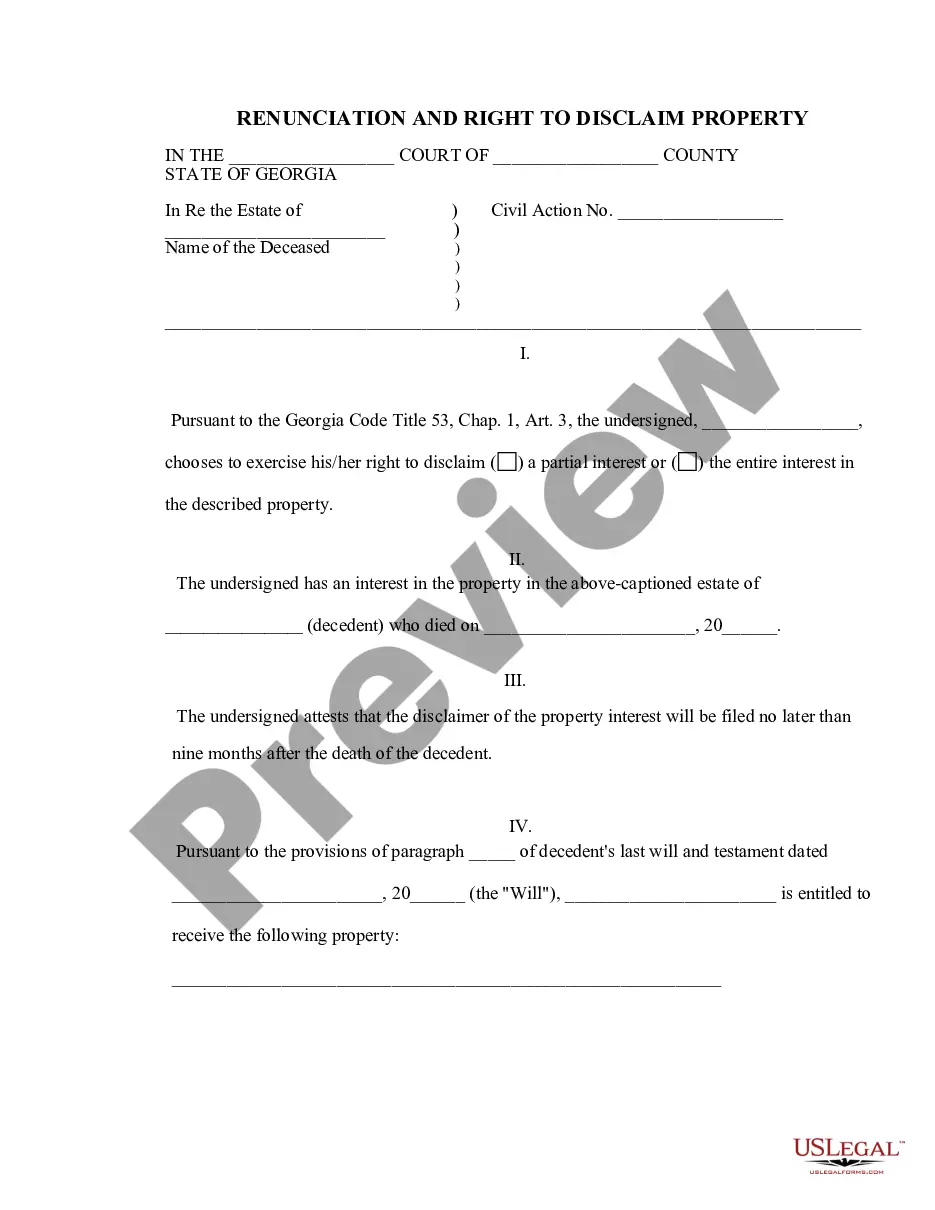

This is a Renunciation form to be used in a Georgia intestate sucession. It simply states that the rightful heir chooses to not take the property left to him/her and renounces his interest in the property. This form is NOT available for immediate downloading and will be provided by e-mail within twenty-four (24) hours from placing your order.

Georgia Renunciation And Disclaimer of Property received by Intestate Succession

Description

Key Concepts & Definitions

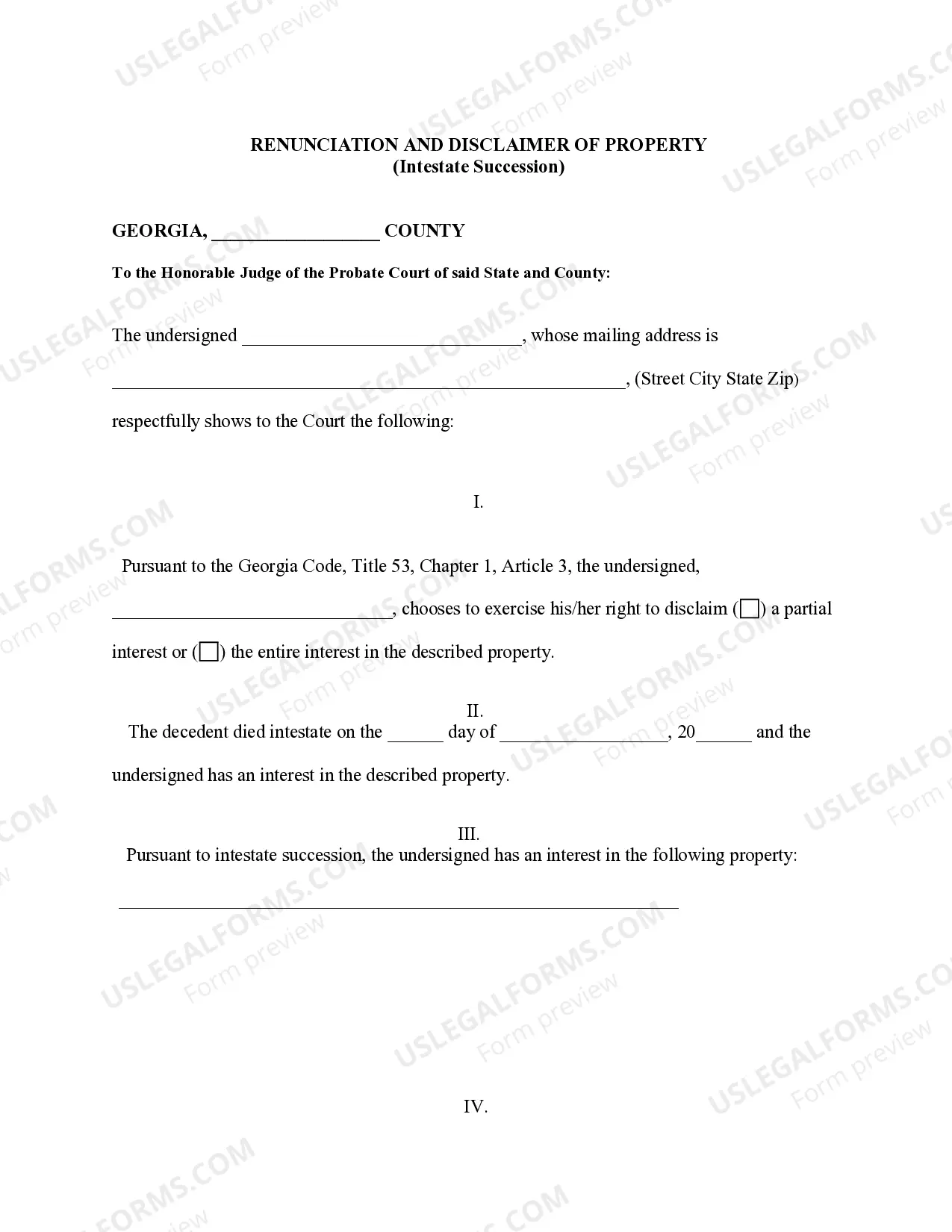

Georgia Renunciation and Disclaimer of Property: In Georgia, when a person renounces and disclaims interest in property, it means they legally refuse to accept an inheritance, gift, or any property interest, often for legal or financial reasons. This is governed under Georgia Code related to property law. Real property and other asset types can be subject to renunciation.

Step-by-Step Guide

- Determine Eligibility: Verify if the person renouncing is eligible under Georgia law to file a disclaimer.

- Prepare Documentation: Gather necessary documents, such as the will or trust deed that includes the property in question.

- File a Disclaimer: Submit the renunciation and disclaimer form to the appropriate county probate court in Georgia.

- Notify Interested Parties: Legally inform all interested parties about the renunciation and disclaimer.

- Record the Disclaimer: Ensure the disclaimer is recorded in the court records to permanently renounce the property rights.

Risk Analysis

- Legal Risks: Incorrect filing might not legally release a person from the duties and rights associated with the property, leading to potential lawsuits or claims.

- Financial Impacts: Renouncing property without proper consideration of the financial implications could lead to unwarranted tax consequences or loss of asset value.

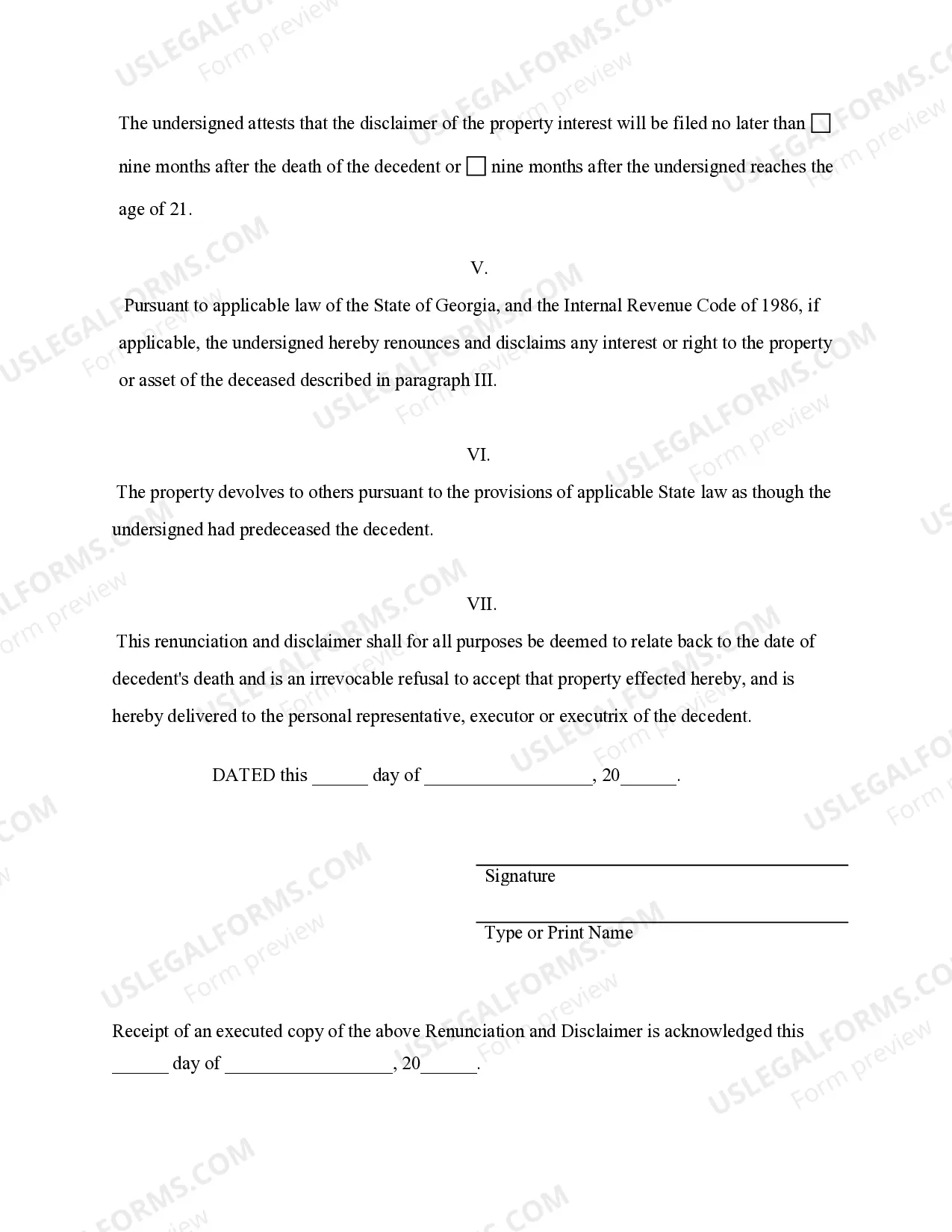

- Irrevocability: Once renounced, it's typically irreversible, requiring careful consideration before proceeding.

Key Takeaways

- Rapid and accurate execution of legal paperwork is crucial in the process of renouncing property.

- Consulting with legal professionals for legal clarity and financial advice is highly recommended.

- Understanding state-specific laws like the Georgia Code on property and property renunciation is essential.

Terminology Glossary

- Renounce Property: To legally refuse to accept an inheritance or property transfer.

- Person Renouncing: The individual who is giving up their rights to the property.

- Real Property: Represents land and any structures that are permanently attached to it.

- Renounced Property: Property that has been formally given up by disclaimer.

How to fill out Georgia Renunciation And Disclaimer Of Property Received By Intestate Succession?

Obtain the most extensive collection of legal documents.

US Legal Forms is essentially a platform to locate any state-specific document in just a few clicks, including the Georgia Renunciation And Disclaimer of Property acquired through Intestate Succession templates.

No need to squander hours searching for a court-acceptable document. Our qualified experts guarantee that you receive the latest materials each time.

After selecting a pricing option, create an account. Pay via credit card or PayPal. Download the template to your device by clicking Download. That's all! You should complete the Georgia Renunciation And Disclaimer of Property document and submit it. To confirm all details are correct, consult your local legal advisor for assistance. Sign up and effortlessly browse over 85,000 useful forms.

- To utilize the forms library, select a subscription and establish an account.

- If you have already signed up, simply Log In and hit the Download button.

- The Georgia Renunciation And Disclaimer of Property template will be promptly saved in the My documents section (a section for each document downloaded from US Legal Forms).

- To create a new account, adhere to the straightforward instructions below.

- If you intend to use a state-specific template, ensure you specify the appropriate state.

- Whenever possible, review the description to understand all details of the document.

- Utilize the Preview feature if available to examine the document's contents.

- If everything seems correct, click the Buy Now button.

Form popularity

FAQ

To disclaim an inheritance for IRS purposes, you need to ensure that you meet the federal and state requirements for renouncing property. You should file appropriate disclaimers with both the IRS and your state probate court. This action helps in determining your tax obligations related to property you do not intend to inherit. Platforms like US Legal Forms offer templates and guidance to assist you in navigating these necessary steps efficiently.

In Georgia, you typically have nine months from the date of the decedent's death to file a disclaimer for property received through intestate succession. This timeframe ensures that beneficiaries can make important decisions regarding the estate promptly. If you miss this deadline, you may forfeit your right to disclaim the inheritance. It's wise to act quickly, and leveraging resources from US Legal Forms can help you stay on track.

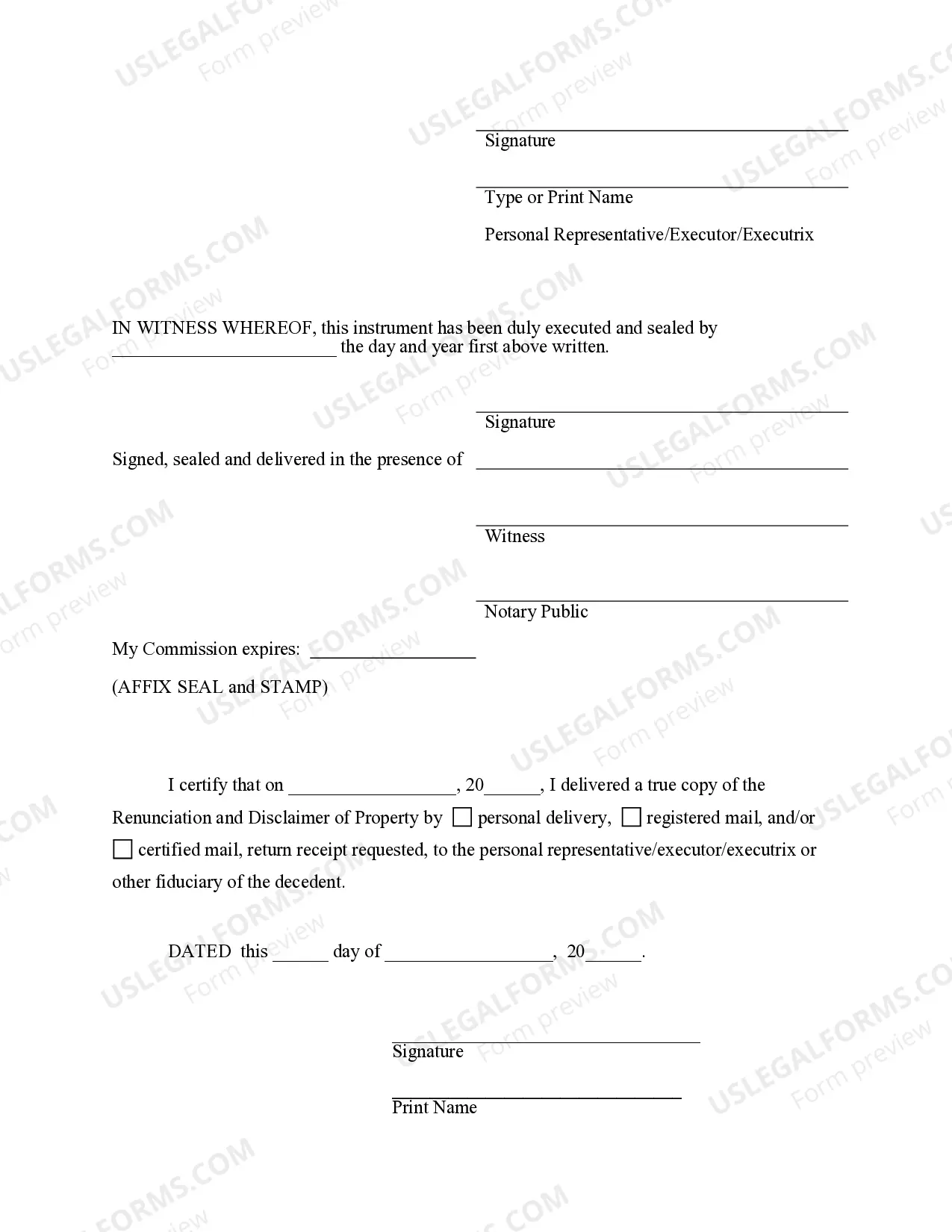

To disclaim an inherited property, you must file a written disclaimer with the appropriate probate court in Georgia. This document should clearly state your intention to renounce any rights to the property received through intestate succession. It is important to include necessary details, such as the decedent's name, your relationship to the decedent, and the property description. Using a platform like US Legal Forms can simplify this process, providing you with the right forms and guidance.

To disclaim an inheritance in Georgia, you must submit a formal written renunciation. This document should express your intent to reject the inheritance and must be filed with the probate court overseeing the estate. It's important to ensure that you follow the Georgia Renunciation And Disclaimer of Property received by Intestate Succession guidelines, as failing to do so can affect your legal rights. For a smooth process, consider using uslegalforms, where you can find templates and help to complete your disclaimer correctly.

Yes, a disclaimer of inheritance must be signed by the person renouncing the inheritance to be valid. This signature indicates your voluntary decision not to accept the property. By properly signing, you help formalize your Georgia Renunciation and Disclaimer of Property received by Intestate Succession, ensuring it holds legal weight.

In Georgia, a disclaimer of inheritance does not need to be notarized to be valid. However, it's advisable to have it notarized to provide an extra layer of authenticity. Doing so can help ensure that your Georgia Renunciation and Disclaimer of Property received by Intestate Succession is respected by all parties involved.

Generally, in Georgia, you do not need to declare inheritance property unless it becomes relevant in terms of debts or taxes. However, if you decide to disclaim an inheritance, documenting this through the Georgia Renunciation and Disclaimer of Property received by Intestate Succession is critical. Keeping records can help clarify your intentions and prevent future disputes.

In Georgia, the rules for disclaiming inheritance require the disclaimer to be in writing and submitted within nine months of the decedent's death for it to be effective. The disclaimant must also not have accepted any benefits from the inheritance. Understanding these regulations helps ensure that your Georgia Renunciation and Disclaimer of Property received by Intestate Succession is valid and binding.

A sample disclaimer of inheritance for the Georgia Renunciation and Disclaimer of Property received by Intestate Succession should clearly express your desire to not accept the property. Begin with your full name and the estate details, followed by a declaration that you are renouncing any claims to the inheritance. Ensure the document is explicit and includes any relevant case numbers to avoid confusion.

To write an inheritance disclaimer letter for the Georgia Renunciation and Disclaimer of Property received by Intestate Succession, start by clearly stating your intention to disclaim the property. Include your name, the name of the deceased, and a statement indicating that you are renouncing your rights to the inheritance. It's important to sign and date the letter before submitting it to the appropriate probate court.