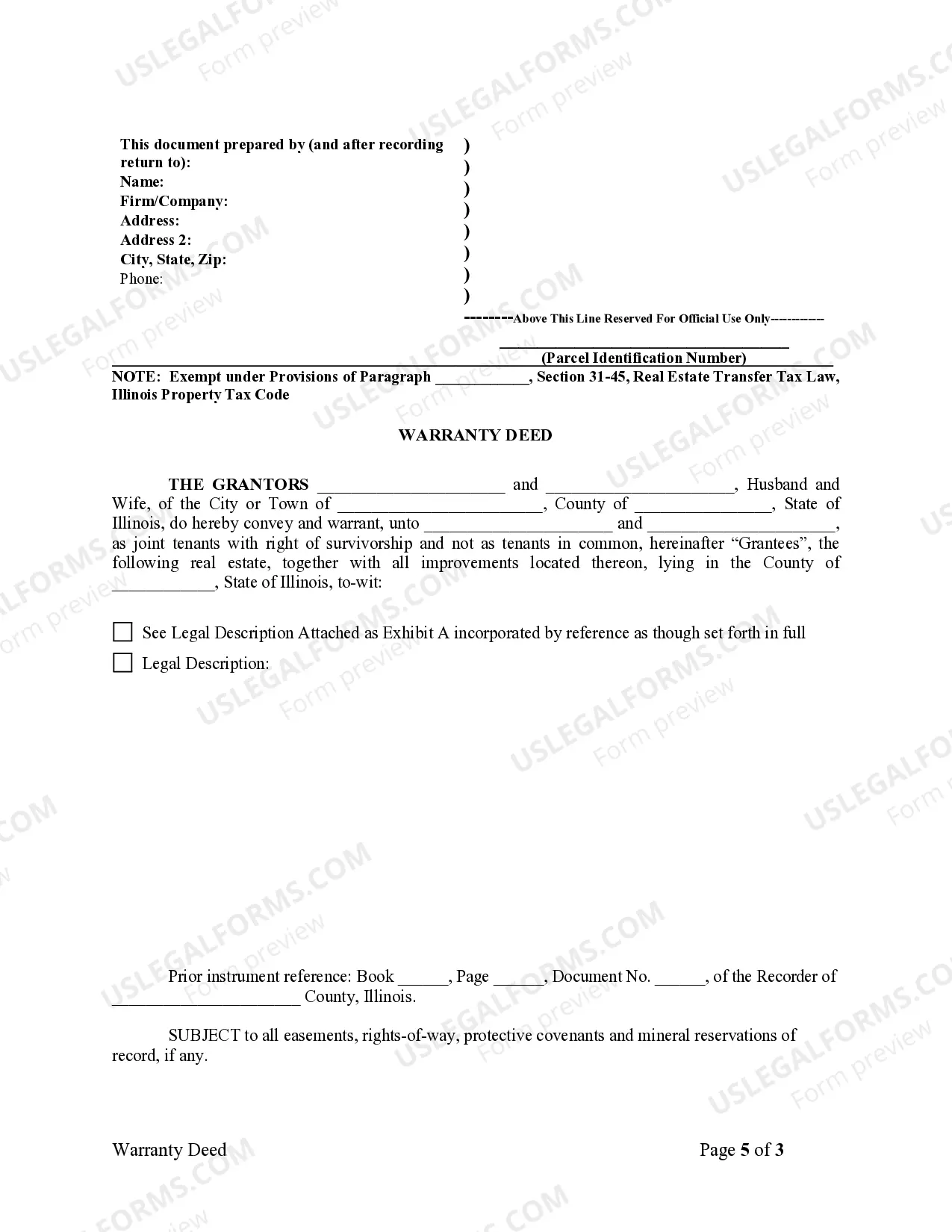

Illinois Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy

Description

How to fill out Illinois Warranty Deed For Husband And Wife Converting Property From Tenants In Common To Joint Tenancy?

Among the many complimentary and paid samples that you can discover online, you cannot guarantee their precision.

For instance, who authored them or if they have the necessary expertise to manage the matters you require assistance with.

Stay calm and use US Legal Forms! Explore Illinois Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy templates made by qualified attorneys and skip the expensive and time-consuming process of seeking out a lawyer and subsequently compensating them to draft a document that you can easily obtain yourself.

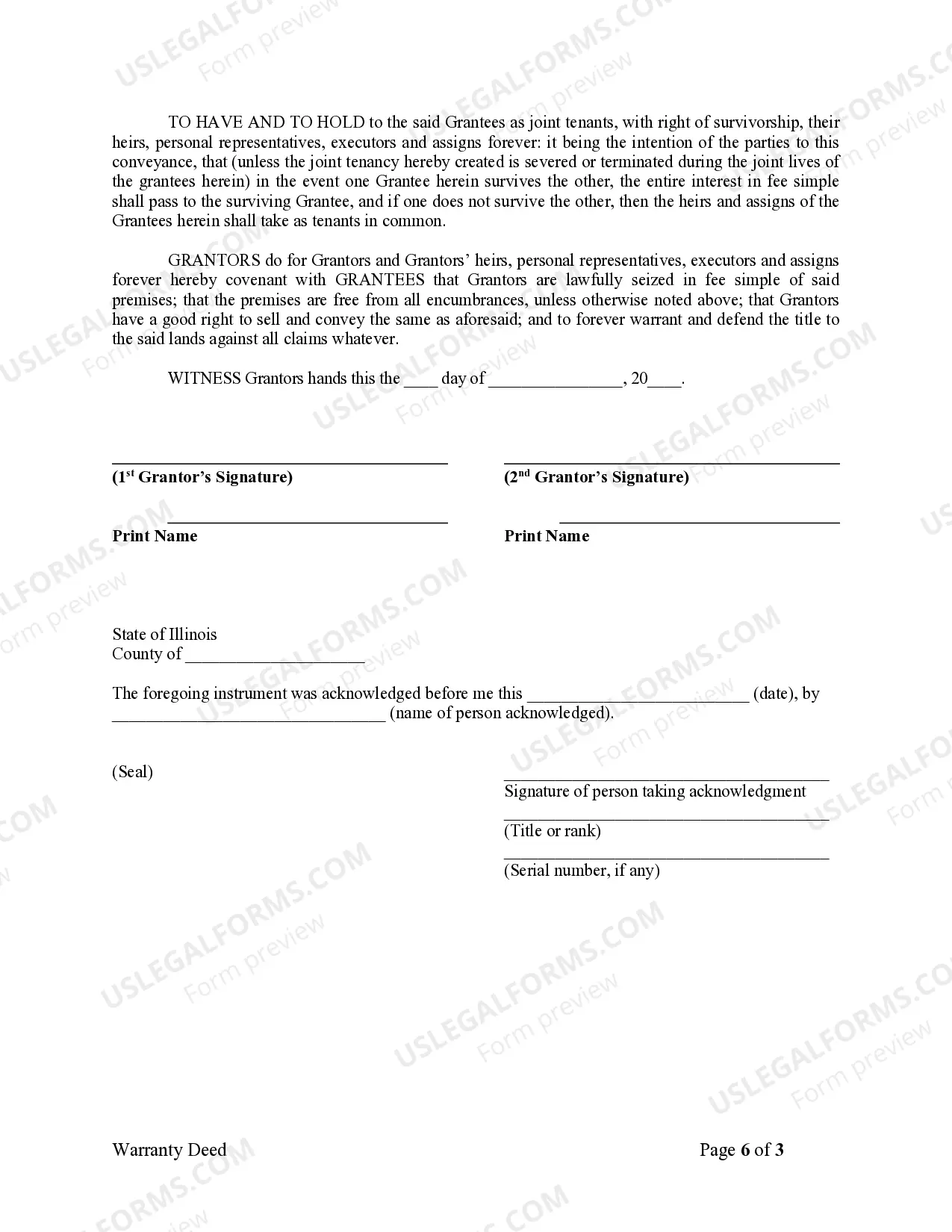

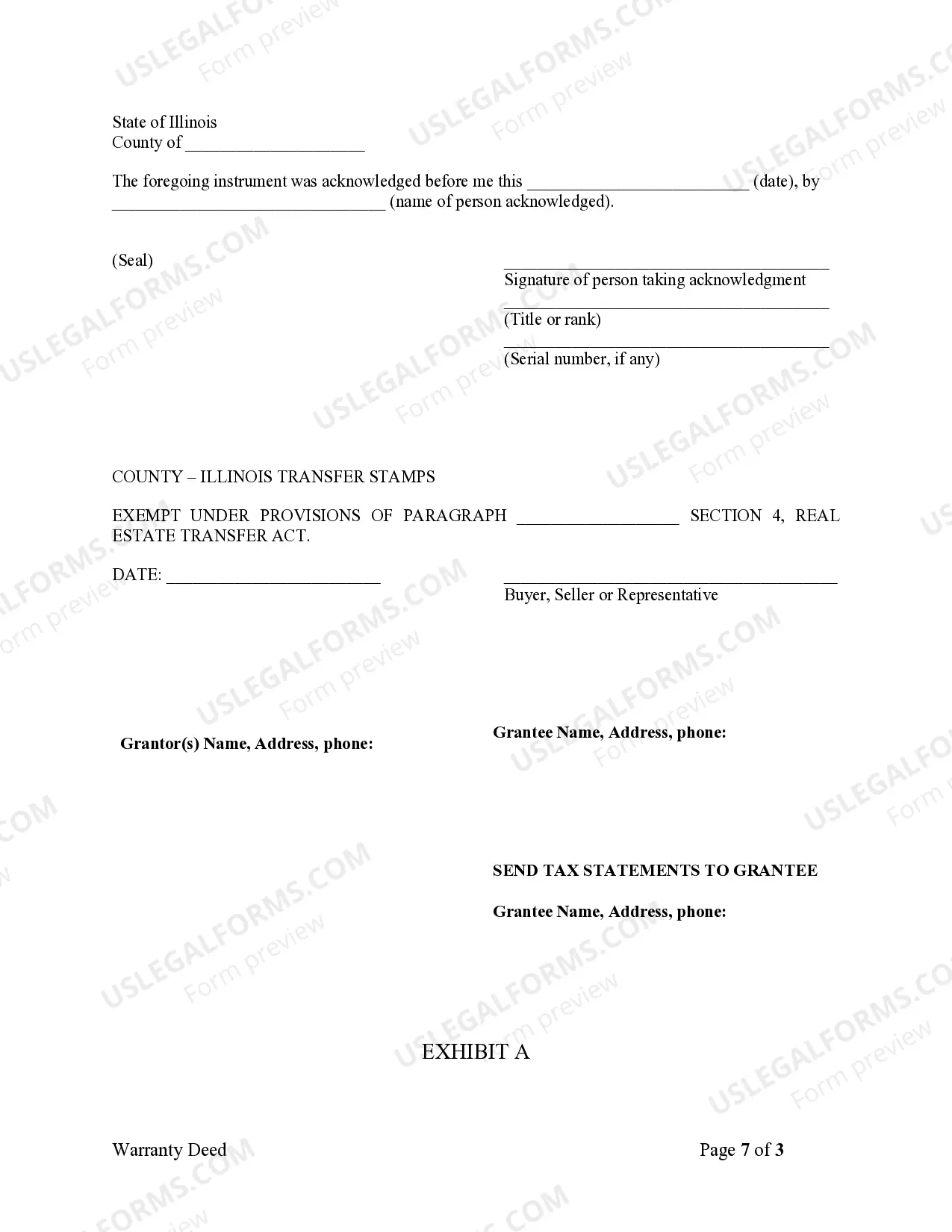

After signing up and purchasing your subscription, you can use your Illinois Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy as many times as you wish or for as long as it stays valid in your area. Edit it in your chosen online or offline editor, complete it, sign it, and print a physical copy. Achieve more for less with US Legal Forms!

- If you hold a subscription, Log In to your account and locate the Download button adjacent to the file you are seeking.

- You will also gain access to all your previously saved templates in the My documents section.

- If you are using our site for the first time, adhere to the steps listed below to easily obtain your Illinois Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy.

- Ensure that the document you are viewing is valid in your jurisdiction.

- Examine the file by consulting the description through the Preview function.

- Select Buy Now to initiate the purchasing procedure or search for another template using the Search field located in the header.

Form popularity

FAQ

Serve a written notice of the change (a 'notice of severance') on the other owners - a conveyancer can help you do this. Download and fill in form SEV to register a restriction without the other owners' agreement. Prepare any supporting documents you need to include.

Jointly-owned property.There is no need for probate or letters of administration unless there are other assets that are not jointly owned. The property might have a mortgage. However, if the partners are tenants in common, the surviving partner does not automatically inherit the other person's share.

The simplest way to add a spouse to a deed is through a quitclaim deed. This type of deed transfers whatever ownership rights you have so that you and your spouse now become joint owners. No title search or complex transaction is necessary. The deed will list you as the grantor and you and your spouse as grantees.

You can apply to court to change your ex-partner's tenancy to your name, or remove their name from a joint tenancy. You can apply for a 'transfer of tenancy' if: your landlord refuses to change your tenancy. your tenancy doesn't allow a transfer.

Jointly owned propertyProperty owned as joint tenants does not form part of a deceased person's estate on death. But the value of the deceased person's share of jointly owned property is included when calculating the value of the estate for Inheritance Tax purposes.

Most jointly owned property is held as joint tenants but you should not assume this.As property held under a joint tenancy will automatically pass to the surviving joint owners it will not form part of the deceased's estate except for the purposes of calculating inheritance tax.

When one co-owner dies, property that was held in joint tenancy with the right of survivorship automatically belongs to the surviving owner (or owners). The owners are called joint tenants.

When you opt to co-own an asset with another individual, you can enter into a legal ownership agreement known as joint tenants with rights of survivorship or JTWROS. Upon the death of one of the owners, the surviving owner automatically becomes sole owner of the property, whether it's a vacation home, a plane, or

Regardless of how the property is owned (and how it will be treated for succession purposes), the deceased's share of jointly owned property will form part of the deceased's estate for inheritance tax (IHT) purposes (although an exemption will, of course, apply where the deceased's share passes to their spouse/civil