This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Gift Deed - Florida - Individual to Individual, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Florida Gift Deed for Individual to Individual

Description

How to fill out Florida Gift Deed For Individual To Individual?

The greater number of documents you need to produce - the more stressed you feel.

You can discover countless Florida Gift Deed for Individual to Individual templates online, yet, you remain uncertain about which ones to trust.

Eliminate the trouble to make acquiring samples easier with US Legal Forms. Obtain expertly crafted documents that are designed to comply with state requirements.

Provide the required information to create your account and complete your order with PayPal or a credit card. Select a convenient file format and obtain your sample. Access all files you download in the My documents section. Simply navigate there to fill out a new version of your Florida Gift Deed for Individual to Individual. Even when using professionally drafted forms, it's still essential to consider consulting your local attorney to double-check the completed document to ensure your record is accurately filled out. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms account, Log In to your profile, and you will find the Download button on the Florida Gift Deed for Individual to Individual’s page.

- If you haven’t used our platform before, follow the registration process using these guidelines.

- Verify that the Florida Gift Deed for Individual to Individual is valid in your state.

- Reassess your choice by reviewing the description or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

A Florida Gift Deed for Individual to Individual offers immediate property transfer, which is a key advantage over a will. This instant transfer allows the recipient to take ownership and control without waiting for probate. However, unlike a will, a gift deed does not allow for modifications after the gift is made, which can restrict your options later. Weigh these pros and cons based on your goals, and consider using the US Legal Forms platform for guidance in drafting your documents.

Gifting a house can be a thoughtful way to help loved ones, but it requires careful consideration. A Florida Gift Deed for Individual to Individual eliminates the burden of property taxes for the giver while providing a valuable asset to the recipient. However, both parties should understand the potential tax ramifications and the irrevocable nature of such a gift. Consulting professionals can provide clarity and direction in making this decision.

Using a Florida Gift Deed for Individual to Individual presents certain drawbacks to keep in mind. One significant disadvantage is that once you complete a gift deed, you relinquish control over the property, which can complicate future decisions. Additionally, the recipient may face tax implications or complications if they later wish to sell the property. It's vital to weigh these factors carefully before proceeding.

A Florida Gift Deed for Individual to Individual can indeed take precedence over a will. When you execute a gift deed, ownership of the property transfers immediately to the recipient, distinguishing it from the terms laid out in a will. This means that if a gift deed exists, the property will not be part of the estate to be distributed according to the will after the owner's passing. Therefore, consider how these documents interact when planning your estate.

The choice between a gift deed and a sale deed often depends on your specific situation. A Florida Gift Deed for Individual to Individual allows you to transfer property without expecting payment, making it suitable for family transfers. Conversely, a sale deed requires a monetary exchange, thereby establishing a buyer and seller relationship. Ultimately, assess both options to determine which aligns better with your intentions.

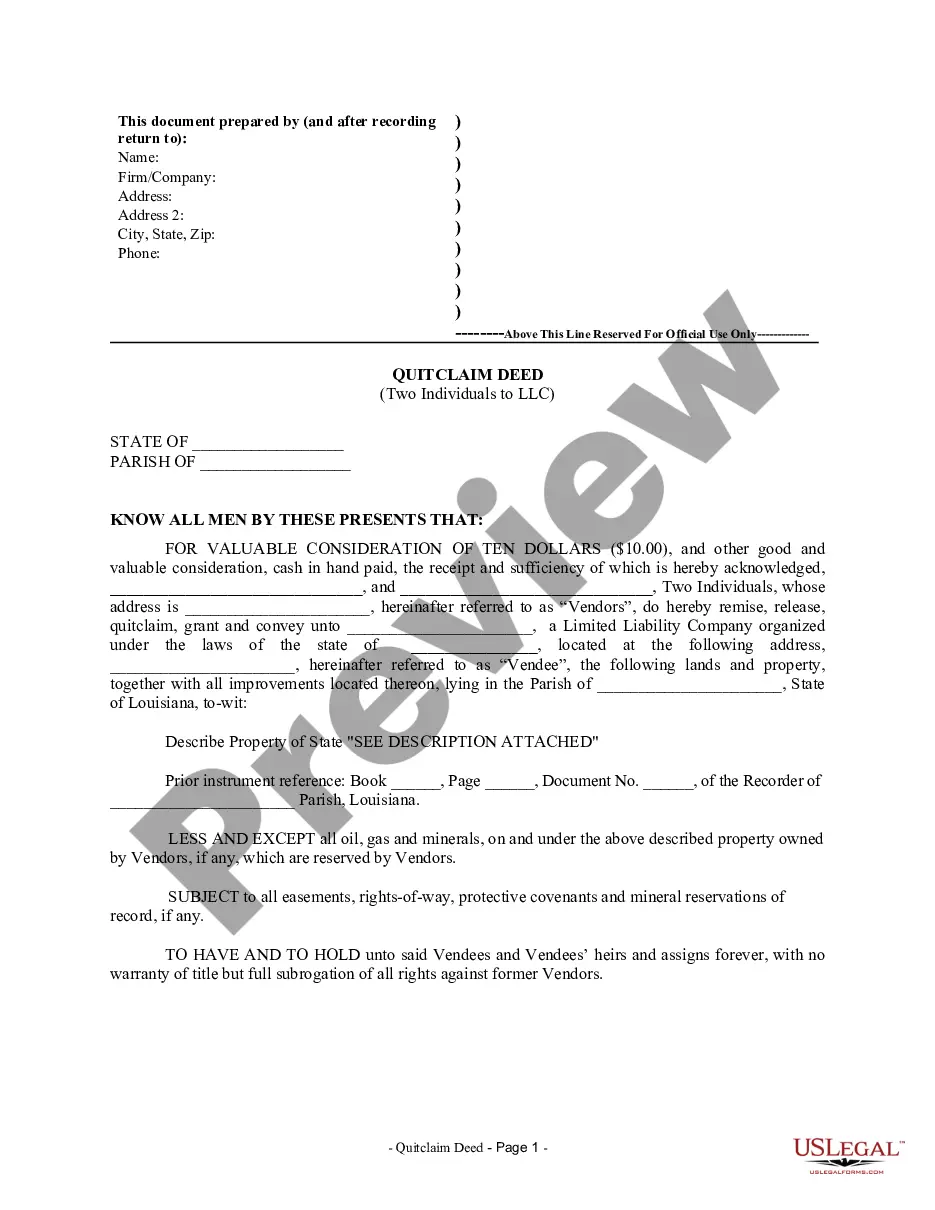

While quit claim deeds are straightforward, they come with some risks. They do not provide any warranties or guarantees about the property's title, which means you could face issues if there are existing liens or title claims. If you are looking for a secure way to transfer property, consider using a Florida Gift Deed for Individual to Individual, as it offers clearer terms regarding the gift and ownership transfer.

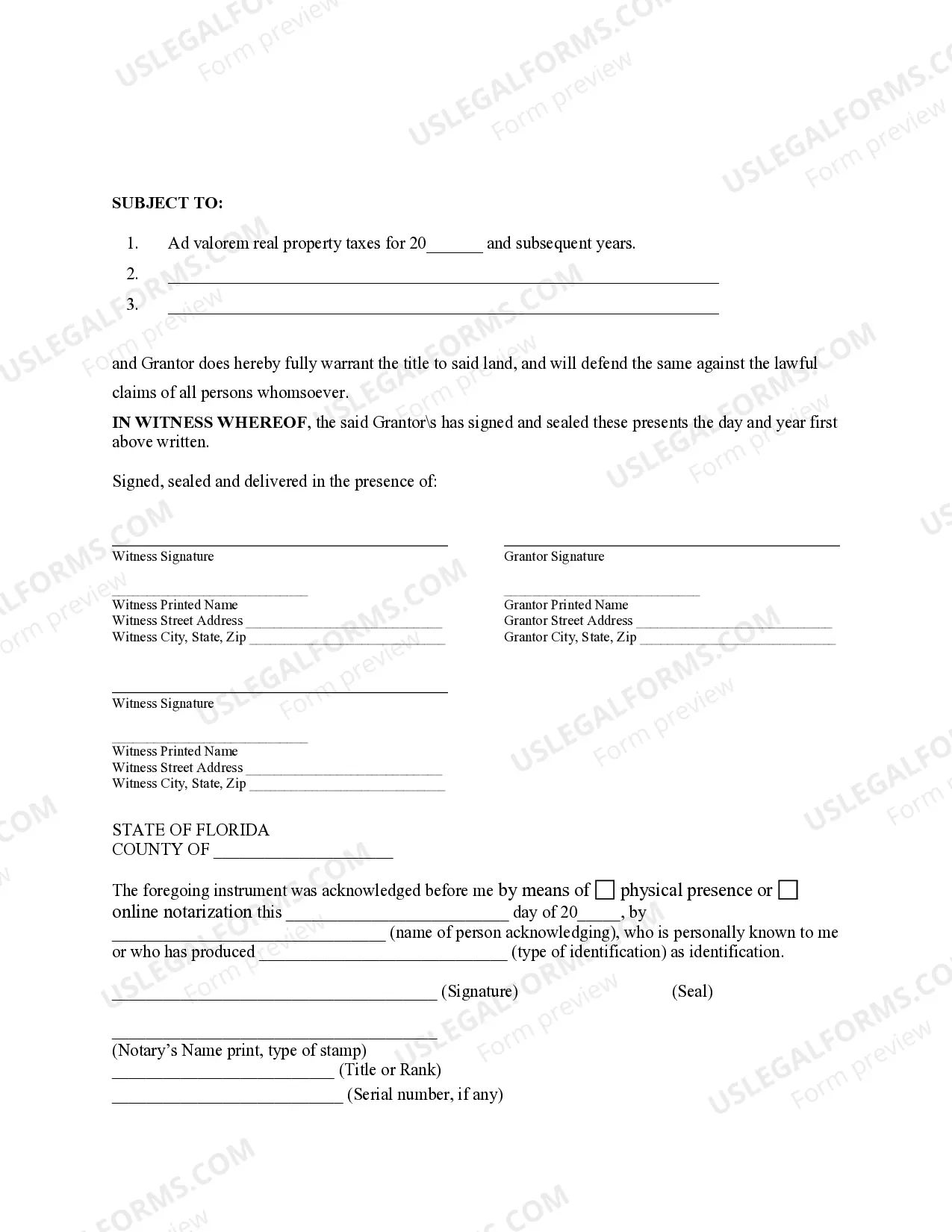

To add someone to your deed in Florida, you typically need to create a new deed that includes the individual you want to add. You can use a Florida Gift Deed for Individual to Individual if you intend to make a gift of the property to that person. Once the new deed is prepared, you should sign it in front of a notary public and file it with the county clerk to make it official.

A gift deed and a quit claim deed serve different purposes in Florida. A gift deed is used to transfer property without receiving payment, while a quit claim deed transfers whatever interest the grantor may have in the property, without guaranteeing that interest is valid. If you are considering a Florida Gift Deed for Individual to Individual, understand that a gift deed can ensure you are giving property as a gift with clarity and intent.

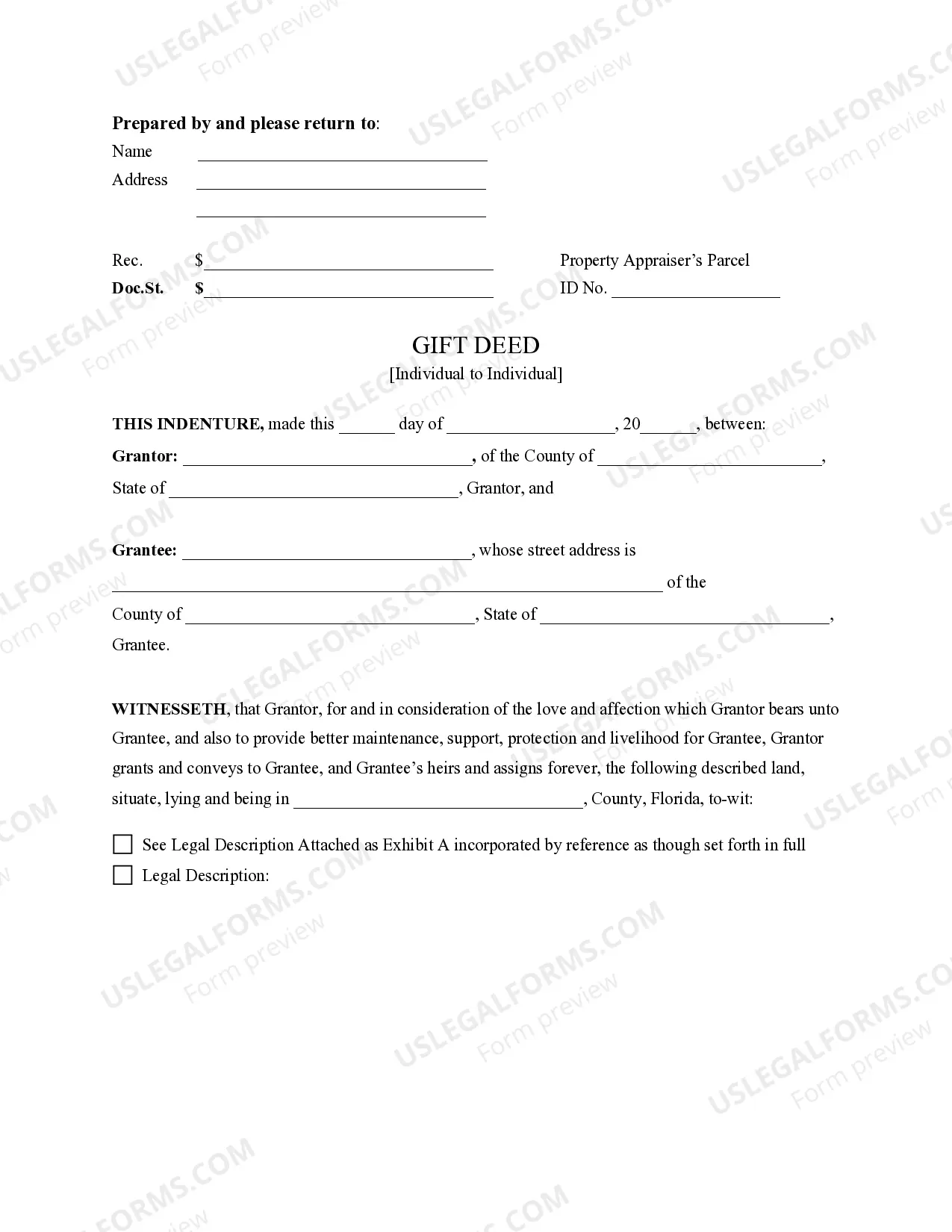

Transferring property from one person to another in Florida involves creating a Florida Gift Deed for Individual to Individual if it’s a gift. You must accurately fill out the deed, sign it, and get it notarized. Finally, file the deed with your county's property appraiser or clerk of court to formalize the transfer. Using US Legal Forms can streamline this process and provide the necessary documentation.

To gift property to someone, you typically start by preparing a Florida Gift Deed for Individual to Individual. This deed will document your intent to gift the property without compensation. After completing the deed, you must sign it and have it notarized, then record it with your local county clerk. A clear and official transfer helps ensure that the recipient has full ownership.