Florida Assignment of Mortgage by Corporate Mortgage Holder

Overview of this form

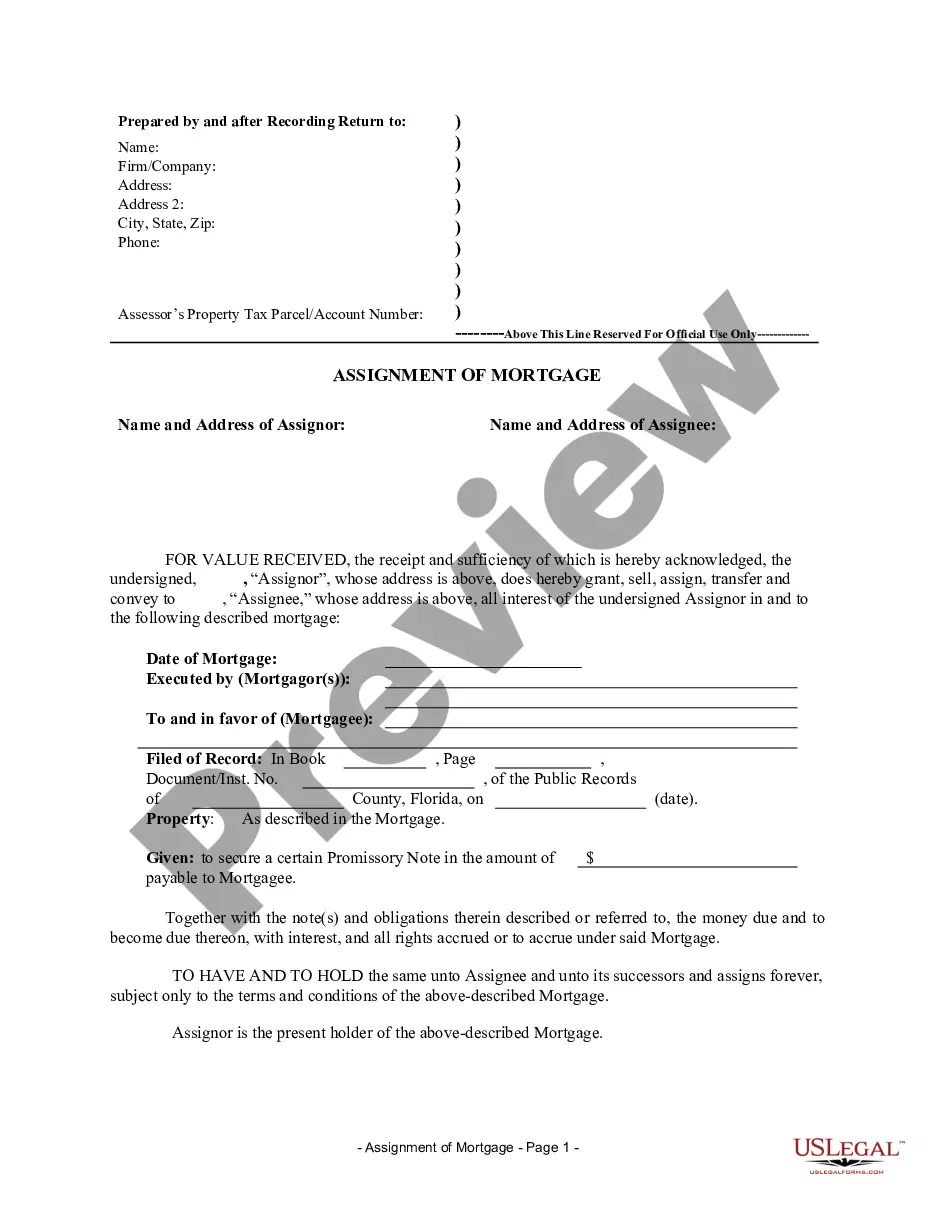

The Assignment of Mortgage by Corporate Mortgage Holder is a legal document that transfers the ownership interest in a mortgage or deed of trust from a corporate mortgage holder to a third party. This form is crucial for documenting the assignment of mortgage rights and is specifically designed for use by corporations, differentiating it from other mortgage assignment forms intended for individual use.

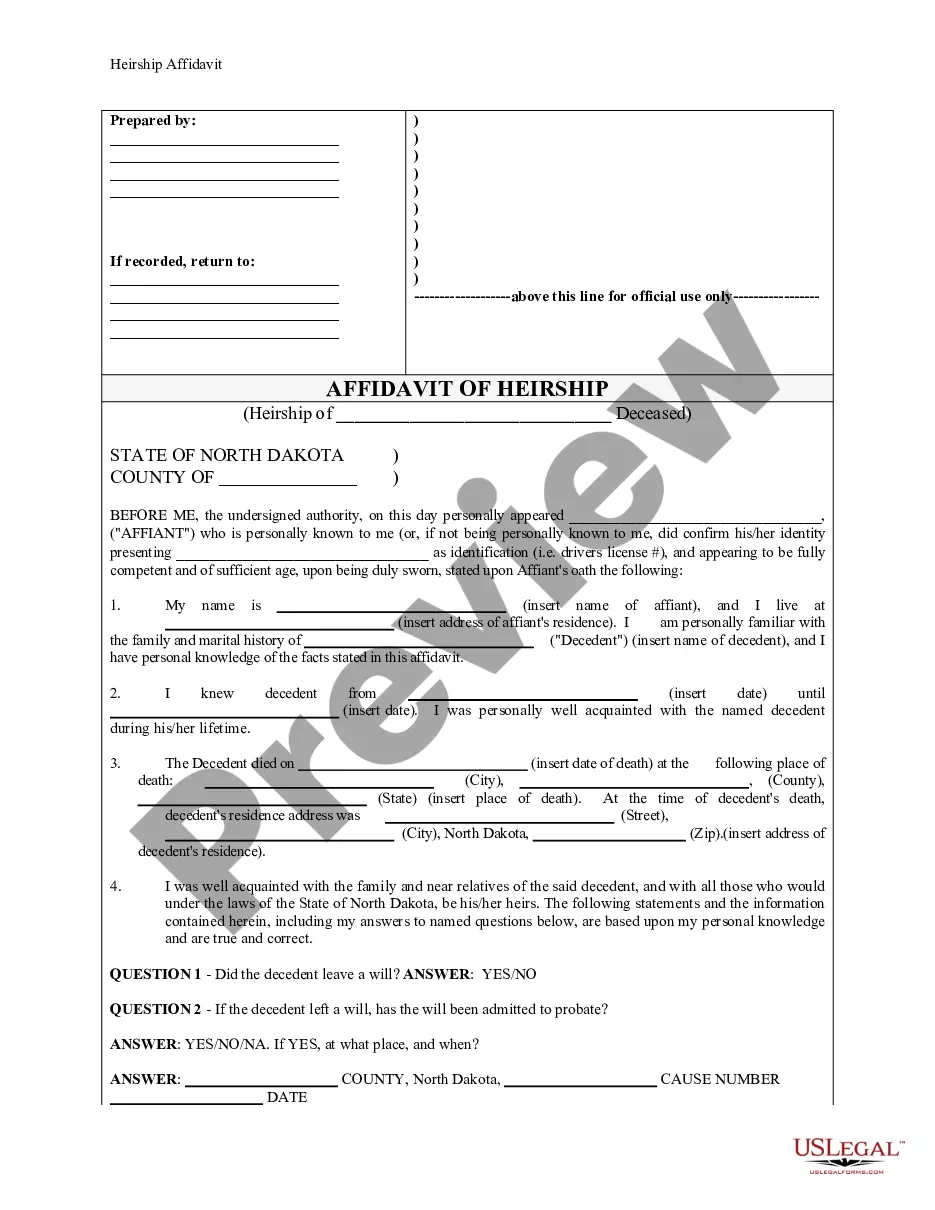

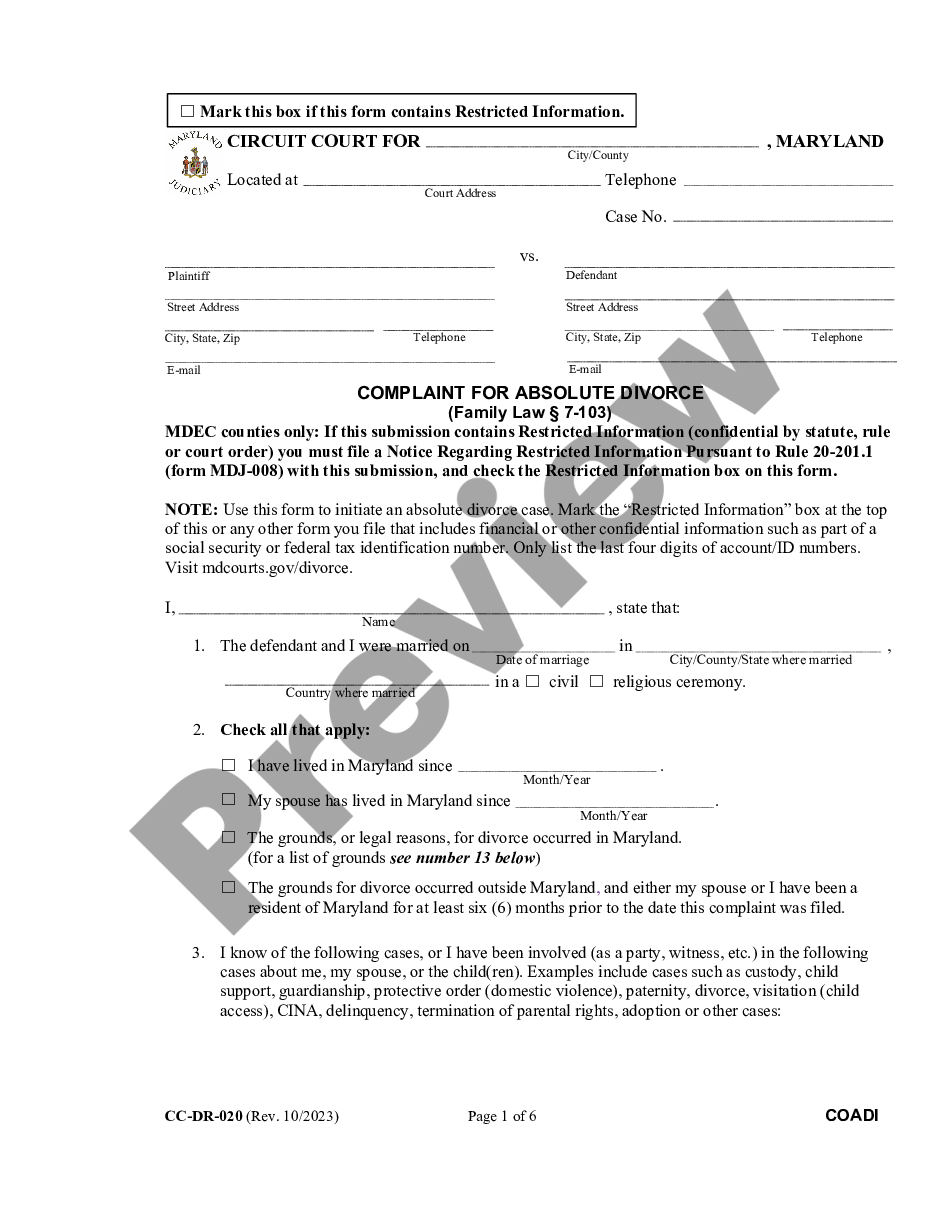

Main sections of this form

- Date of Mortgage: Date the original mortgage was executed.

- Mortgagor(s): Names of the individuals or entities that took out the mortgage.

- Mortgagee: Name of the current mortgage holder who is transferring the rights.

- Recording Information: Details about where the original mortgage is recorded.

- Property Description: Specific details identifying the property under the mortgage.

- Promissory Note: Reference to the underlying note secured by the mortgage.

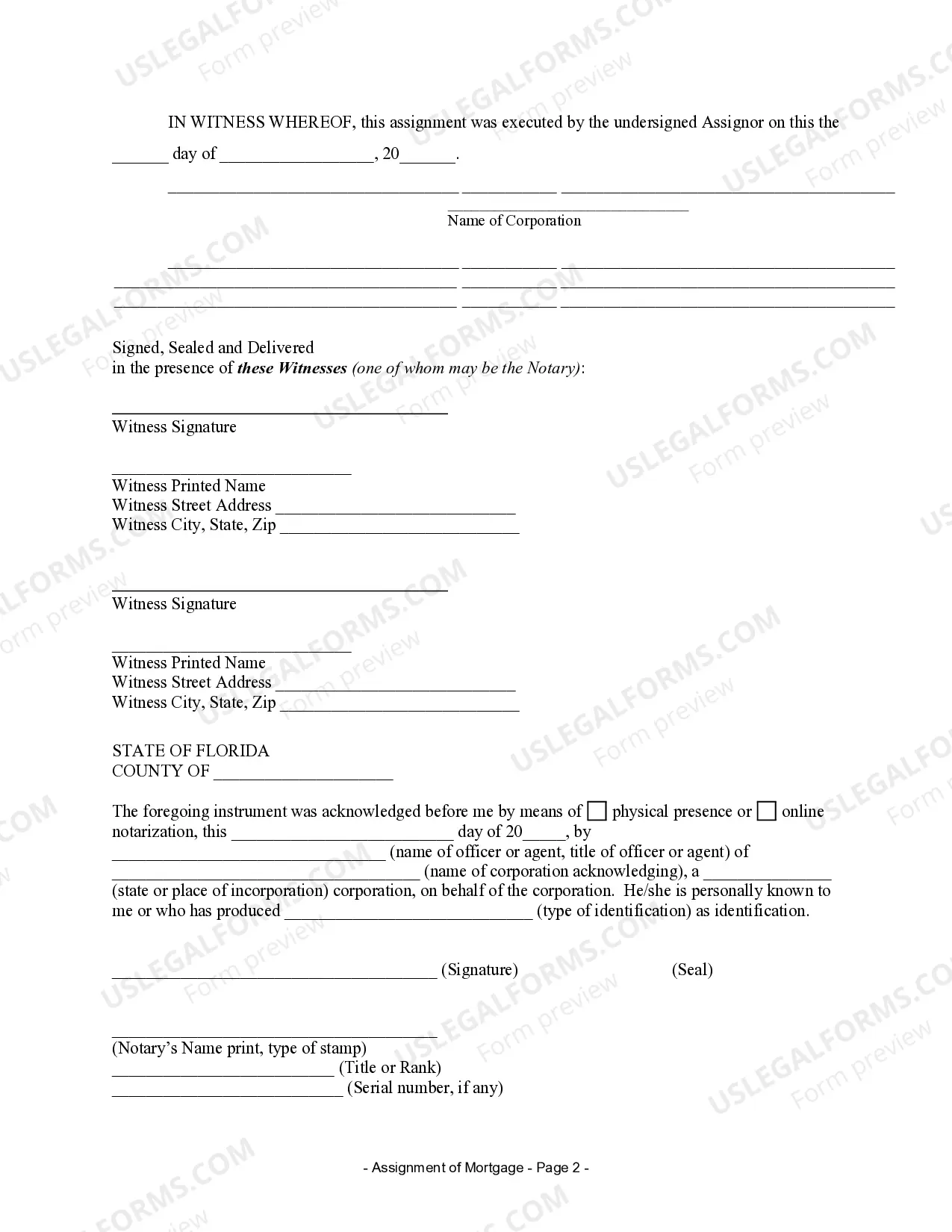

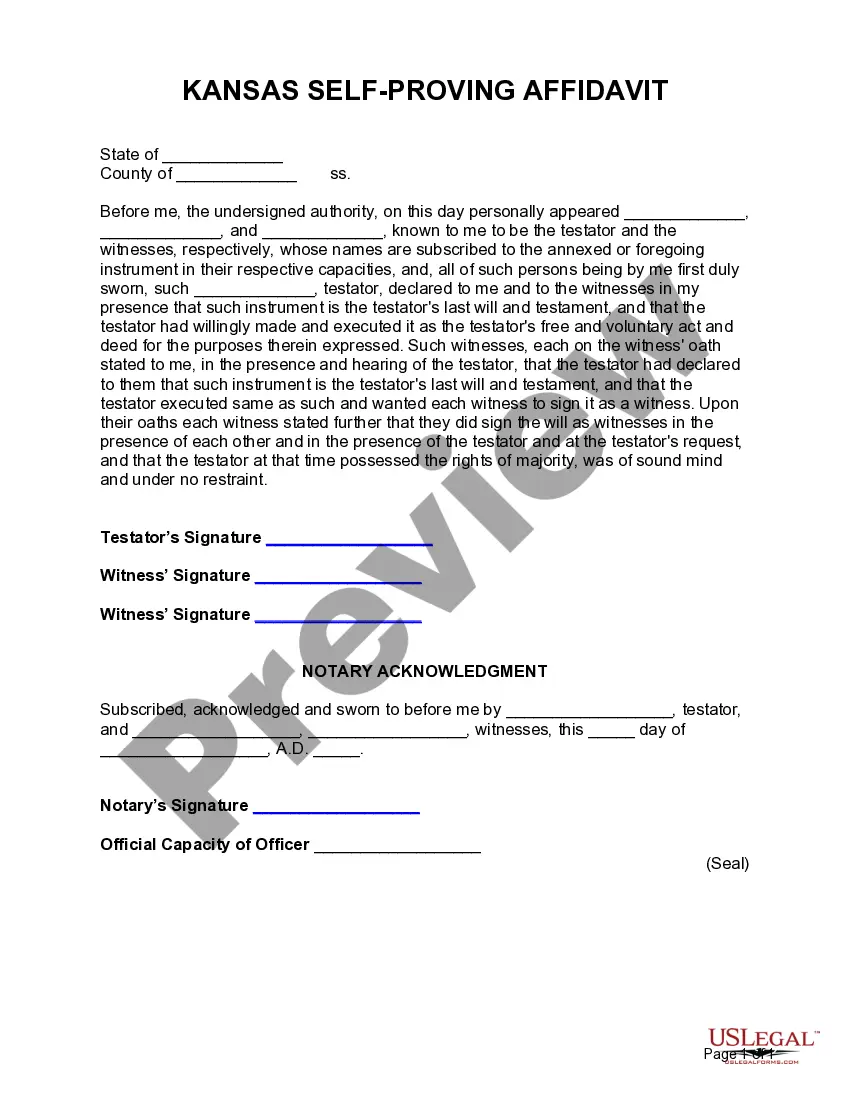

- Signatures: Required signatures from the corporate representative and witnesses.

- Notary Acknowledgment: Space for notarization, confirming the authenticity of the assignment.

Situations where this form applies

This form should be used when a corporation that holds a mortgage wishes to assign its interest in that mortgage to another party. Common scenarios include the sale of the mortgage to another lender or financial institution, or when a corporation reorganizes and needs to transfer its mortgage assets to a new entity. It is essential for ensuring that the assignee has legally recognized rights to the mortgage.

Intended users of this form

- Corporations that hold mortgages and wish to transfer them.

- Financial institutions involved in mortgage transactions.

- Legal representatives acting on behalf of corporations in mortgage assignments.

Completing this form step by step

- Identify the parties involved: Fill in the names of the current mortgage holder and the new assignee.

- Specify the property: Provide a clear description of the property associated with the mortgage.

- Enter dates and signatures: Complete the date of the assignment and obtain required signatures from the corporate representative.

- Add witness signatures: Ensure that the assignment is signed in front of the appropriate witnesses.

- Notarize the document: Have a notary public witness the signing and complete the notary acknowledgment section.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Mistakes to watch out for

- Failing to include the date of the mortgage or the property description.

- Omitting necessary signatures or witnesses.

- Not having the document notarized when required.

Why use this form online

- Convenience: Download and complete the form at your own pace.

- Editability: Easily make updates to meet your specific needs before finalizing.

- Reliability: Forms are drafted by licensed attorneys to ensure legal compliance.

Form popularity

FAQ

A corporate assignment of a mortgage refers to the process through which a corporation transfers its mortgage interest to another party. This type of assignment allows corporations to streamline their operations and manage assets effectively. It is an integral part of the financial ecosystem, particularly in transactions involving a Florida Assignment of Mortgage by Corporate Mortgage Holder, ensuring all parties are aware of the current mortgage holder.

A mortgage assignment works by transferring the rights and obligations from the current mortgage holder to a new one. The document outlining the assignment must be executed and recorded to make the transfer legally effective. This process ensures clarity in ownership and is critical in the context of a Florida Assignment of Mortgage by Corporate Mortgage Holder, making transparency vital for all parties involved.

Typically, the corporate mortgage holder or their authorized representative signs the assignment of a mortgage. This ensures that the legal transfer of the mortgage is valid and binding. If you’re navigating a Florida Assignment of Mortgage by Corporate Mortgage Holder, it's crucial to ensure that the right individuals are involved to avoid legal complications.

When the assignment of mortgage is not recorded, it can lead to various complications for the mortgage holder and borrower. Without recording, there may be disputes over ownership rights, potentially leaving the lender vulnerable. Additionally, subsequent buyers may not be aware of the mortgage change, creating confusion. Therefore, it is crucial to properly record the Florida Assignment of Mortgage by Corporate Mortgage Holder to avoid these issues.

Yes, recording an assignment of mortgage is typically necessary to protect the rights of the new mortgage holder. In Florida, when a Corporate Mortgage Holder assigns a mortgage, it should be recorded in the county where the property is located. This action makes the assignment public, ensuring that all parties are aware of the current holder of the mortgage. To facilitate this process, you can visit uslegalforms, which provides resources to help you navigate through Florida Assignment of Mortgage by Corporate Mortgage Holder effectively.

Completing an assignment of mortgage involves several steps to ensure that the transfer is legally sound. First, you must prepare a written assignment document that specifies the parties involved and the mortgage being assigned. Then, you will need to have the document notarized and recorded in the appropriate county office. For detailed guidance, consider utilizing USLegalForms to access templates and assistance related to the Florida Assignment of Mortgage by Corporate Mortgage Holder.

An assignment of mortgage in Florida refers to the legal transfer of the rights and obligations of a mortgage from one party to another. This process enables the new holder to collect payments and enforce terms of the mortgage agreement. It plays a fundamental role for lenders and borrowers alike, making it crucial to understand when engaging in real estate transactions. For those dealing with the Florida Assignment of Mortgage by Corporate Mortgage Holder, knowing this process is vital.

Section 77.0305 in Florida statutes relates to the procedural aspects of civil actions, particularly regarding the assignment of obligations. This section provides guidance on how affidavits and related documents should be managed during such processes. Ensuring compliance can help in preventing legal issues in property assignments. This knowledge is essential when navigating the landscape of the Florida Assignment of Mortgage by Corporate Mortgage Holder.

Section 893.03 of the Florida statute addresses the classification of controlled substances. While this section may seem unrelated, understanding its implications is essential for real estate professionals, particularly those involved in transactions requiring compliance. Legal clarity in property holdings can impact investments. Thus, it’s important to consider all aspects when dealing with the Florida Assignment of Mortgage by Corporate Mortgage Holder.

A corporate assignment of a mortgage refers to the transfer of a mortgage from one corporate entity to another. This process involves legal documentation and must comply with Florida laws. Such assignments usually occur during corporate restructurings or asset sales, and they ensure continued revenue for the originating lender. It is vital to understand corporate assignments, especially in the context of the Florida Assignment of Mortgage by Corporate Mortgage Holder.