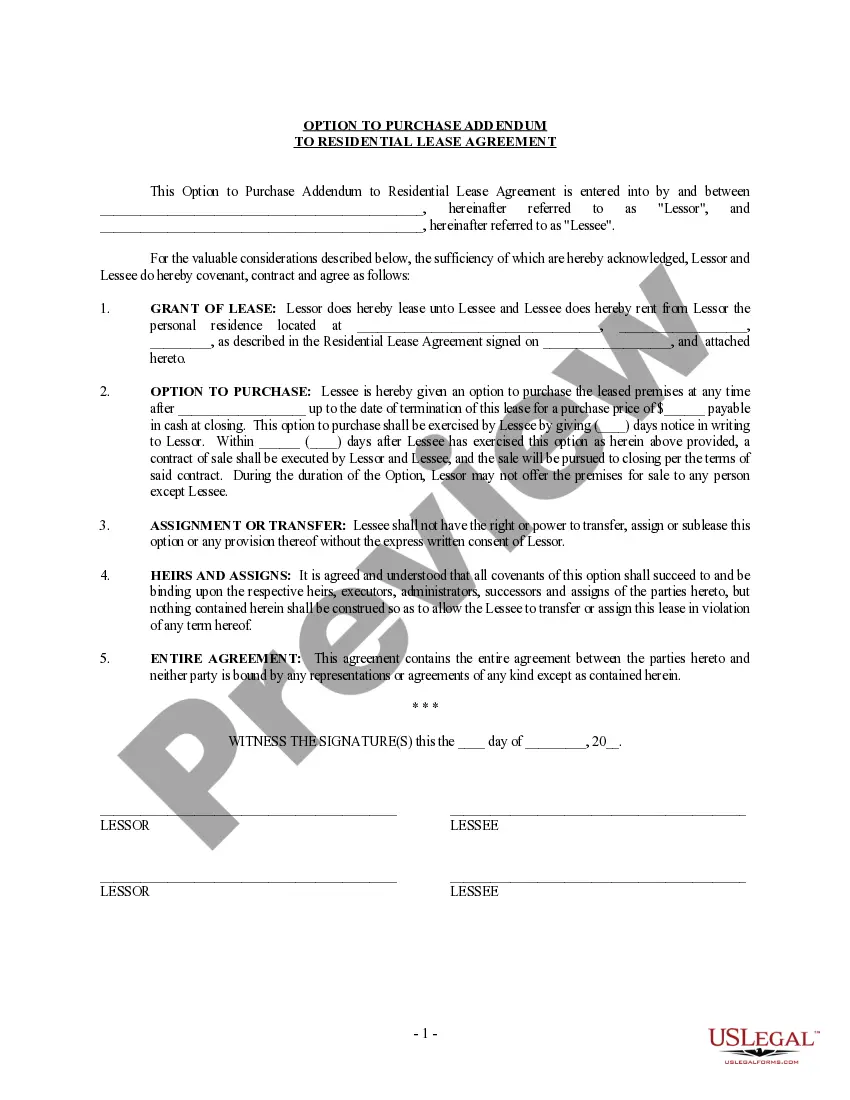

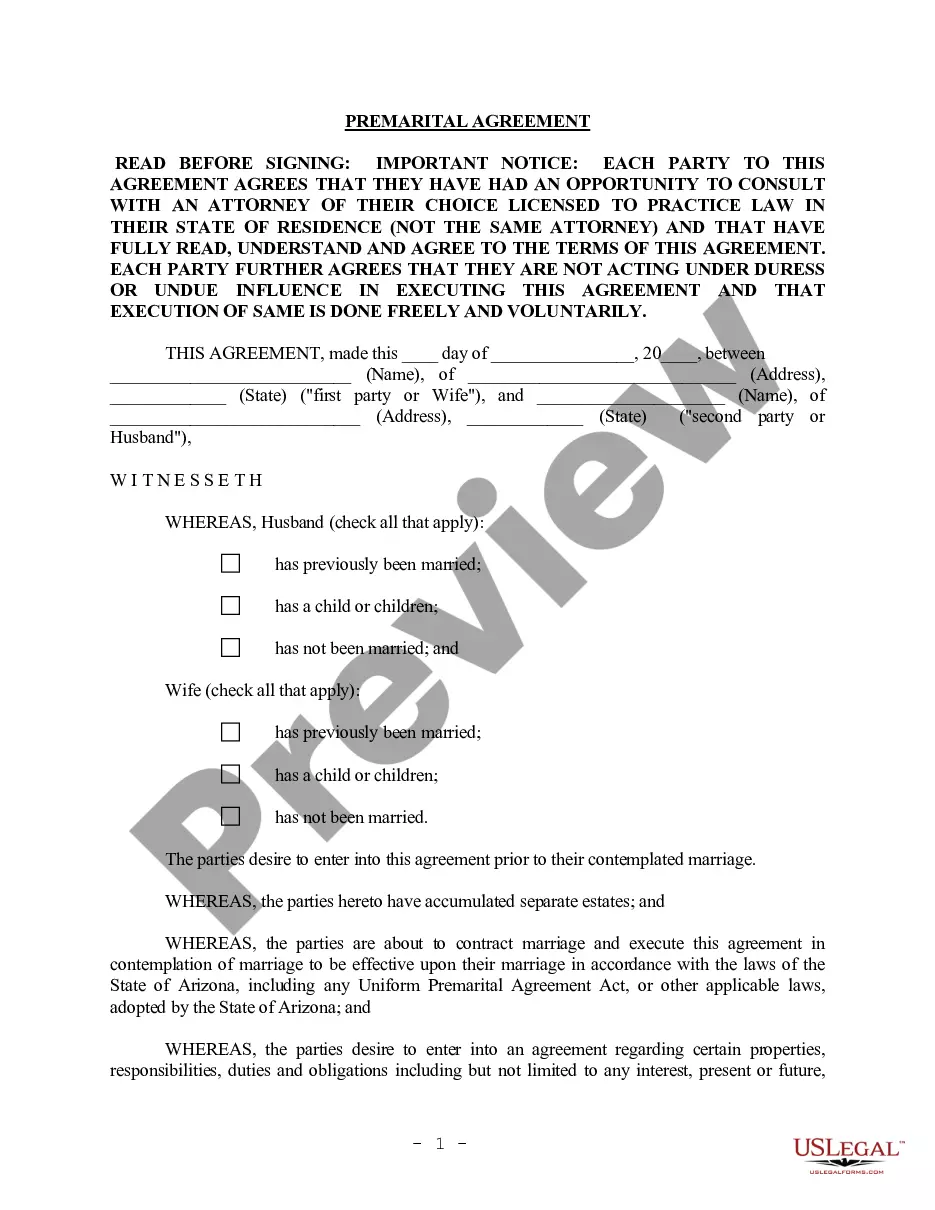

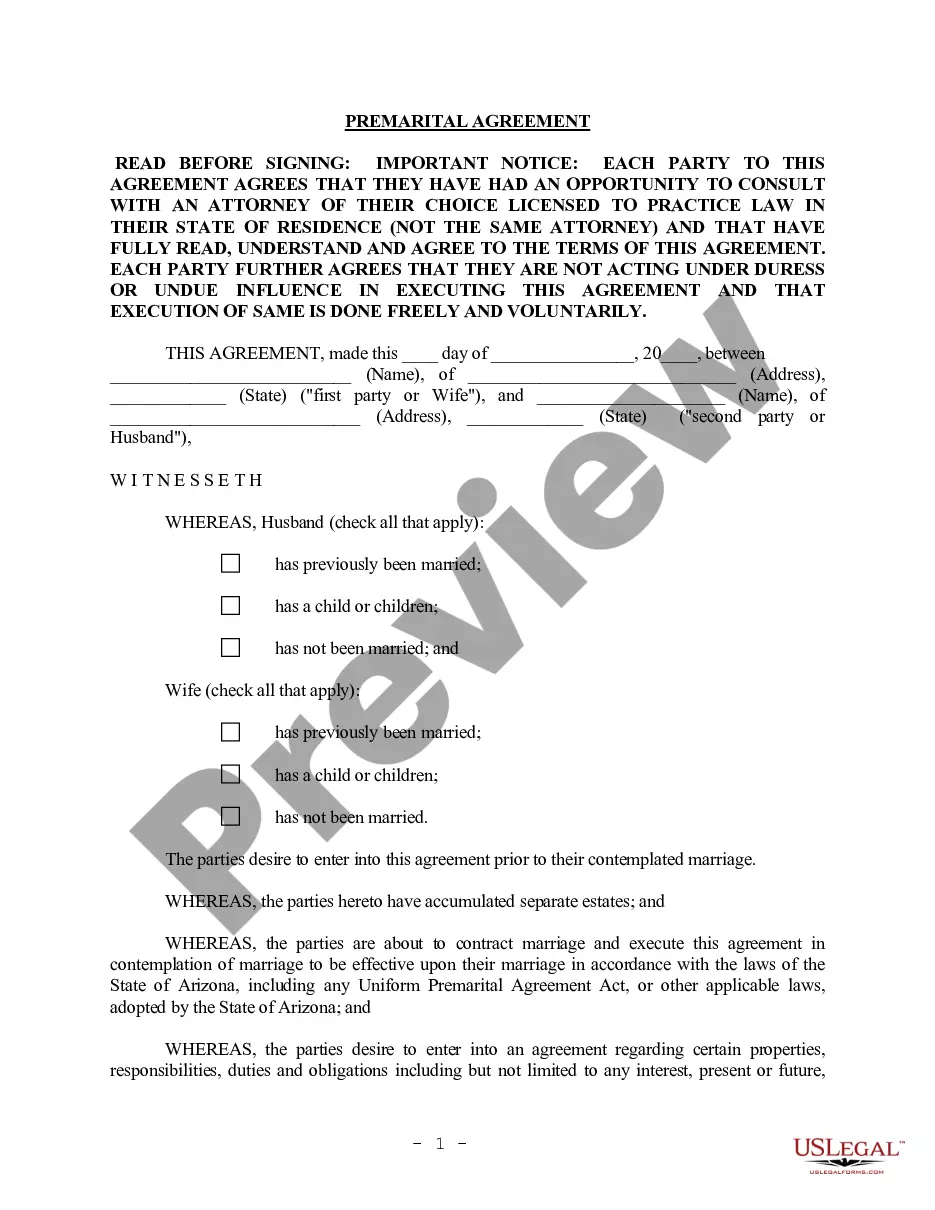

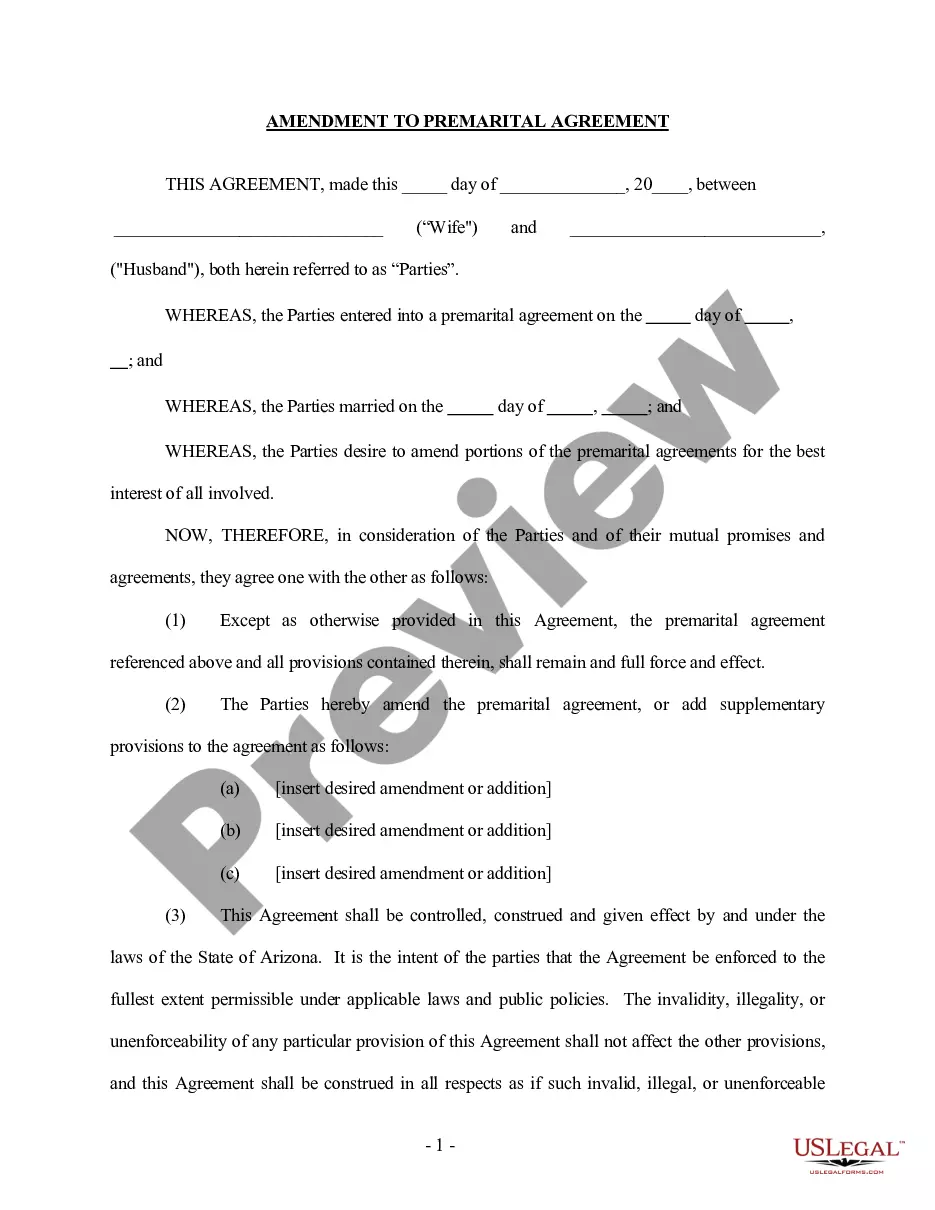

The Idaho Trustee Ch 7 Conversion Fee Waiver is a fee waiver available to individuals who convert from Chapter 7 bankruptcy into Chapter 13 bankruptcy in the state of Idaho. This fee waiver allows individuals to convert their case without having to pay the conversion fee that is usually associated with such a conversion. There are two types of Idaho Trustee Ch 7 Conversion Fee Waiver: a full fee waiver, which waives the entirety of the conversion fee, and a partial fee waiver, which waives a portion of the conversion fee. Both waivers are subject to certain eligibility requirements, such as having the necessary documentation, having a current income, and meeting other criteria.

Idaho Trustee Ch 7 Conversion Fee Waiver

Description

How to fill out Idaho Trustee Ch 7 Conversion Fee Waiver?

How much time and resources do you usually spend on composing formal documentation? There’s a greater opportunity to get such forms than hiring legal experts or wasting hours searching the web for a proper blank. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Idaho Trustee Ch 7 Conversion Fee Waiver.

To acquire and prepare an appropriate Idaho Trustee Ch 7 Conversion Fee Waiver blank, follow these easy steps:

- Look through the form content to ensure it meets your state requirements. To do so, read the form description or use the Preview option.

- In case your legal template doesn’t satisfy your needs, locate a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Idaho Trustee Ch 7 Conversion Fee Waiver. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally safe for that.

- Download your Idaho Trustee Ch 7 Conversion Fee Waiver on your device and fill it out on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most trusted web services. Sign up for us now!

Form popularity

FAQ

The main cons to Chapter 7 bankruptcy are that most unsecured debts won't be erased, you may lose nonexempt property, and your credit score will likely take a temporary hit. While a successful bankruptcy filing can give you a fresh start, it's important to do your research before deciding what's right for you.

Chapter 7 is your better bet if you are hopelessly awash in debt from credit cards, medical bills, personal loans, and/or car loans and your income simply cannot keep up. As noted above, you're most likely going to get to keep most of your assets while erasing your unsecured debt.

In a Chapter 7 bankruptcy, assets are liquidated to pay creditors, with secured debts having priority over unsecured debts. In a Chapter 11 bankruptcy, a company is restructured under the supervision of a trustee appointed by the court. The company continues to operate, paying its debts back with future earnings.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

Chapter 11's disadvantages include: Not shielding sole proprietors from creditors seeking repayment. It's expensive, thanks to the need for legal and other professional advice. Cases can take a long time. The business may not be able to sell assets, borrow or make other decisions without court approval.

Under Chapter 11 bankruptcy, a business or person generally gets to keep most of their assets, though the debtor could propose to sell many of their assets as part of the reorganization plan.

Chapter 7 cases are typically only filed voluntarily by the debtor. The primary purpose of a Chapter 11 bankruptcy is to give business entities and individuals with large amounts of debt an opportunity to reorganize their financial affairs.

Bankruptcy is a legal process where you're declared unable to pay your debts. It can release you from most debts, provide relief and allow you to make a fresh start. You can enter into voluntary bankruptcy. To do this you need to complete and submit a Bankruptcy Form.