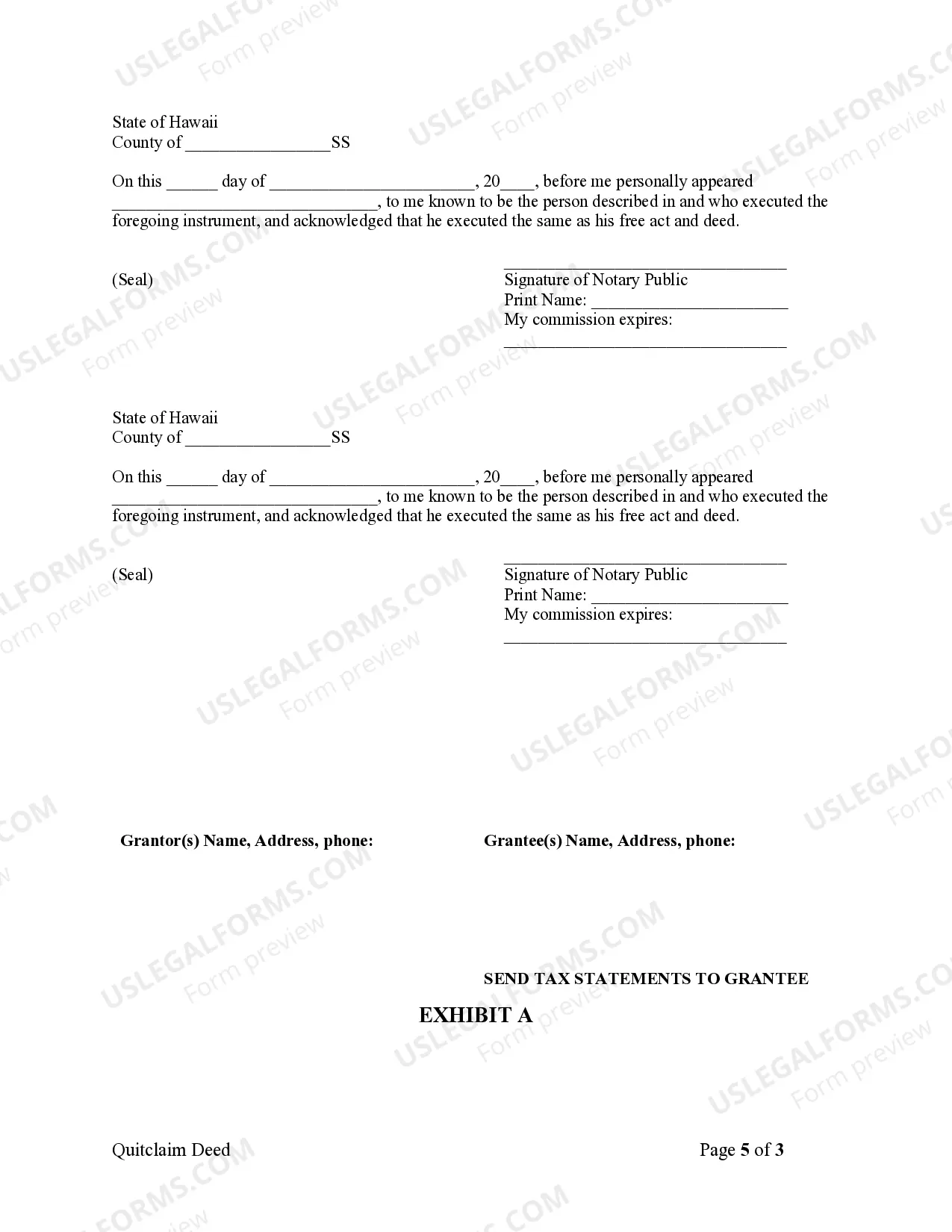

Hawaii Quitclaim Deed from Husband and Wife to Living Trust

Description

How to fill out Hawaii Quitclaim Deed From Husband And Wife To Living Trust?

Amid numerous free and paid samples available online, you cannot be certain about their reliability. For instance, it is unclear who crafted them or if they possess the expertise needed to address your requirements.

Always maintain composure and utilize US Legal Forms! Locate Hawaii Quitclaim Deed from Husband and Wife to Living Trust templates designed by experienced legal professionals and avoid the costly and lengthy process of searching for an attorney, then compensating them to draft a document that you can find on your own.

If you hold a subscription, Log In to your account and find the Download button adjacent to the file you desire. You will also be able to access all your previously obtained samples in the My documents section.

Once you have registered and purchased your subscription, you can utilize your Hawaii Quitclaim Deed from Husband and Wife to Living Trust as frequently as necessary or for as long as it remains valid in your area. Modify it in your chosen online or offline editor, fill it out, sign it, and print a hard copy. Achieve more for less with US Legal Forms!

- Make sure that the document you locate is legitimate for your location.

- Examine the document by reading the description using the Preview option.

- Click Buy Now to initiate the ordering process or find another template using the Search bar in the header.

- Select a pricing plan and create an account.

- Purchase the subscription using your credit card, debit card, or Paypal.

- Download the form in the desired format.

Form popularity

FAQ

One significant disadvantage of a quitclaim deed is that it offers no guarantee regarding the property's title, meaning the grantee may inherit unknown liabilities or claims. Additionally, because quitclaim deeds do not validate ownership, they might not be the best choice for high-value properties. It is advisable to consult with professionals when using the Hawaii Quitclaim Deed from Husband and Wife to Living Trust to ensure informed decisions.

People commonly use a quitclaim deed for various reasons, such as avoiding probate, simplifying transfers among family members, or placing property into a trust. This type of deed can facilitate quick and straightforward property transfers without extensive legal processes. If you are looking to formalize a transfer using the Hawaii Quitclaim Deed from Husband and Wife to Living Trust, this approach can streamline your estate planning.

Gifting a house directly can have tax implications and may expose the recipient to obligations and risks. Placing a house in a trust, however, ensures that it is managed according to your wishes and can clarify distribution after your passing. If you're considering using the Hawaii Quitclaim Deed from Husband and Wife to Living Trust, it provides an effective way to protect and control your assets.

Whether a trust or a quit claim deed is better depends on your specific needs. A trust offers more comprehensive estate planning benefits and avoids probate, while a quitclaim deed simply transfers property ownership. If your goal is to place property securely in a living trust, then using the Hawaii Quitclaim Deed from Husband and Wife to Living Trust is an effective strategy.

The strongest form of deed is typically a warranty deed, which guarantees clear title to the property and provides the highest level of protection to the buyer. Unlike a quitclaim deed, a warranty deed ensures that the seller is legally obligated to defend the title against any claims. However, for transferring property into a trust, the Hawaii Quitclaim Deed from Husband and Wife to Living Trust may suffice.

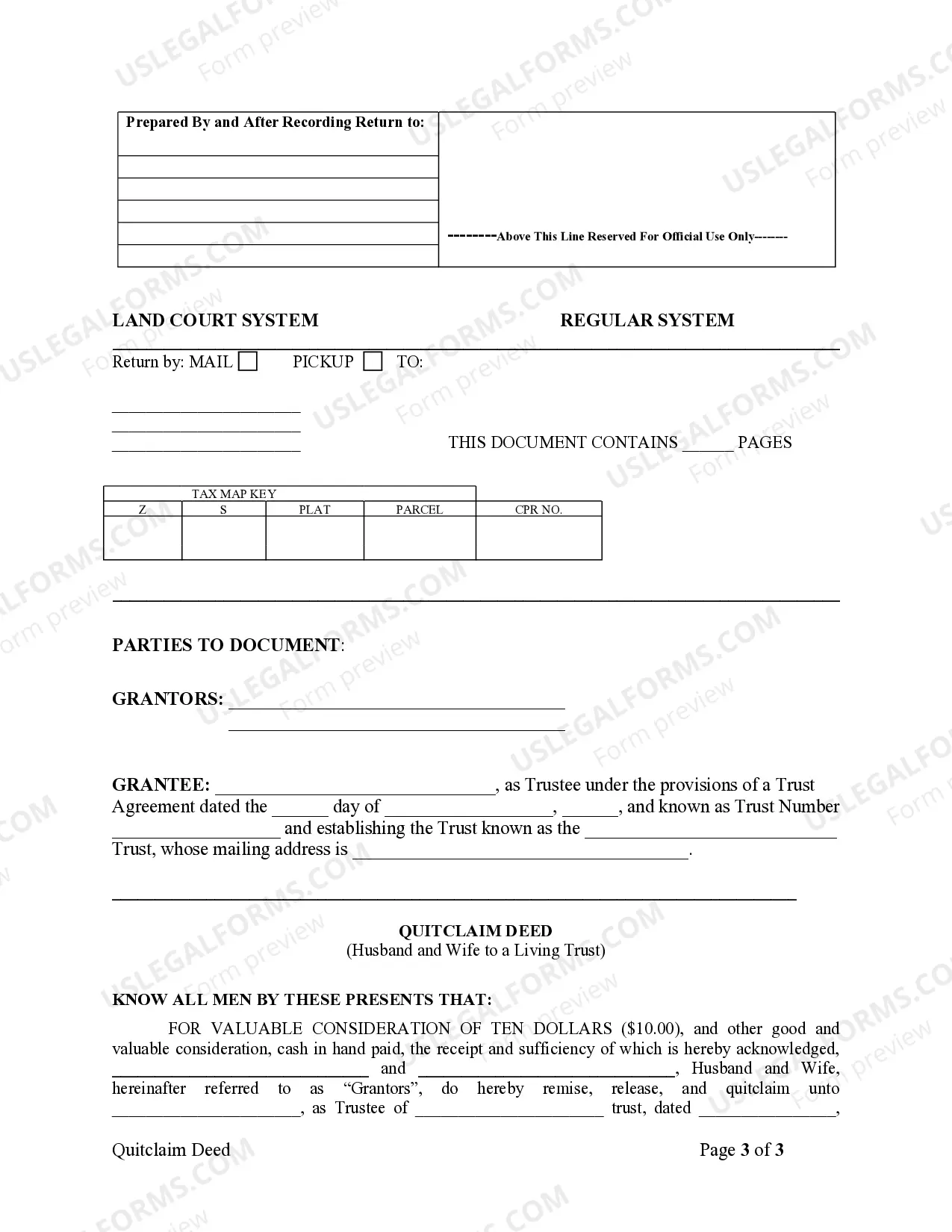

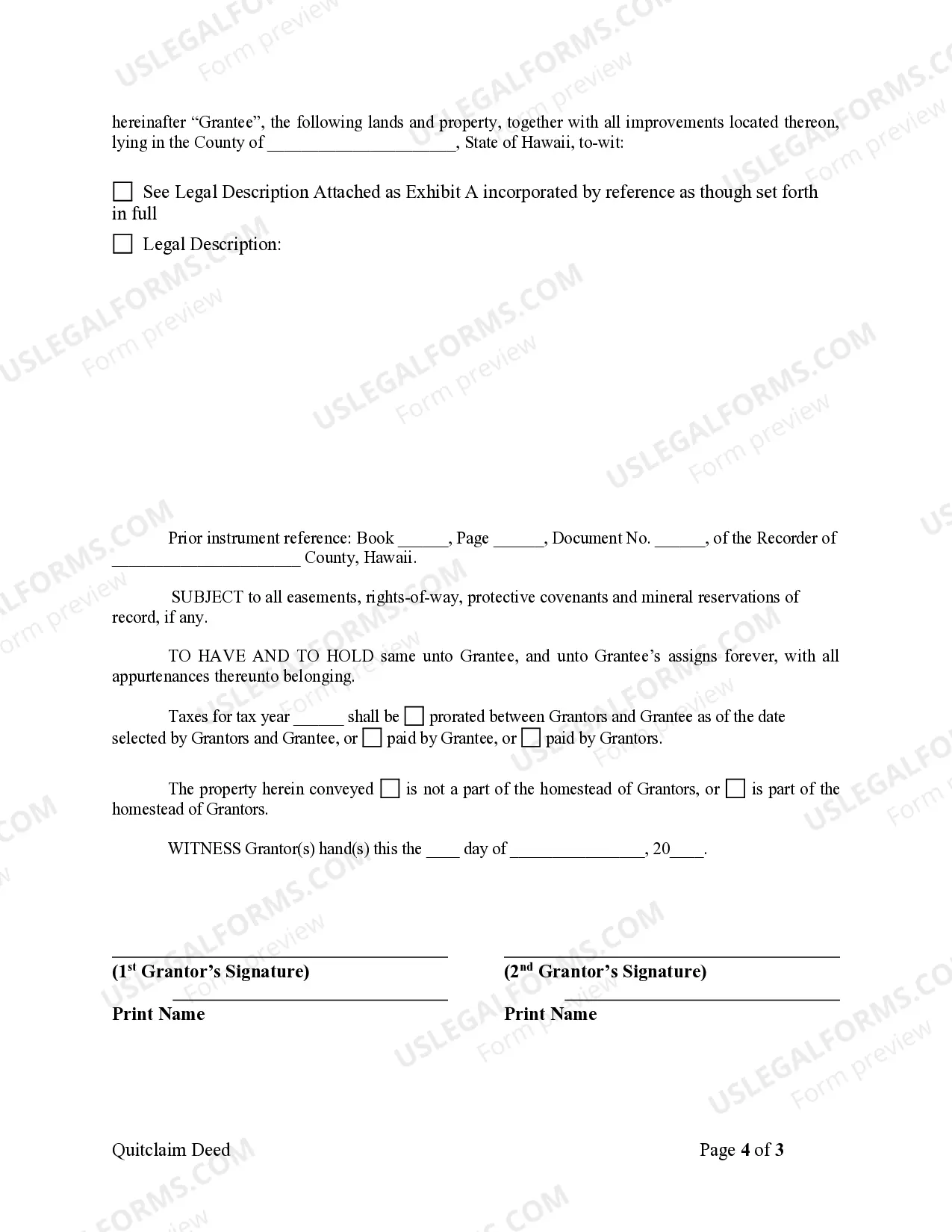

To fill out a quitclaim deed to add a spouse, start by obtaining a blank form specific to your state, in this case, Hawaii. Include the names of both spouses and clearly state that the property is being transferred into the trust. With the Hawaii Quitclaim Deed from Husband and Wife to Living Trust, ensure accurate and clear information to avoid future disputes.

Yes, a quitclaim deed can transfer property out of a trust. This action requires the trust's trustee to effectively execute the deed to ensure legally transferring ownership to a new party. If you are considering making such a transfer using the Hawaii Quitclaim Deed from Husband and Wife to Living Trust, consult legal resources to ensure compliance with relevant laws.

A quitclaim deed transfers ownership of property from one party to another but does not provide any warranty regarding the property's title. In contrast, a living trust holds property for the benefit of the beneficiaries during their lifetime and after death. When using a Hawaii Quitclaim Deed from Husband and Wife to Living Trust, it's vital to understand that the deed transfers property into the trust, allowing for better management of assets.

A spouse might execute a quitclaim deed to clarify or change ownership of property, especially in situations such as divorce or estate planning. By using a Hawaii Quitclaim Deed from Husband and Wife to Living Trust, they can place property into the trust for better management and distribution after death. This action can help avoid potential disputes and provides a clear legal framework for asset management. It's advisable to explore all options available to make informed decisions.

Yes, a quitclaim deed can be used to transfer property out of a trust if the trustee decides to do so. However, this process can be more complex, as the transfer must comply with the terms established in the trust. Utilizing a Hawaii Quitclaim Deed from Husband and Wife to Living Trust can streamline the transfer, but it's essential to document everything correctly. Consulting with a legal expert will help ensure that the transfer adheres to legal requirements.