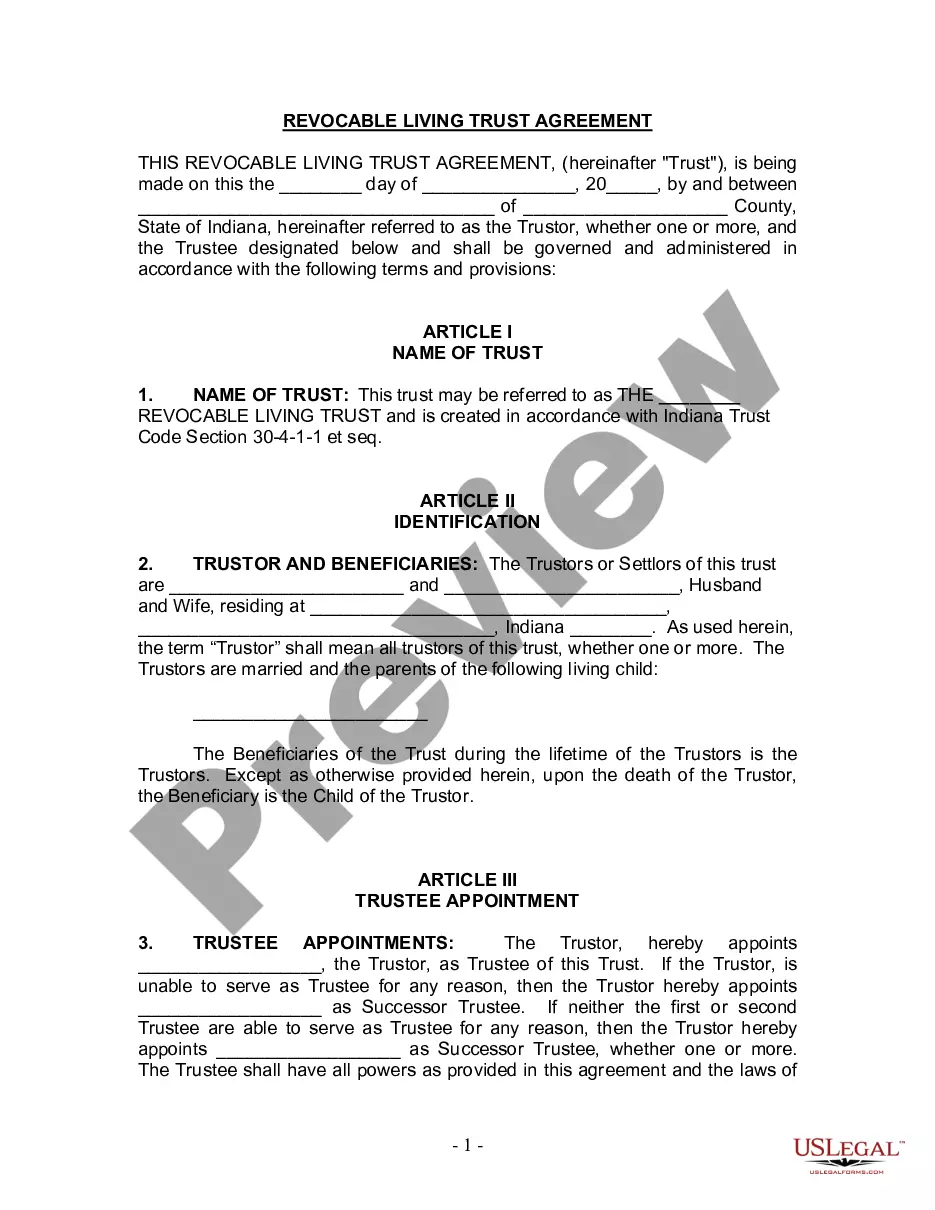

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Indiana Living Trust for Husband and Wife with One Child

Description

How to fill out Indiana Living Trust For Husband And Wife With One Child?

Searching for Indiana Living Trust for Spouses with a Single Child template and completing them might be challenging.

To conserve substantial time, expenses, and effort, utilize US Legal Forms and locate the suitable template specifically for your area in merely a few clicks.

Our attorneys create each document, so you only need to complete them. It's truly that effortless.

Select your payment method on the pricing page and create your account. Choose whether to pay with a credit card or via PayPal. Download the template in your desired format. Now you can print the Indiana Living Trust for Spouses with a Single Child form or complete it using any online editor. No need to stress about making mistakes since your form can be used and submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log into your account and return to the document's page to download it.

- All of your saved templates are stored in My documents and are always available for future access.

- If you haven’t signed up yet, you need to register.

- Review our detailed instructions on how to obtain your Indiana Living Trust for Spouses with a Single Child form in a few minutes.

- To acquire a legitimate template, verify its relevance for your area.

- Preview the template using the Preview option (if available).

- If there’s a description, read it to comprehend the specifics.

- Press Buy Now if you found what you are searching for.

Form popularity

FAQ

Joint trusts are easier to fund and maintain.In a joint trust, after the death of the first spouse, the surviving spouse has complete control of the assets. When separate trusts are used, the deceased spouses' trust becomes irrevocable and the surviving spouse has limited control over assets.

At the time of your death, the assets in your family trust are protected by the exemption, and the assets in your marital trust are protected by the marital deduction. No estate taxes are due.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.

Separate trusts may offer better protection from creditors, if this is a concern. For example, at the death of the first spouse, the deceased spouse's trust becomes irrevocable, which makes it harder to access by creditors. And yet the surviving spouse can still access it for income and other needs.

Generally, trusts are considered the separate property of the beneficiary spouse and the assets in a trust are not subject to equitable distribution unless they contain marital property.Any funds remaining in the trust or in a separate account will continue to be the separate property of the beneficiary spouse.

In California, surviving spouses already receive all of the community property upon the death of their spouse.However, creating a joint will is still an option in California, and while it might help a couple save some time and money on their estate plan, it can also lead to some complex problems.

Typically, when a married couple utilizes a Revocable Living Trust based estate plan, each spouse creates and funds his or her own separate Revocable Living Trust. This results in two trusts. However, in the right circumstances, a married couple may be better served by creating a single Joint Trust.

Q: Can a person have more than one trust? A: Yes, it is not that uncommon for a person to be the beneficiary of multiple trusts. However, caution should be used. Trusts come in many shapes and sizes and can serve multiple purposes and can be established by you or by someone else for your benefit.