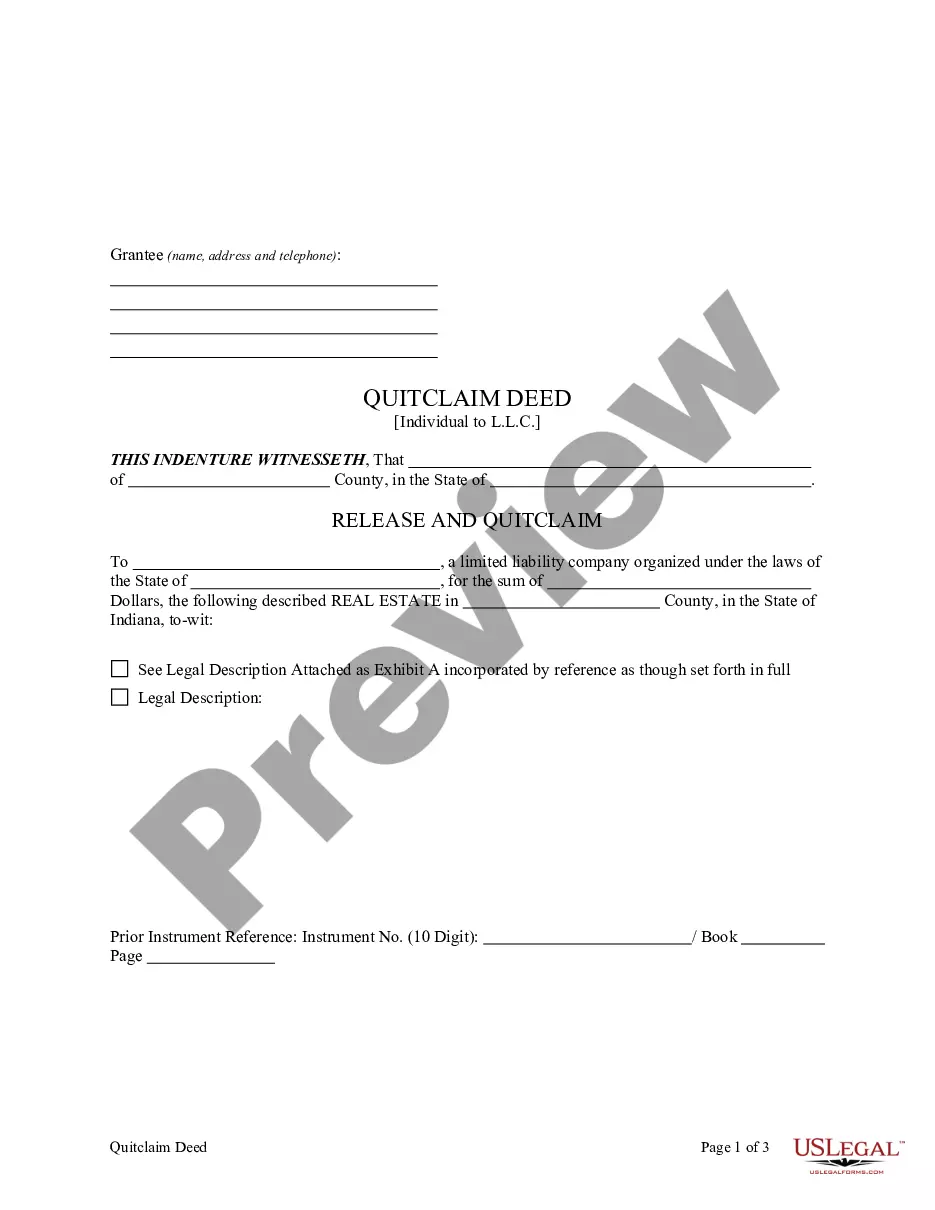

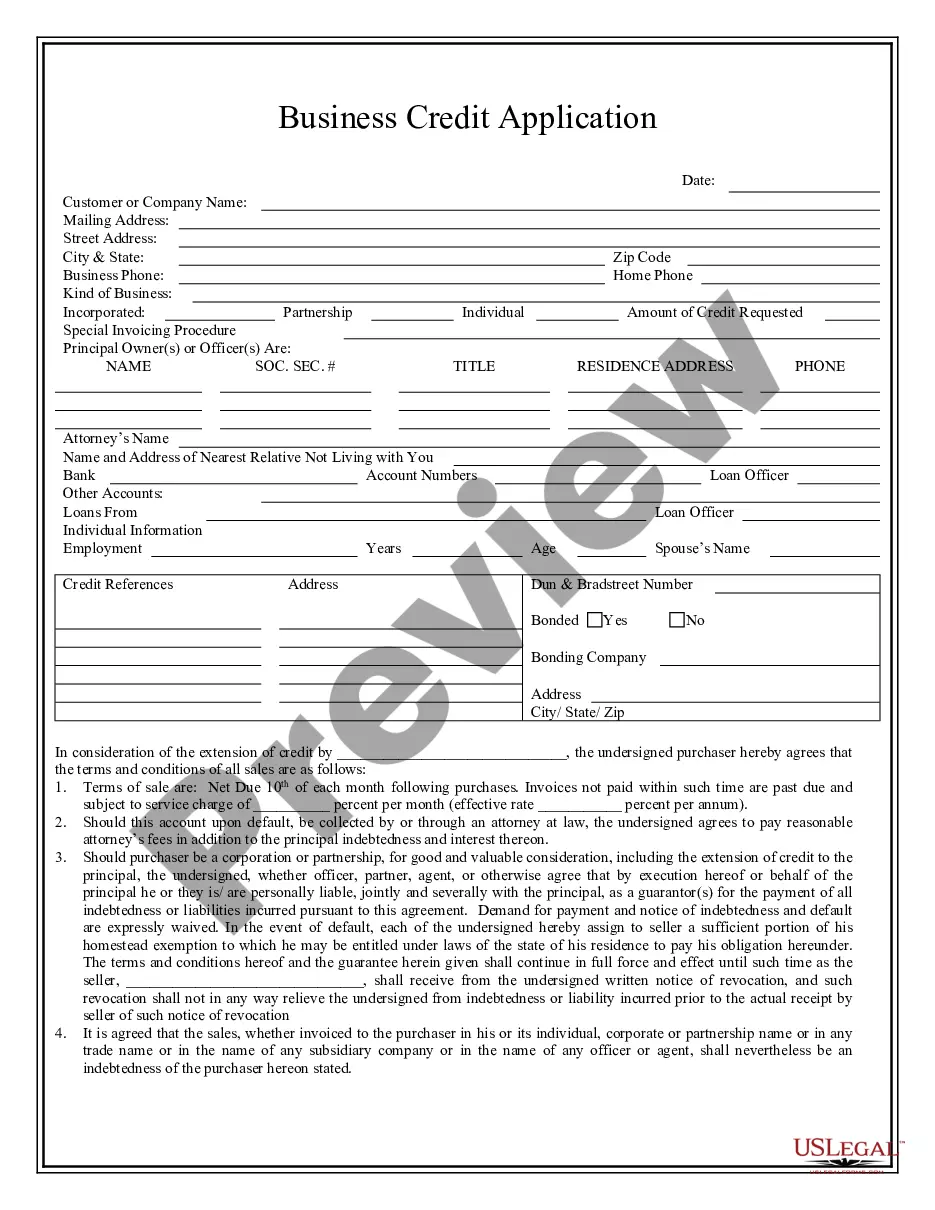

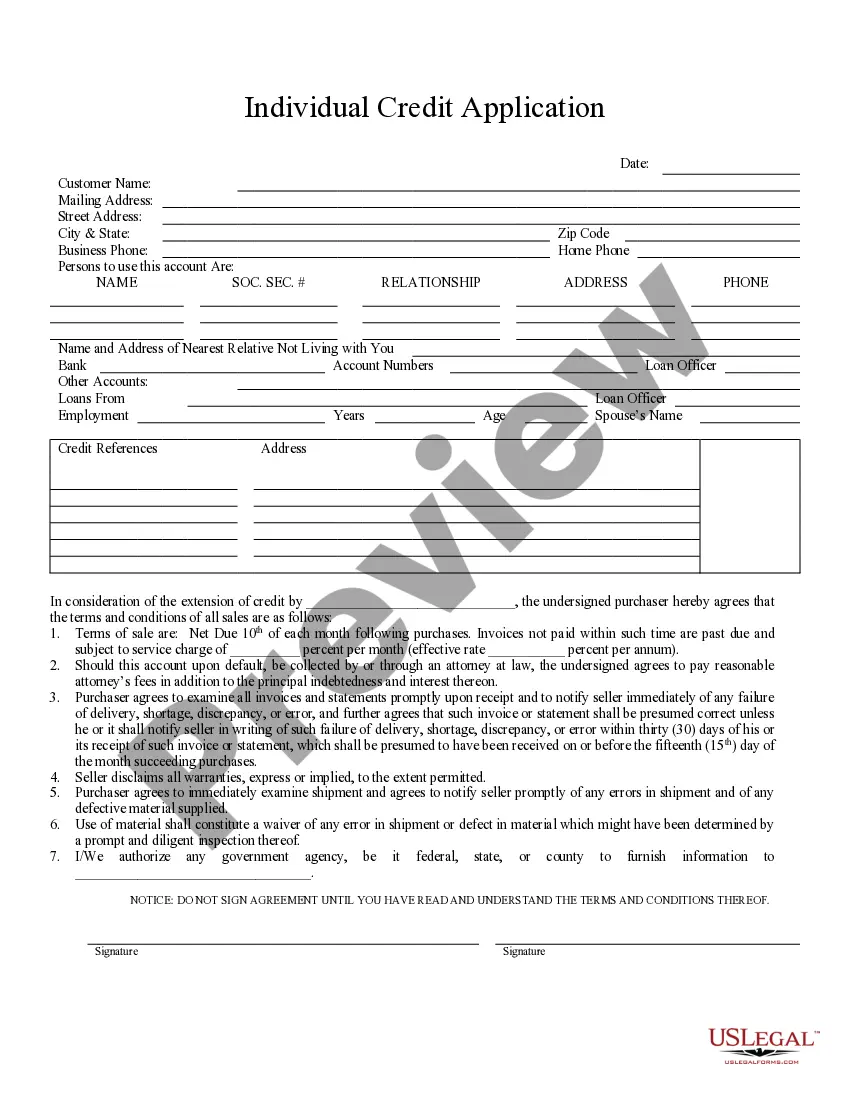

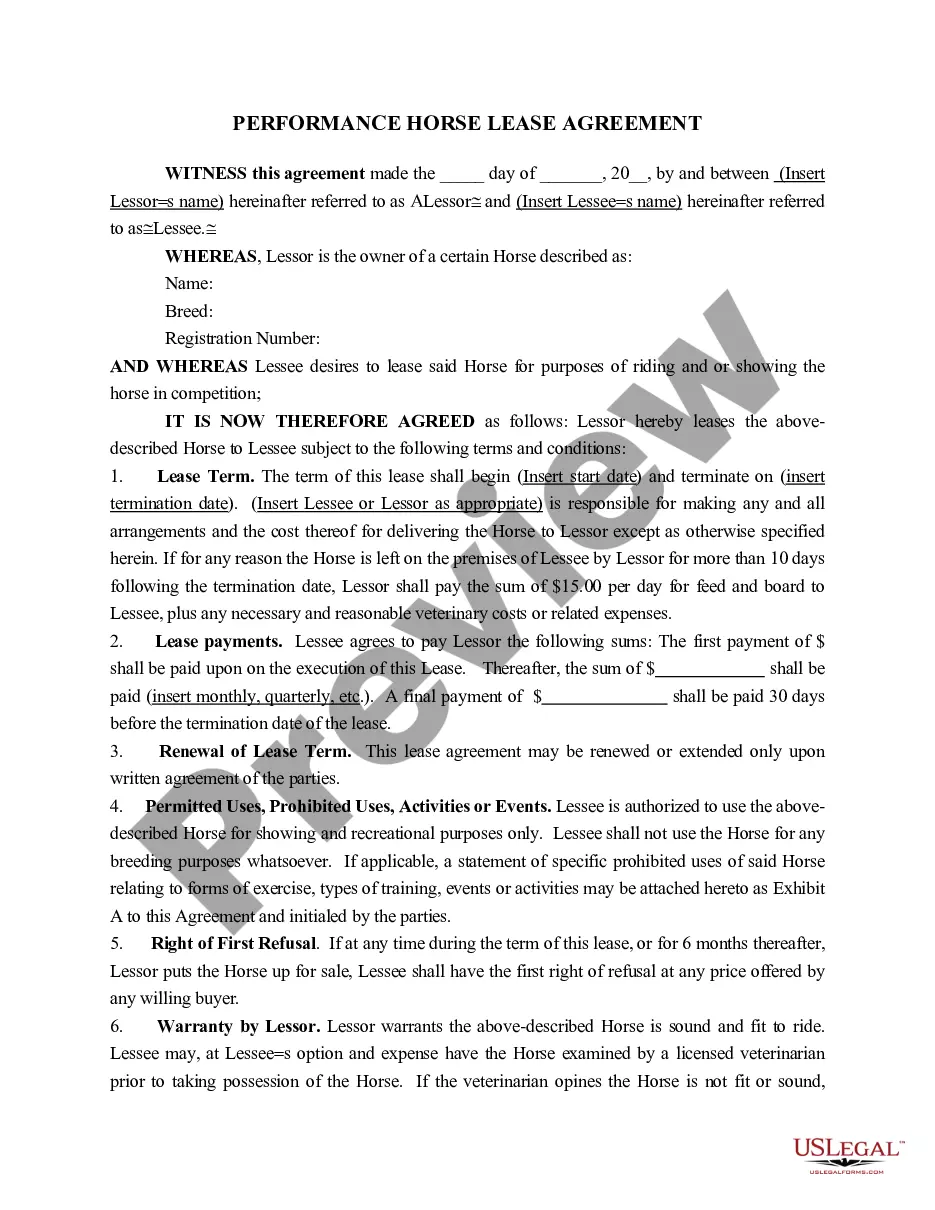

This form is a Quitclaim Deed where the grantor is an unmarried individual and the grantee is a limited liability company. Upon ordering, you may download the form in Word, Rich Text or Wordperfect formats.

Indiana Quitclaim Deed from Individual to LLC

Description

How to fill out Indiana Quitclaim Deed From Individual To LLC?

Looking for Indiana Quitclaim Deed forms from Individual to LLC can be challenging.

To minimize time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your state in mere moments.

Our legal professionals create each document, so you only need to complete them.

Choose your plan on the pricing page and create an account. Decide how you want to pay, either with a card or via PayPal. Download the template in your preferred format. Now you can print the Indiana Quitclaim Deed from Individual to LLC template or complete it using any online editor. Don't worry about errors because your template can be used and submitted multiple times, as well as printed as often as you desire. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's section to save the sample.

- All downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven’t yet signed up, you need to register.

- Follow our comprehensive instructions on how to acquire your Indiana Quitclaim Deed from Individual to LLC template in just a few minutes.

- To obtain a valid sample, verify its appropriateness for your state.

- Examine the example using the Preview feature (if available).

- If there's a description, review it to understand the specifics.

- Click on the Buy Now button if you found what you're seeking.

Form popularity

FAQ

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

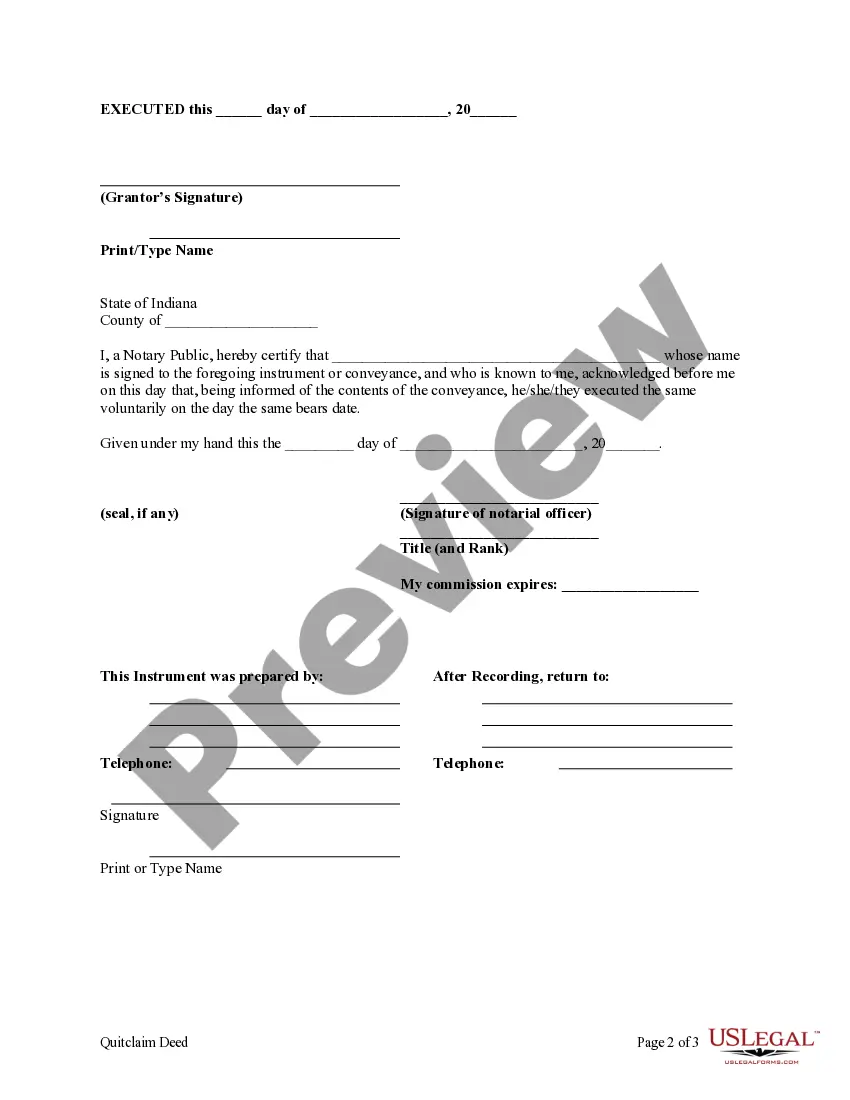

Step 1: Find your IN quitclaim deed form. Step 2: Gather the information you need. Step 3: Enter the information about the parties. Step 4: Enter the legal description of the property. Step 5: Have the grantor sign the document in the presence of a Notary Public.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.