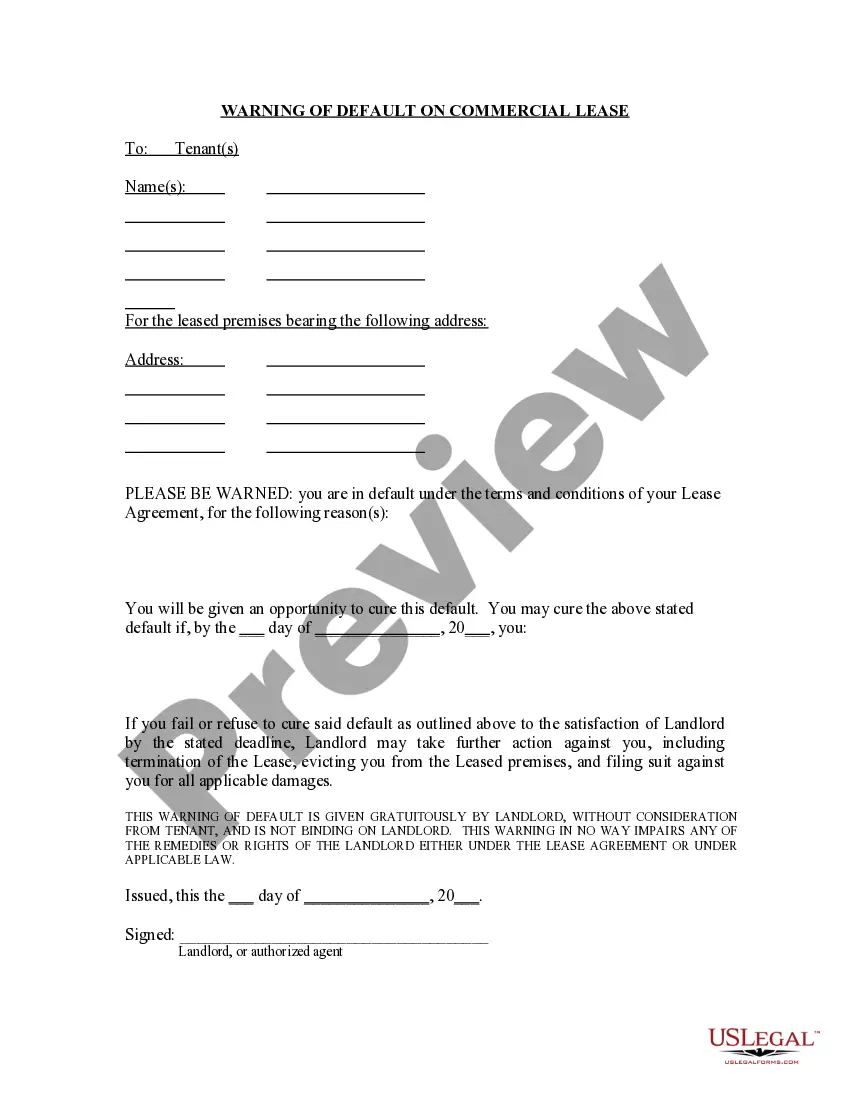

This Warning of Default on Commercial Lease is a warning letter from landlord to tenant expressing concern that if certain conditions are not remedied, tenant will be held in default under the lease agreement.

In landlord-tenant law, default usually refers to the failure of a tenant to timely pay rent due. In anticipation of such an occurence, landlords commonly require a new tenant to pay a security deposit, which may be used to remedy defaults in payment of rent and other monetary obligations under the rental agreement. In general, the landlord is required to give the tenant notice of the default before bringing eviction proceedings or applying security deposit proceeds to the payment in default. The fixing of a definite default date for payment of rent can be critical if it becomes necessary to evict a tenant for a default in the payment of rent. Landlords often require a background and/or reference check on prospective tenants in an attempt to minimize defaults in rent payments.