Florida Fuel Sales Agreement/Branded Agreement

Description

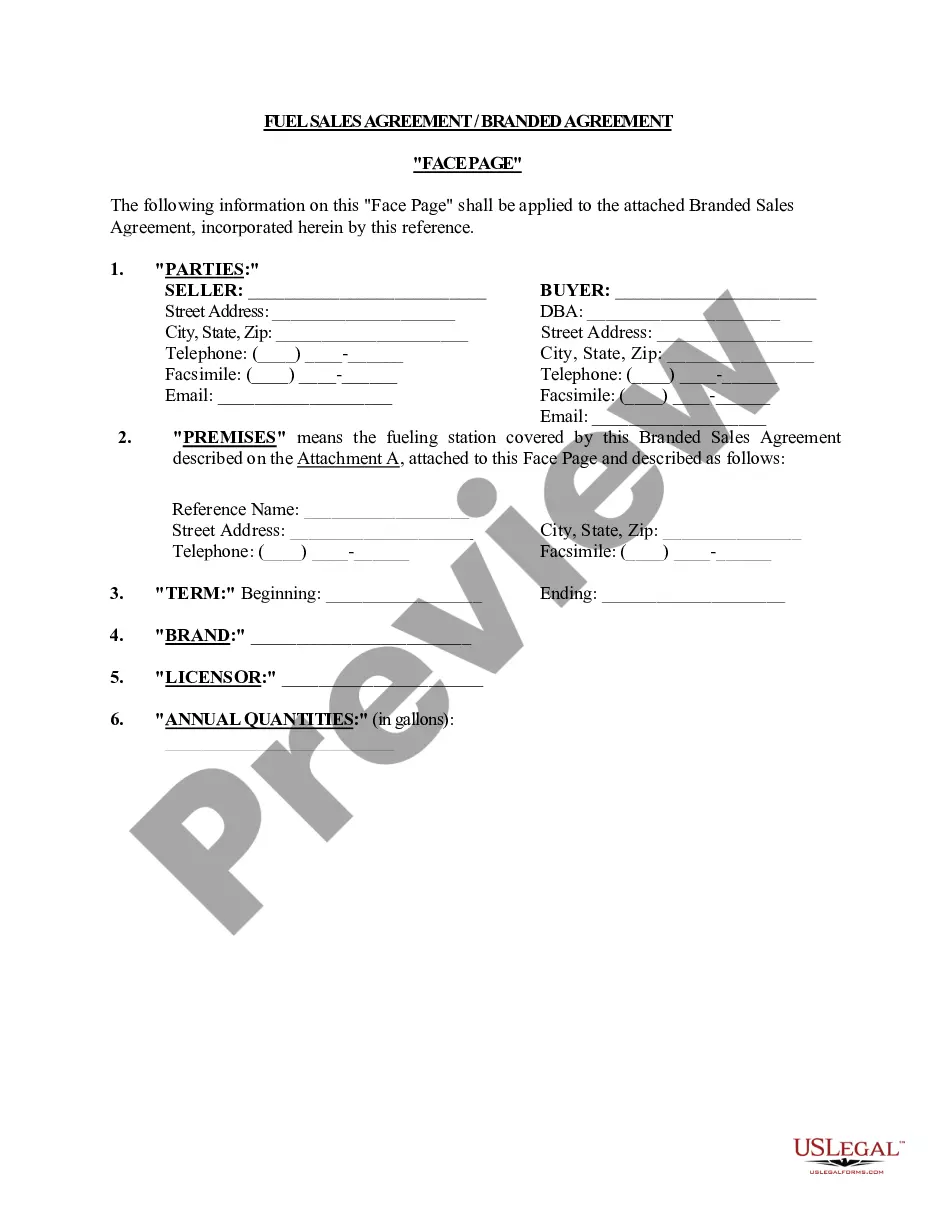

How to fill out Florida Fuel Sales Agreement/Branded Agreement?

Access one of the largest collections of verified forms.

US Legal Forms serves as a solution to locate any state-specific document in just a few clicks, including Florida Fuel Sales Agreement/Branded Agreement samples.

There is no need to waste your time searching for a court-approved template.

After selecting a pricing plan, register your account. Make a payment via credit card or PayPal. Download the template to your device by clicking Download. That's it! You need to complete the Florida Fuel Sales Agreement/Branded Agreement form and submit it. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and discover over 85,000 useful templates.

- To utilize the document library, select a subscription and create your account.

- If you have already created it, just Log In and click on the Download button.

- The Florida Fuel Sales Agreement/Branded Agreement file will be promptly saved in the My documents tab (which is where all forms you download from US Legal Forms are stored).

- To create a new account, follow the quick steps below.

- If you need to use a state-specific document, make sure to specify the correct state.

- If possible, review the description to understand all the details of the form.

- Use the Preview option if available to check the document's details.

- If everything looks right, click on the Buy Now button.

Form popularity

FAQ

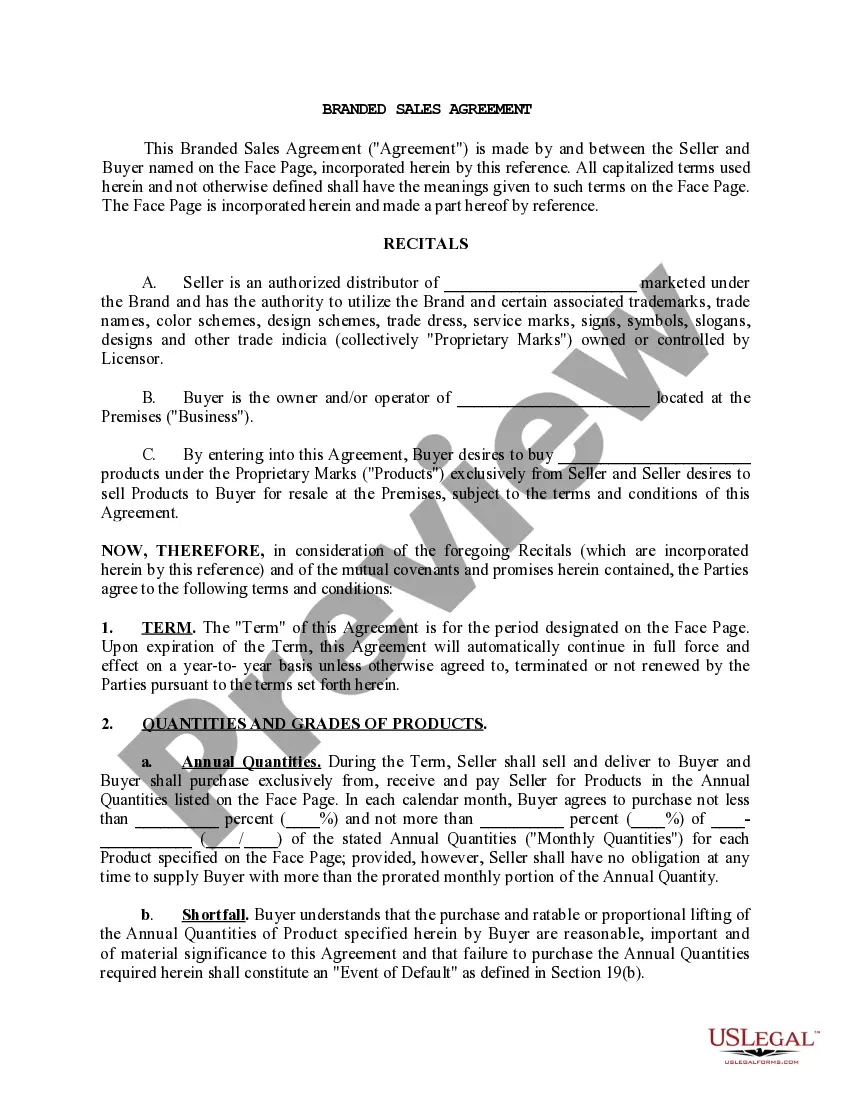

A model gas sales agreement serves as a framework that organizations can use to draft their own contracts for fuel sales. It typically includes standard terms and conditions that address common concerns in fuel transactions. By utilizing a Florida Fuel Sales Agreement/Branded Agreement as a model, you can customize your terms to fit your specific business needs while ensuring clarity and compliance.

A fuel supply agreement is a formal contract that delineates the terms under which fuel is supplied, including quantities, prices, and delivery timelines. This agreement helps both parties maintain reliability in their business relationships and avoid disputes. By implementing a Florida Fuel Sales Agreement/Branded Agreement, you establish a clear understanding that fosters successful transactions.

The primary purpose of a supply agreement is to outline the commitments of both the supplier and the buyer regarding the provision of goods or services, in this case, fuel. Such agreements protect both parties by clearly defining responsibilities, prices, and delivery schedules. With a Florida Fuel Sales Agreement/Branded Agreement, you gain peace of mind through a structured framework that governs your fuel transactions.

A gas supply agreement is a contract between a fuel supplier and a buyer, detailing the terms for the sale and delivery of fuel. This agreement ensures that the buyer receives a reliable supply of fuel at agreed-upon prices. You can create a Florida Fuel Sales Agreement/Branded Agreement to formalize this relationship, providing clarity and security for both parties.

The fines for not displaying an IFTA sticker can vary by state; in Florida, the penalties may escalate based on the duration of non-compliance. Regular checks can prevent penalties and ensure you're operating legally. Utilize resources such as US Legal Forms, which can help guide you through compliance practices related to the Florida Fuel Sales Agreement/Branded Agreement.

Yes, Florida imposes a sales tax on fuel purchases, which can vary based on location and fuel type. This tax is an important consideration for businesses and individuals purchasing fuel as part of their operation. Always factor this into your financial planning under the Florida Fuel Sales Agreement/Branded Agreement to ensure accurate budgeting.

If your truck's weight is under 26,000 lbs and operates solely within Florida, you likely do not need an IFTA sticker. However, if your vehicle travels across state lines or significantly exceeds weight limits, you may then need to comply with IFTA regulations. Understanding these guidelines ensures compliance within the framework of the Florida Fuel Sales Agreement/Branded Agreement.

In Florida, farm trucks may be exempt from IFTA stickers if used for agricultural purposes solely within the state. However, if these trucks engage in interstate travel or commercial activities, IFTA compliance is necessary. Always clarify your specific circumstances, as it can directly impact your obligations under the Florida Fuel Sales Agreement/Branded Agreement.

An IFTA audit may be triggered by discrepancies in your fuel usage reports or if your records are significantly inconsistent. Auditors often look for patterns that suggest potential misuse or inaccurate reporting of fuel consumption. Maintain accurate records to decrease the chances of an audit and ensure your compliance with the Florida Fuel Sales Agreement/Branded Agreement.

Operating without an IFTA sticker can lead to fines and penalties, which vary based on the specific circumstances. Generally, you might face fines that escalate over time if not addressed. Compliance with IFTA regulations is crucial to avoid these fines and to keep your operations under the Florida Fuel Sales Agreement/Branded Agreement smooth.