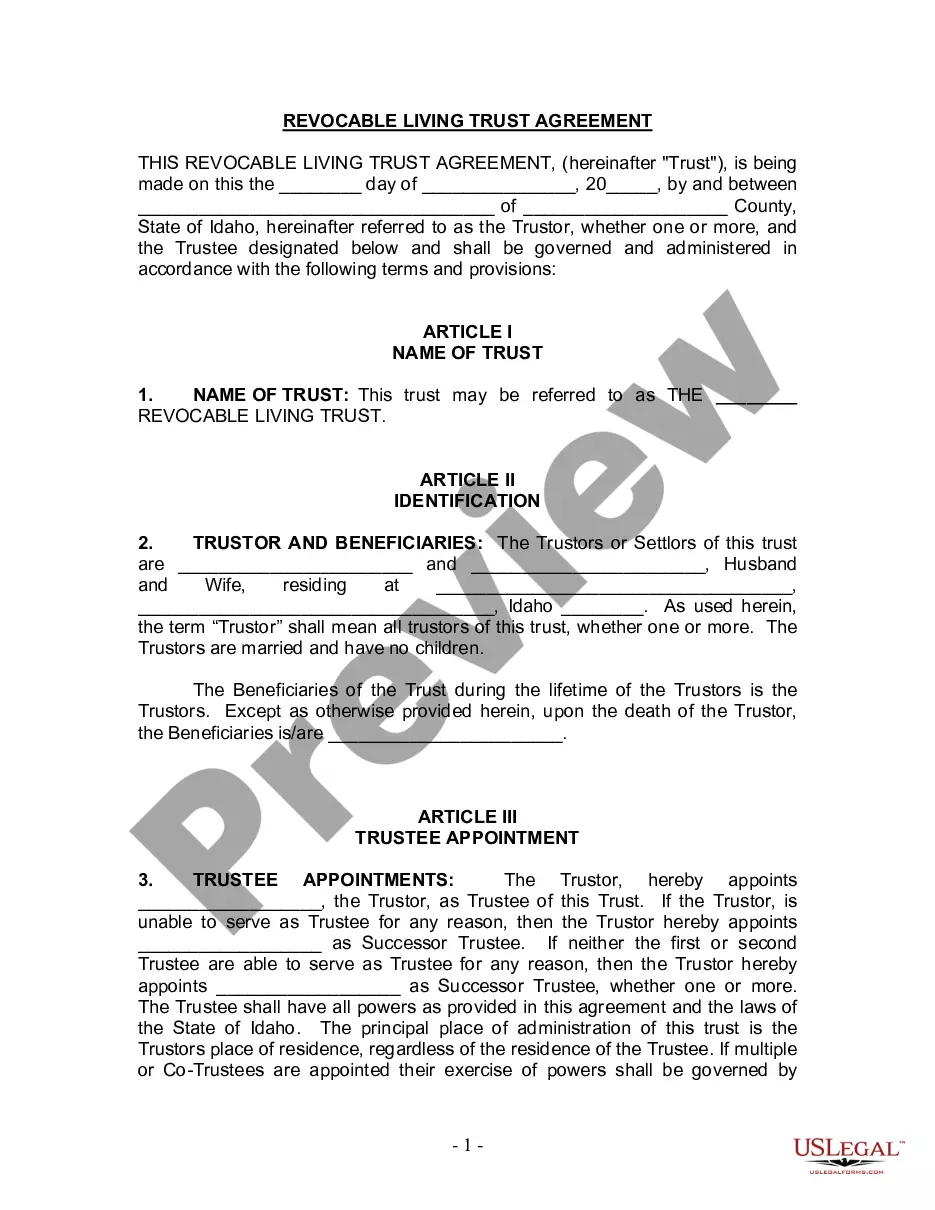

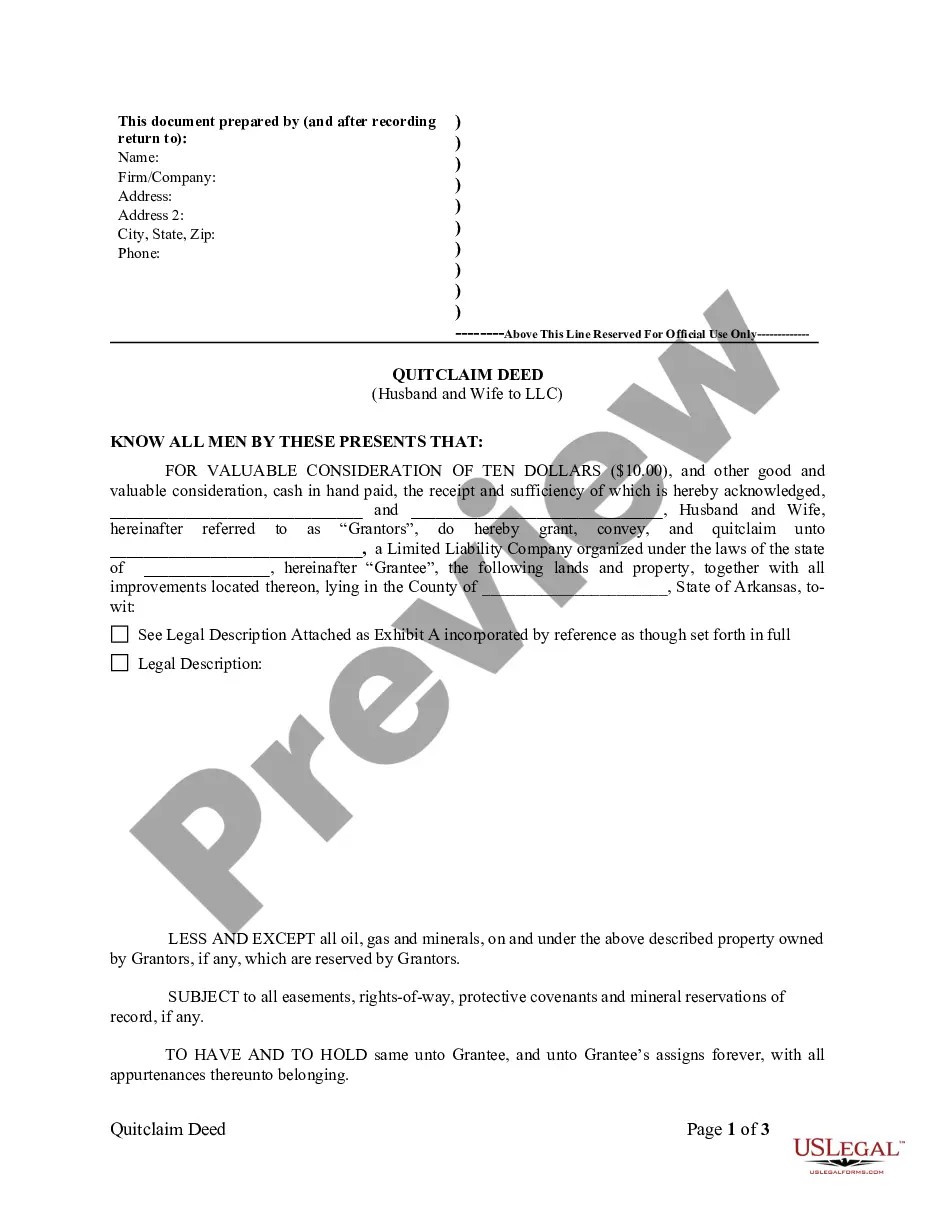

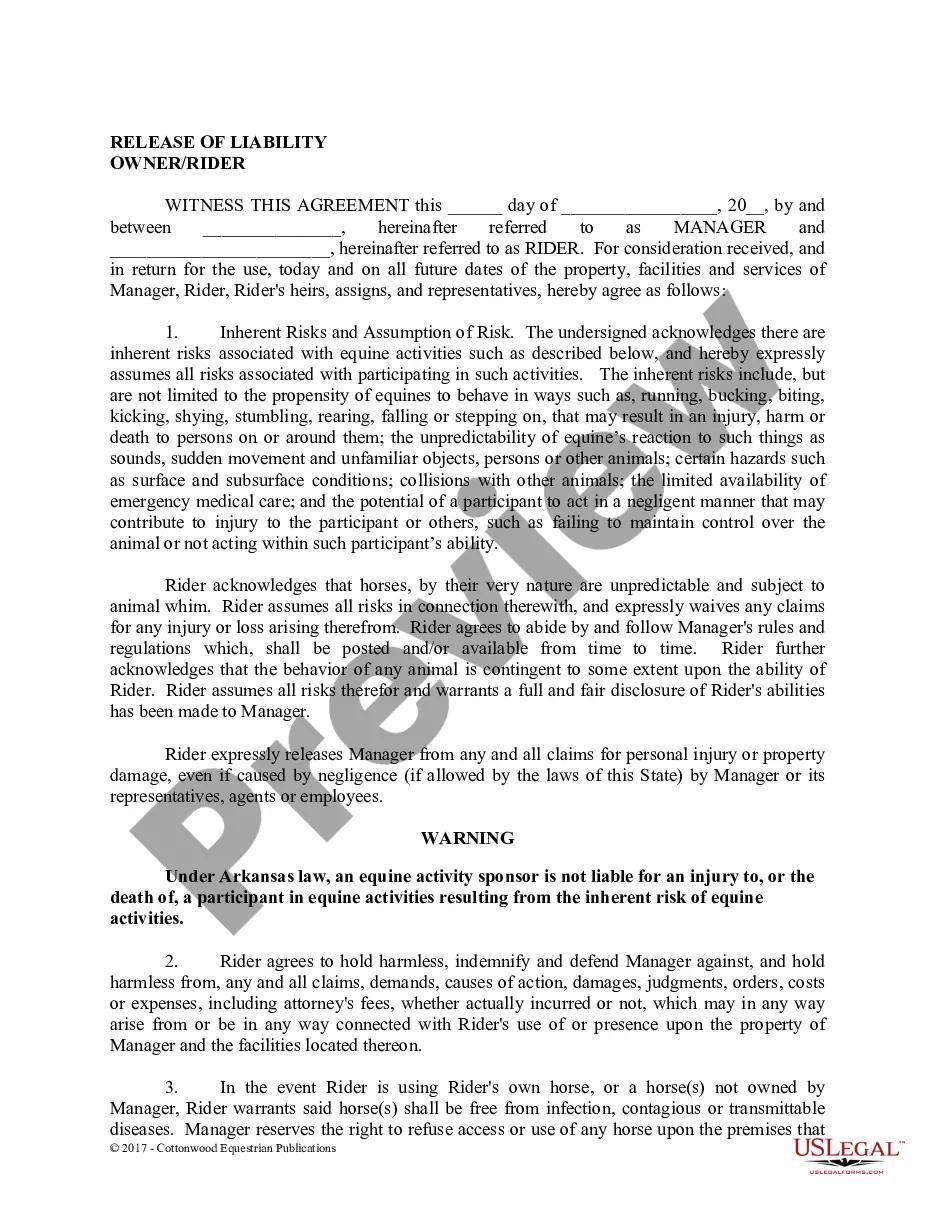

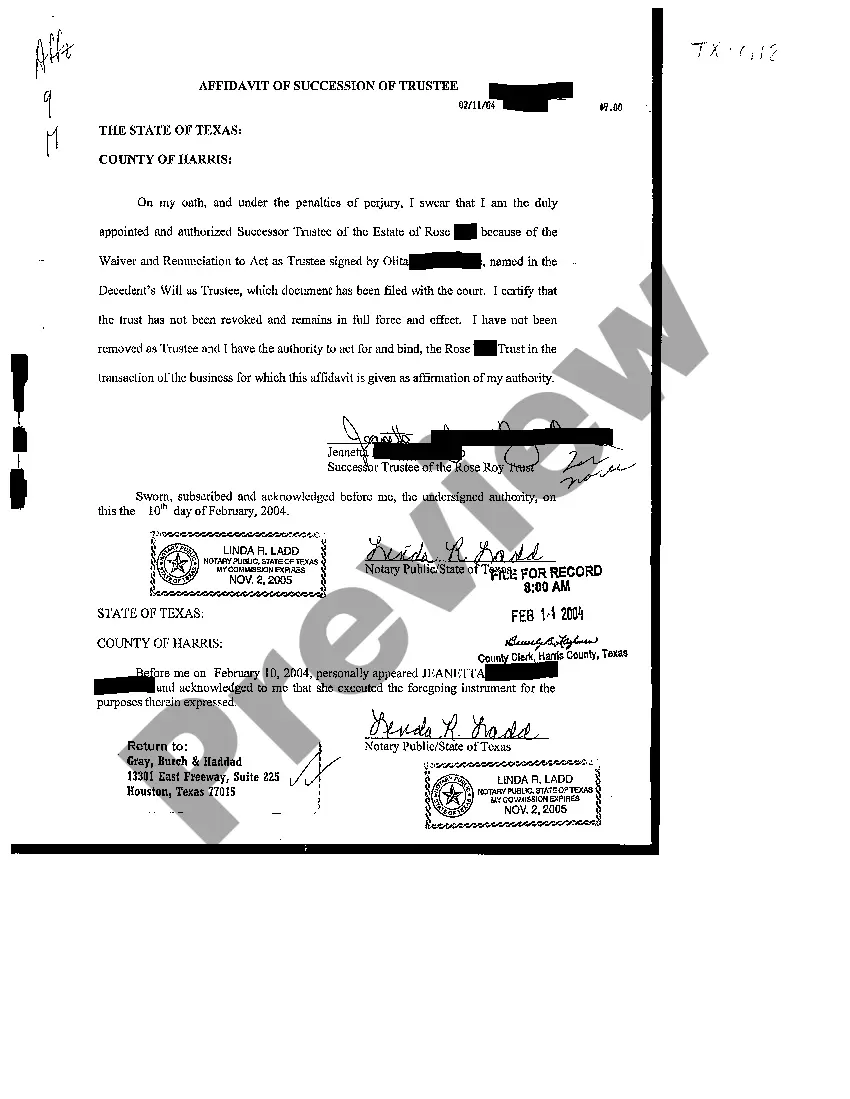

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Idaho Living Trust for Husband and Wife with No Children

Description

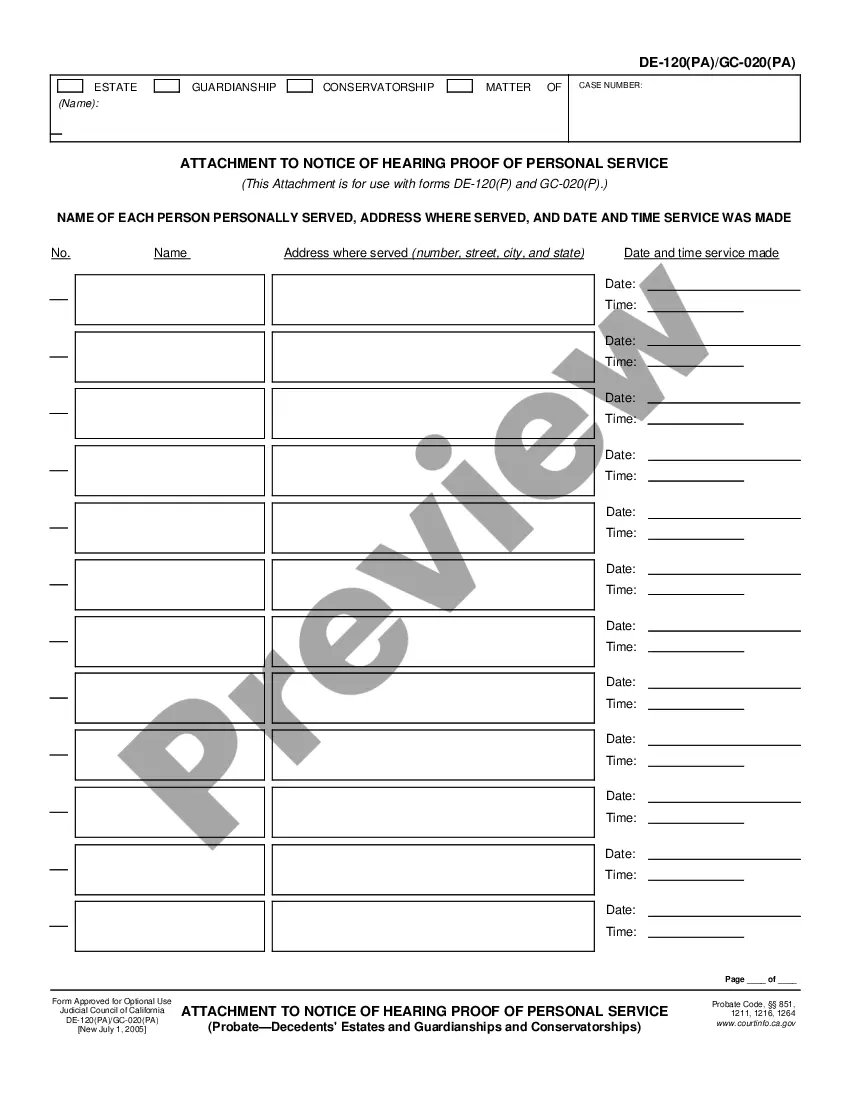

How to fill out Idaho Living Trust For Husband And Wife With No Children?

Searching for Idaho Living Trust for Spouse and Partner with No Offspring example and completing them can be rather difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and locate the suitable sample specifically for your state in just a few clicks.

Our legal professionals prepare all documents, so you merely need to complete them.

You can print the Idaho Living Trust for Spouse and Partner with No Offspring form or complete it using any online editor. Don’t worry about making errors as your template can be utilized, sent, and printed as many times as you desire. Try US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to download the document.

- All your downloaded samples are stored in My documents and are always accessible for later use.

- If you haven’t registered yet, you need to create an account.

- Review our comprehensive instructions on how to acquire the Idaho Living Trust for Spouse and Partner with No Offspring template within minutes.

- To obtain a qualified form, verify its relevance for your state.

- Examine the sample using the Preview feature (if available).

- If there is a description, read it to grasp the details.

- Click on the Buy Now button if you found what you're looking for.

- Choose your plan on the pricing page and set up an account.

- Select your payment method using a credit card or via PayPal.

- Download the template in your desired file format.

Form popularity

FAQ

The national average cost for a living trust for an individual is $1,100-1,500 USD. The national average cost for a living trust for a married couple is $1,700-2,500 USD. Part of the reason for this range in prices is the range of services that are available from various estate planning attorneys.

Compared to Simple Will Package, our office charges an additional $800 to upgrade to a Living Trust or Family Trust. In total dollars, the cost of a Family Trust or Living Trust package for an unmarried person would cost $1,895. For a married couple, the total cost would be just $2,295.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

How Much Does a Living Trust Cost in California? A common question that people ask when they're considering if a living trust is right for their family is how much it costs. On average, a living trust costs between $1000 and $5000 to put together.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

If you die without one (referred to as intestate), the state where you live will divvy up your assets as it sees fit, and the outcome may not be what you intended. If no heirs are found, your property may be escheated, which means the state gets to keep it.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Administering a living trust after your death is not cost-free.Living trusts are much more expensive to set up and maintain than a will. Probate can often be avoided without using a living trust, by setting up "payable on death" accounts, making beneficiary designations, holding assets jointly, etc.