Illinois General Contractor's Lien - Notice of Lien - Mechanic Liens - Corporation or LLC

What this document covers

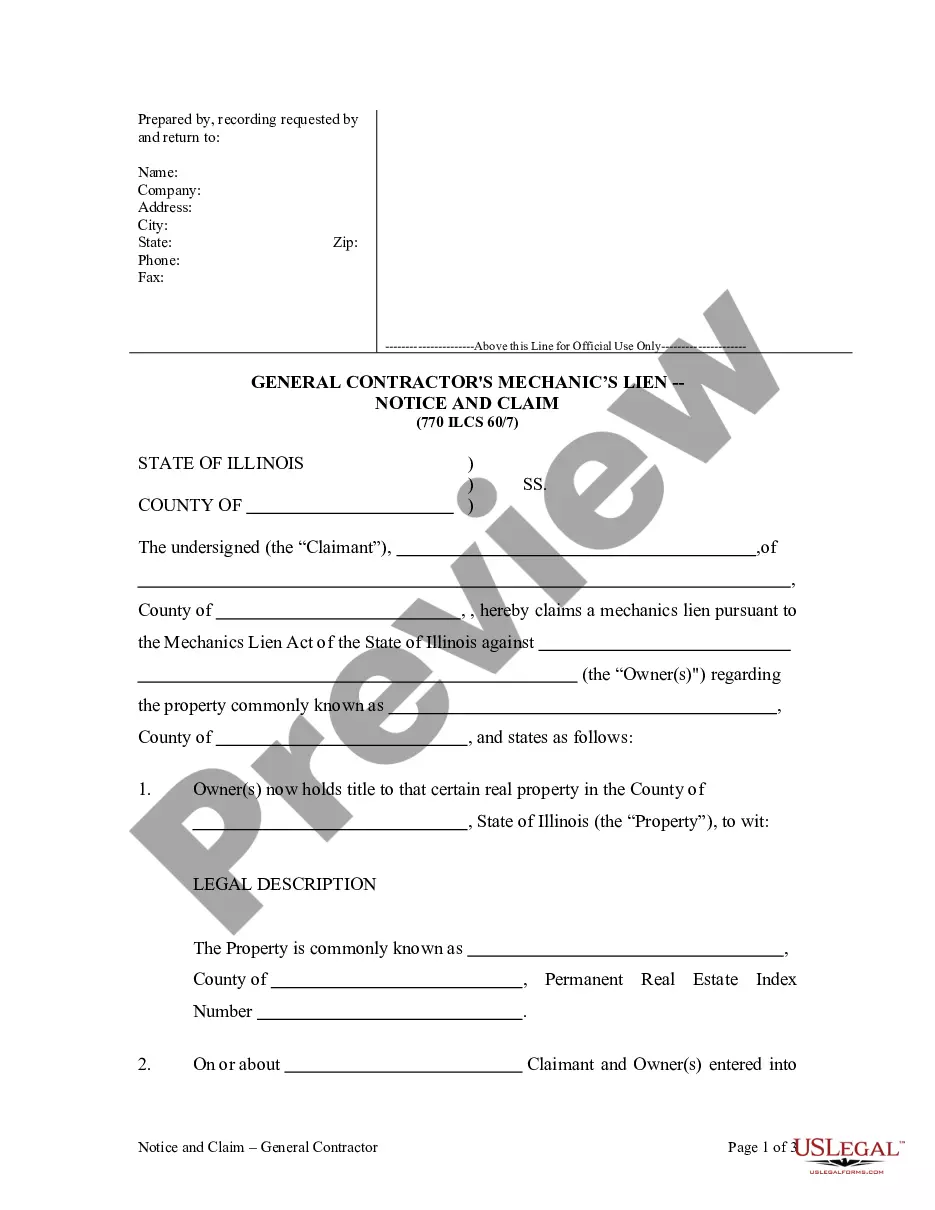

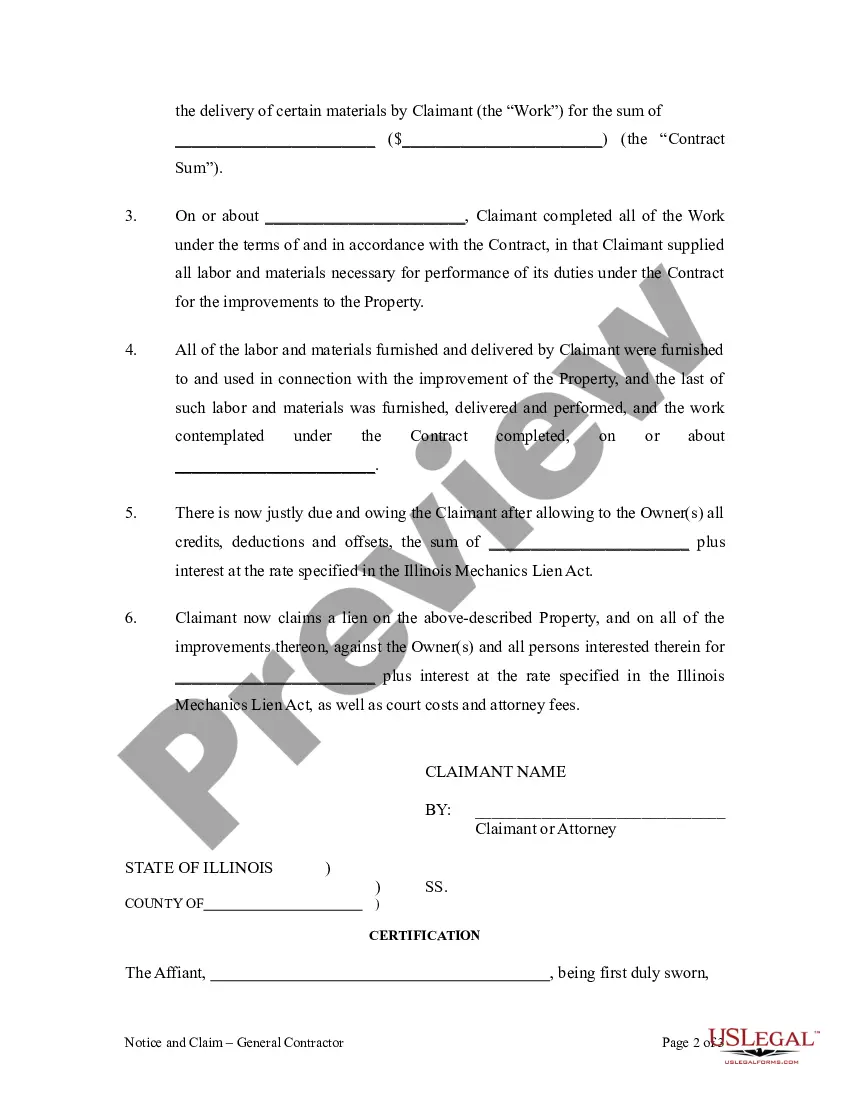

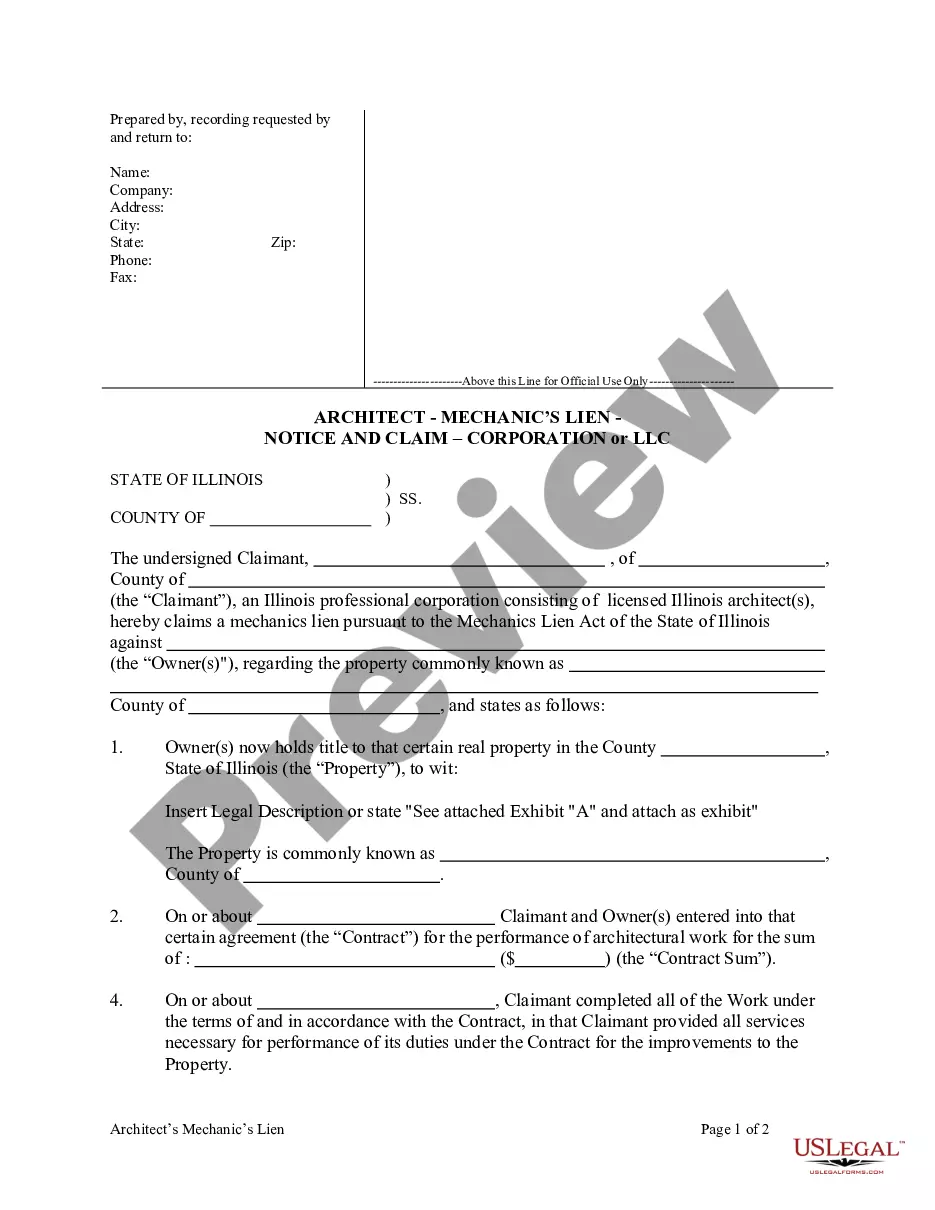

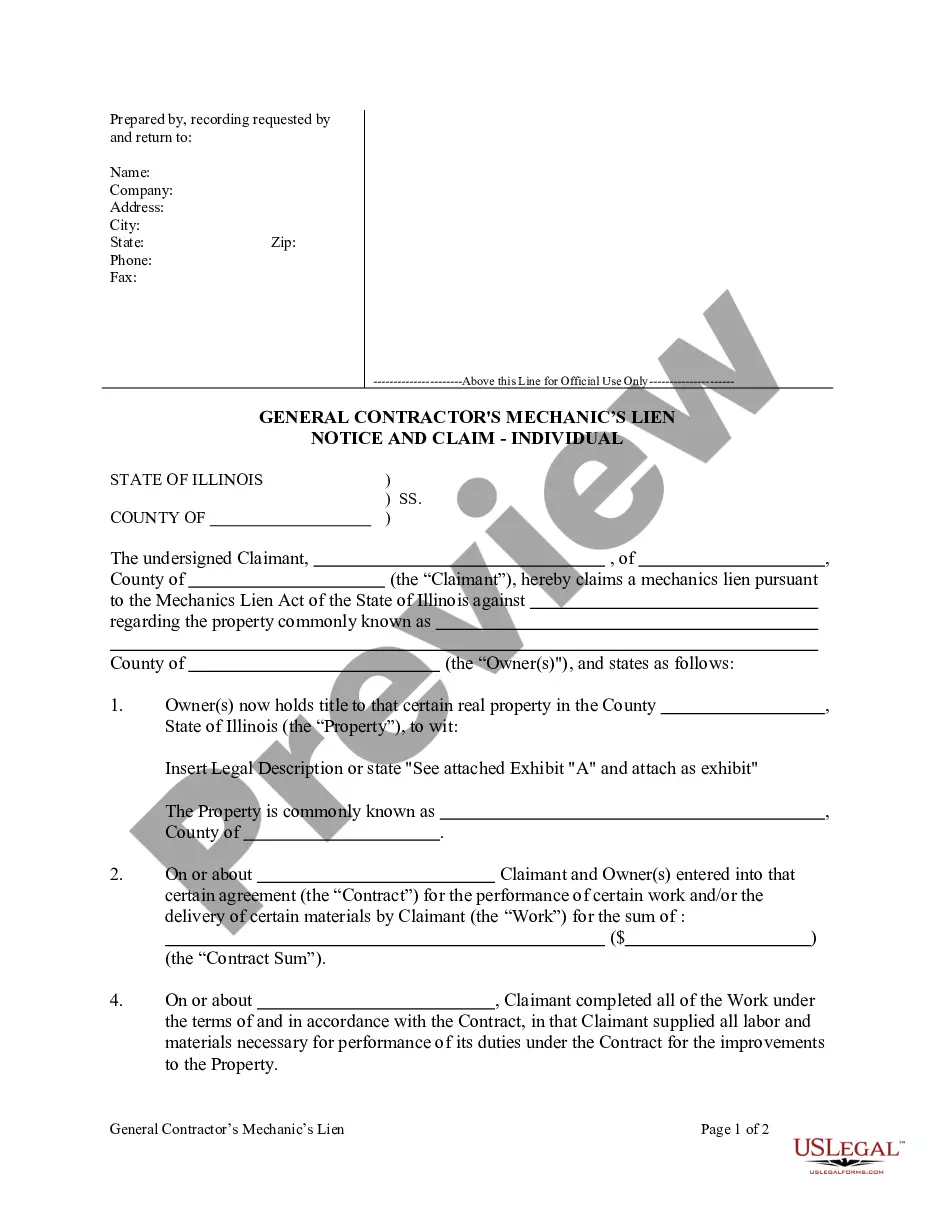

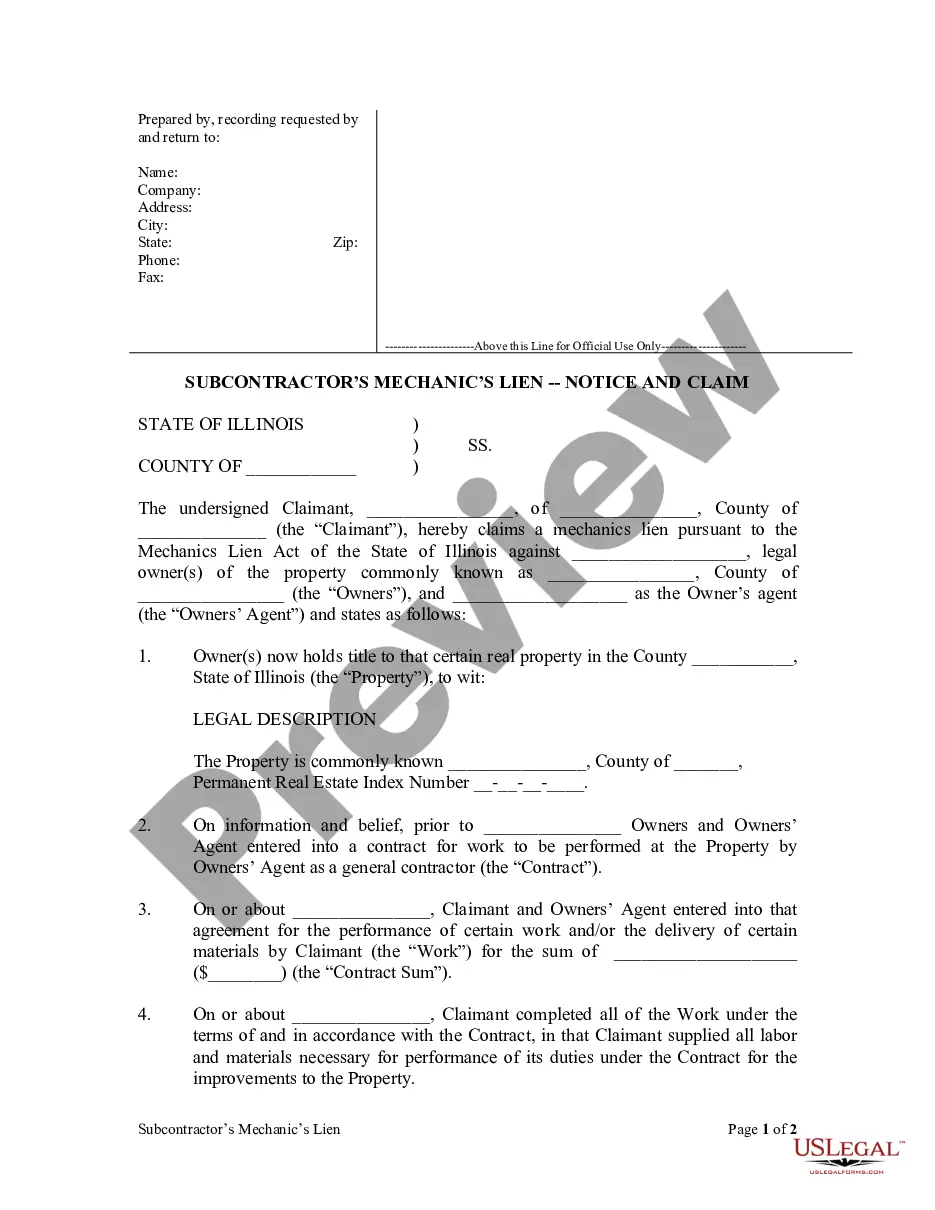

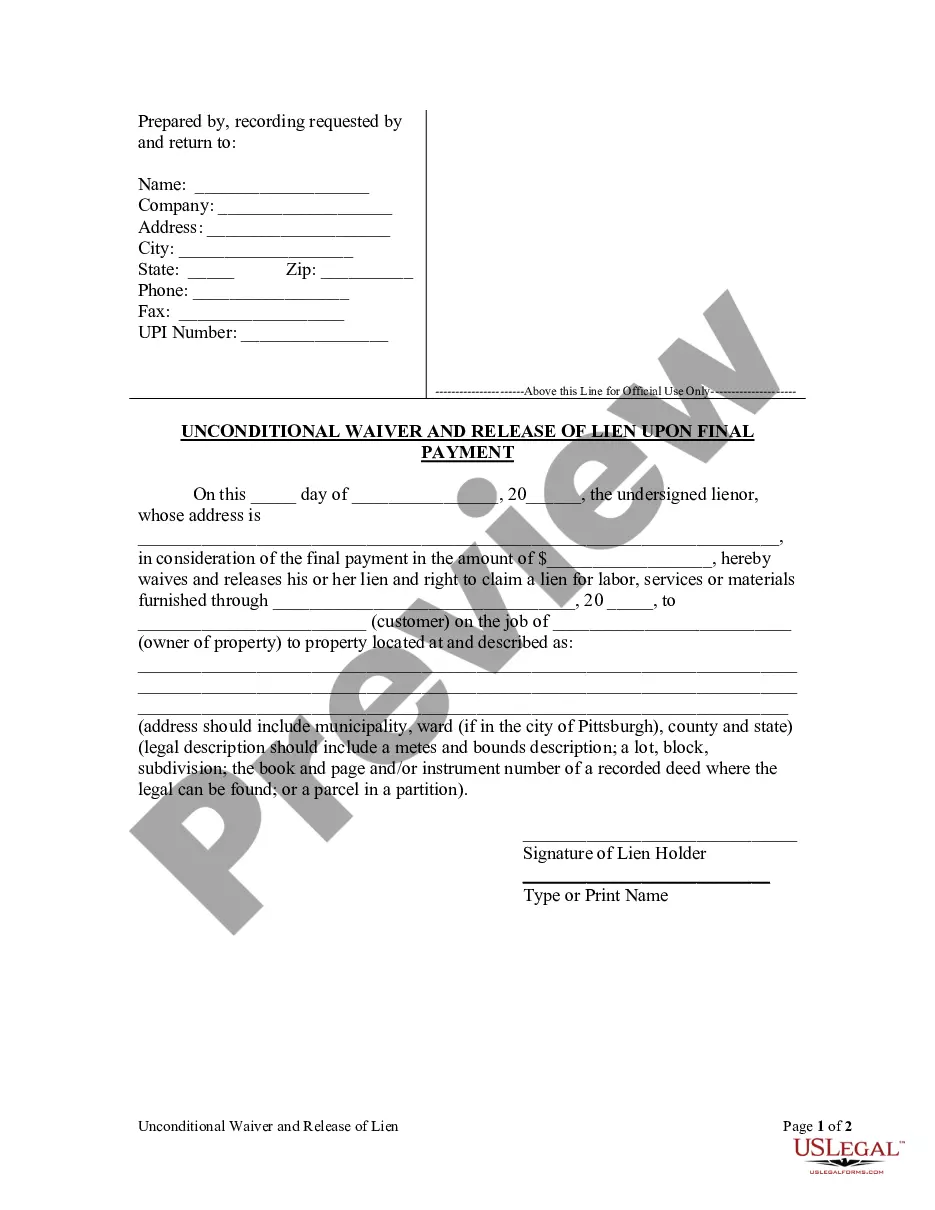

The General Contractor's Lien - Notice of Lien is a legal document used by corporate contractors or LLCs in Illinois to establish a claim of lien on a property for unpaid work or materials. This form is designed to protect contractors' rights by providing a formal notice to property owners and relevant parties, ensuring that claims for payment are documented. It differs from other lien forms by being specifically intended for entities structured as corporations or limited liability companies (LLCs).

Key parts of this document

- Name of the contractor and company information.

- Property address where work was performed.

- Details of the lien claim, including the amount owed.

- Signatures of authorized representatives from the corporation or LLC.

- Verification of service to relevant parties.

When to use this document

This form should be used when a corporate contractor or LLC has not been paid for labor or materials provided on a construction project. It serves as a formal way to notify property owners and other interested parties of the unpaid debt, helping contractors secure their right to payment through lien enforcement if necessary. Consider using this form if you have sent invoices and reminders but have not received payment within the agreed timeframe.

Who should use this form

This form is intended for:

- Corporate contractors who have done work on a property.

- Limited liability companies (LLCs) involved in construction or renovation projects.

- Construction managers or other parties acting on behalf of a contractor entity.

How to prepare this document

- Identify and provide your name, company name, and contact information at the top of the form.

- Fill in the property address where the work was performed.

- Detail the claim amount due for the work completed or materials supplied.

- Have the authorized representatives of your corporation or LLC sign the document.

- Ensure that copies of this notice are sent to all relevant parties, including the property owner.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include the complete property address.

- Not providing accurate or updated contact information for the contractor.

- Leaving out the signature or improper authorization of the form.

- Not serving the notice to all required parties.

Benefits of using this form online

- Convenient access to downloadable legal templates without the need for in-person appointments.

- Edit and fill out the form at your own pace.

- Instant availability ensures timely filing of your lien notice.

- Compliance with legal standards as forms are drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Get free mechanics lien form A construction mechanics lien is claimed against real estate property, and the lien must be filed in the appropriate office in order to be valid.Additionally, construction liens have strict timing and notice requirements. Machinery mechanics liens are possessory liens.

When a contractor files a mechanics' (construction) lien on your home, the lien makes your home into what's called security for an outstanding debt, which the contractor claims is due and unpaid for services or materials.

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

WHAT MUST I DO BEFORE I FILE MY LIEN? Usually there is at least one notice that you must mail before you can file your lien. These notices are sometimes called notices of intent to file lien. Illinois Document Preparation fee of $165 includes all required notices of intent.

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

A construction lien is a claim made against a property by a contractor or subcontractor who has not been paid for work done on that property. Construction liens are designed to protect professionals from the risk of not being paid for services rendered.

Even though these states may permit project participants to secure lien rights and claim a mechanics lien even without a written contract, it is generally best practice to have a signed written contract for work provided.

The deadline for contractors and subcontractors to file their statement of mechanic's lien is four months (not 120 days) from the last date of work (exclusive of warranty work or other work performed free of charge), or from the last date that materials were supplied to the project.

Posting a Bond Asselta says to expect to pay 110 percent of the lien amount. Submit the bond to the court. The lien will then transfer to the bond and clear the property's title. Wait for the contractor claimant to foreclose on the lien in the allotted period to dispute the lien in court.