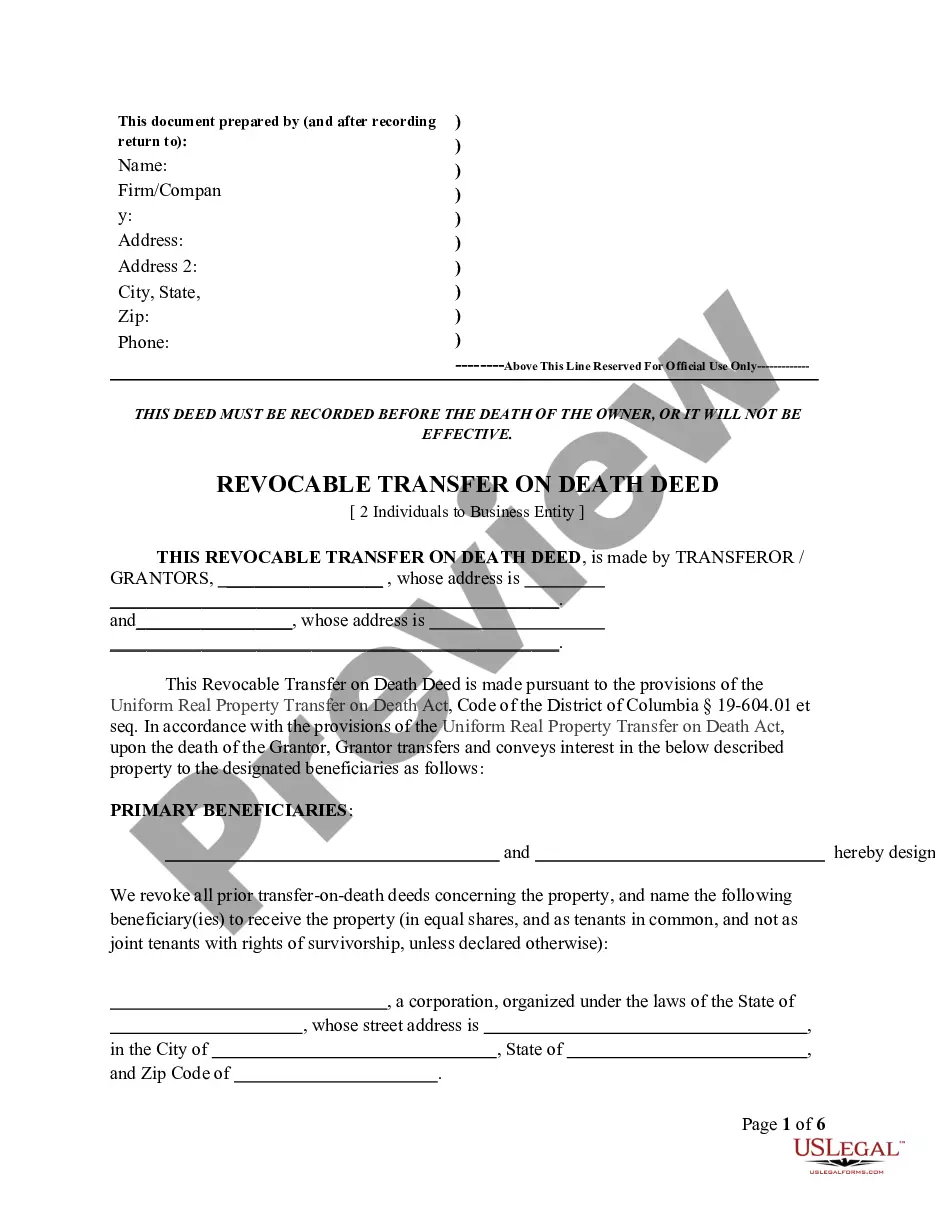

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Business Entity?

Utilize US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Married Couples to Business Entity.

Our court-accepted forms are crafted and frequently refreshed by experienced attorneys.

Ours is the most comprehensive Forms library available online and provides cost-effective and precise samples for clients, legal practitioners, and small to medium-sized businesses.

Select Buy Now if it’s the template you require. Set up your account and make payments through PayPal or credit card. Download the form to your device and feel free to reuse it multiple times. Use the Search field if you need to find another document template. US Legal Forms offers thousands of legal and tax templates and packages for both business and personal needs, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Married Couples to Business Entity. More than three million users have successfully employed our service. Pick your subscription plan and acquire high-quality documents within a few clicks.

- The templates are categorized based on state-specific segments, and some can be viewed before download.

- To access templates, users need to have a subscription and to Log In to their account.

- Click Download beside any form of interest and locate it in My documents.

- For users without a subscription, follow the steps below to effortlessly locate and download the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Married Couples to Business Entity.

- Ensure that you select the correct template for the relevant state.

- Examine the form by reading the description and utilizing the Preview function.

Form popularity

FAQ

Yes, Washington D.C. does permit the use of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity. This allows property owners to designate beneficiaries who can receive the property directly upon the owner's death without going through probate. It simplifies the passing of property to loved ones and can help avoid lengthy legal processes. For more detailed information, consider visiting uslegalforms for resources tailored to your needs.

Currently, several states recognize the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity. States such as Arizona, California, and Tennessee have implemented similar laws to facilitate property transfer without the need for probate. However, it’s crucial to check local regulations since the specifics can vary widely. Always consult a legal expert or use a resource like uslegalforms for tailored guidance.

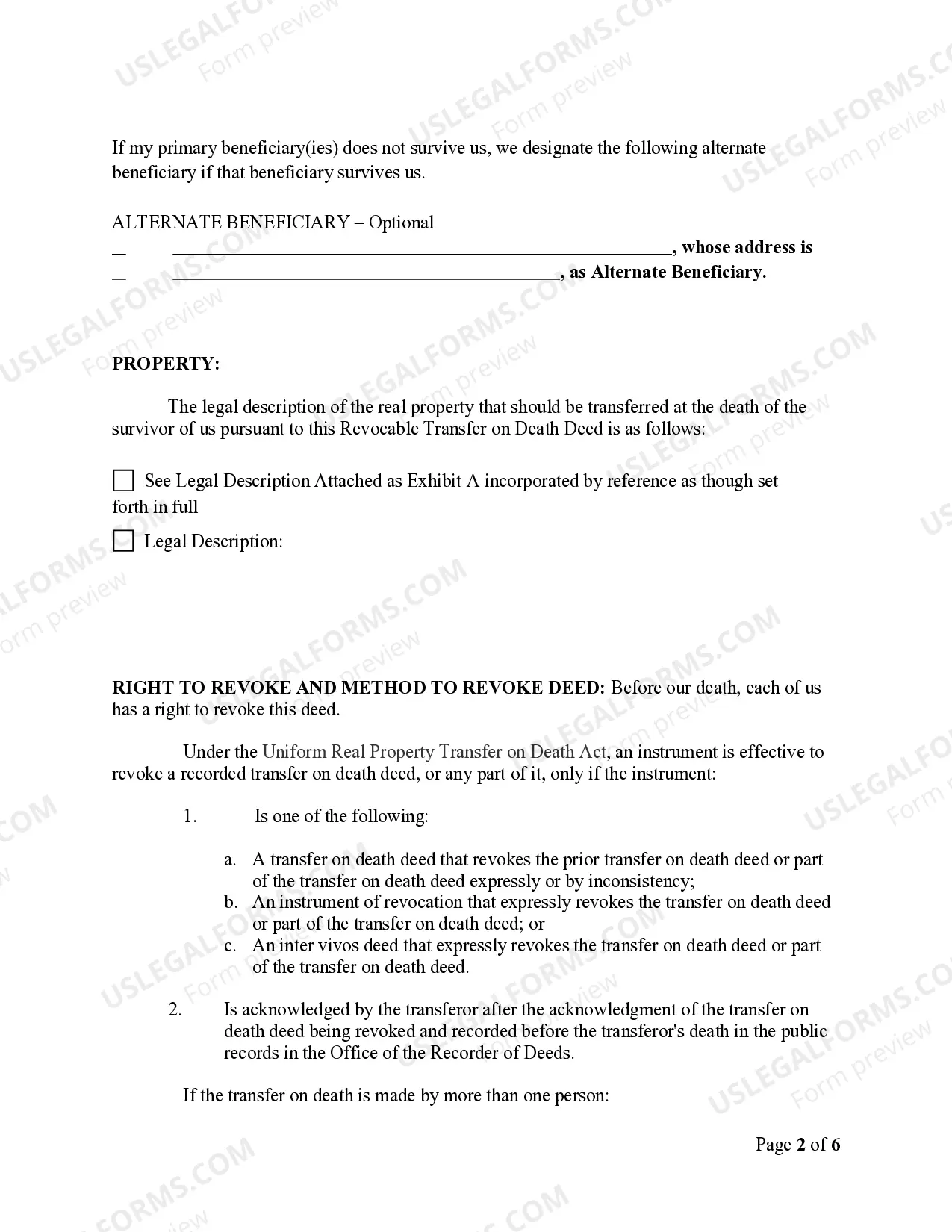

The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity may have several disadvantages. First, this deed does not offer any tax benefits; instead, the property may still be subject to estate taxes. Additionally, if the beneficiary faces financial issues or a legal dispute, creditors may claim the property. Finally, the deed may not provide a comprehensive solution for complex family situations, so you might want to consider other estate planning tools.

A transfer on death deed can carry some disadvantages. One concern is that it may not avoid probate for certain assets, and beneficiaries cannot access the property until the owner's death. Additionally, if property laws change or if beneficiaries do not align with your current wishes, it can create legal complexities and confusion down the line.

Filling out a transfer on death designation affidavit is straightforward but requires attention to detail. Start by entering the name of the property owner, the property address, and the names of the beneficiaries. Make sure to sign the document, and if necessary, have it notarized to comply with the requirements of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity.

To complete an affidavit of death and heirship for a District of Columbia Transfer on Death Deed, begin by collecting necessary information about the deceased. Fill in details like their full name, date of death, and information about the heirs. Ensure to sign the document in the presence of a notary, confirming its accuracy and legality, which helps in establishing rightful ownership.

While it is not mandatory to hire a lawyer for executing a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity, consulting one can provide clarity. Legal assistance can ensure you understand all requirements and implications. Therefore, it may be beneficial to seek guidance, especially if your situation involves complicated assets or multiple beneficiaries.

Yes, accounts held under a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity avoid probate. This feature allows beneficiaries to access the asset directly upon the owner's death, streamlining the process. Utilizing resources like U.S. Legal Forms can help you set up your accounts correctly to ensure a smooth transition.

Yes, Washington, D.C., does allow for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity. This legal option provides a quick and easy way to transfer property outside of probate, benefiting many residents. Always check the latest regulations and consider professional advice to ensure compliance.

Choosing between a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Business Entity and naming a beneficiary depends on your individual needs. TOD allows you to retain control during your lifetime while ensuring seamless transfer upon death. However, designating a beneficiary through a different method might provide greater flexibility in some situations.