Illinois Unsecured Installment Payment Promissory Note for Fixed Rate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Unsecured Installment Payment Promissory Note For Fixed Rate?

Searching for Illinois Unsecured Installment Payment Promissory Note for Fixed Rate documents and completing them may pose a challenge.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state in just a few clicks.

Our attorneys prepare each document, so you only need to complete them. It's really that simple.

Select your plan on the pricing page and create your account. Decide how you prefer to pay, either by credit card or PayPal. Save the document in your desired file format. You can now print the Illinois Unsecured Installment Payment Promissory Note for Fixed Rate form or complete it using any online editor. Don’t worry about typographical errors since your document can be used, sent, and printed multiple times. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to download the document.

- All your stored templates are maintained in My documents and are always accessible for future use.

- If you have yet to register, you must sign up.

- Review our detailed instructions on how to obtain your Illinois Unsecured Installment Payment Promissory Note for Fixed Rate form in minutes.

- To acquire an appropriate form, verify its relevance for your state.

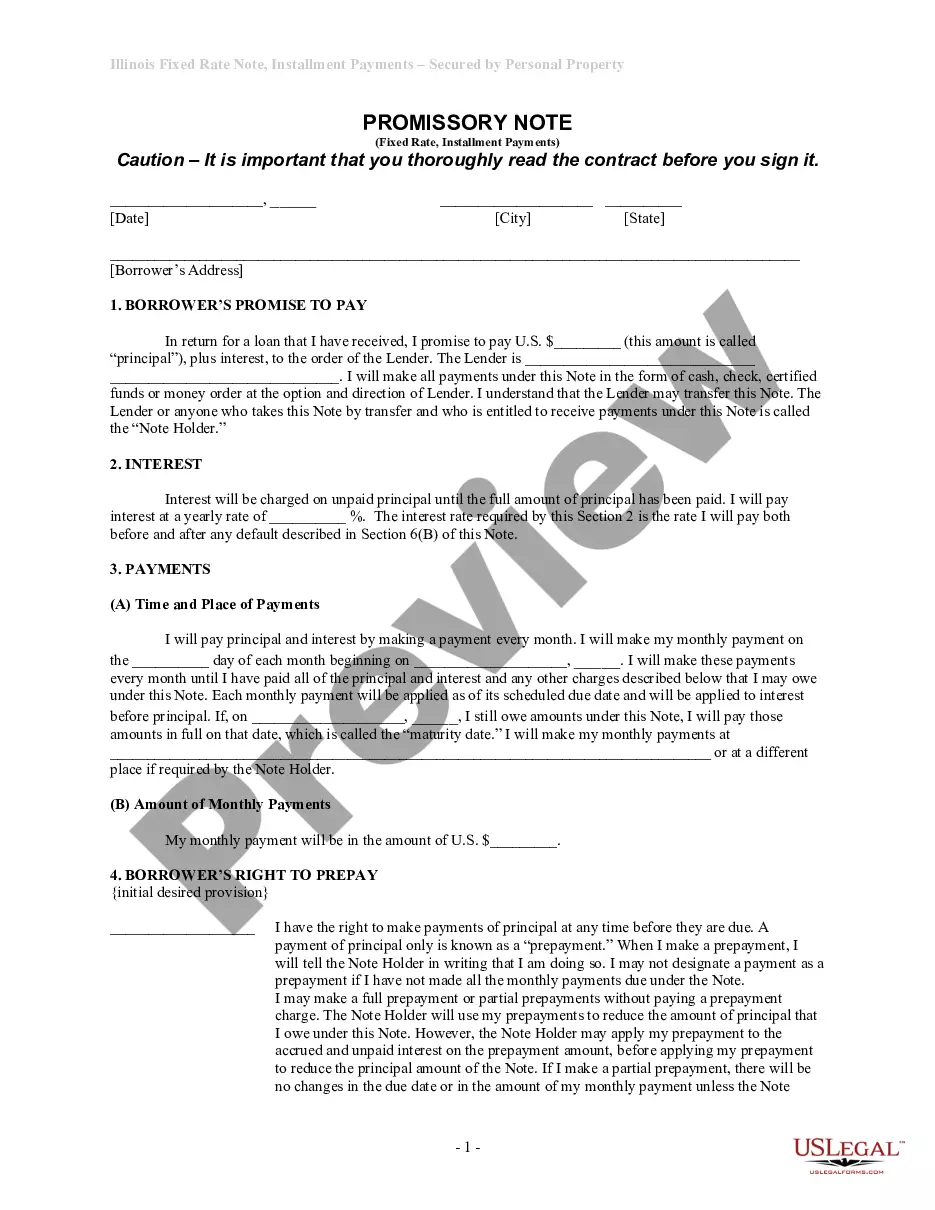

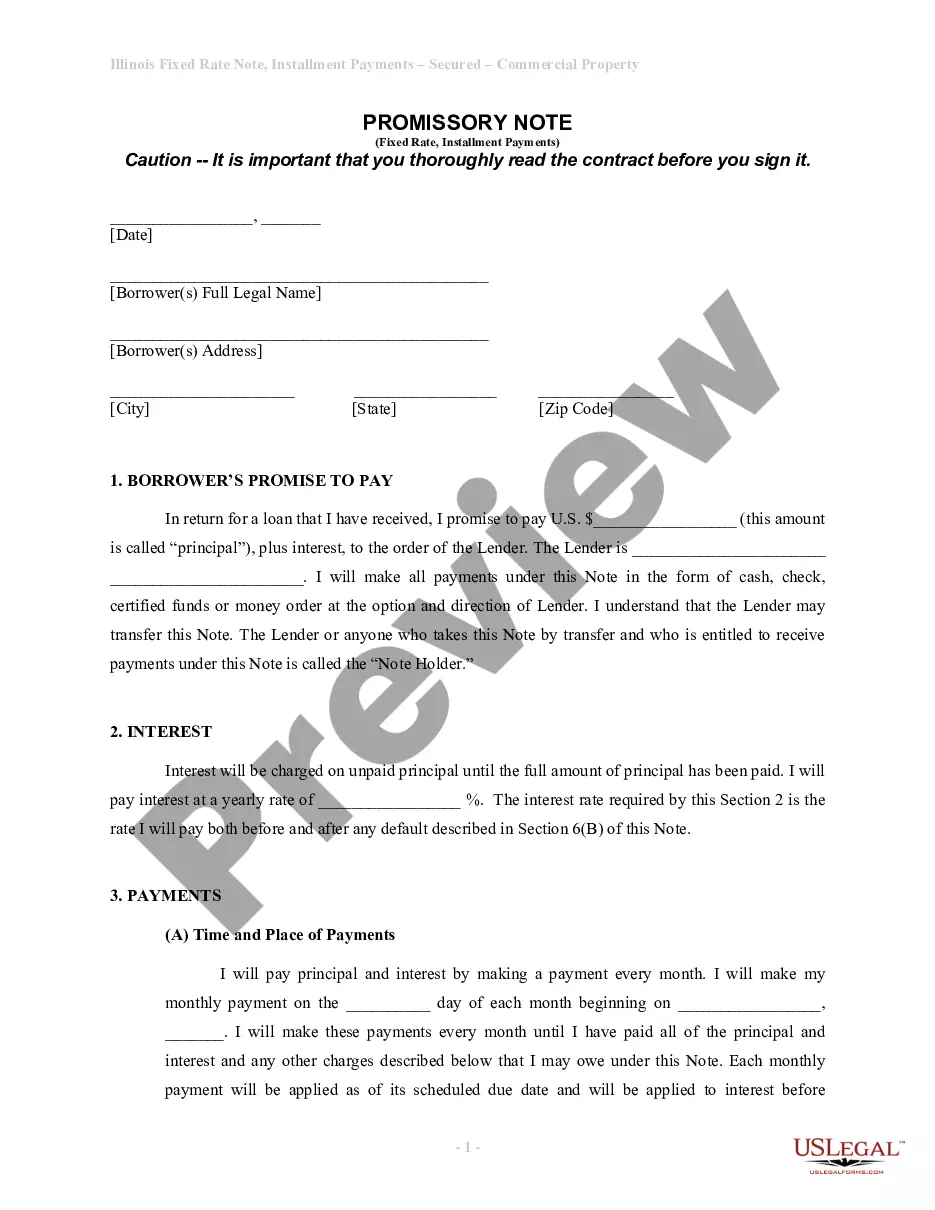

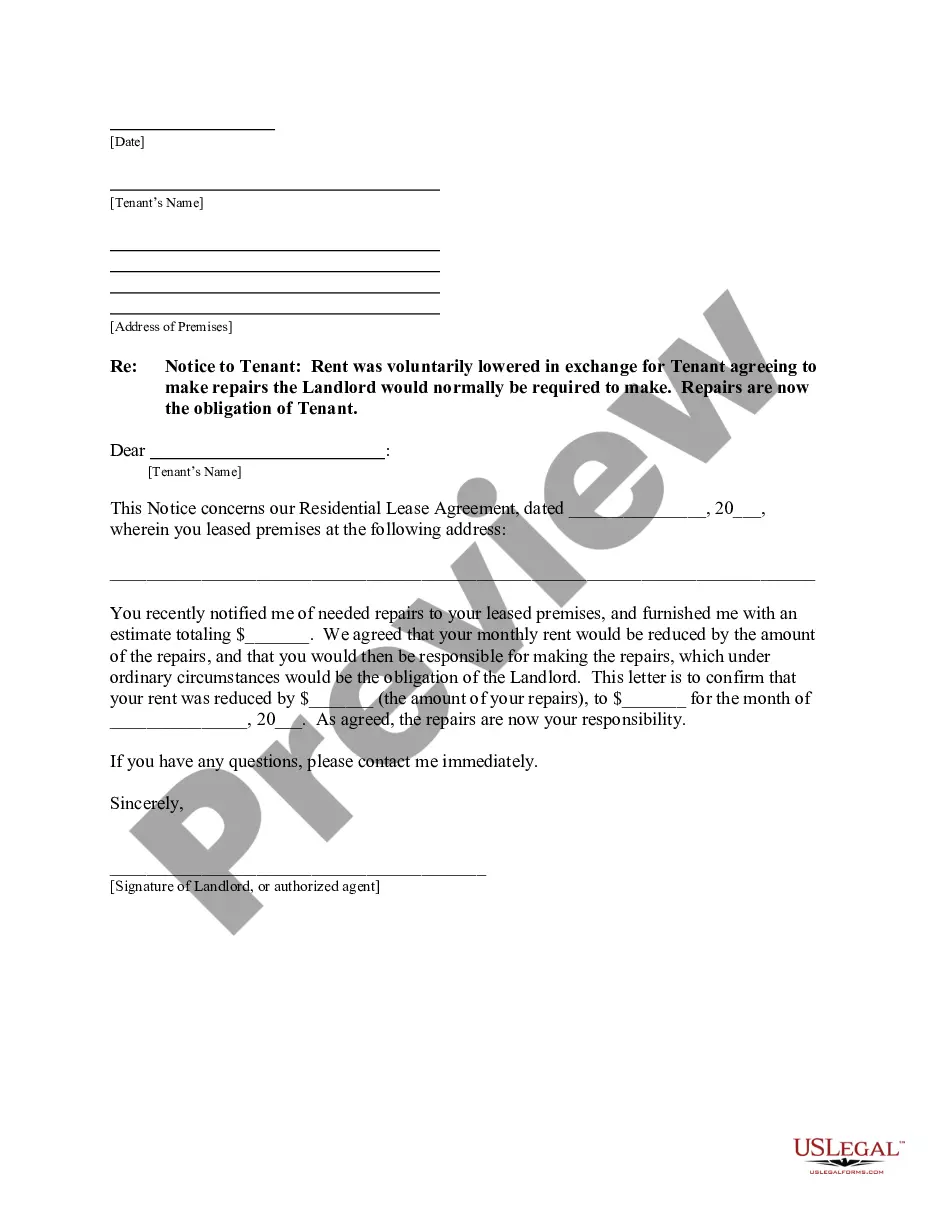

- Examine the example via the Preview option (if available).

- If there’s a description, read it to comprehend the specifics.

- Click the Buy Now button if you find what you're looking for.

Form popularity

FAQ

For a promissory note to be valid, it must contain essential components like the principal amount, interest rate, and repayment terms. Additionally, both parties need to agree on the terms outlined within the document. This ensures that the agreement serves as a binding Illinois Unsecured Installment Payment Promissory Note for Fixed Rate.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Note generally refers to the promissory note or agreement to pay something back. Loan just means that there is borrowing and lending going on, and we assume that - if it's a company - there is some legal and accounting documentation of it.

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends.This note will be a legal record of the loan and will protect you and help make sure you are repaid.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

What is the difference between a Promissory Note and a Loan Agreement? Both contracts evidence a debt owed from the Borrower to the Lender, but the Loan Agreement contains more extensive clauses than the Promissory Note. Further, only the Borrower signs the promissory note while both parties sign a loan agreement.

Personal Promissory Notes This is a particular loan taken from family or friends. Commercial Here, the note is made when dealing with commercial lenders such as banks. Real Estate This is similar to commercial notes in terms of nonpayment consequences.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Traditionally, lenders used promissory notes to evidence (i.e., to legally document) their loans and borrowers' obligations to repay them.In transactions using a loan or credit agreement, promissory notes typically reference the loan agreement, requiring a reading of both documents to fully understand the terms.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.