Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate

What this document covers

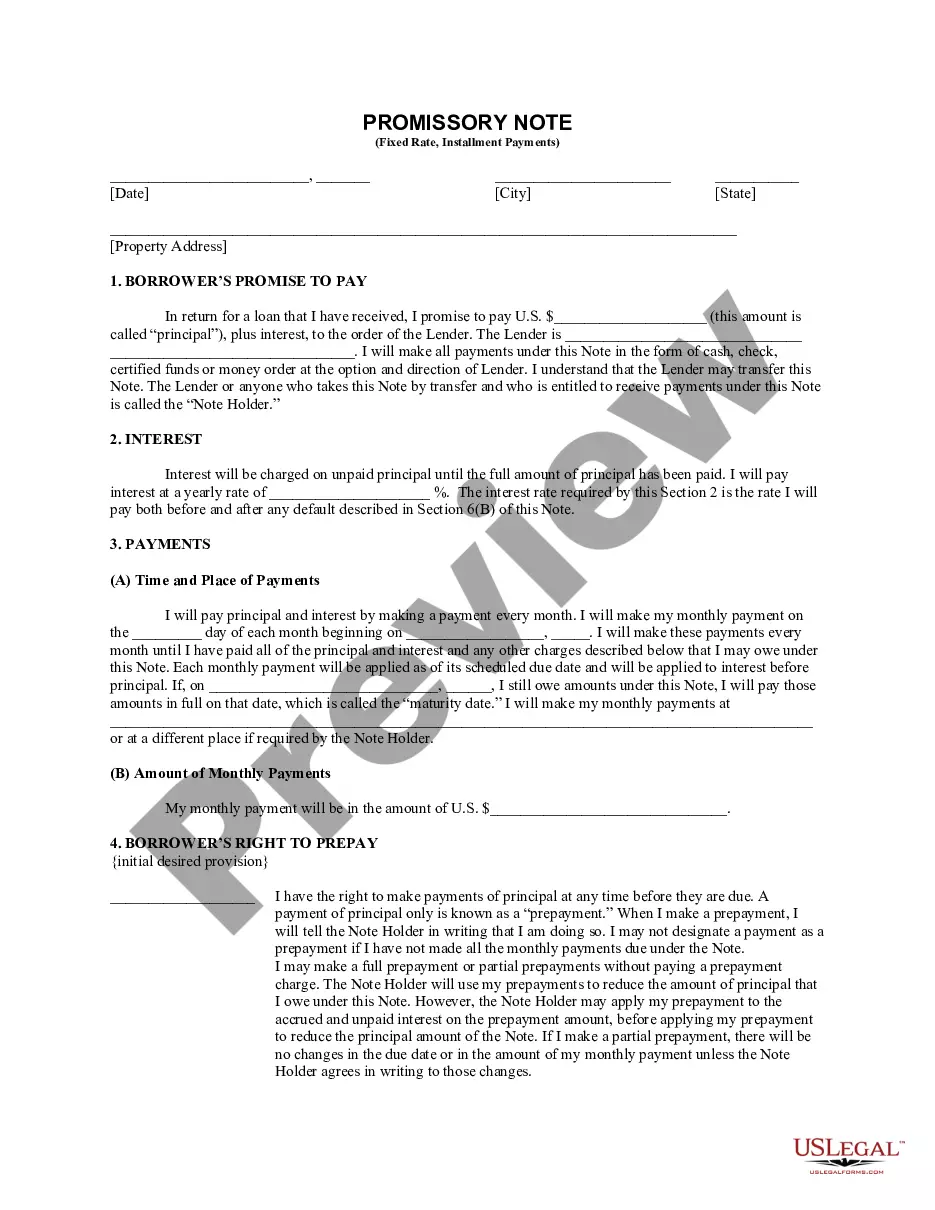

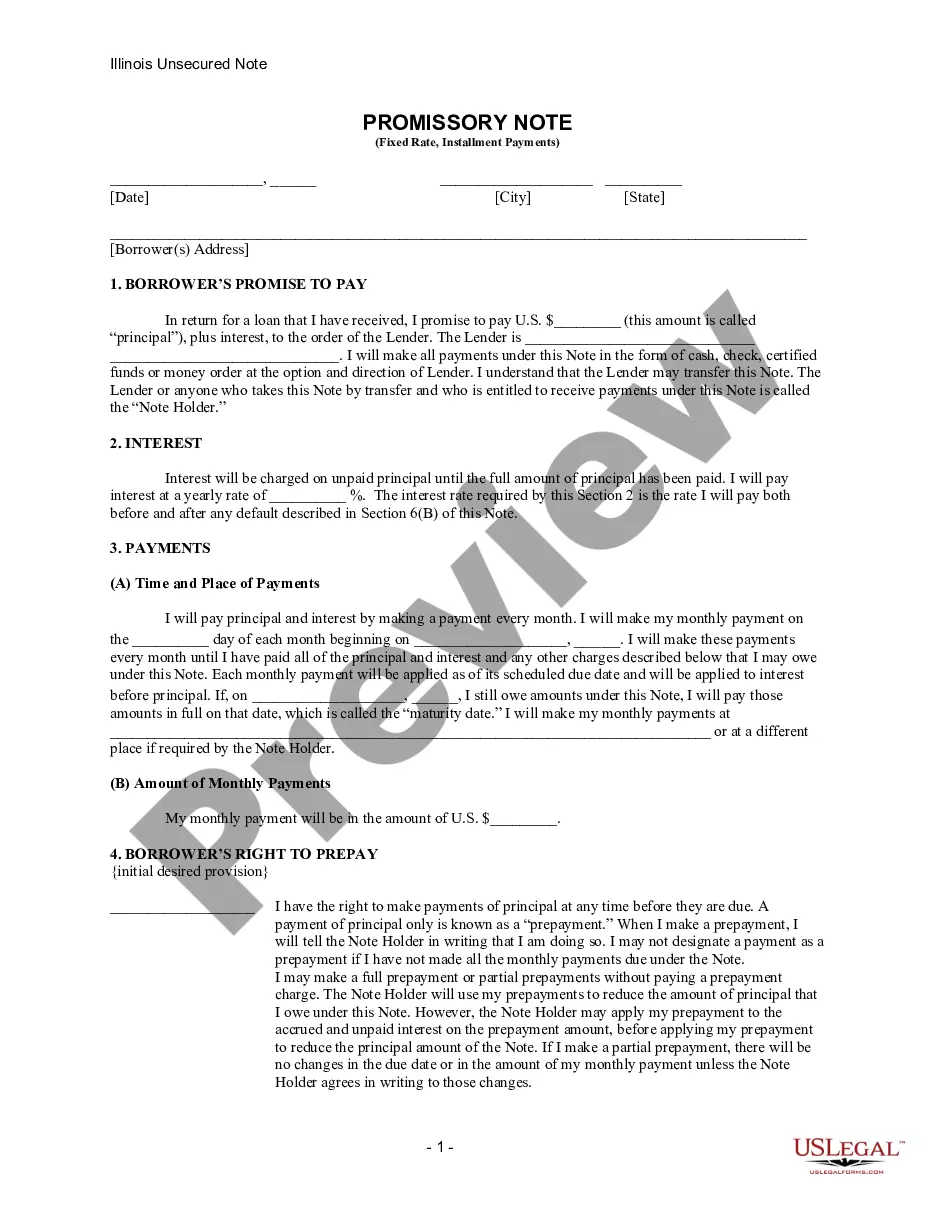

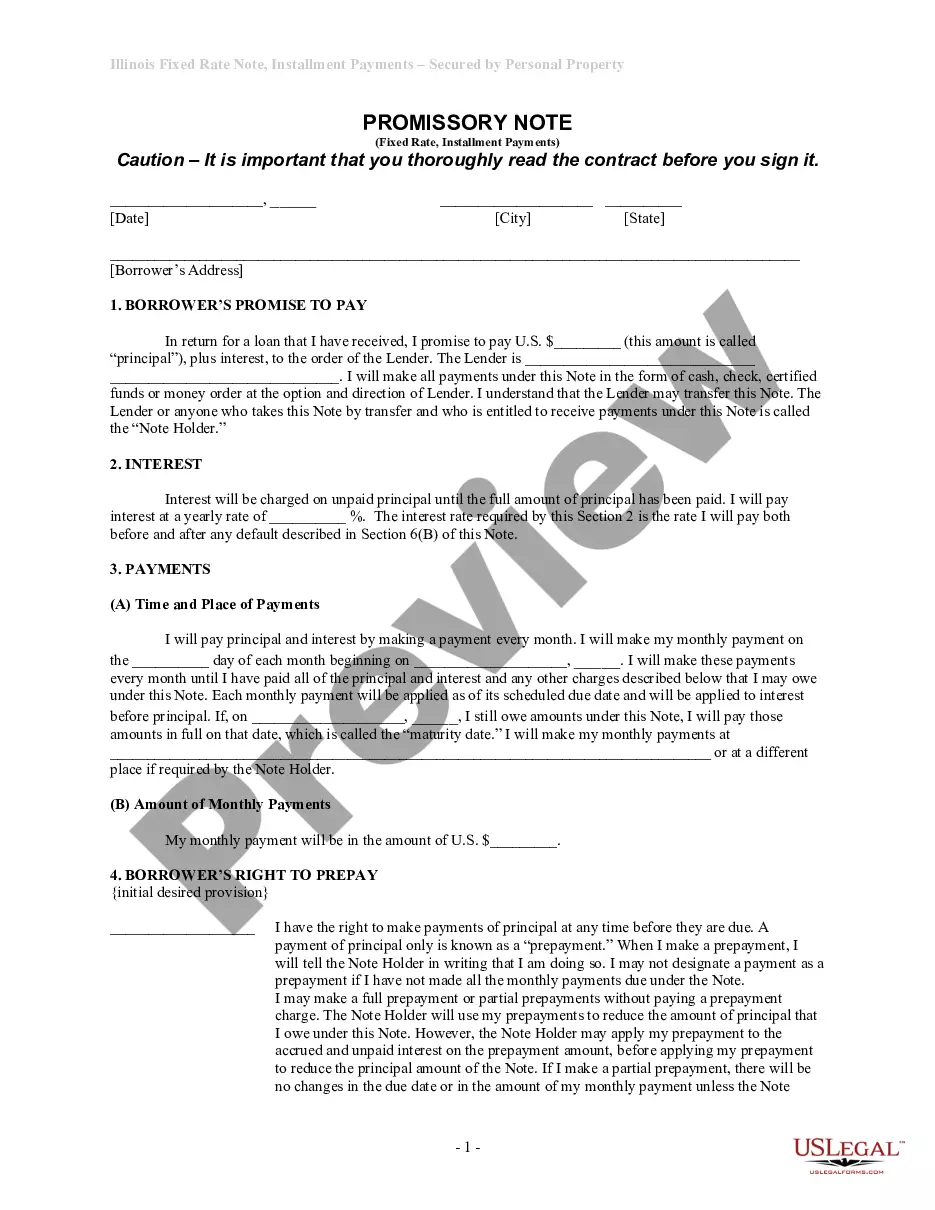

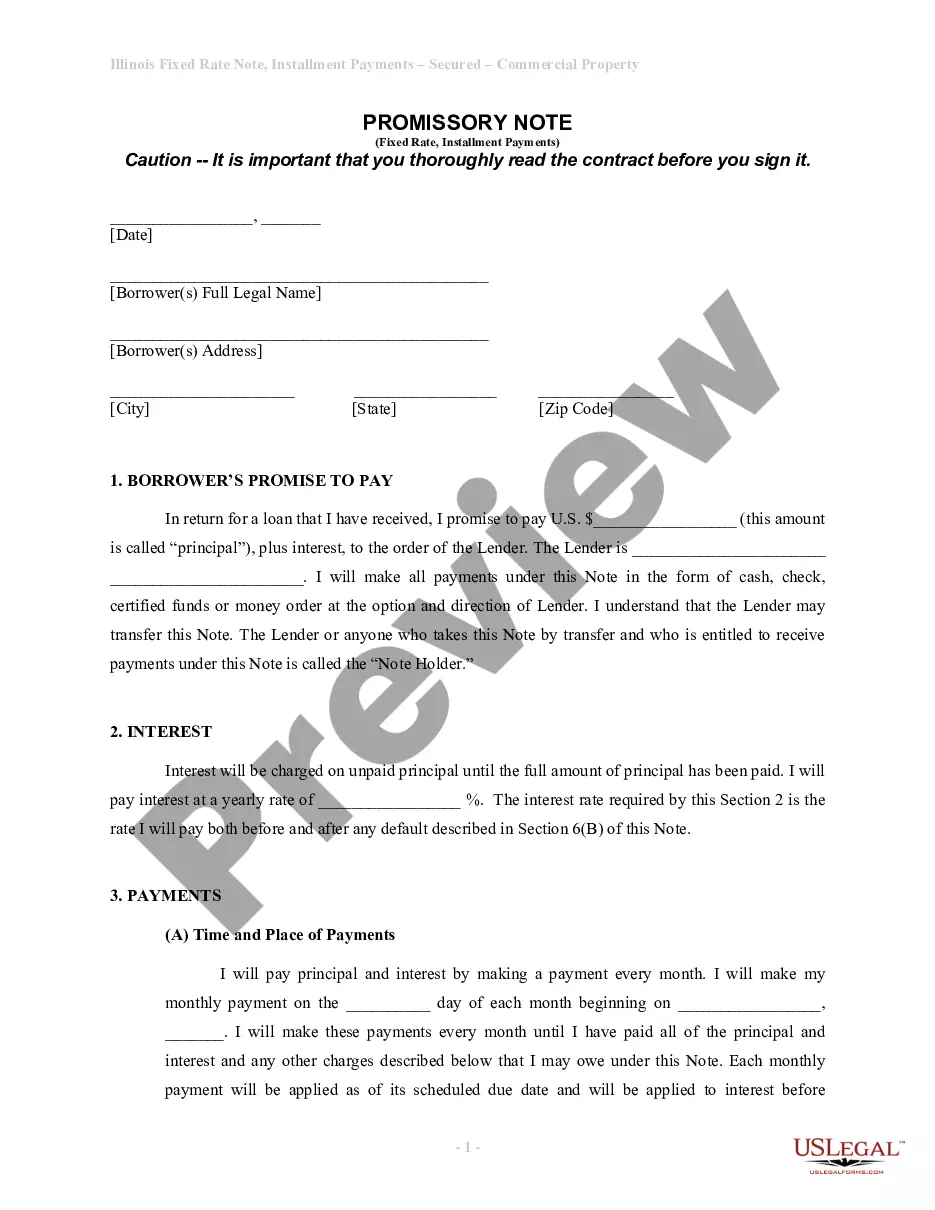

The Illinois Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that serves as a written promise to repay a loan with residential property as collateral. This form outlines the borrower's commitment to repay the loan amount, interest, and any additional charges to the lender. It differs from other promissory notes by specifying that the loan is secured by real estate, providing the lender additional protection in case of default.

Form components explained

- Borrower's promise to pay: Details the principal amount, interest rate, and payment schedule.

- Interest: Specifies the annual interest rate applied to the loan.

- Payment terms: Outlines the timing, amount, and location of monthly payments.

- Borrower's right to prepay: Explains conditions for making early payments, including any penalties.

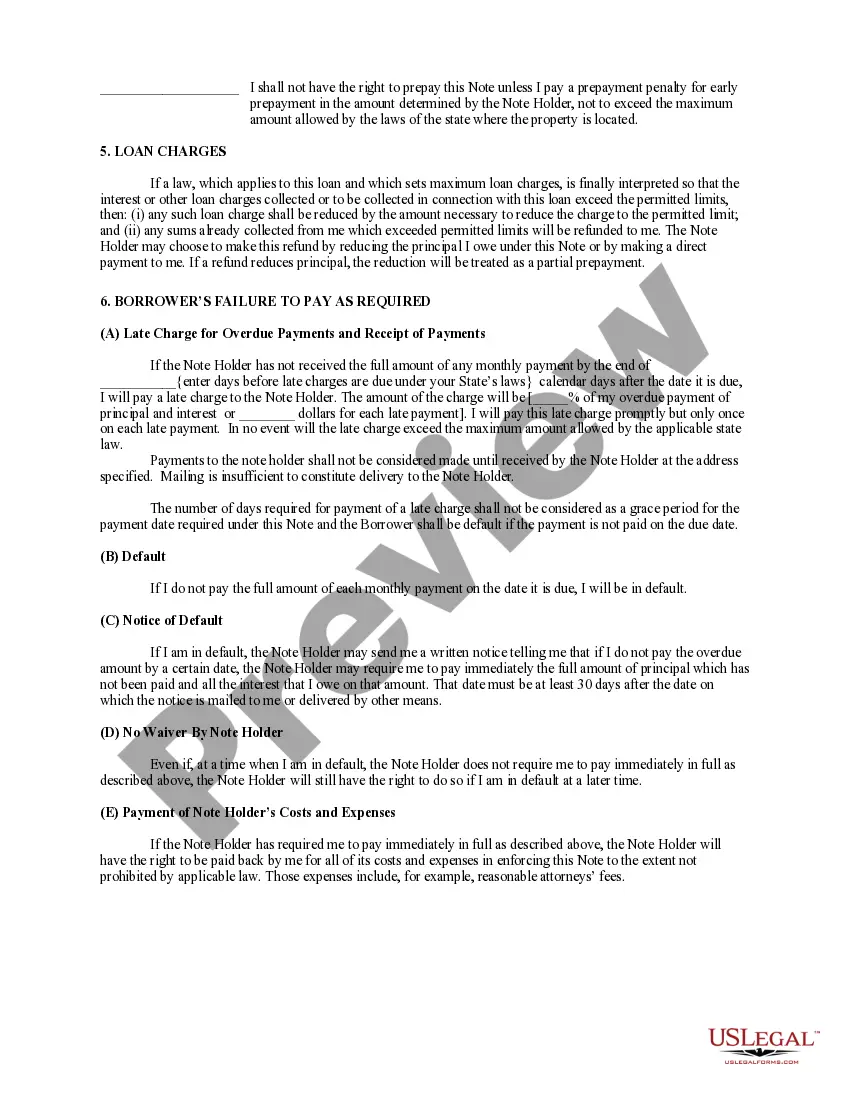

- Late charges: Defines penalties for overdue payments and conditions for default.

- Secured note: Clarifies that the note is secured by a mortgage or deed of trust on the property.

When this form is needed

This form should be used when a borrower needs to secure a loan with residential property. It's applicable in situations where a homeowner seeks financing for personal or investment purposes and agrees to repay the loan in fixed monthly installments. This promissory note ensures that both the lender and borrower have a clear understanding of the repayment terms and security involved.

Who can use this document

- Homeowners who want to take out a loan secured by their residential property.

- Individuals seeking to borrow money for purchasing a home or for renovations.

- Lenders who require documentation of loan agreements involving real estate as collateral.

- Real estate investors looking for a structured payment agreement on financed properties.

Steps to complete this form

- Identify the parties: Fill in the names of the borrower(s) and lender.

- Specify the loan details: Enter the principal amount and annual interest rate.

- Determine payment schedule: Indicate the monthly payment amount and due dates.

- Include relevant addresses: Provide the property address and the lender's address for payment delivery.

- Sign and date the document: Ensure all parties sign the form to make it legally binding.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Not clearly defining the interest rate, which can lead to confusion about payment obligations.

- Failing to specify the payment schedule, causing potential disputes about due dates.

- Omitting the property address, which is crucial for securing the loan.

- Not including initial payments for prepayment, which may affect the ability to pay off the loan early.

- Neglecting to sign the document, rendering it unenforceable.

Advantages of online completion

- Convenient access to legally vetted documents that can be downloaded instantly.

- Editable templates allow users to customize the form as needed to fit their specific terms.

- Ensures compliance with state regulations as the form is designed with jurisdictional guidelines in mind.

- Eliminates the need for legal consultations unless necessary, saving time and money.

Looking for another form?

Form popularity

FAQ

Promissory notes are typically recorded as public documents and accessible shortly after the closing. The trustee maintains the original deed until the loan is satisfied. When the loan is paid off, the trustee automatically records a deed of reconveyance at the county recorder's office for safekeeping.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

No. California promissory notes do not need to be notarized or witnessed for validity.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.