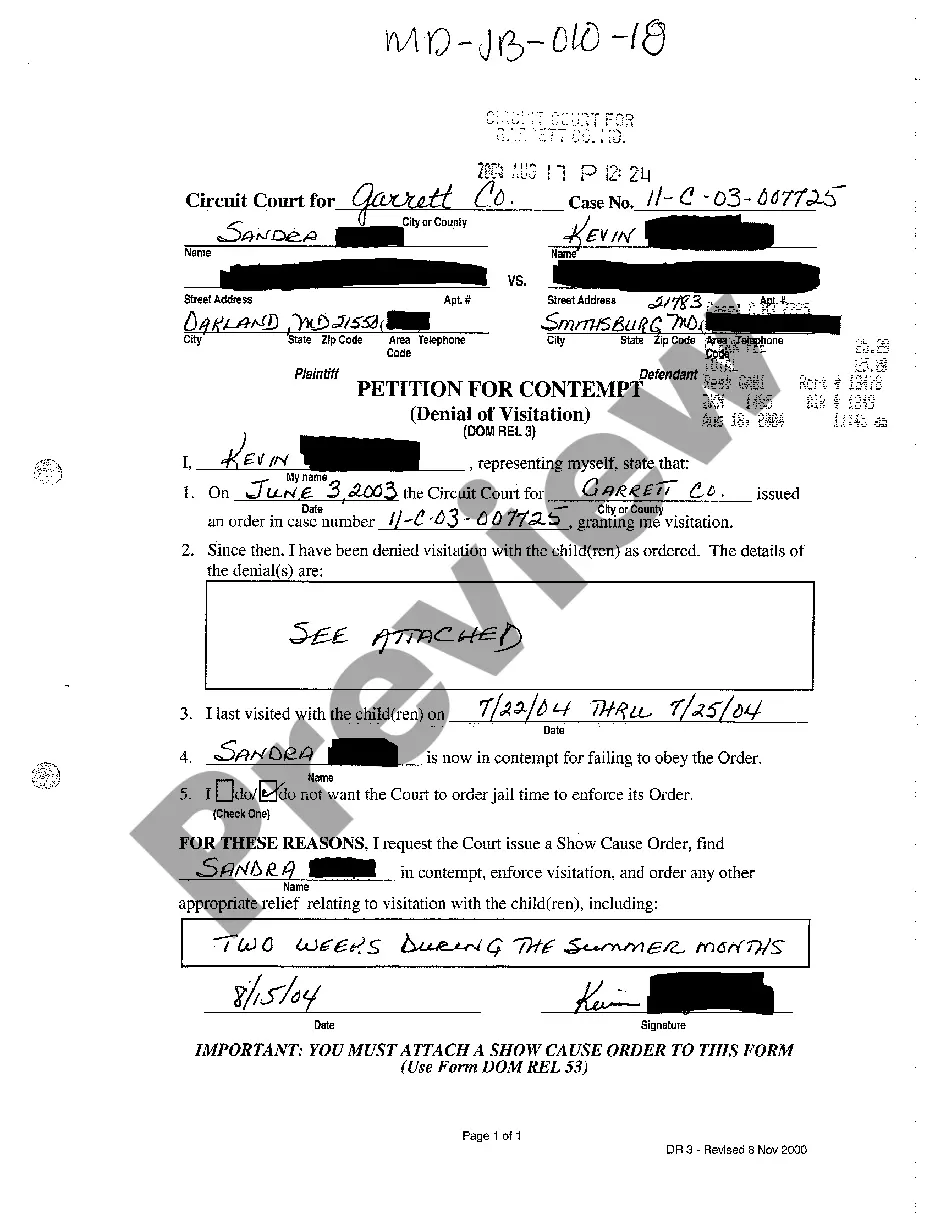

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

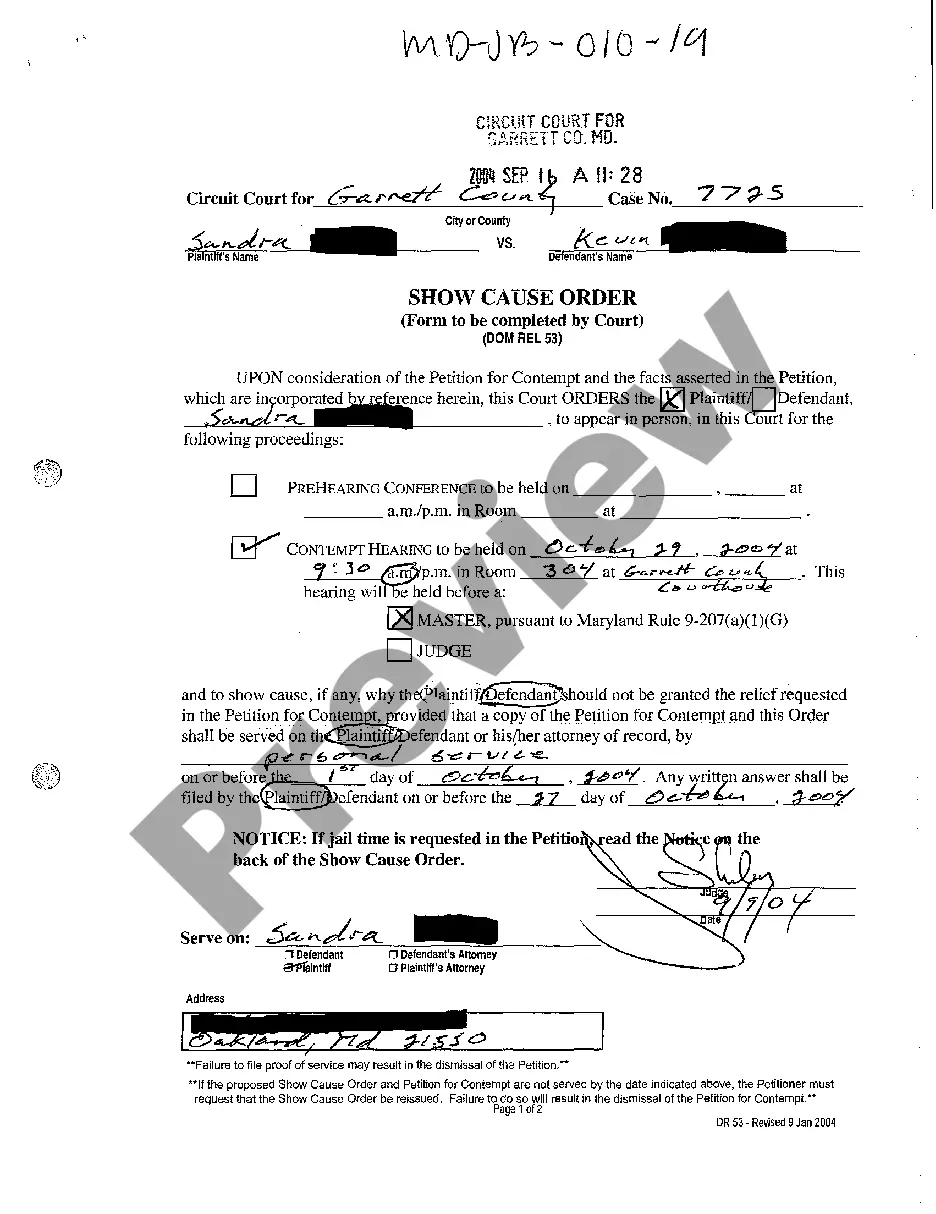

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.