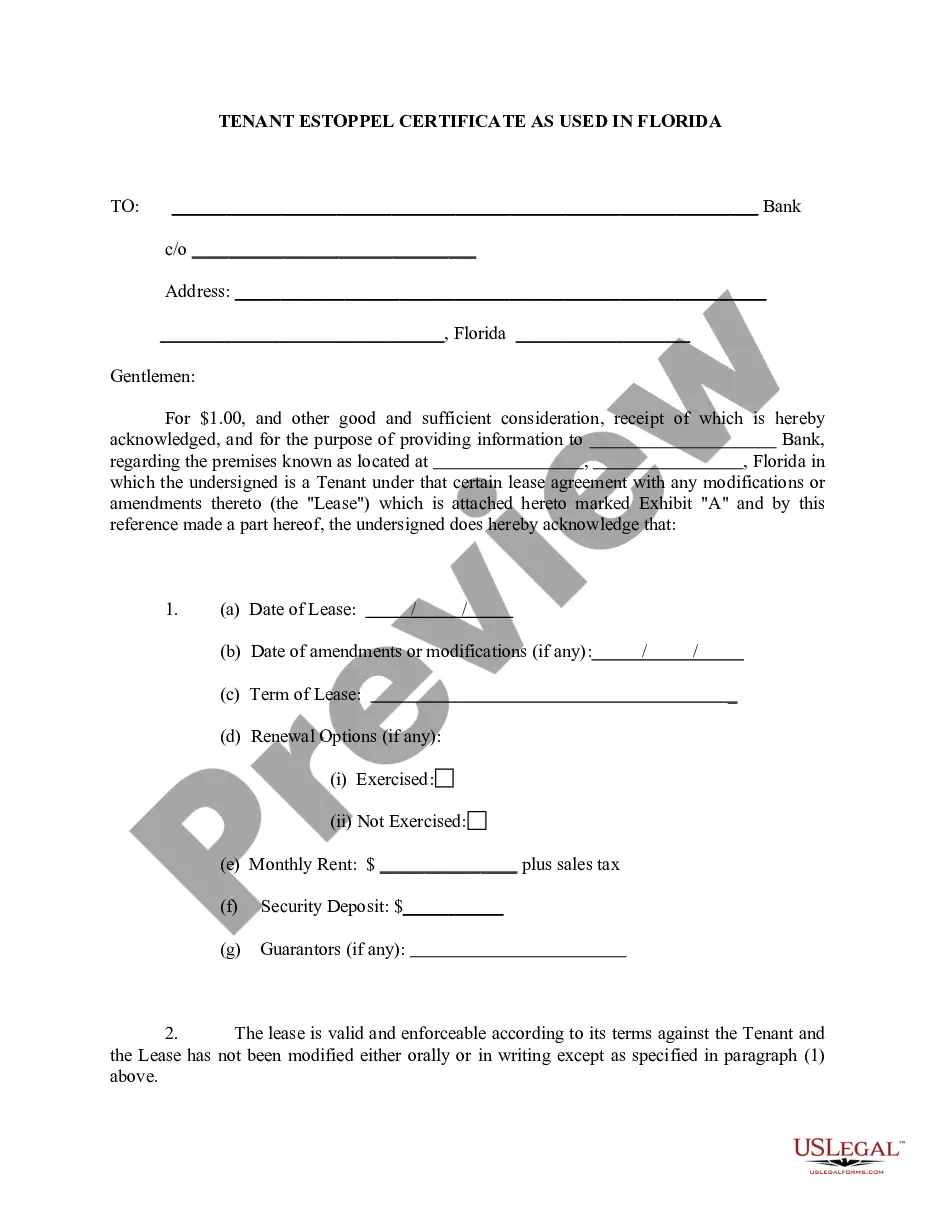

Florida Tenant Estoppel to Lender is a legal concept that protects a lender from liability arising from a tenant’s failure to perform its obligations under a lease. This concept is derived from the legal doctrine of Estoppel, which prevents a tenant from denying the validity of a lease when the lender relies on the tenant’s representation that the lease is valid. There are three types of Florida Tenant Estoppel to Lender: 1) Equitable Estoppel; 2) Contractual Estoppel; and 3) Promissory Estoppel. Equitable Estoppel prevents a tenant from denying the existence of a lease when the lender relied on the tenant’s representation that the lease was valid. Contractual Estoppel prevents a tenant from denying the terms of a lease when the lender relied on the tenant’s representation that the lease was valid. Promissory Estoppel prevents a tenant from denying the performance of obligations under a lease when the lender relied on the tenant’s representations that the obligations had been performed.

Florida Tenat estoppel to lender

Description

How to fill out Florida Tenat Estoppel To Lender?

Managing legal paperwork necessitates focus, precision, and utilizing well-prepared templates. US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Florida Tenant estoppel to lender template from our collection, you can trust it adheres to federal and state laws.

Engaging with our service is straightforward and quick. To acquire the required document, all you’ll need is an account with an active subscription. Here’s a brief guide to obtaining your Florida Tenant estoppel to lender within moments.

All documents are crafted for multiple uses, like the Florida Tenant estoppel to lender you see on this page. If you require them in the future, you can complete them without additional payment - just access the My documents tab in your profile and finish your document whenever you need it. Experience US Legal Forms and manage your business and personal paperwork swiftly and in full legal compliance!

- Be sure to carefully review the form’s content and its alignment with general and legal standards by previewing it or reading its description.

- Look for another official template if the one you opened does not fit your needs or state regulations (the option for that is located on the top page corner).

- Log in to your account and download the Florida Tenant estoppel to lender in the format you prefer. If this is your first time using our service, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in which format you wish to save your document and click Download. Print the template or upload it to a professional PDF editor to submit it without paper.

Form popularity

FAQ

An estoppel certificate is commonly used in real estate transactions, especially when a property is being sold or refinanced. In Florida, this document confirms the current terms of a lease between a landlord and tenant, providing essential details to lenders. It can also clarify any obligations or promises that may affect property value, which is crucial when lenders assess risk. Thus, understanding Florida tenant estoppel to lender situations can ensure smooth transactions.

A tenant estoppel serves to confirm the specifics of a tenant's lease, detailing their rights and obligations to prospective buyers or lenders. It provides essential documentation that reassures all parties of the current lease terms, minimizing misunderstandings. By obtaining a Florida tenant estoppel to lender, property owners can ensure that lenders fully understand the rental agreements before making financing decisions. This process ultimately fosters trust and clarity within the real estate community.

The purpose of an estoppel is to provide clarity and security in real estate dealings by confirming the terms of existing agreements. It prevents disputes by ensuring all parties have a mutual understanding of the lease terms and obligations. This legal tool serves to protect landlords, tenants, and lenders alike during transactions, ultimately enhancing trust in the real estate market. A well-structured Florida tenant estoppel to lender can facilitate smooth negotiations.

The estoppel law in Florida establishes guidelines on how lease agreements are handled when properties change ownership or when financing is involved. It mandates that parties provide accurate disclosures about rental agreements, ensuring everyone is informed. This law protects both tenants and lenders, fostering a transparent environment during real estate transactions. Embracing a Florida tenant estoppel to lender can greatly facilitate these processes and provide clearer insights.

A lender estoppel is a document that confirms a tenant's lease agreement and any related obligations to the lender in a real estate transaction. This document assures lenders that the tenant is aware of their duties and the terms of the lease. It plays a critical role in safeguarding the lender's investment and the property's value. Essentially, a Florida tenant estoppel to lender ensures all obligations are documented, minimizing potential disputes.

The new estoppel law in Florida, which took effect recently, aims to streamline the process for landlords and tenants. It requires landlords to provide tenants with an estoppel certificate upon request, ensuring transparency in lease agreements. This change benefits all stakeholders by ensuring that tenants can access crucial information about their leases before any transactions occur. Overall, this law strengthens the importance of obtaining a Florida tenant estoppel to lender.

In Florida, an estoppel letter is often required during real estate transactions, particularly when a property is financed by a lender. This letter serves to confirm the terms of the lease agreements and the status of the tenants. By obtaining a Florida tenant estoppel to lender, landlords can ensure that the lender understands the property's rental situation. This process protects all parties involved and enhances the transaction's clarity.

Writing an estoppel certificate involves gathering key information about the lease and the tenant's obligations. Start by including the tenant's name, the property address, and the lease terms. Then, affirm the status of the lease, any rent payments, and other important conditions. For a streamlined process, consider using the US Legal Forms platform, which offers templates for creating a Florida Tenant estoppel to lender that meets legal standards and simplifies your task.

Generally, the landlord or their legal representative drafts the estoppel certificate. However, tenants may need to verify specific details. For convenience, consider using US Legal Forms to obtain a professionally written Florida tenant estoppel to lender, keeping the process efficient and ensuring all necessary components are included.

The estoppel certificate for a lender outlines the terms of the lease agreement and confirms that the tenant agrees to those terms. This information is valuable for lenders to assess investment risks before providing financing. Utilizing a Florida tenant estoppel to lender will ensure all parties have a clear understanding of current lease conditions.