Illinois Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Illinois Contract For Deed Seller's Annual Accounting Statement?

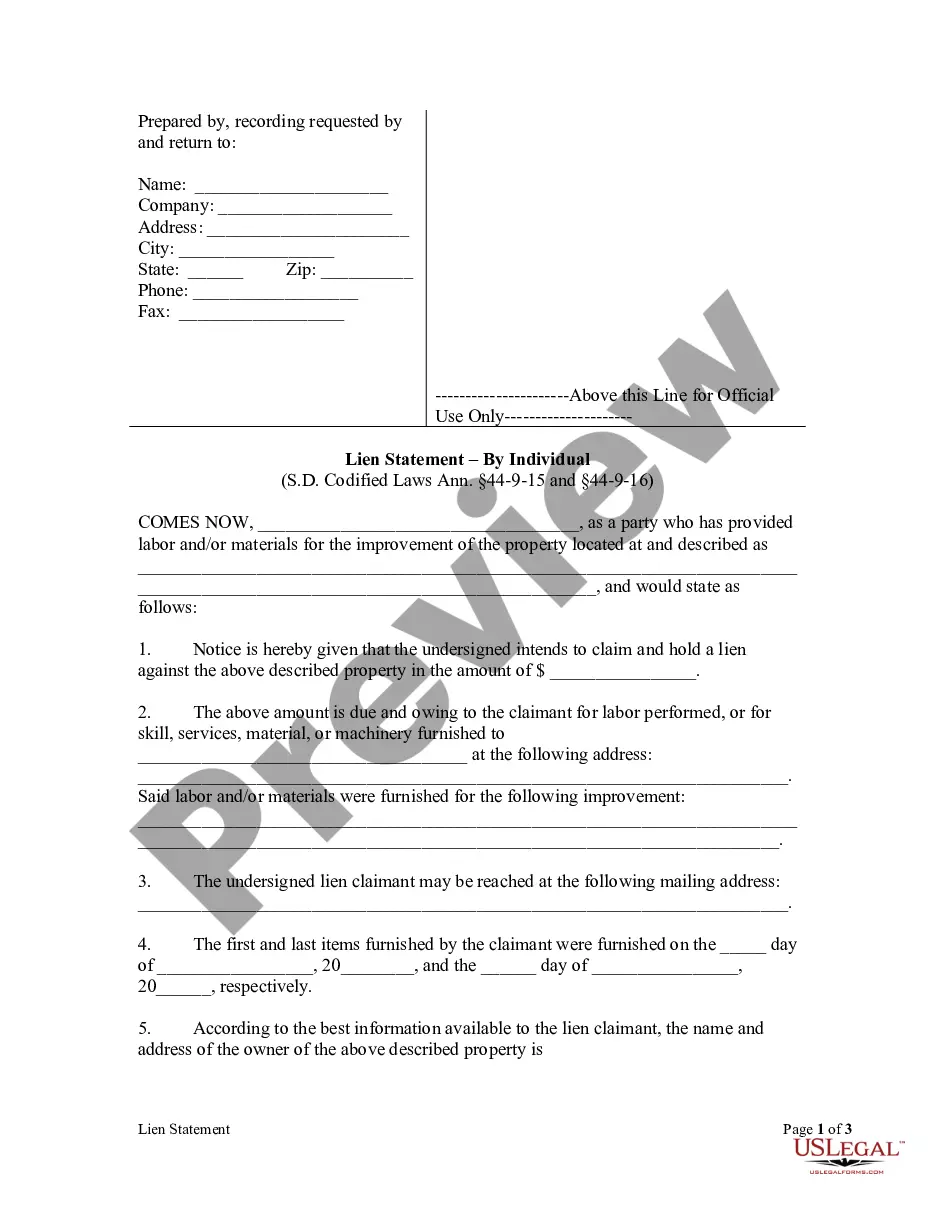

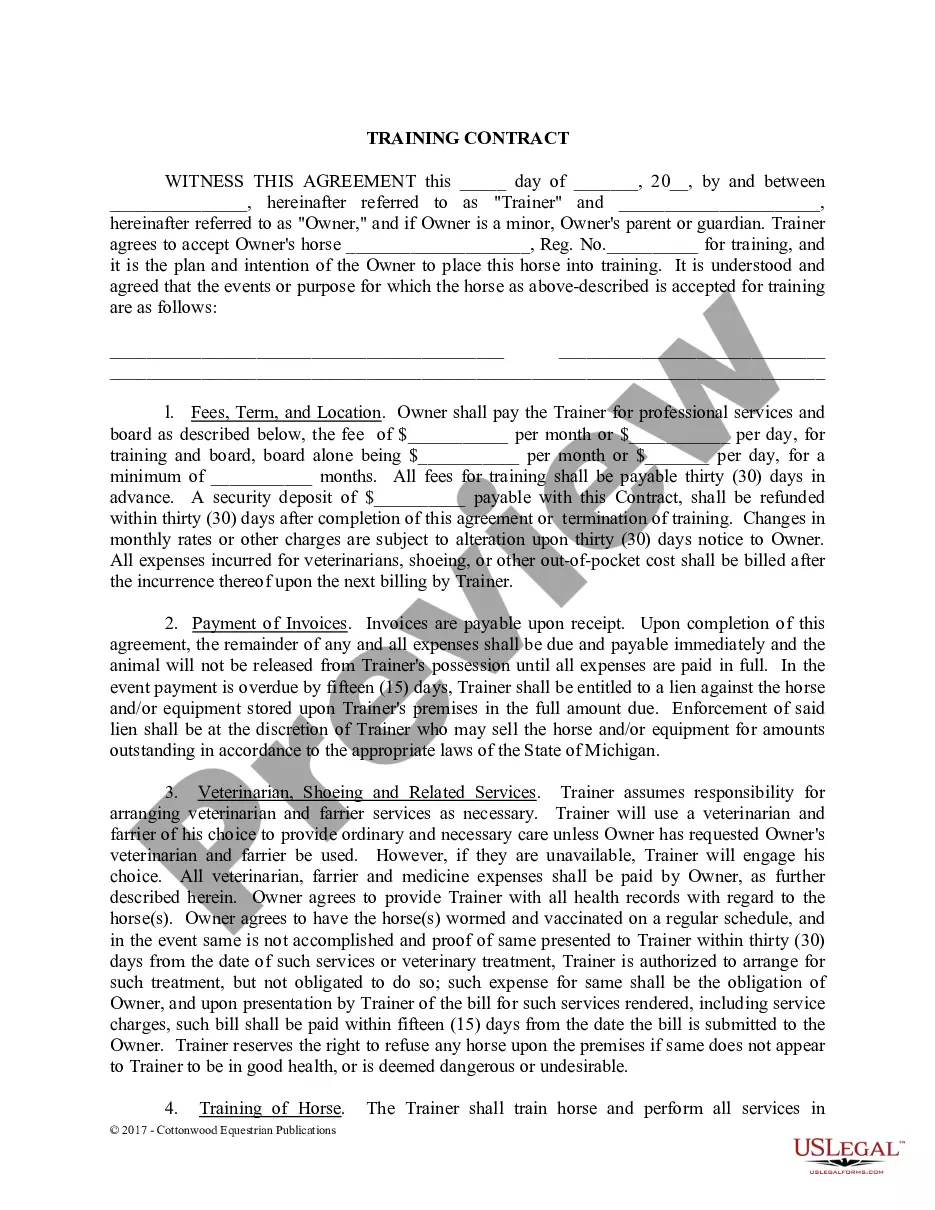

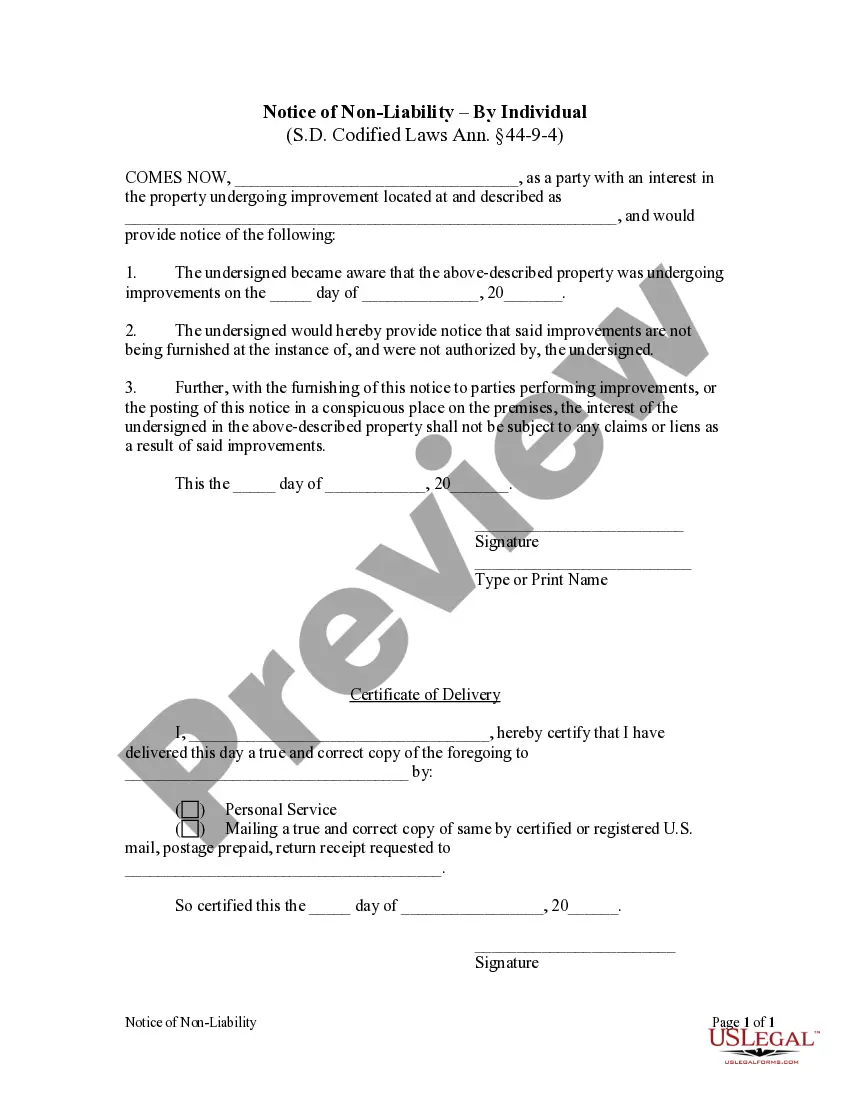

Utilize US Legal Forms to obtain a printable Illinois Contract for Deed Seller's Annual Accounting Statement.

Our court-recognized forms are crafted and consistently updated by skilled attorneys.

Ours is the most extensive Forms collection available online and provides economical and precise samples for consumers, legal professionals, and small to medium-sized businesses.

Examine the form by reading its description and utilizing the Preview feature. Click Buy Now if it matches your needs. Create your account and pay via PayPal or credit card. Download the form onto your device for repeated use. Use the Search function if you need to find additional document templates. US Legal Forms provides thousands of legal and tax documents and packages catering to both business and personal requirements, including the Illinois Contract for Deed Seller's Annual Accounting Statement. Over three million users have successfully leveraged our platform. Choose your subscription plan to access high-quality documents in just a few clicks.

- Templates are organized into state-specific categories.

- Some of the templates may be viewed before downloading.

- To obtain templates, users must have a subscription and Log In to their account.

- Click Download next to any desired form and locate it in My documents.

- For individuals without a subscription, follow these steps to find and download the Illinois Contract for Deed Seller's Annual Accounting Statement.

- Ensure you select the correct template based on the state requirements.

Form popularity

FAQ

On a land contract, the buyer is responsible for property taxes, insurance and mortgage interest, although these will usually be paid through the seller. However, the buyer does get to deduct them from his or her taxes; the seller cannot.

A Contract for Deed is a way to buy a house that doesn't involve a bank. The seller finances the property for the buyer.The buyer pays the seller monthly payments that go towards payment for the home. Once the house is paid off, the buyer gets the deed recorded in the buyer's name.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

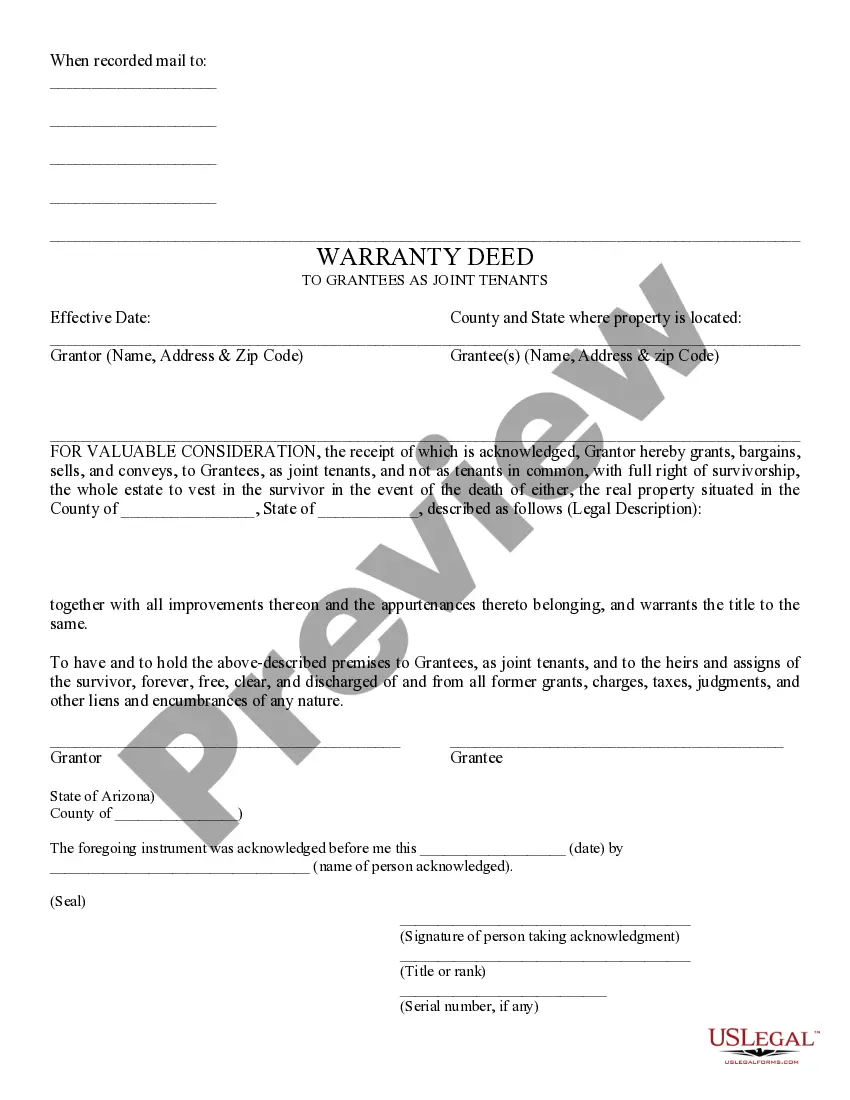

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

Contract for Deed Seller Financing. A contract for deed is used by some sellers who finance the sale of their homes. Seller's Ownership Liability. Buyer Default Risk. Seller Performance. Property Liens Could Hinder Purchase.

A contract for deed is an agreement for buying property without going to a mortgage lender. The buyer agrees to pay the seller monthly payments, and the deed is turned over to the buyer when all payments have been made.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

A contract for deed is a legal agreement for the sale of property in which a buyer takes possession and makes payments directly to the seller, but the seller holds the title until the full payment is made.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.